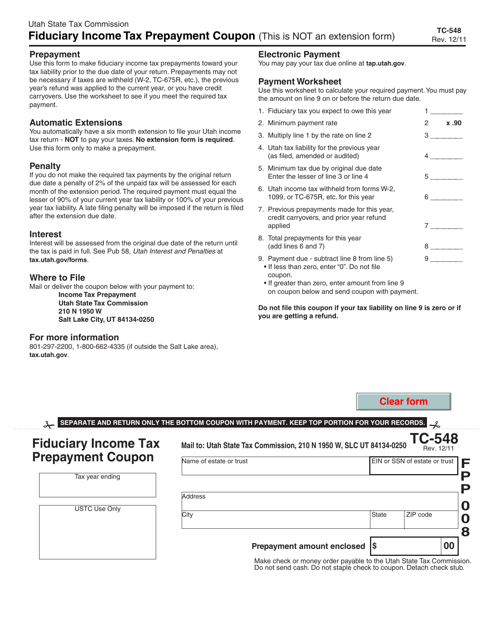

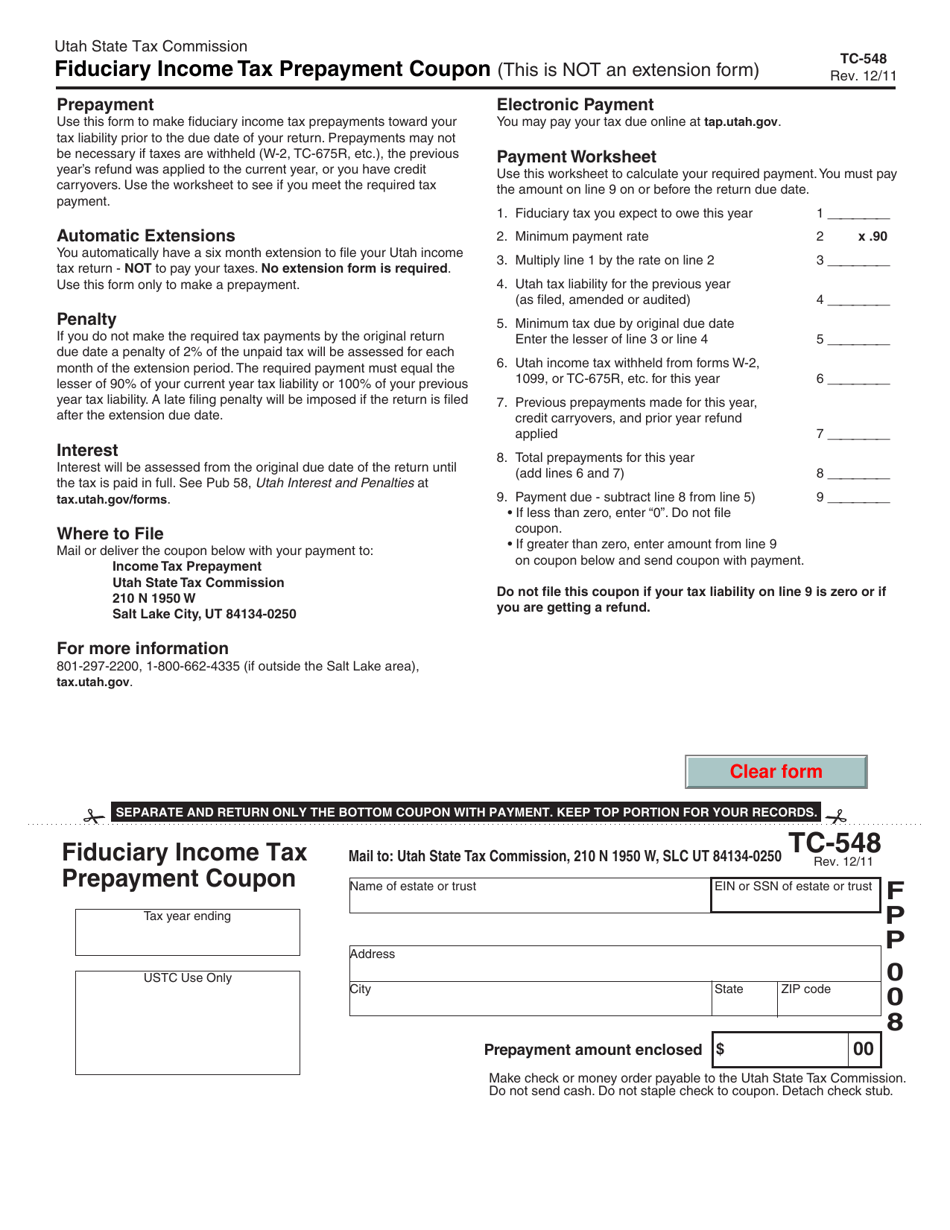

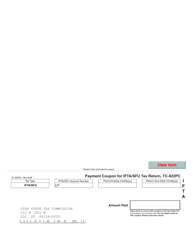

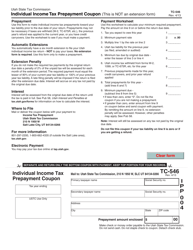

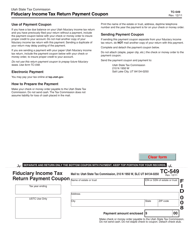

Form TC-548 Fiduciary Income Tax Prepayment Coupon - Utah

What Is Form TC-548?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-548?

A: Form TC-548 is the Fiduciary Income Tax Prepayment Coupon specific to Utah.

Q: What is a fiduciary income tax prepayment coupon?

A: A fiduciary income tax prepayment coupon is a form used to make prepayments towards the fiduciary income tax owed.

Q: Who needs to use Form TC-548?

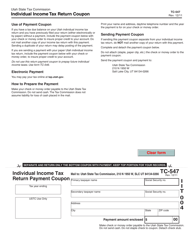

A: Form TC-548 is specifically for fiduciaries in Utah who need to make prepayments towards their income tax liability.

Q: What is a fiduciary?

A: A fiduciary is a person or entity who is responsible for managing the financial affairs of another person, such as a trustee, executor, or administrator.

Q: What is the purpose of making prepayments towards fiduciary income tax?

A: Making prepayments helps to ensure that the fiduciary has enough funds to cover their income tax liability when it is due, and can help avoid penalties and interest.

Form Details:

- Released on December 1, 2011;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-548 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.