This version of the form is not currently in use and is provided for reference only. Download this version of

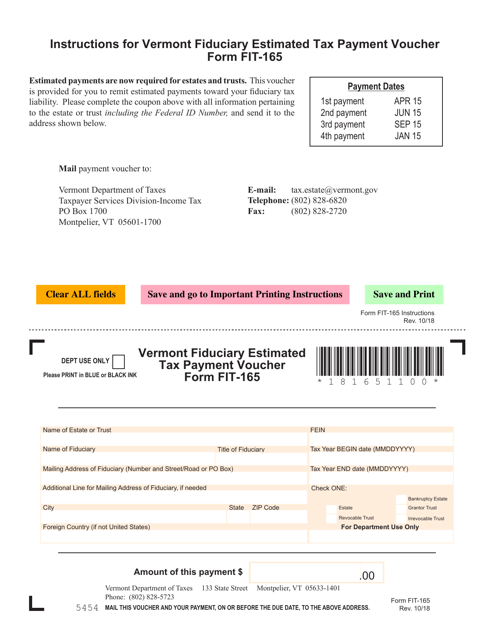

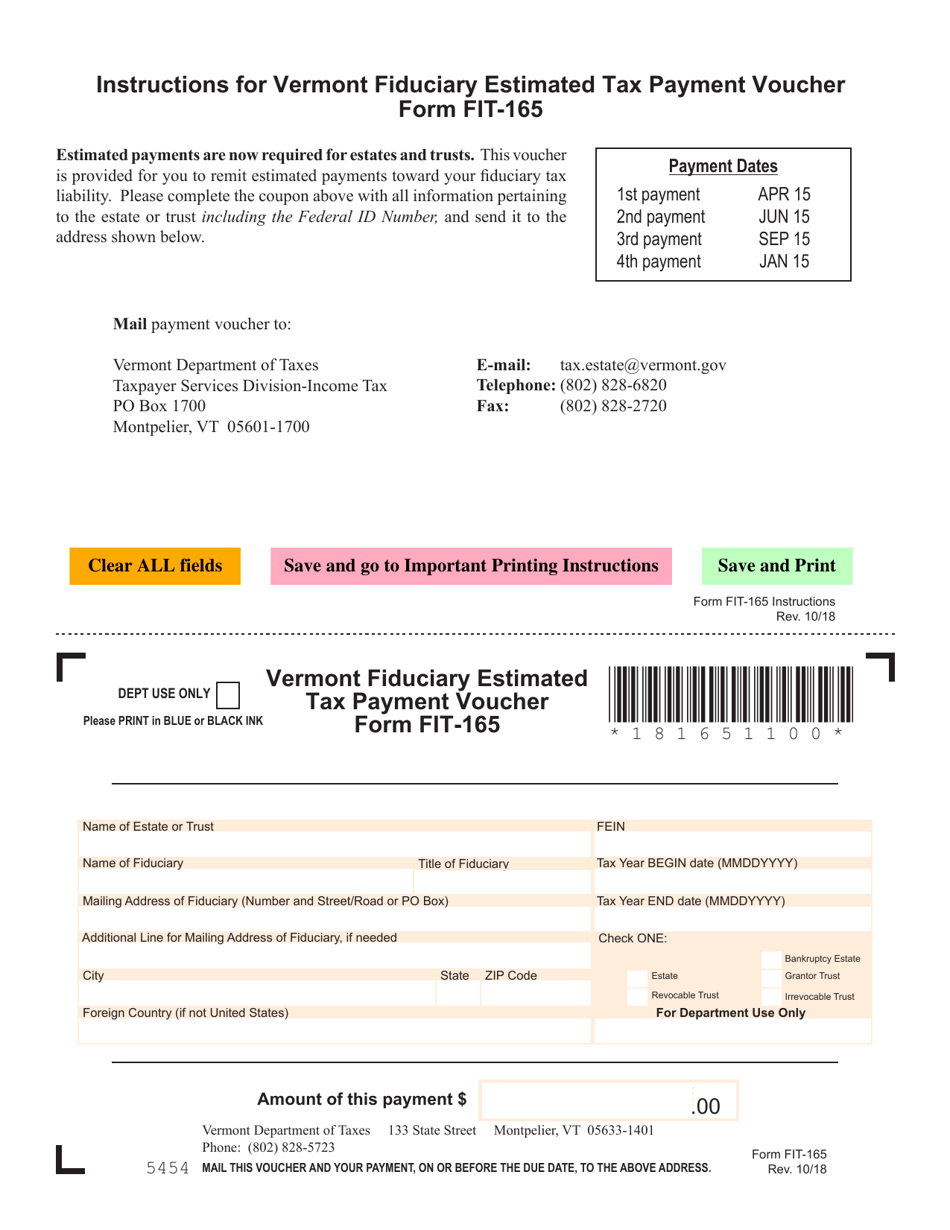

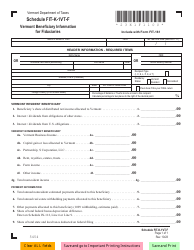

VT Form FIT-165

for the current year.

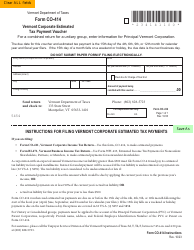

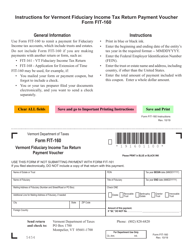

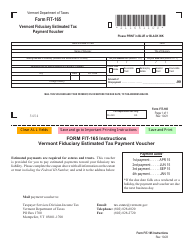

VT Form FIT-165 Fiduciary Estimated Tax Payment Voucher - Vermont

What Is VT Form FIT-165?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

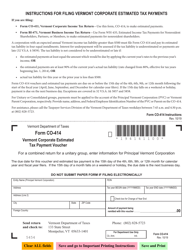

Q: What is the VT Form FIT-165?

A: The VT Form FIT-165 is the Fiduciary Estimated Tax Payment Voucher specifically for Vermont.

Q: Who should use the VT Form FIT-165?

A: Fiduciaries who need to make estimated tax payments for Vermont should use the VT Form FIT-165.

Q: What is a fiduciary?

A: A fiduciary is an individual or entity that acts on behalf of another party in managing assets or finances.

Q: What is an estimated tax payment?

A: An estimated tax payment is a payment made to the government in advance to cover expected tax liability for a specific tax period.

Q: Why would a fiduciary need to make estimated tax payments?

A: Fiduciaries may need to make estimated tax payments if they anticipate owing taxes to Vermont.

Q: How often should a fiduciary make estimated tax payments?

A: Fiduciaries generally need to make estimated tax payments on a quarterly basis.

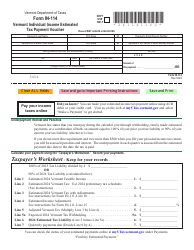

Q: Are there any penalties for not making estimated tax payments?

A: Yes, there may be penalties for not making estimated tax payments or underpaying the required amount.

Q: Is the VT Form FIT-165 required for all fiduciaries?

A: No, the requirement to file the VT Form FIT-165 depends on the specific circumstances and tax liability of the fiduciary.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form FIT-165 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.