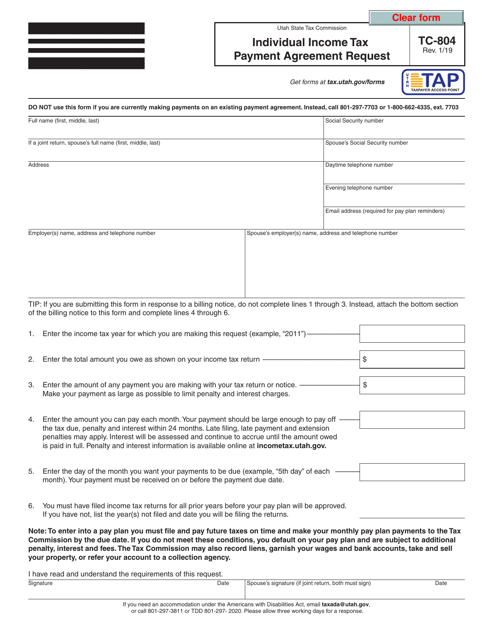

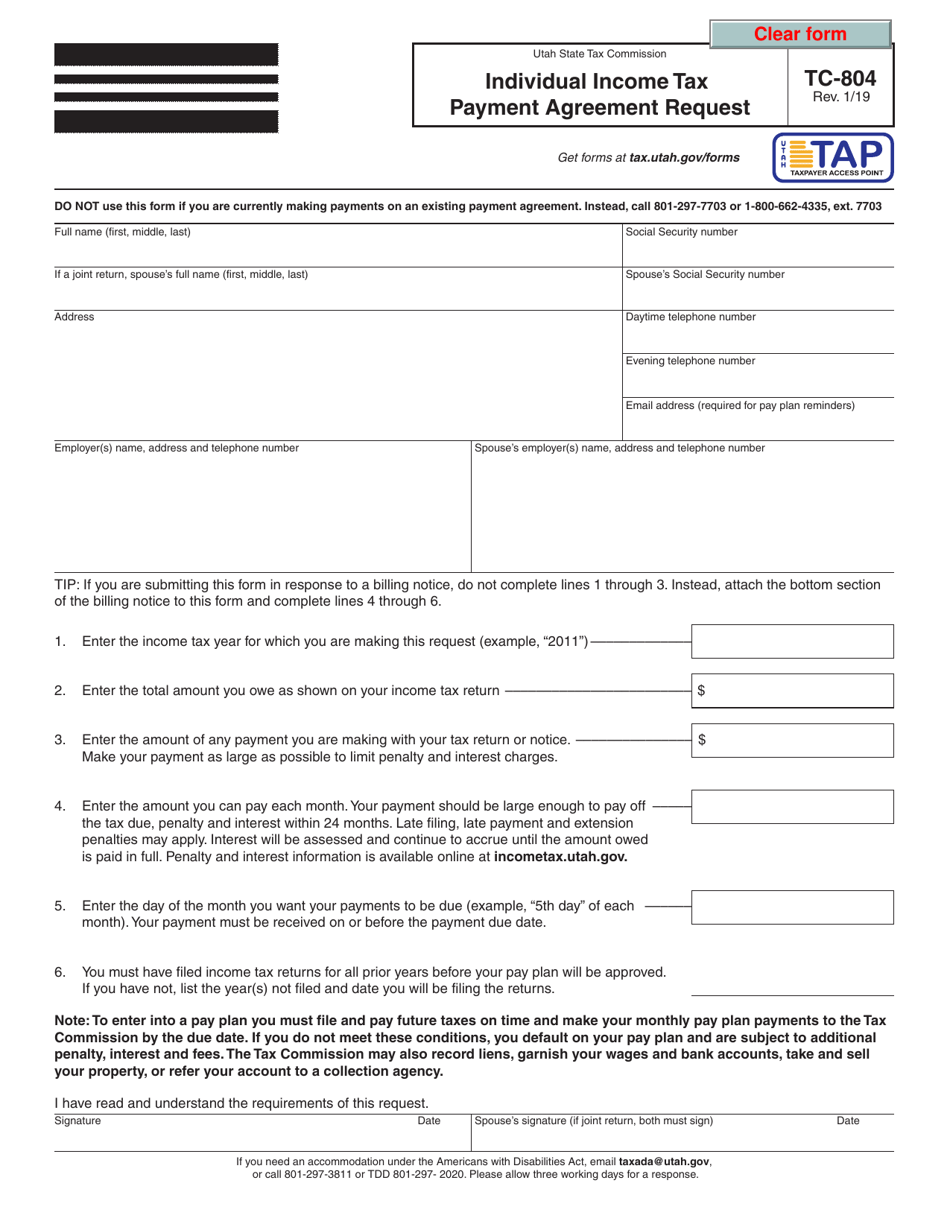

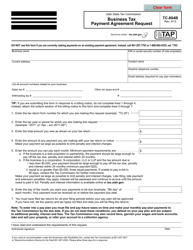

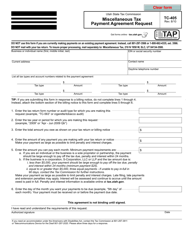

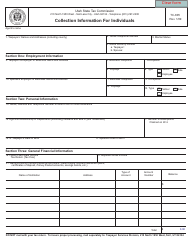

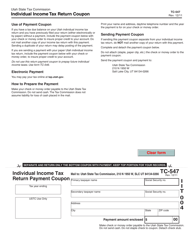

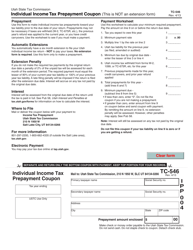

Form TC-804 Individual Income Tax Payment Agreement Request - Utah

What Is Form TC-804?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-804?

