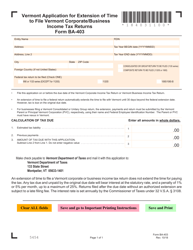

This version of the form is not currently in use and is provided for reference only. Download this version of

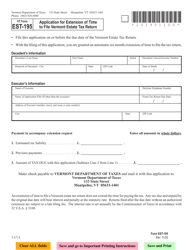

VT Form FIT-168

for the current year.

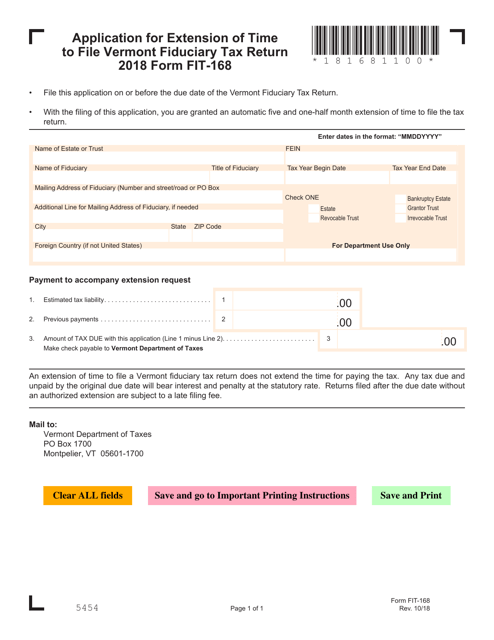

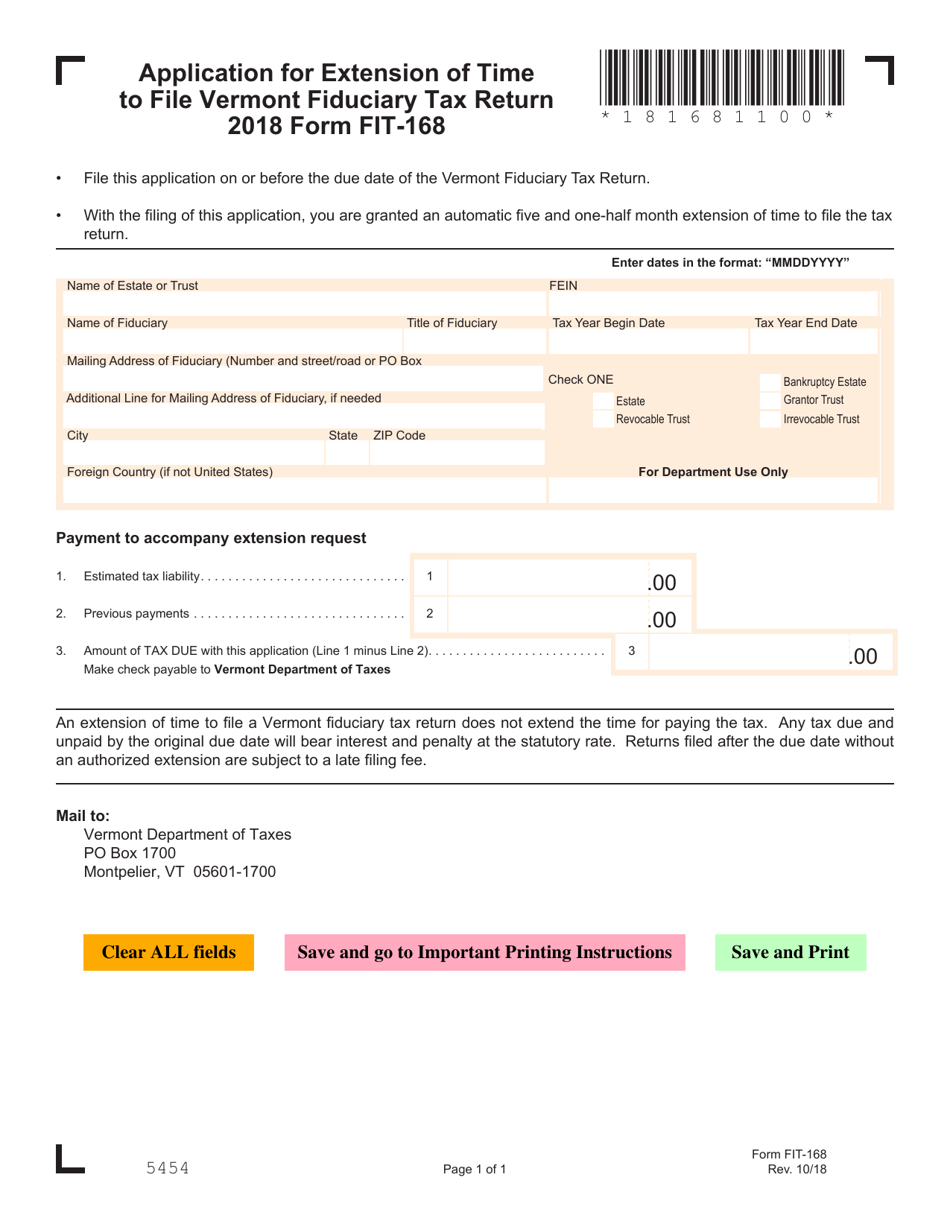

VT Form FIT-168 Application for Extension of Time to File Vermont Fiduciary Tax Return - Vermont

What Is VT Form FIT-168?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form FIT-168?

A: VT Form FIT-168 is the Application for Extension of Time to File Vermont Fiduciary Tax Return in Vermont.

Q: Who needs to use the VT Form FIT-168?

A: The VT Form FIT-168 should be used by anyone who needs additional time to file their Vermont Fiduciary Tax Return.

Q: How can I use the VT Form FIT-168?

A: You can use the VT Form FIT-168 to request an extension of time to file your Vermont Fiduciary Tax Return by submitting the form to the Vermont Department of Taxes.

Q: What is the deadline for filing VT Form FIT-168?

A: The deadline for filing VT Form FIT-168 is the same as the deadline for filing your Vermont Fiduciary Tax Return, which is typically April 15th.

Q: Is there a fee for filing VT Form FIT-168?

A: No, there is no fee for filing VT Form FIT-168.

Q: How long of an extension does VT Form FIT-168 provide?

A: VT Form FIT-168 provides a 6-month extension of time to file your Vermont Fiduciary Tax Return.

Q: Do I still need to pay my taxes by the original deadline when filing VT Form FIT-168?

A: Yes, even with an extension, you are still required to pay any taxes owed by the original deadline to avoid penalties and interest.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form FIT-168 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.