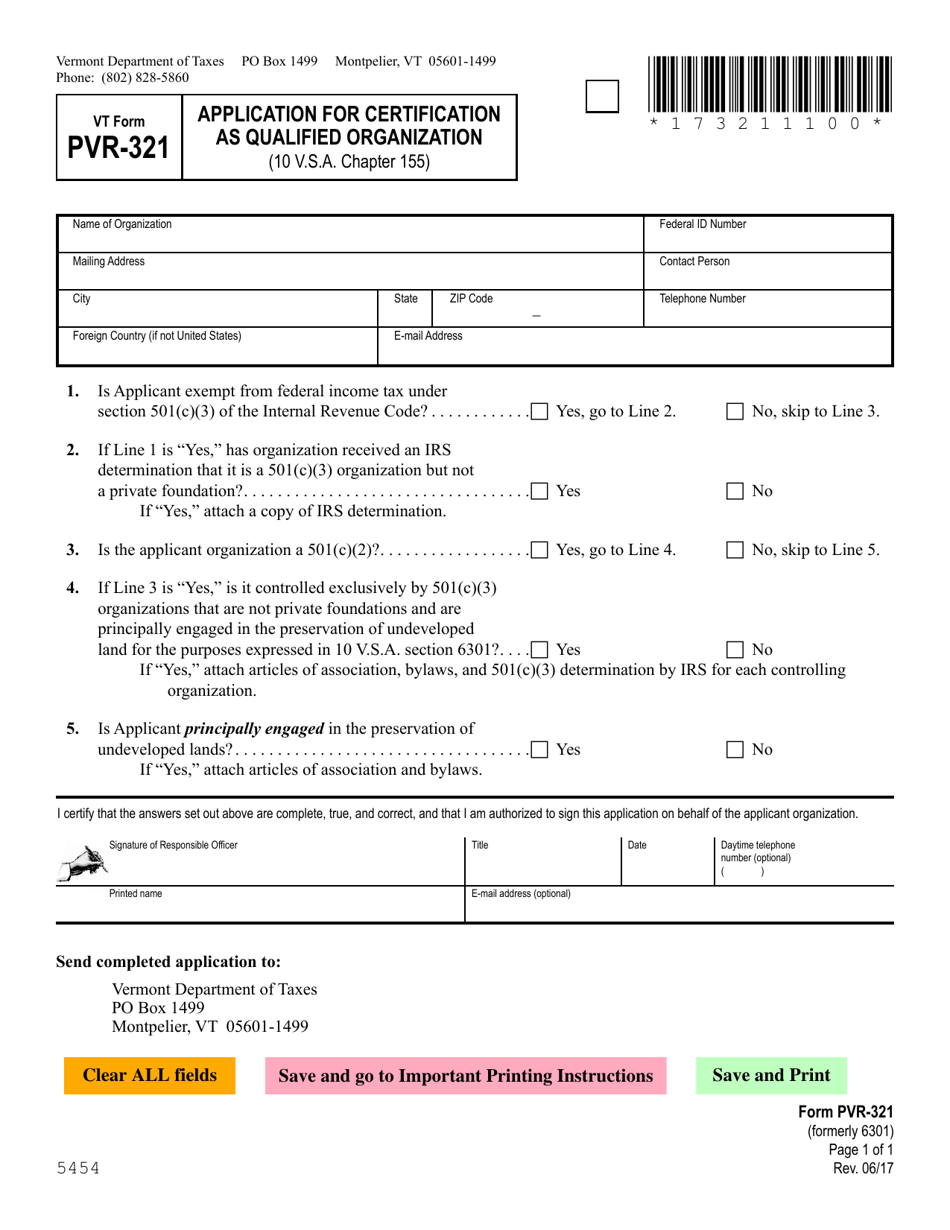

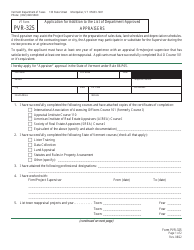

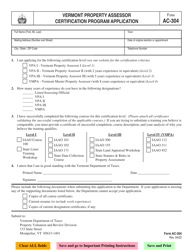

VT Form PVR-321 Application for Certification as Qualified Organization - Vermont

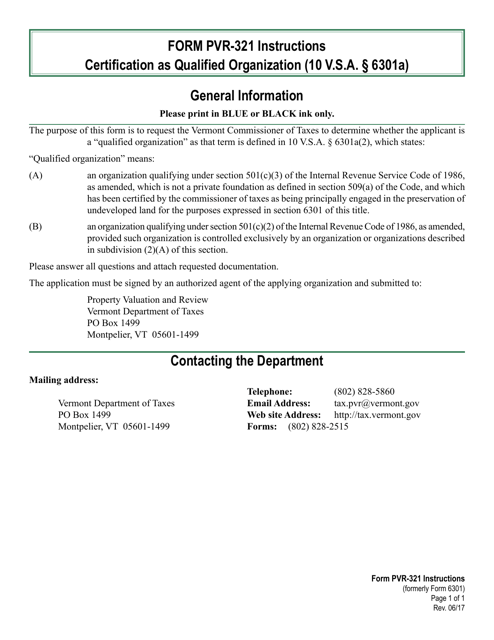

What Is VT Form PVR-321?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form PVR-321?

