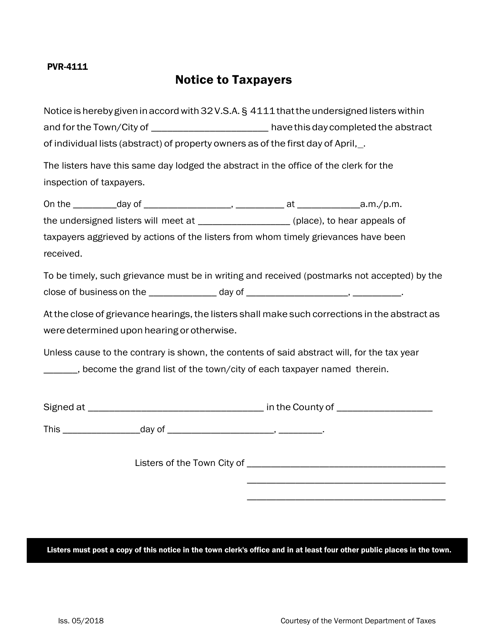

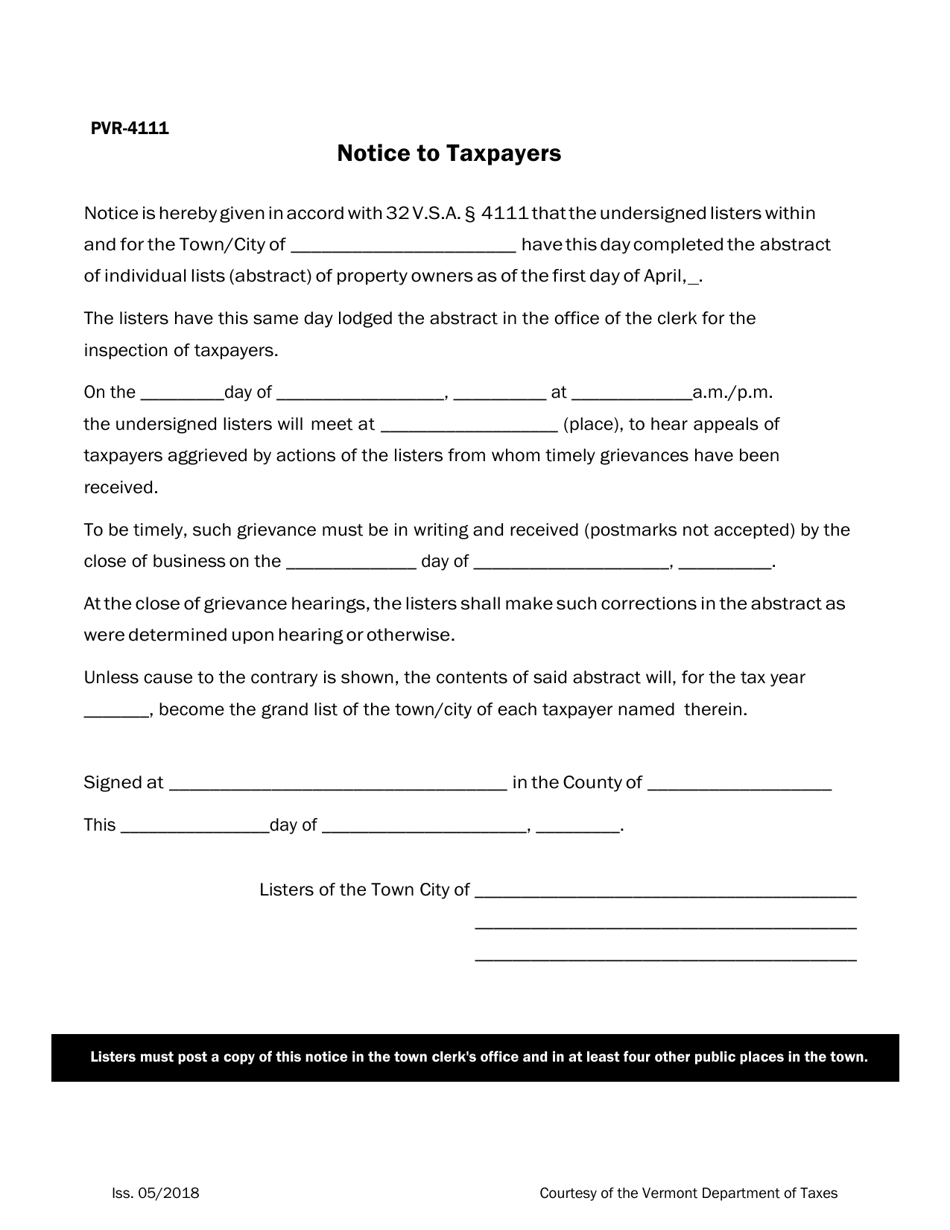

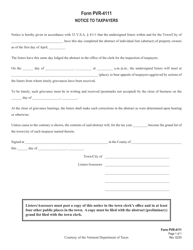

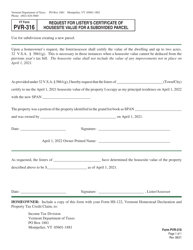

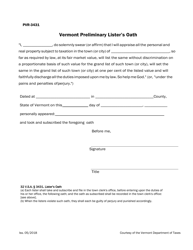

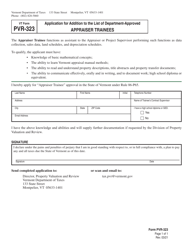

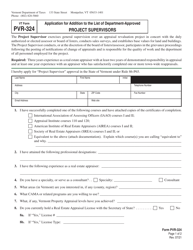

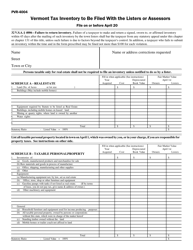

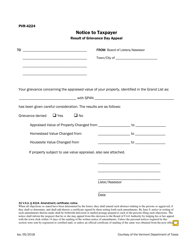

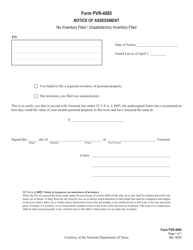

VT Form PVR-4111 Notice to Taxpayers - Vermont

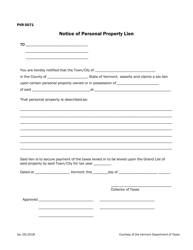

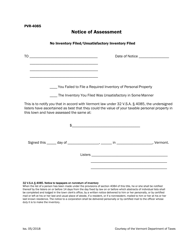

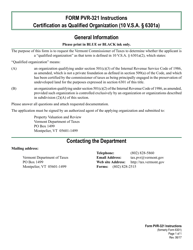

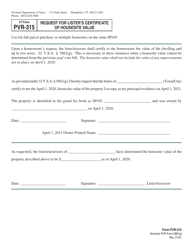

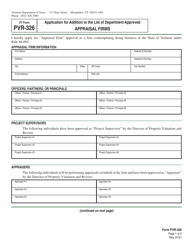

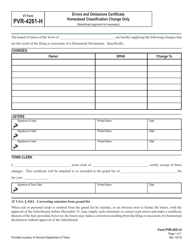

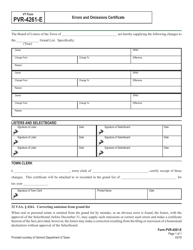

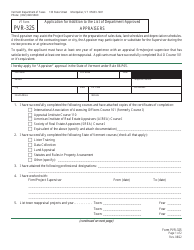

What Is VT Form PVR-4111?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form PVR-4111?

A: VT Form PVR-4111 is the Notice to Taxpayers in Vermont.

Q: What is the purpose of VT Form PVR-4111?

A: VT Form PVR-4111 is used to provide important tax-related information to taxpayers in Vermont.

Q: Who receives VT Form PVR-4111?

A: VT Form PVR-4111 is typically sent to individual taxpayers in Vermont.

Q: What information is included in VT Form PVR-4111?

A: VT Form PVR-4111 includes information about tax credits, deductions, deadlines, and other tax-related topics.

Q: When is VT Form PVR-4111 sent out?

A: VT Form PVR-4111 is typically sent out by the Vermont Department of Taxes before the tax filing season begins.

Q: Do I need to take any action after receiving VT Form PVR-4111?

A: Depending on the information provided in the form, you may need to take certain actions, such as claiming tax credits or submitting additional documentation.

Q: Can I contact the Vermont Department of Taxes if I have questions about VT Form PVR-4111?

A: Yes, you can contact the Vermont Department of Taxes if you have any questions or need further assistance regarding VT Form PVR-4111.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form PVR-4111 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.