This version of the form is not currently in use and is provided for reference only. Download this version of

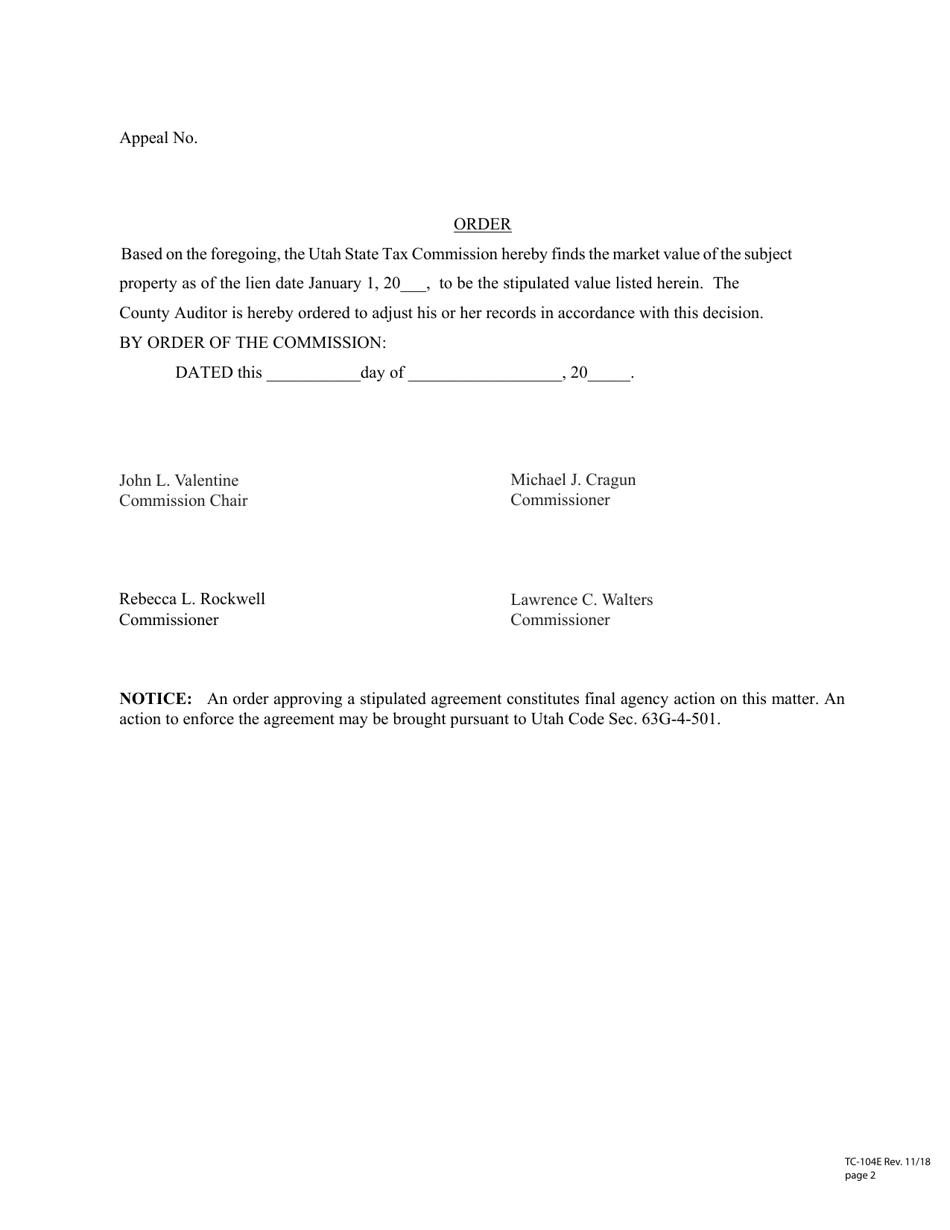

Form TC-104E

for the current year.

