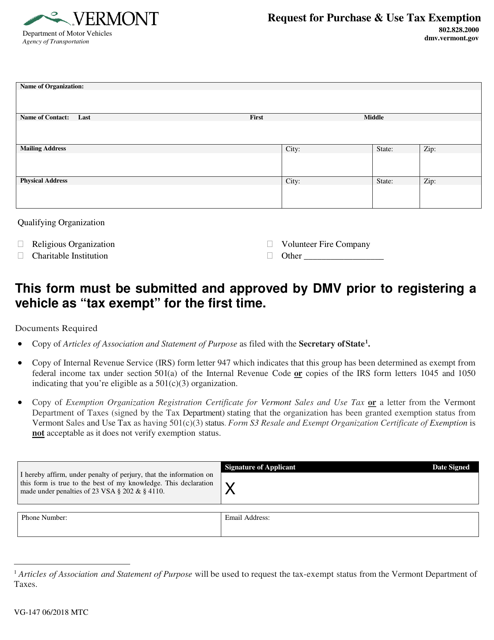

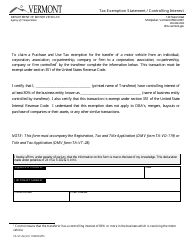

Form VG-147 Request for Purchase & Use Tax Exemption - Vermont

What Is Form VG-147?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VG-147?

A: Form VG-147 is a request for Purchase & Use Tax Exemption in Vermont.

Q: Who can use Form VG-147?

A: Any individual or organization that qualifies for a sales tax exemption in Vermont.

Q: Why would someone use Form VG-147?

A: To request an exemption from paying purchase and use tax in Vermont.

Q: What information is required on Form VG-147?

A: Form VG-147 requires information such as the requester's name, address, tax exemption number, and description of the items being purchased.

Q: Is there a deadline for submitting Form VG-147?

A: There is no specific deadline mentioned for submitting Form VG-147, but it is recommended to submit it before making any tax-exempt purchases.

Q: Are there any fees for submitting Form VG-147?

A: There are no fees associated with submitting Form VG-147.

Q: What should I do after completing Form VG-147?

A: After completing Form VG-147, you should submit it to the Vermont Department of Taxes along with any required supporting documentation.

Q: How long does it take to process Form VG-147?

A: The processing time for Form VG-147 may vary, so it is advisable to submit it well in advance of the intended tax-exempt purchases.

Q: Is there a limit to the number of tax-exempt purchases I can make?

A: There is no specific limit mentioned for tax-exempt purchases; however, eligibility for exemption may be subject to certain conditions or limitations.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VG-147 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.