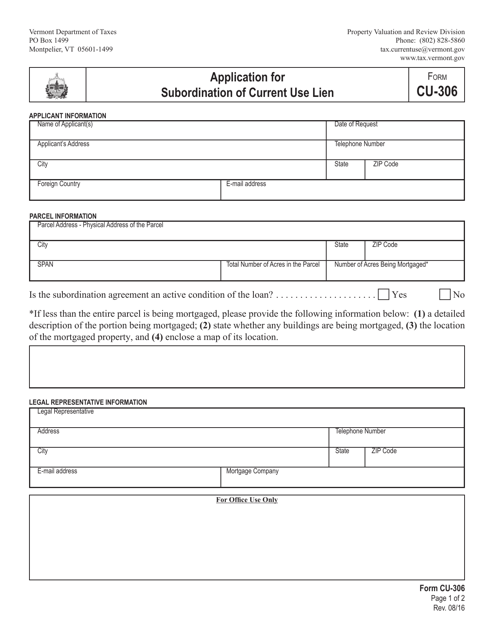

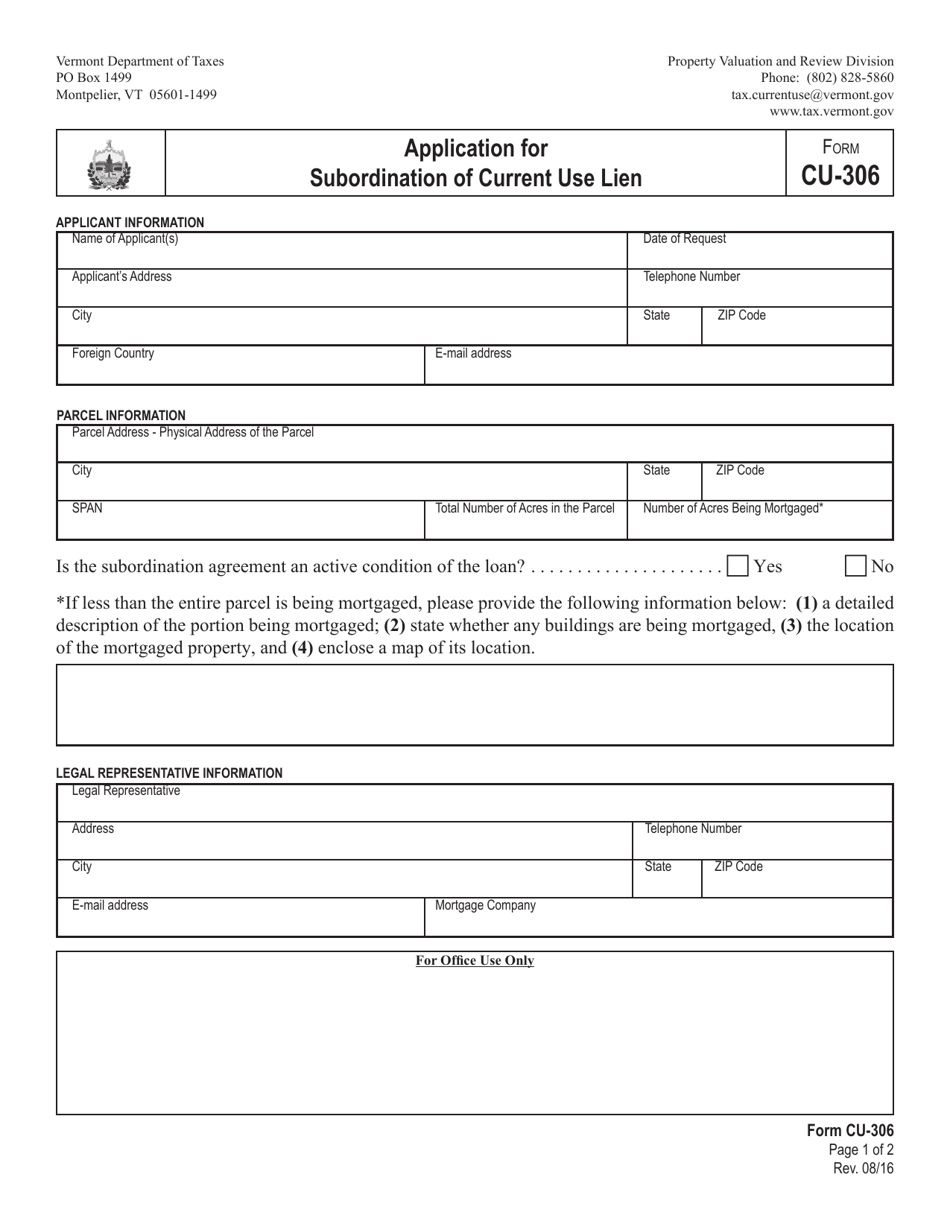

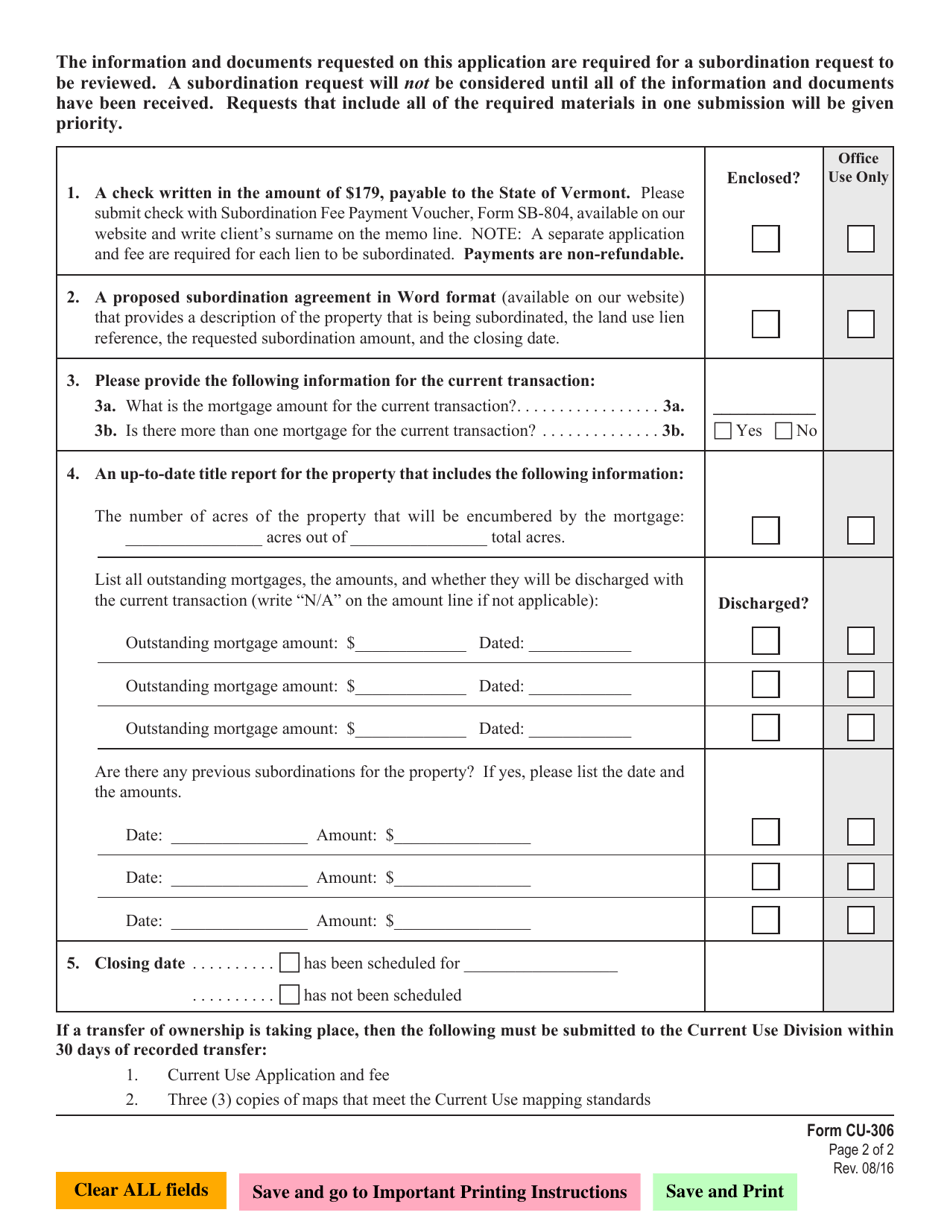

VT Form CU-306 Application for Subordination of Current Use Lien - Vermont

What Is VT Form CU-306?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form CU-306?

A: VT Form CU-306 is the Application for Subordination of Current Use Lien in Vermont.

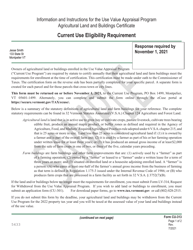

Q: What is a Current Use Lien in Vermont?

A: A Current Use Lien is a lien placed on a property that is enrolled in the Vermont Current Use Program.

Q: What is the purpose of VT Form CU-306?

A: The purpose of VT Form CU-306 is to apply for the subordination of a current use lien in Vermont.

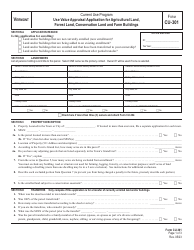

Q: Who needs to complete VT Form CU-306?

A: Property owners who have a current use lien on their property and wish to apply for subordination need to complete VT Form CU-306.

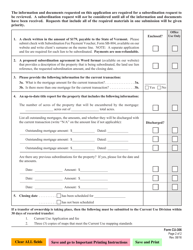

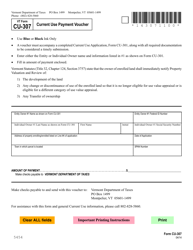

Q: Is there a fee for submitting VT Form CU-306?

A: Yes, there is a fee associated with submitting VT Form CU-306. The current fee is specified on the form.

Q: What is the deadline for submitting VT Form CU-306?

A: The deadline for submitting VT Form CU-306 varies. It is recommended to refer to the instructions provided with the form for the specific deadline.

Q: Can I submit VT Form CU-306 electronically?

A: No, currently VT Form CU-306 must be submitted in paper form with original signatures.

Q: Who should I contact for assistance with VT Form CU-306?

A: For assistance with VT Form CU-306 or questions about the application process, it is recommended to contact the Vermont Department of Taxes or a local tax office.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form CU-306 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.