This version of the form is not currently in use and is provided for reference only. Download this version of

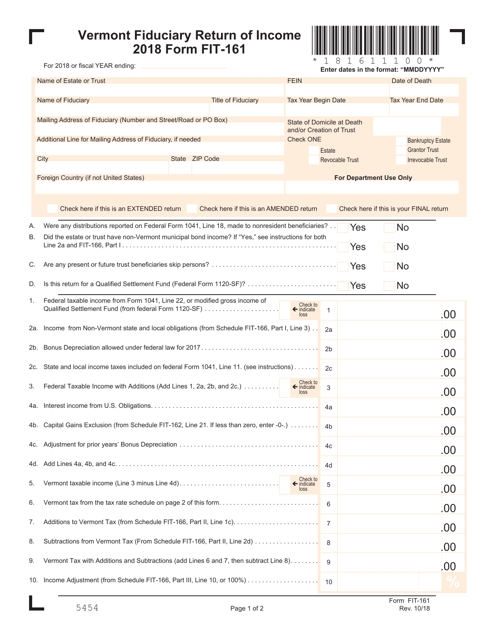

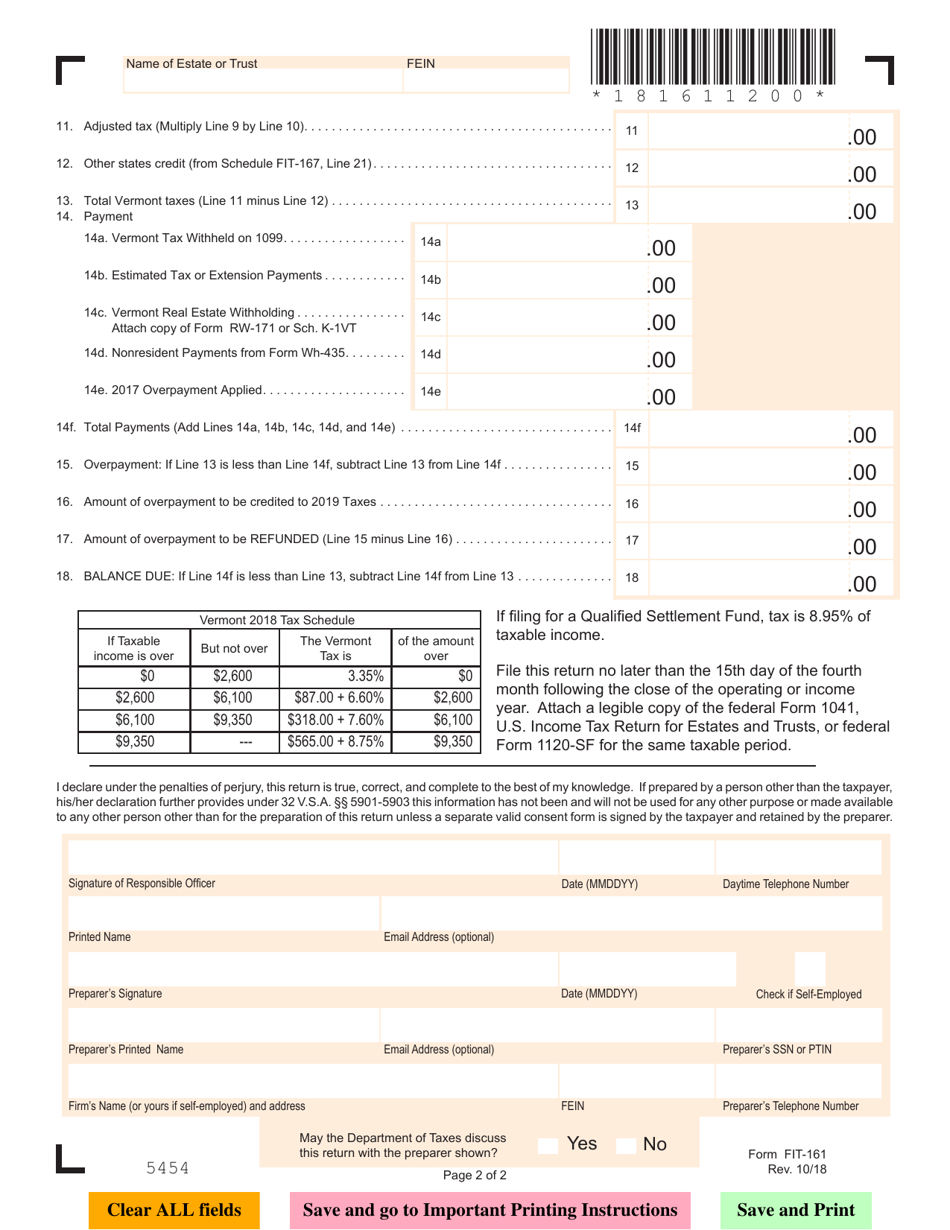

VT Form FIT-161

for the current year.

