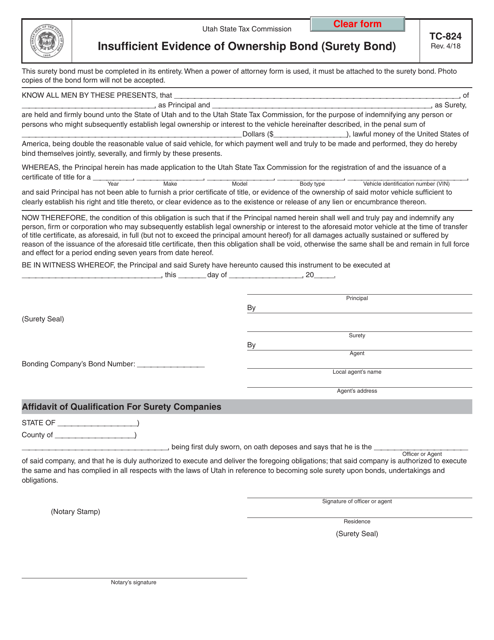

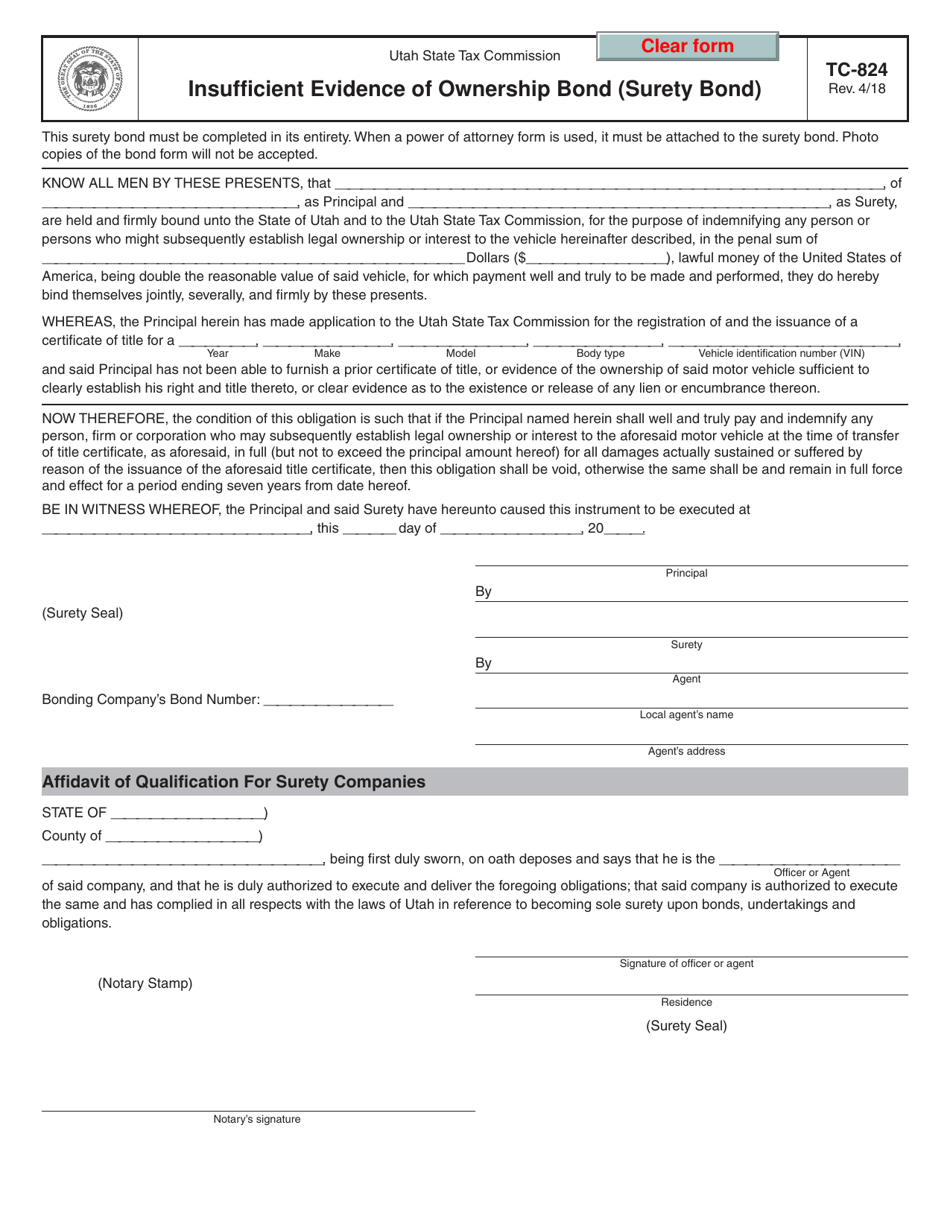

Form TC-824 Insufficient Evidence of Ownership Bond (Surety Bond) - Utah

What Is Form TC-824?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-824?

A: Form TC-824 is the Insufficient Evidence of Ownership Bond, also known as a Surety Bond, used in Utah.

Q: What is the purpose of Form TC-824?

A: The purpose of Form TC-824 is to provide a bond to legally establish ownership of a vehicle in Utah when the evidence of ownership is not sufficient.

Q: Who needs to use Form TC-824?

A: Individuals or businesses who need to establish ownership of a vehicle in Utah when the evidence of ownership is not sufficient.

Q: What does Form TC-824 do?

A: Form TC-824 provides a financial guarantee to the Utah Division of Motor Vehicles that the person or business requesting the bond is the rightful owner of the vehicle.

Q: Are there any fees associated with Form TC-824?

A: Yes, there are fees associated with obtaining a TC-824 bond, including the cost of the bond itself and any processing fees charged by the surety company.

Q: How long is Form TC-824 valid for?

A: Form TC-824 is typically valid for a specific period, as determined by the Utah Division of Motor Vehicles.

Q: What happens after submitting Form TC-824?

A: After submitting Form TC-824 and the required fees, the Utah Division of Motor Vehicles will review the application and bond to determine if it meets the requirements for establishing ownership of the vehicle.

Q: Can Form TC-824 be cancelled or revoked?

A: Yes, Form TC-824 can be cancelled or revoked if the Utah Division of Motor Vehicles determines that the bond was obtained fraudulently or if the owner fails to meet their obligations.

Q: Is Form TC-824 required for all vehicles in Utah?

A: No, Form TC-824 is only required when the evidence of ownership of a vehicle is not sufficient.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-824 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.