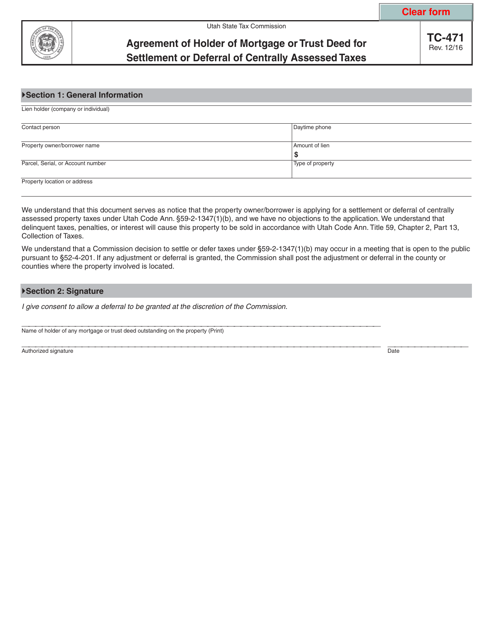

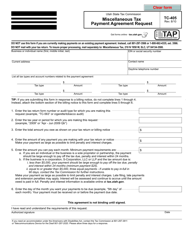

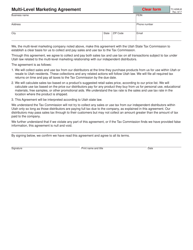

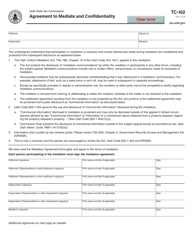

Form TC-471 Agreement of Holder of Mortgage or Trust Deed for Settlement or Deferral of Centrally Assessed Taxes - Utah

What Is Form TC-471?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-471?

A: Form TC-471 is an agreement used by the holder of a mortgage or trust deed in Utah to settle or defer centrally assessed taxes.

Q: Who uses Form TC-471?

A: The holder of a mortgage or trust deed in Utah uses Form TC-471.

Q: What is the purpose of Form TC-471?

A: The purpose of Form TC-471 is to settle or defer centrally assessed taxes.

Q: What are centrally assessed taxes?

A: Centrally assessed taxes are property taxes assessed on certain types of property, such as railroads, telecommunications companies, and utility companies.

Q: Does Form TC-471 apply to all types of property?

A: No, Form TC-471 applies specifically to centrally assessed property.

Q: Can the settlement or deferral of centrally assessed taxes be requested using Form TC-471?

A: Yes, Form TC-471 can be used to request the settlement or deferral of centrally assessed taxes.

Q: Is the completion of Form TC-471 mandatory?

A: Yes, if you are the holder of a mortgage or trust deed in Utah and you want to settle or defer centrally assessed taxes, the completion of Form TC-471 is mandatory.

Q: Are there any fees associated with the submission of Form TC-471?

A: There may be fees associated with the submission of Form TC-471. You should consult the instructions on the form or contact the Utah State Tax Commission for more information.

Q: Can Form TC-471 be used for other purposes besides settling or deferring centrally assessed taxes?

A: No, Form TC-471 is specifically designed for the settlement or deferral of centrally assessed taxes and should not be used for other purposes.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-471 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.