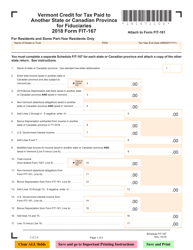

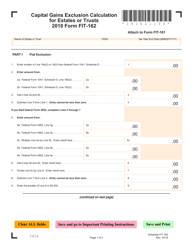

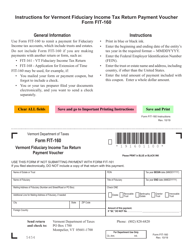

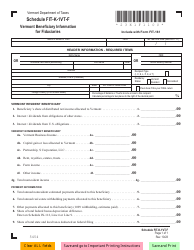

VT Form FIT-161 Fiduciary Return of Income - Vermont

What Is VT Form FIT-161?

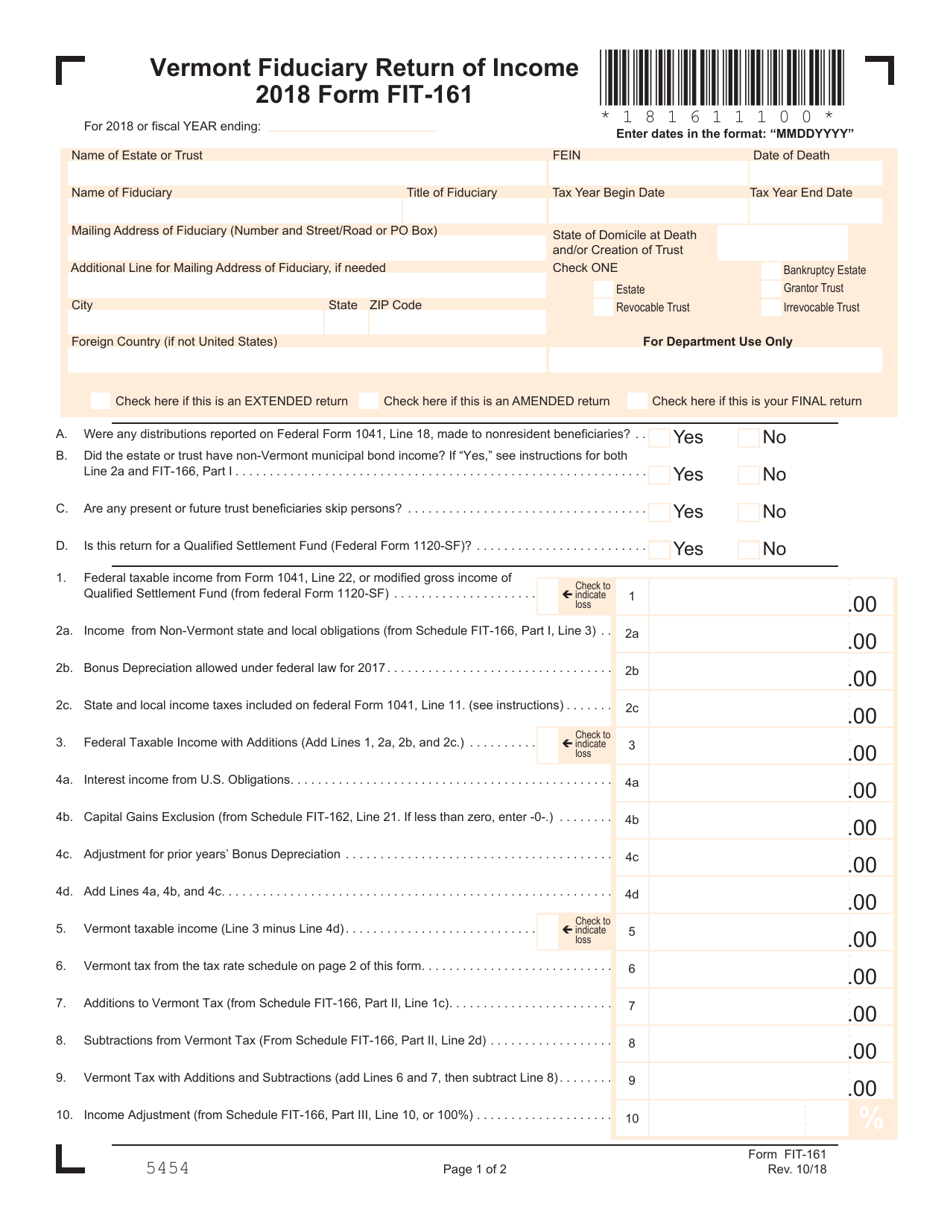

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form FIT-161?

A: VT Form FIT-161 is the Fiduciary Return of Income form for the state of Vermont.

Q: Who needs to file VT Form FIT-161?

A: Fiduciaries, such as trustees or executors, who are responsible for managing and distributing income on behalf of beneficiaries, need to file VT Form FIT-161.

Q: What income should be reported on VT Form FIT-161?

A: All income received by the fiduciary on behalf of the beneficiaries should be reported on VT Form FIT-161.

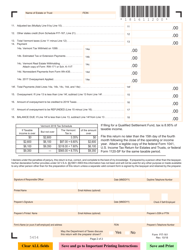

Q: When is the deadline to file VT Form FIT-161?

A: VT Form FIT-161 is due on or before April 15th of the following year, or the 15th day of the fourth month after the close of the tax year.

Q: Is there a penalty for late filing of VT Form FIT-161?

A: Yes, there may be a late filing penalty imposed for filing VT Form FIT-161 after the due date.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form FIT-161 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.