This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

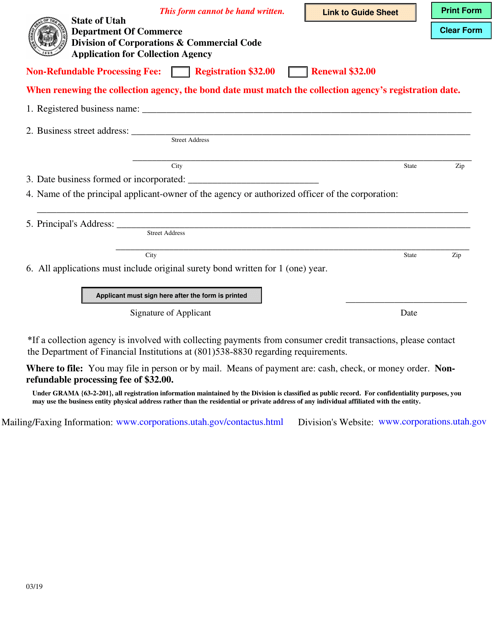

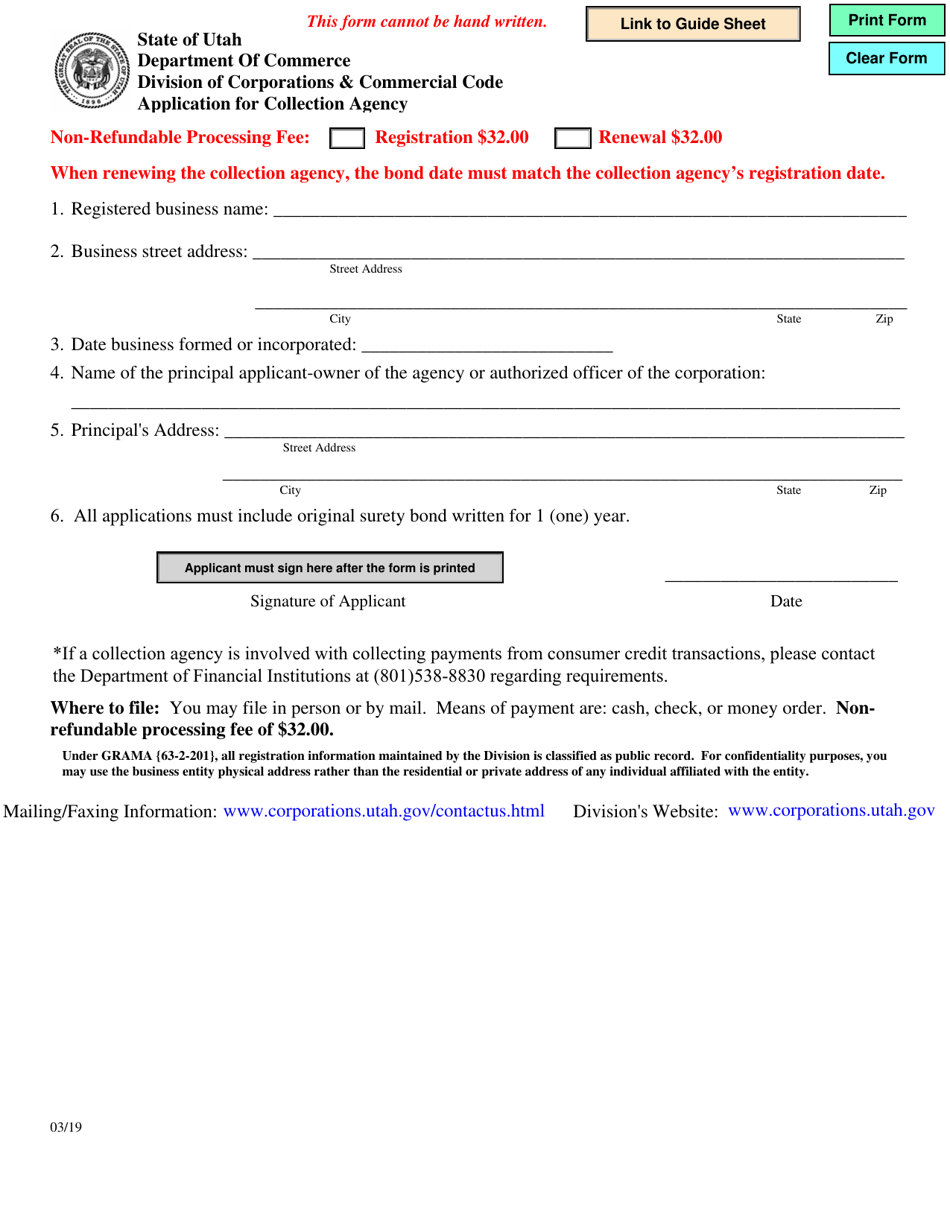

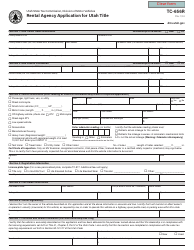

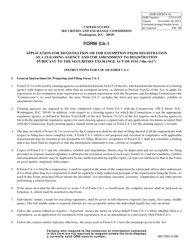

Application for Collection Agency - Utah

Application for Collection Agency is a legal document that was released by the Utah Department of Commerce - a government authority operating within Utah.

FAQ

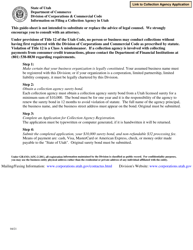

Q: What is a collection agency?

A: A collection agency is a business that helps creditors collect unpaid debts from consumers.

Q: Why do I need to apply for a collection agency license in Utah?

A: In Utah, collection agencies are required to be licensed in order to operate legally and provide debt collection services.

Q: How can I apply for a collection agency license in Utah?

A: To apply for a collection agency license in Utah, you need to complete an application form, provide supporting documentation, and pay the required fees. The application form can be obtained from the Utah Department of Commerce, Division of Consumer Protection.

Q: What supporting documentation is needed for the application?

A: The supporting documentation for the application may include a surety bond, background checks, financial statements, letters of reference, and proof of compliance with debt collection laws and regulations.

Q: What are the requirements to operate a collection agency in Utah?

A: In addition to obtaining a collection agency license, the requirements to operate a collection agency in Utah include compliance with the Utah Collection Agency Act, maintaining proper records, following debt collection practices, and handling consumer complaints.

Q: How long does it take to get a collection agency license in Utah?

A: The processing time for a collection agency license application in Utah can vary. It is advisable to submit a complete and accurate application with all required supporting documents to avoid delays.

Form Details:

- Released on March 1, 2019;

- The latest edition currently provided by the Utah Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Utah Department of Commerce.