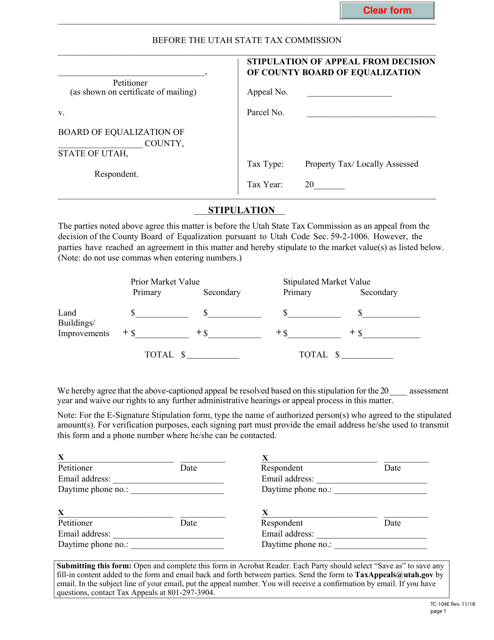

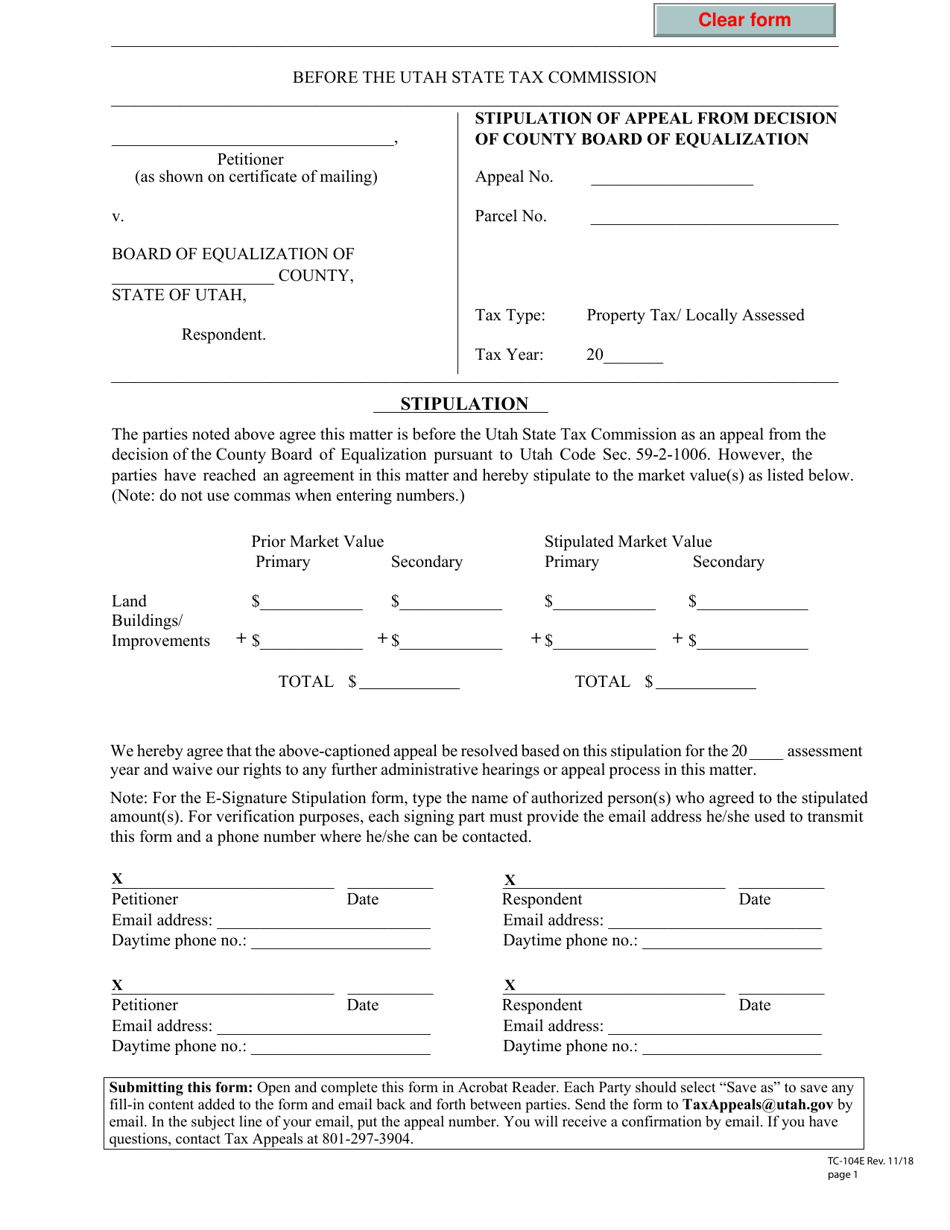

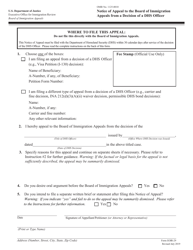

Form TC-104E Stipulation of Appeal From Decision of County Board of Equalization (For Single Parcels) - Utah

What Is Form TC-104E?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form TC-104E?

A: Form TC-104E is the Stipulation of Appeal From Decision of County Board of Equalization for Single Parcels in Utah.

Q: What is the purpose of Form TC-104E?

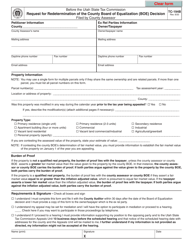

A: The purpose of Form TC-104E is to appeal the decision made by the County Board of Equalization regarding the valuation of a single parcel.

Q: Who can use Form TC-104E?

A: Any individual or entity who owns a single parcel of property in Utah and wants to appeal the valuation decision made by the County Board of Equalization can use Form TC-104E.

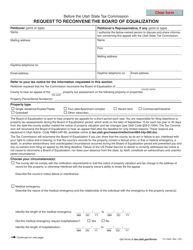

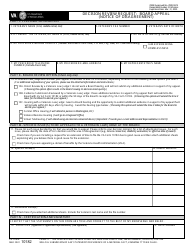

Q: What information do I need to provide on Form TC-104E?

A: On Form TC-104E, you will need to provide your name, contact information, parcel number, the reason for the appeal, and any supporting documentation.

Q: What is the deadline for filing Form TC-104E?

A: The deadline for filing Form TC-104E is 30 days from the date of the County Board of Equalization's decision.

Q: What happens after I file Form TC-104E?

A: After you file Form TC-104E, the Utah State Tax Commission will schedule a hearing to review your appeal. You will be notified of the hearing date and time.

Q: Can I represent myself at the hearing?

A: Yes, you can represent yourself at the hearing or you can choose to have an attorney represent you.

Q: How long does the appeal process take?

A: The length of the appeal process can vary. It typically takes several months for a decision to be reached.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-104E by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.