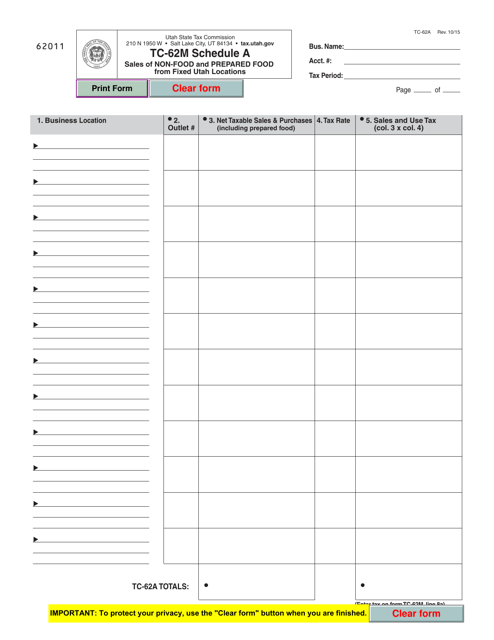

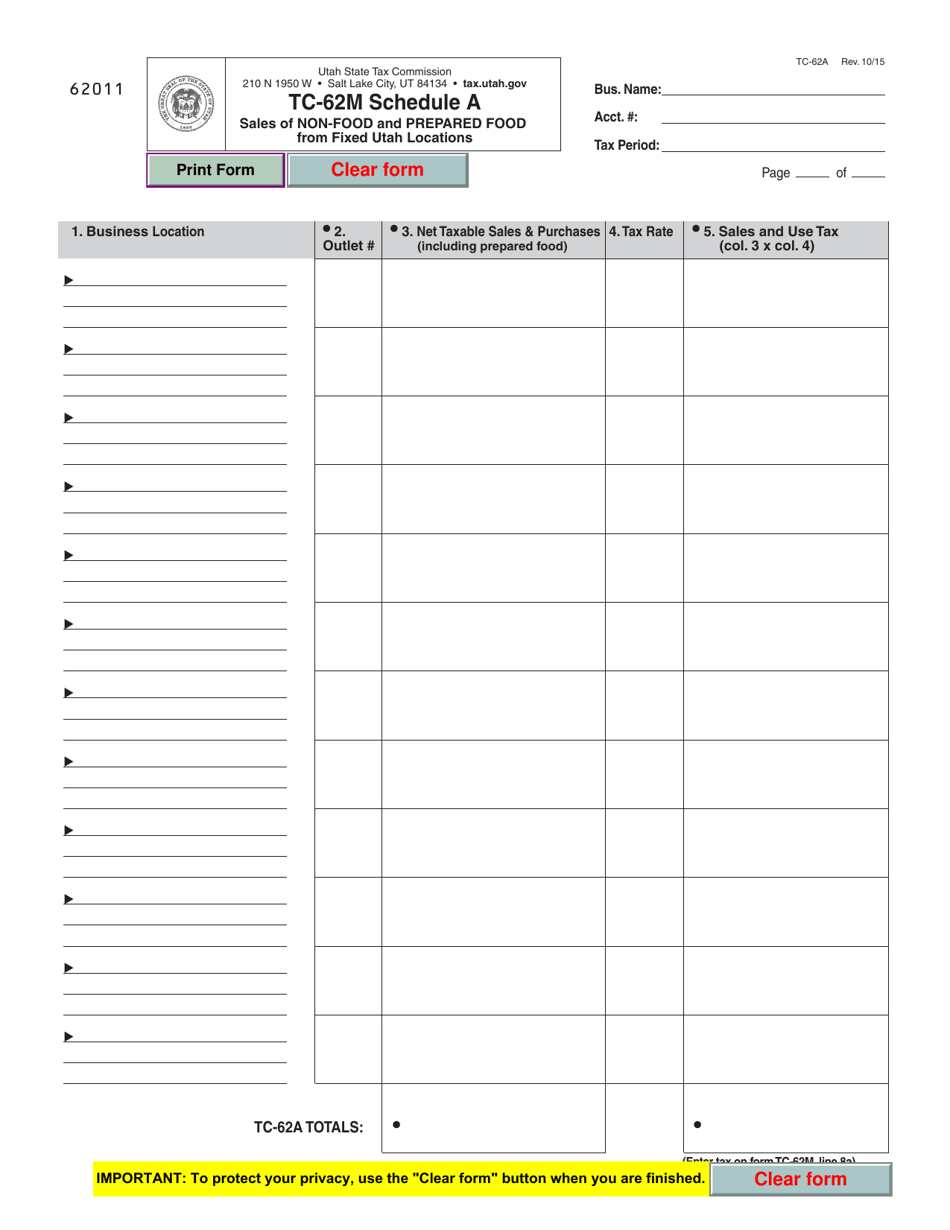

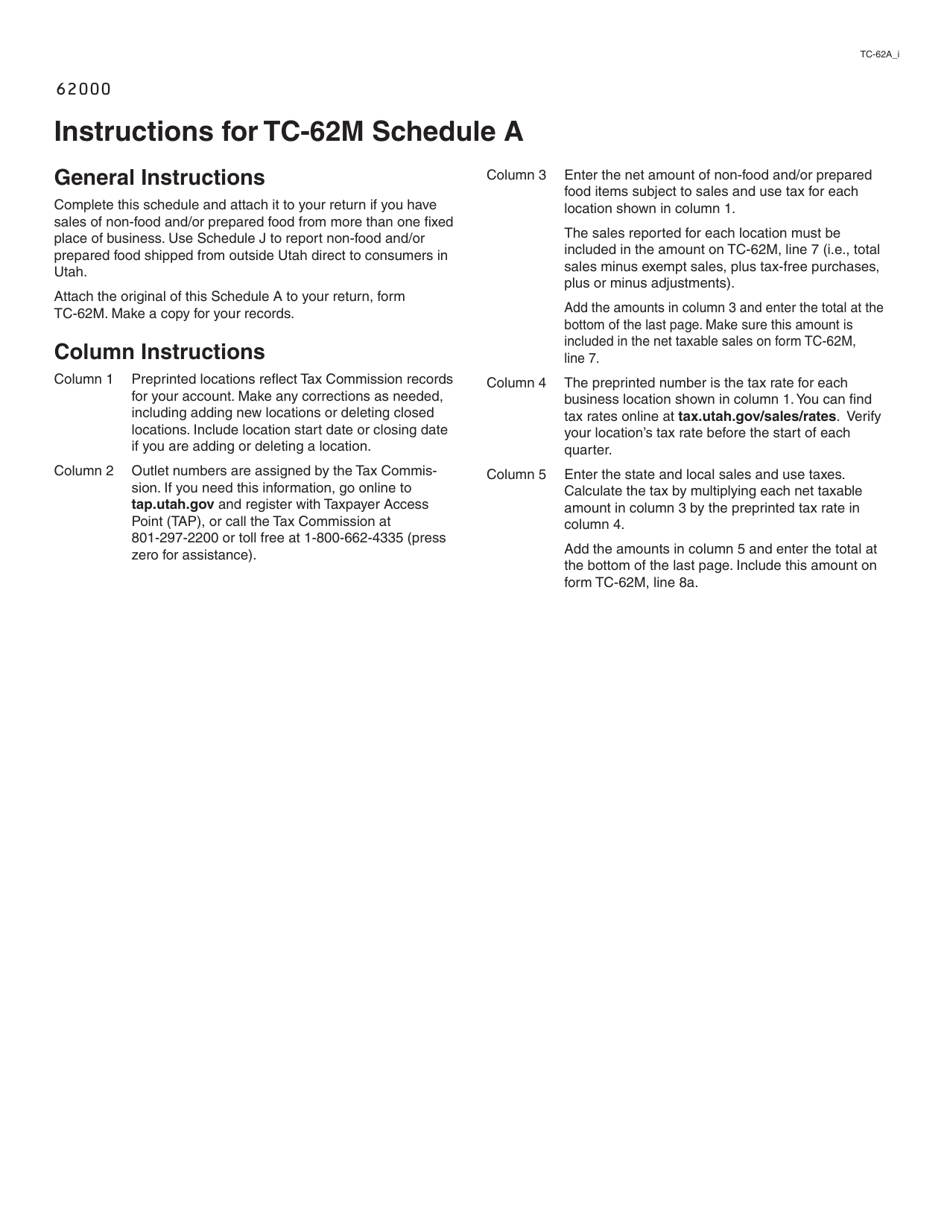

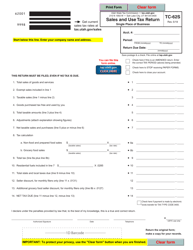

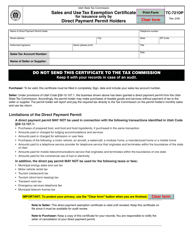

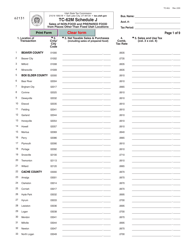

Form TC-62M (TC-62A) Schedule A Sales of Non-food and Prepared Food From Fixed Utah Locations - Utah

What Is Form TC-62M (TC-62A) Schedule A?

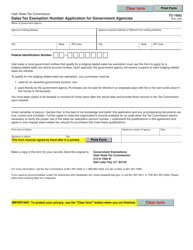

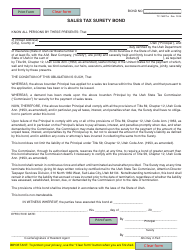

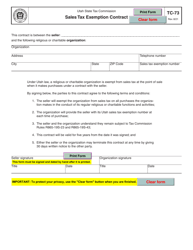

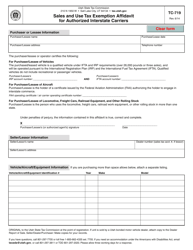

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah.The document is a supplement to Form TC-62M, Sales and Use Tax Return for Multiple Places of Business. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TC-62M (TC-62A) Schedule A?

A: TC-62M (TC-62A) Schedule A is a form used for reporting sales of non-food and prepared food from fixed Utah locations.

Q: Who needs to file TC-62M (TC-62A) Schedule A?

A: Businesses that sell non-food and prepared food from fixed locations in Utah need to file TC-62M (TC-62A) Schedule A.

Q: What type of sales should be reported on TC-62M (TC-62A) Schedule A?

A: TC-62M (TC-62A) Schedule A should be used to report sales of non-food and prepared food from fixed locations in Utah.

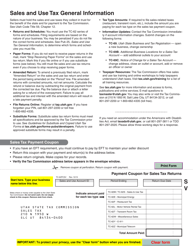

Q: Are there any exemptions or deductions available for TC-62M (TC-62A) Schedule A?

A: There may be exemptions or deductions available for certain types of sales on TC-62M (TC-62A) Schedule A. It is recommended to consult the instructions or a tax professional for more information.

Q: When is the deadline to file TC-62M (TC-62A) Schedule A?

A: The deadline to file TC-62M (TC-62A) Schedule A depends on the reporting period and is typically on a quarterly basis. It is important to check the instructions or consult with the Utah State Tax Commission for the specific deadline.

Q: What should I do if I have additional questions about TC-62M (TC-62A) Schedule A?

A: If you have additional questions about TC-62M (TC-62A) Schedule A, it is recommended to contact the Utah State Tax Commission or consult with a tax professional for assistance.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-62M (TC-62A) Schedule A by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.