This version of the form is not currently in use and is provided for reference only. Download this version of

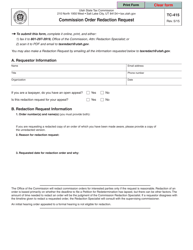

Form TC-104

for the current year.

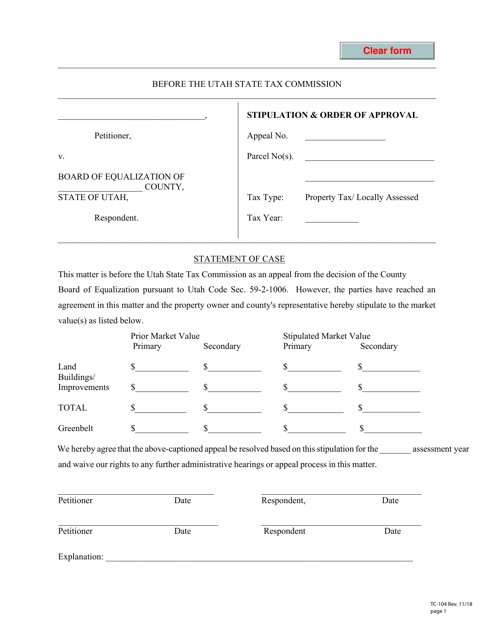

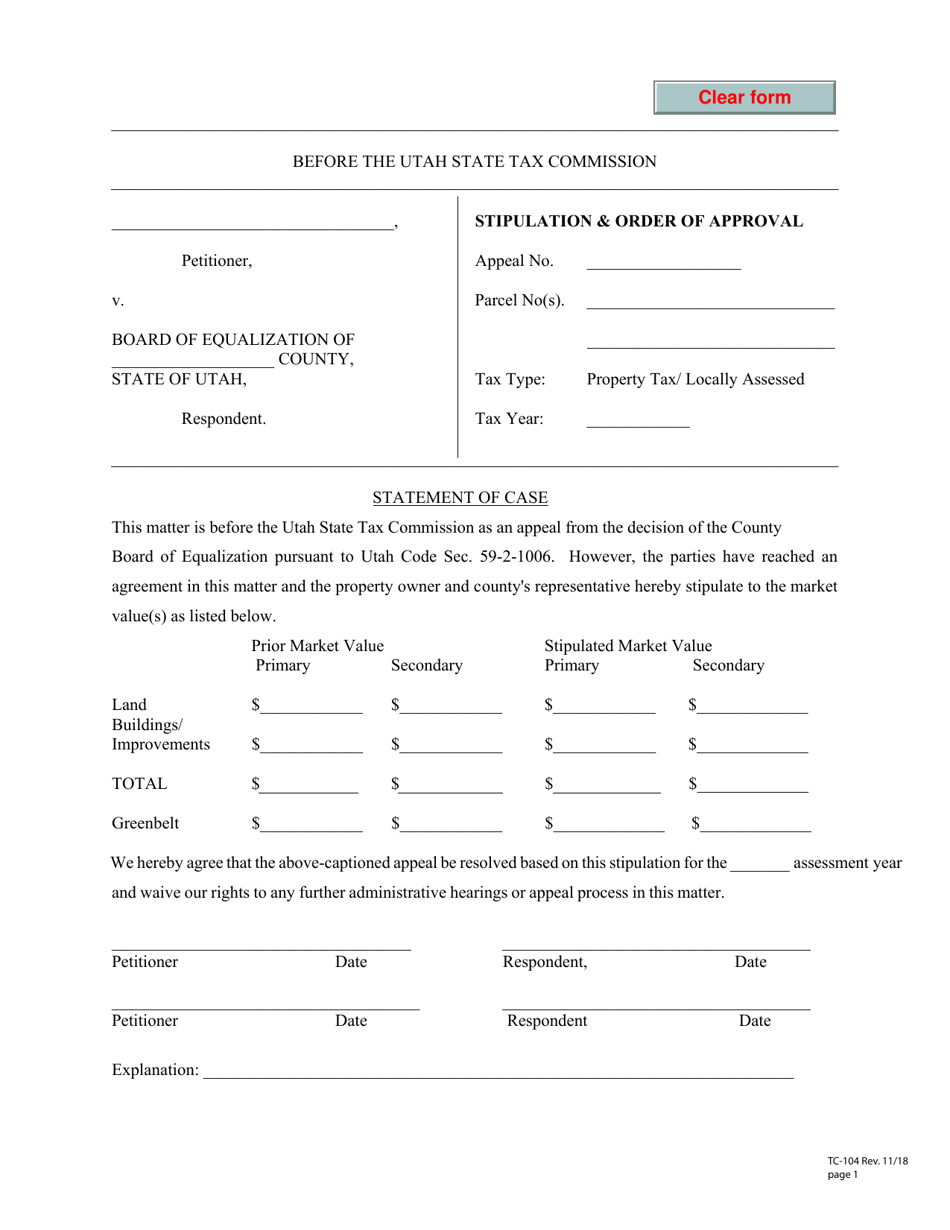

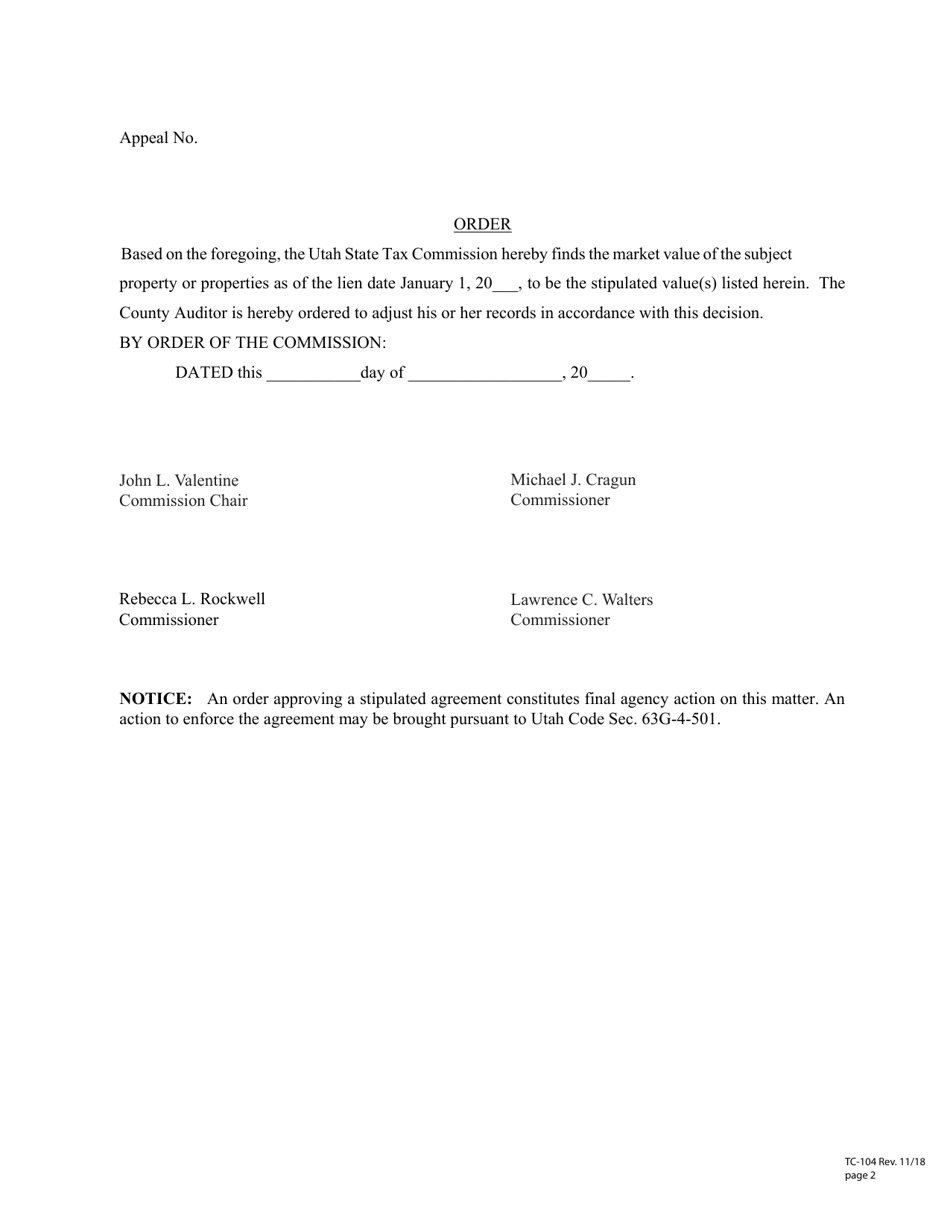

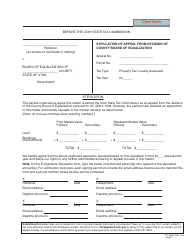

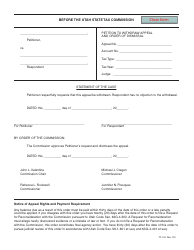

Form TC-104 Stipulation & Order of Approval - Utah

What Is Form TC-104?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

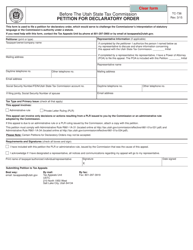

Q: What is Form TC-104?

A: Form TC-104 is a Stipulation & Order of Approval document in Utah.

Q: What is the purpose of Form TC-104?

A: The purpose of Form TC-104 is to obtain approval for a stipulation or agreement in a Utah court case.

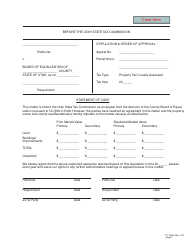

Q: How do I use Form TC-104?

A: To use Form TC-104, you need to fill out the required information, including the details of the stipulation or agreement, and then submit it to the court for approval.

Q: Do I need to have an attorney to fill out Form TC-104?

A: It is recommended to consult with an attorney before filling out Form TC-104, but it is not required.

Q: Can I modify Form TC-104 to fit my specific case?

A: You should not modify the content or format of Form TC-104. It is important to use the official version provided by the Utah court.

Q: What happens after I submit Form TC-104?

A: After you submit Form TC-104, the court will review the stipulation or agreement and decide whether to approve it.

Q: Are there any fees associated with filing Form TC-104?

A: There may be filing fees associated with submitting Form TC-104. It is best to check with the court or consult with an attorney for the current fee schedule.

Q: How long does it take for the court to approve Form TC-104?

A: The time it takes for the court to approve Form TC-104 can vary. It is best to check with the court or consult with an attorney for an estimate.

Q: What should I do if my Form TC-104 is denied?

A: If your Form TC-104 is denied, you may need to revise the stipulation or agreement and resubmit it to the court for approval.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-104 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.