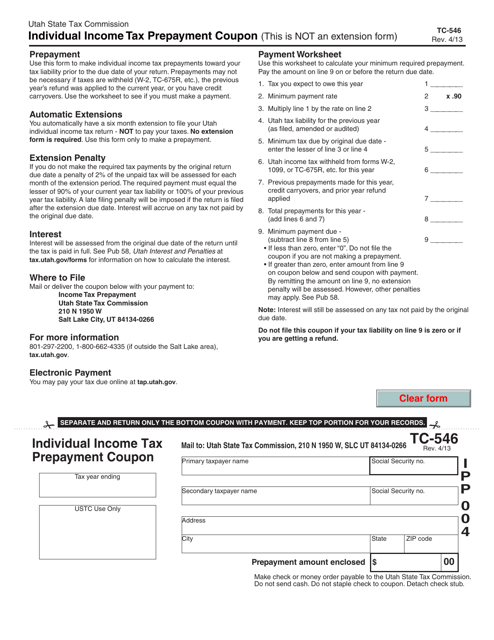

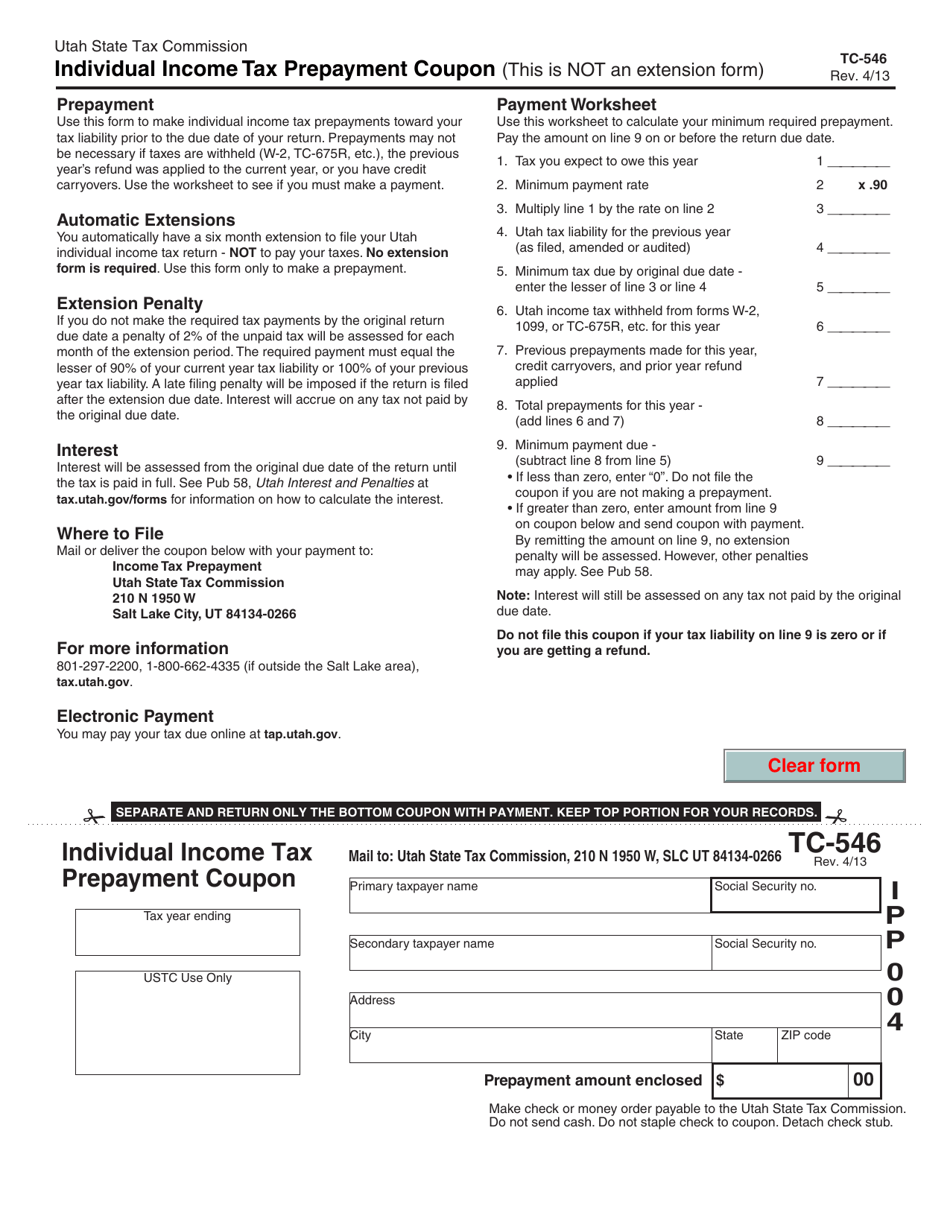

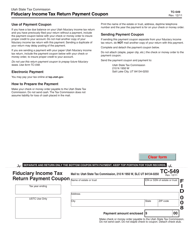

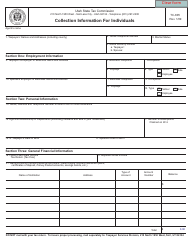

Form TC-546 Individual Income Tax Prepayment Coupon - Utah

What Is Form TC-546?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-546?

A: Form TC-546 is the Individual Income Tax Prepayment Coupon used in Utah.

Q: What is the purpose of Form TC-546?

A: The purpose of Form TC-546 is to make prepayments of income tax in Utah.

Q: Who should use Form TC-546?

A: Form TC-546 is used by individuals who need to make prepayments of income tax in Utah.

Q: When should Form TC-546 be used?

A: Form TC-546 should be used when making prepayments of income tax in Utah.

Q: How do I fill out Form TC-546?

A: To fill out Form TC-546, you will need to provide your personal information, calculate the amount of your prepayment, and submit the form with your payment to the Utah State Tax Commission.

Q: What happens after I submit Form TC-546?

A: After you submit Form TC-546 with your payment, the Utah State Tax Commission will apply the prepayment to your individual income tax account.

Q: Is Form TC-546 mandatory?

A: Form TC-546 is not mandatory but is recommended for individuals who want to make prepayments of income tax in Utah.

Form Details:

- Released on April 1, 2013;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-546 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.