A: VT Form PVR-321 is the Application for Certification as Qualified Organization in Vermont.

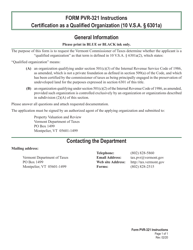

Q: Who needs to fill out VT Form PVR-321?

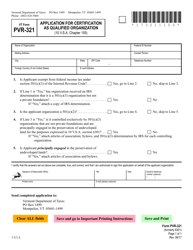

A: Any organization seeking certification as a Qualified Organization in Vermont needs to fill out VT Form PVR-321.

Q: What is the purpose of VT Form PVR-321?

A: The purpose of VT Form PVR-321 is to apply for certification as a Qualified Organization, which allows the organization to receive tax-exempt status in Vermont.

Q: Are there any fees associated with filing VT Form PVR-321?

A: Yes, there is a fee required when filing VT Form PVR-321. The fee amount may vary and should be verified with the Vermont Department of Taxes.

Q: What supporting documents are required to be submitted with VT Form PVR-321?

A: The exact supporting documents required may vary depending on the organization, but generally, documents such as financial statements, bylaws, and proof of tax-exempt status at the federal level are required.

Q: How long does it take to process VT Form PVR-321?

A: Processing times can vary, but it typically takes several weeks to months to process VT Form PVR-321.

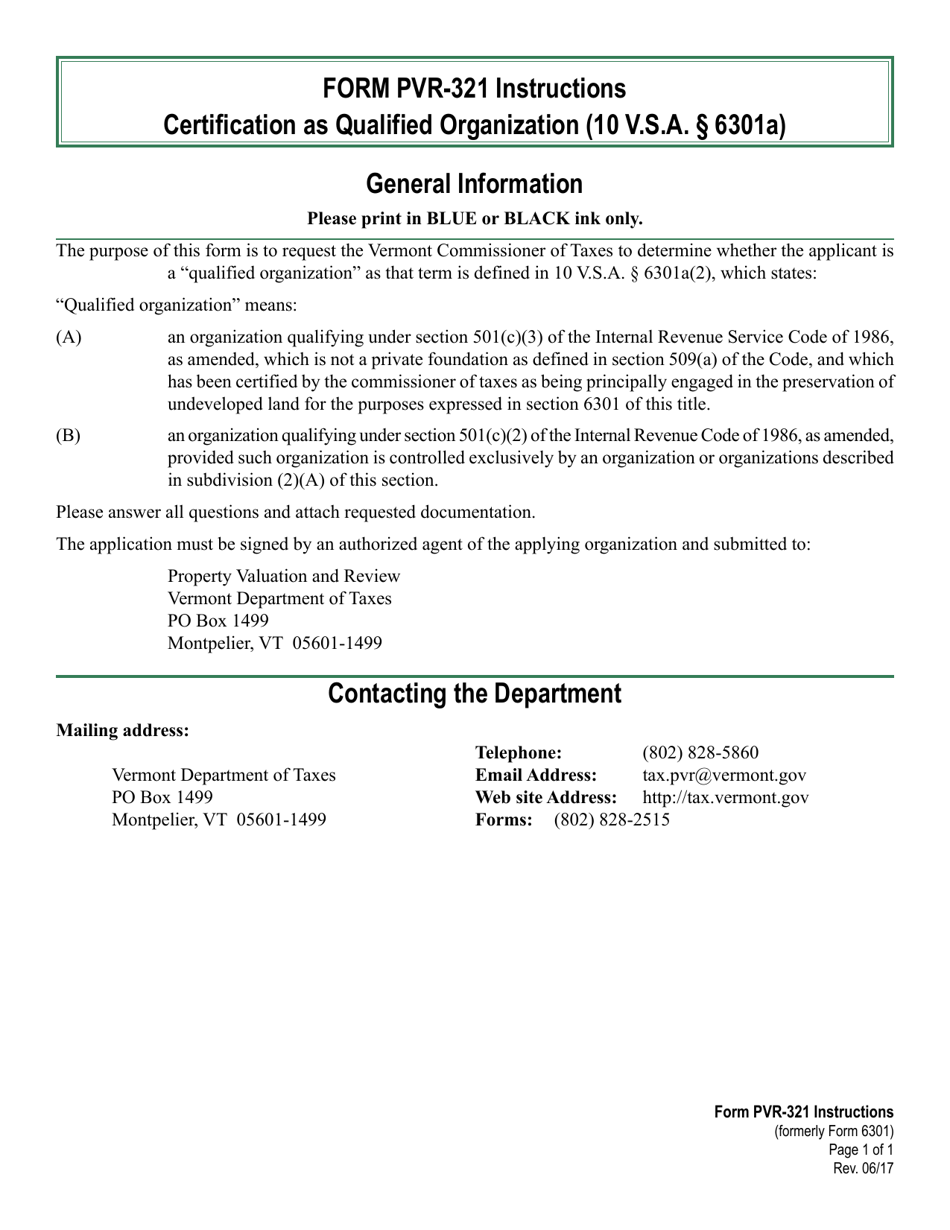

Q: What should I do if I have questions or need assistance with VT Form PVR-321?

A: If you have questions or need assistance with VT Form PVR-321, you can contact the Vermont Department of Taxes directly for guidance and support.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form PVR-321 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.