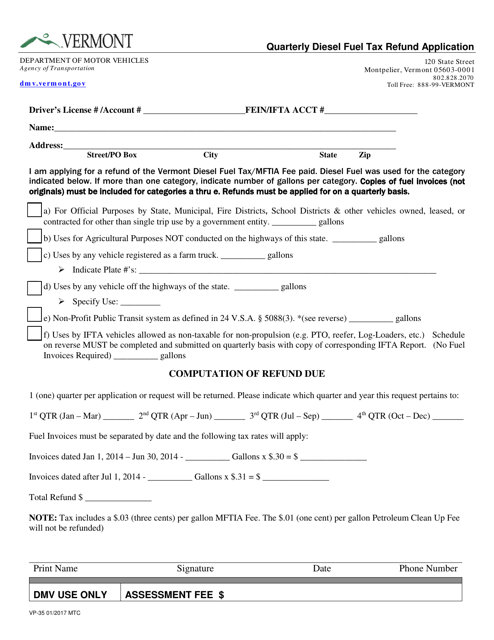

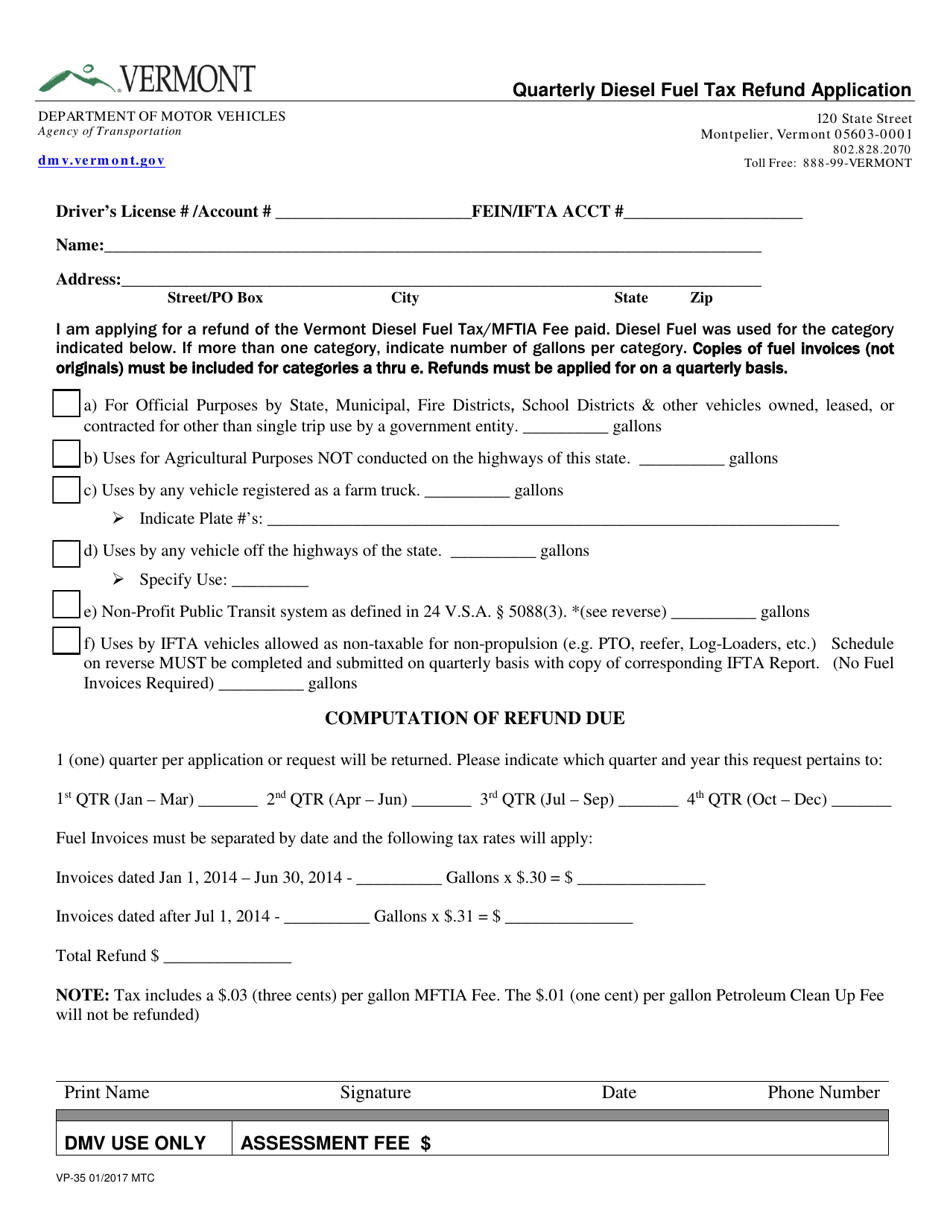

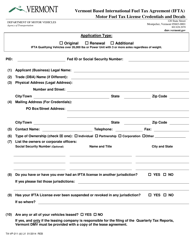

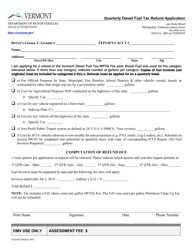

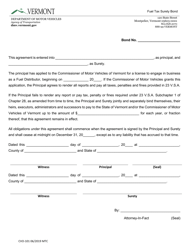

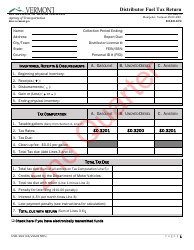

Form VP-35 Quarterly Diesel Fuel Tax Refund Application - Vermont

What Is Form VP-35?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VP-35?

A: Form VP-35 is the Quarterly Diesel Fuel Tax Refund Application for the state of Vermont.

Q: What is the purpose of Form VP-35?

A: The purpose of Form VP-35 is to apply for a refund of the diesel fuel tax paid in Vermont.

Q: Who needs to file Form VP-35?

A: Anyone who paid diesel fuel tax in Vermont and is eligible for a refund can file Form VP-35.

Q: When should Form VP-35 be filed?

A: Form VP-35 must be filed quarterly, with the deadline being the last day of the month following the end of the quarter.

Q: Is there a filing fee for Form VP-35?

A: No, there is no filing fee for Form VP-35.

Q: Are there any supporting documents required with Form VP-35?

A: No, there are no supporting documents required to be submitted with Form VP-35.

Q: What should I do with Form VP-35 after filing?

A: After filing Form VP-35, you should keep a copy for your records.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VP-35 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.