This version of the form is not currently in use and is provided for reference only. Download this version of

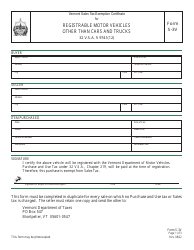

Form VT-013

for the current year.

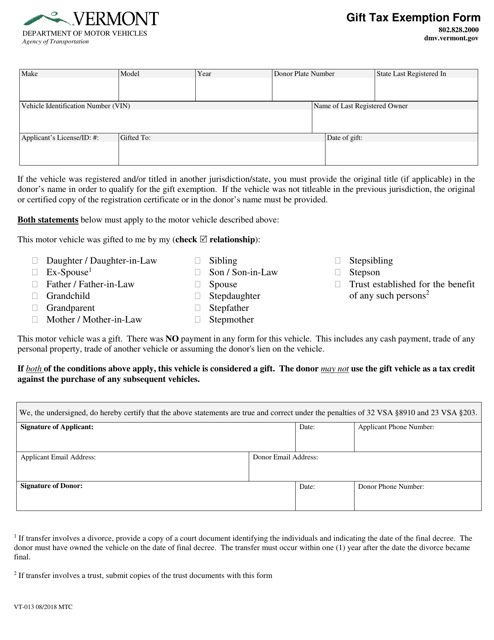

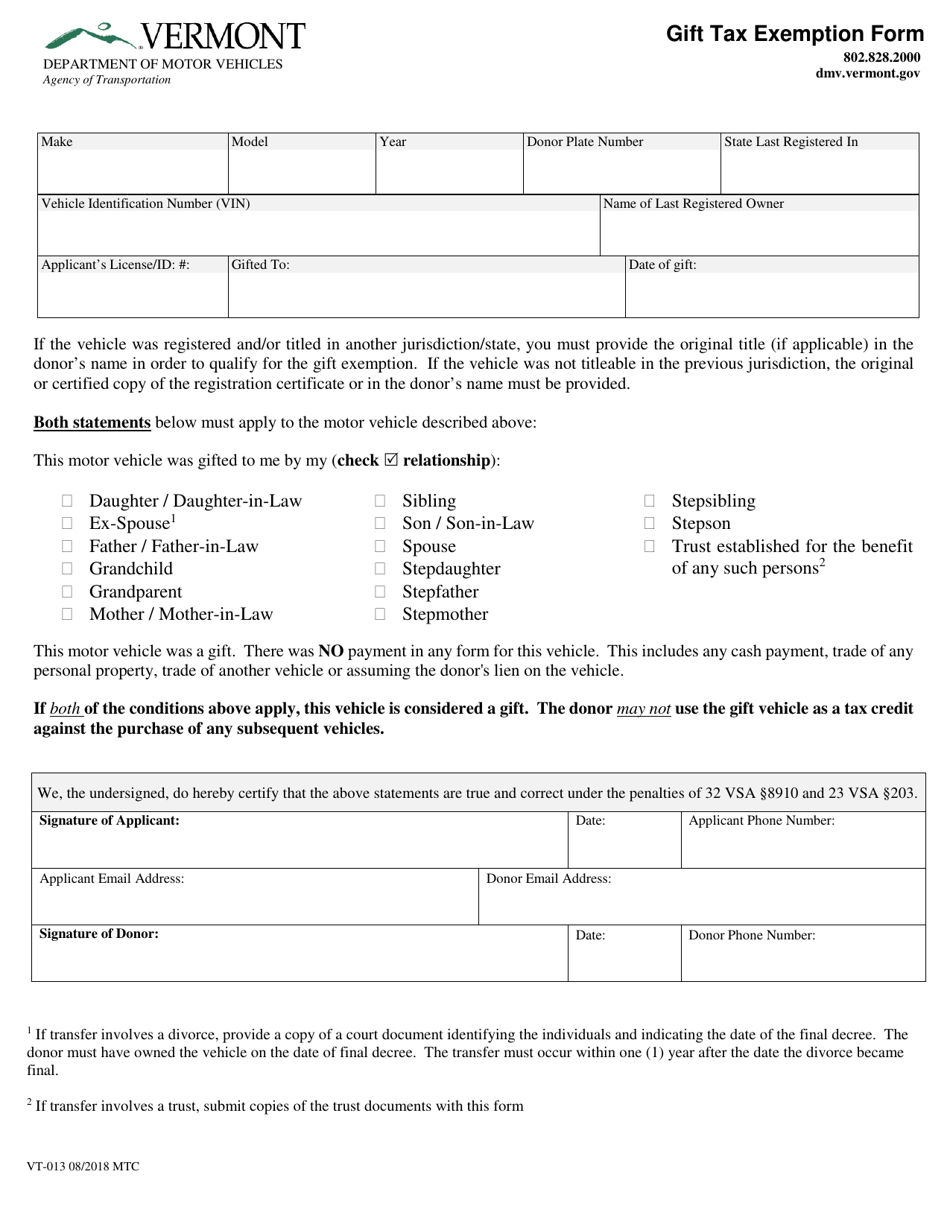

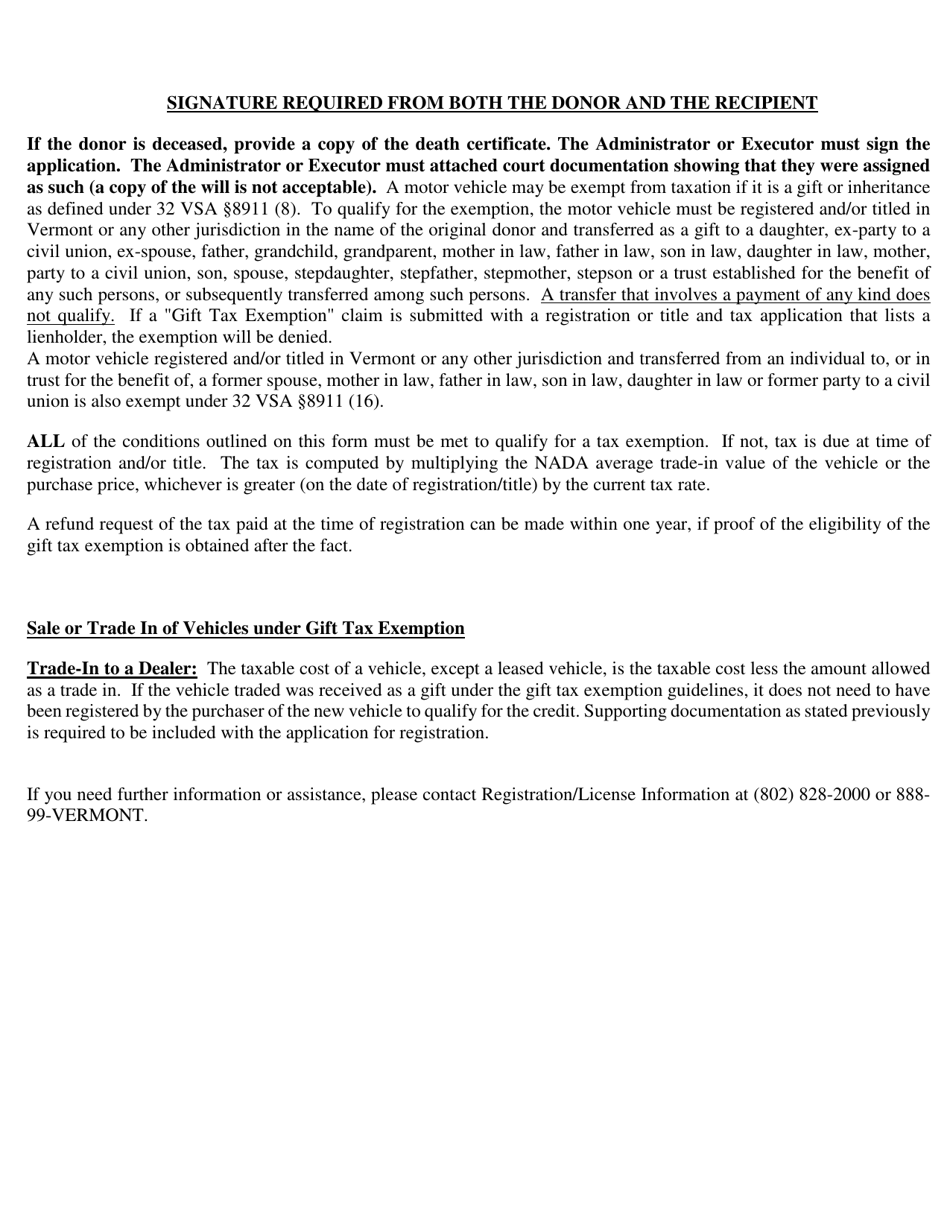

Form VT-013 Gift Tax Exemption Form - Vermont

What Is Form VT-013?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

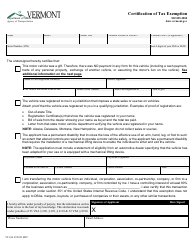

Q: What is VT-013 Gift Tax Exemption Form?

A: VT-013 is a form used in Vermont to claim a gift tax exemption.

Q: Who needs to file VT-013 Gift Tax Exemption Form?

A: Anyone who wants to claim a gift tax exemption in Vermont needs to file this form.

Q: What is a gift tax exemption?

A: A gift tax exemption is a provision that allows certain gifts to be excluded from taxation.

Q: Are all gifts taxable in Vermont?

A: No, certain gifts may be exempt from taxation based on gift tax exemption rules in Vermont.

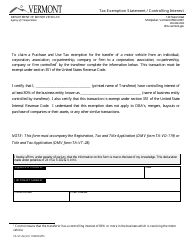

Q: What information is required on the VT-013 Gift Tax Exemption Form?

A: The form will require information about the donor, the recipient, the value of the gift, and any applicable exemptions.

Q: When is the deadline for filing VT-013 Gift Tax Exemption Form?

A: The deadline for filing the VT-013 form is usually the same as the deadline for filing Vermont income tax returns.

Q: Is there a fee for filing the VT-013 Gift Tax Exemption Form?

A: No, there is no fee for filing the VT-013 form.

Q: What happens if I don't file the VT-013 Gift Tax Exemption Form?

A: If you don't file the form, you may not be able to claim a gift tax exemption and may be subject to taxes on the gift.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VT-013 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.