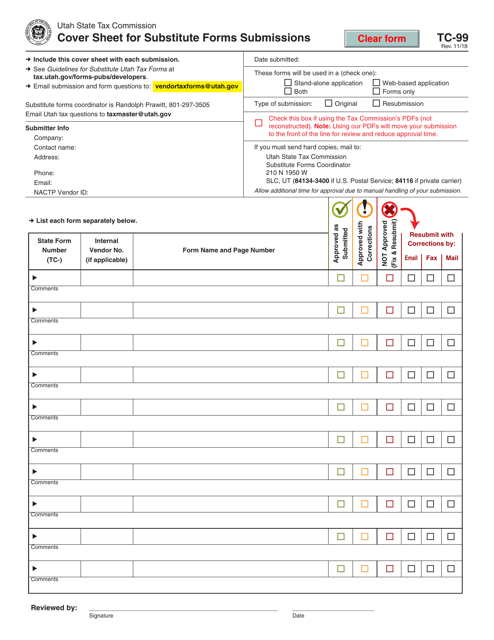

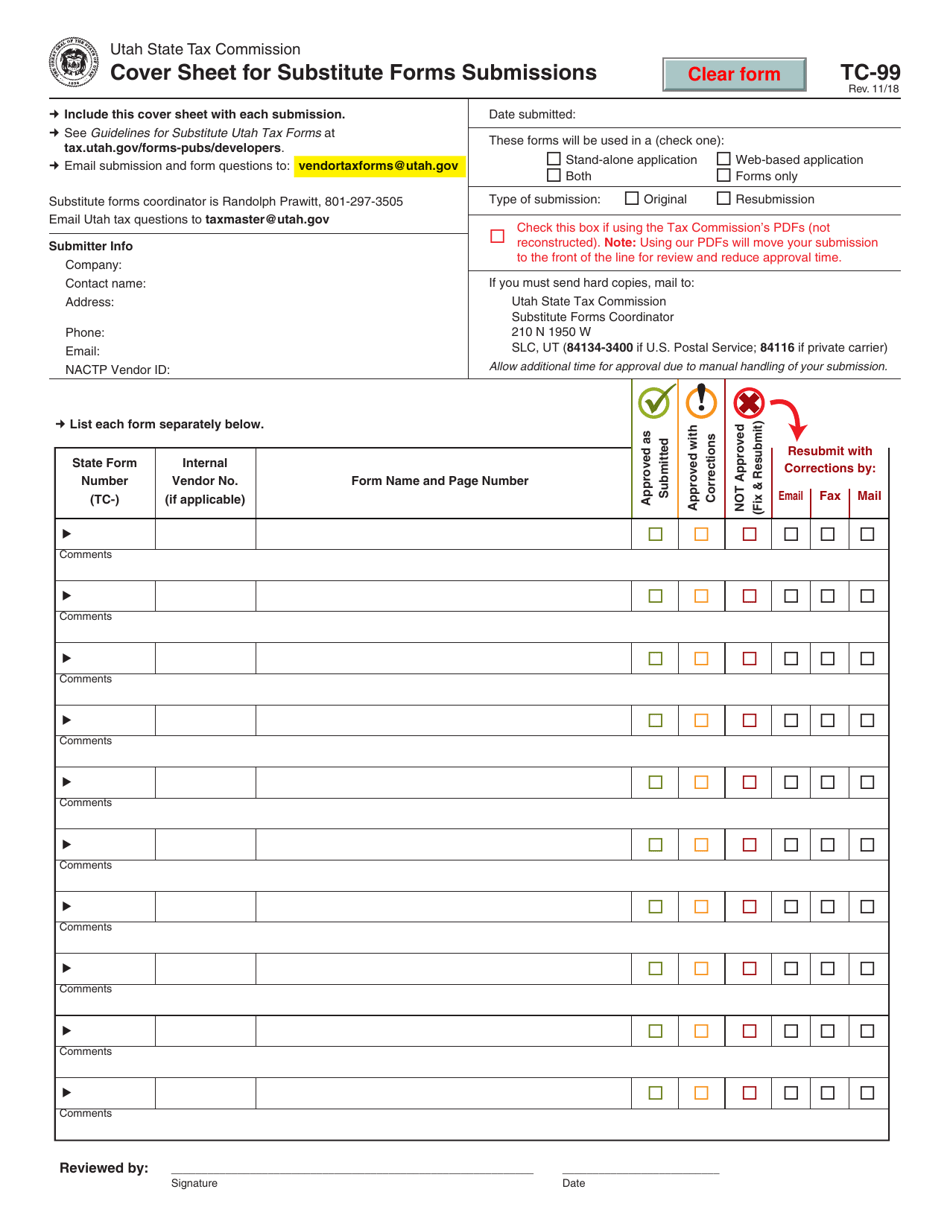

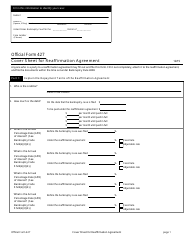

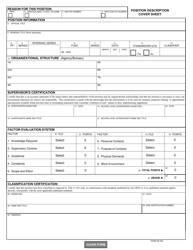

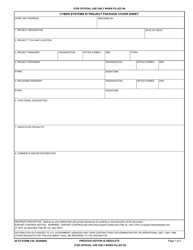

Form TC-99 Cover Sheet for Substitute Forms Submissions - Utah

What Is Form TC-99?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-99?

A: Form TC-99 is the Cover Sheet for Substitute Forms Submissions in Utah.

Q: What is the purpose of Form TC-99?

A: The purpose of Form TC-99 is to serve as a cover sheet for submitting substitute forms to the Utah State Tax Commission.

Q: Who needs to fill out Form TC-99?

A: Anyone who is submitting substitute forms to the Utah State Tax Commission needs to fill out Form TC-99.

Q: Are there any fees associated with Form TC-99?

A: No, there are no fees associated with Form TC-99.

Q: Can I submit Form TC-99 electronically?

A: No, Form TC-99 cannot be submitted electronically. It must be mailed or hand-delivered to the Utah State Tax Commission.

Q: Is Form TC-99 required for all substitute forms submissions in Utah?

A: Yes, Form TC-99 is required for all substitute forms submissions in Utah.

Q: What information is required on Form TC-99?

A: Form TC-99 requires information such as the name of the taxpayer, the type of form being substituted, and the reason for the substitution.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-99 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.