A: Form TC-804 is the Individual IncomeTax Payment Agreement Request form used in Utah.

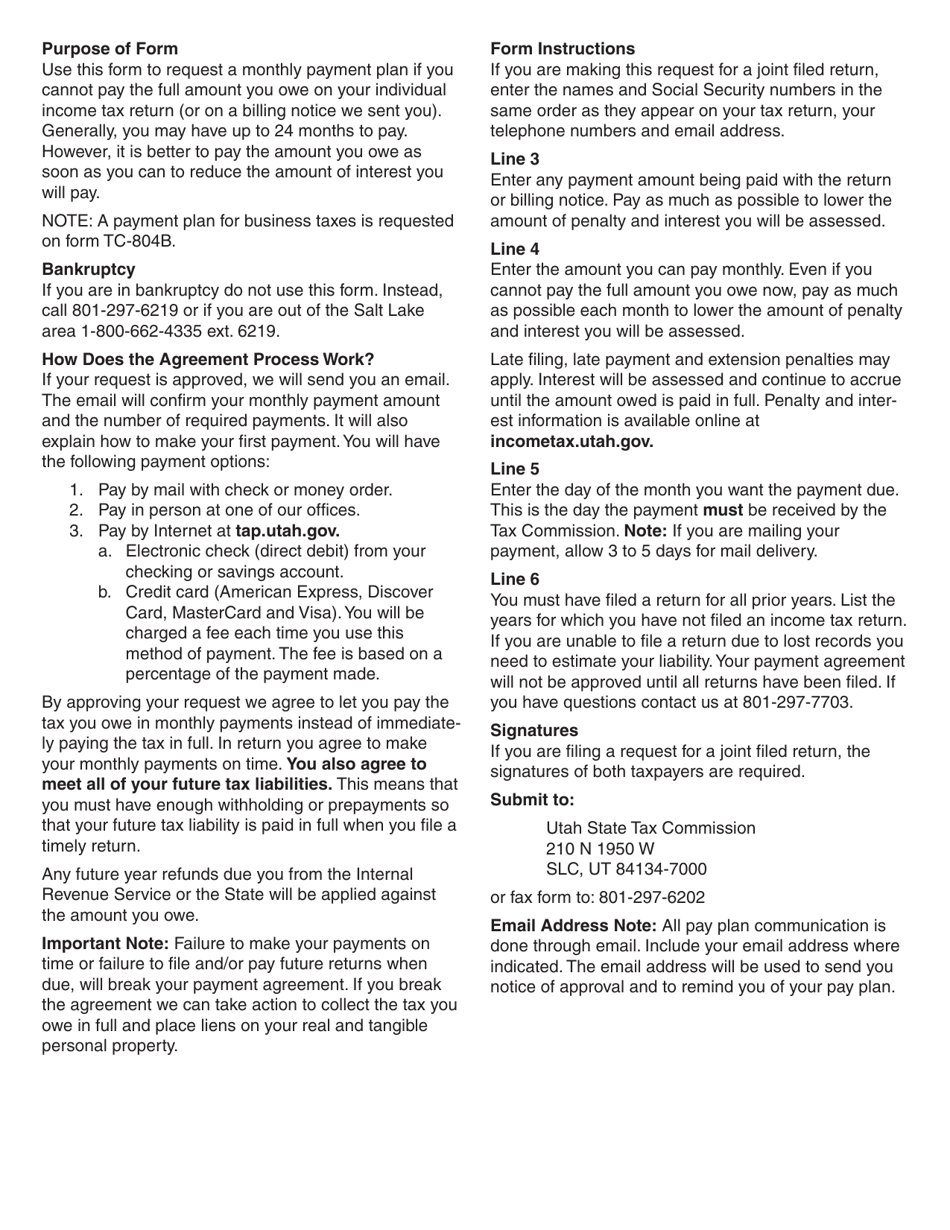

Q: What is the purpose of Form TC-804?

A: The purpose of Form TC-804 is to request a payment agreement to pay off individual income tax owed to the state of Utah.

Q: Who can use Form TC-804?

A: Any individual taxpayer in Utah who owes income tax can use Form TC-804 to request a payment agreement.

Q: How do I fill out Form TC-804?

A: Fill out the form with your personal information, tax details, and proposed payment terms. Be sure to sign and date the form.

Q: Is there a fee to request a payment agreement using Form TC-804?

A: Yes, there is a $50 fee to request a payment agreement using Form TC-804.

Q: How long does it take to process Form TC-804?

A: Processing times may vary, but typically it takes 4-6 weeks for the Utah State Tax Commission to process Form TC-804.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-804 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.