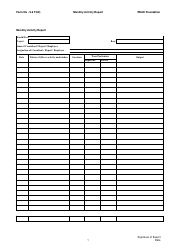

This version of the form is not currently in use and is provided for reference only. Download this version of

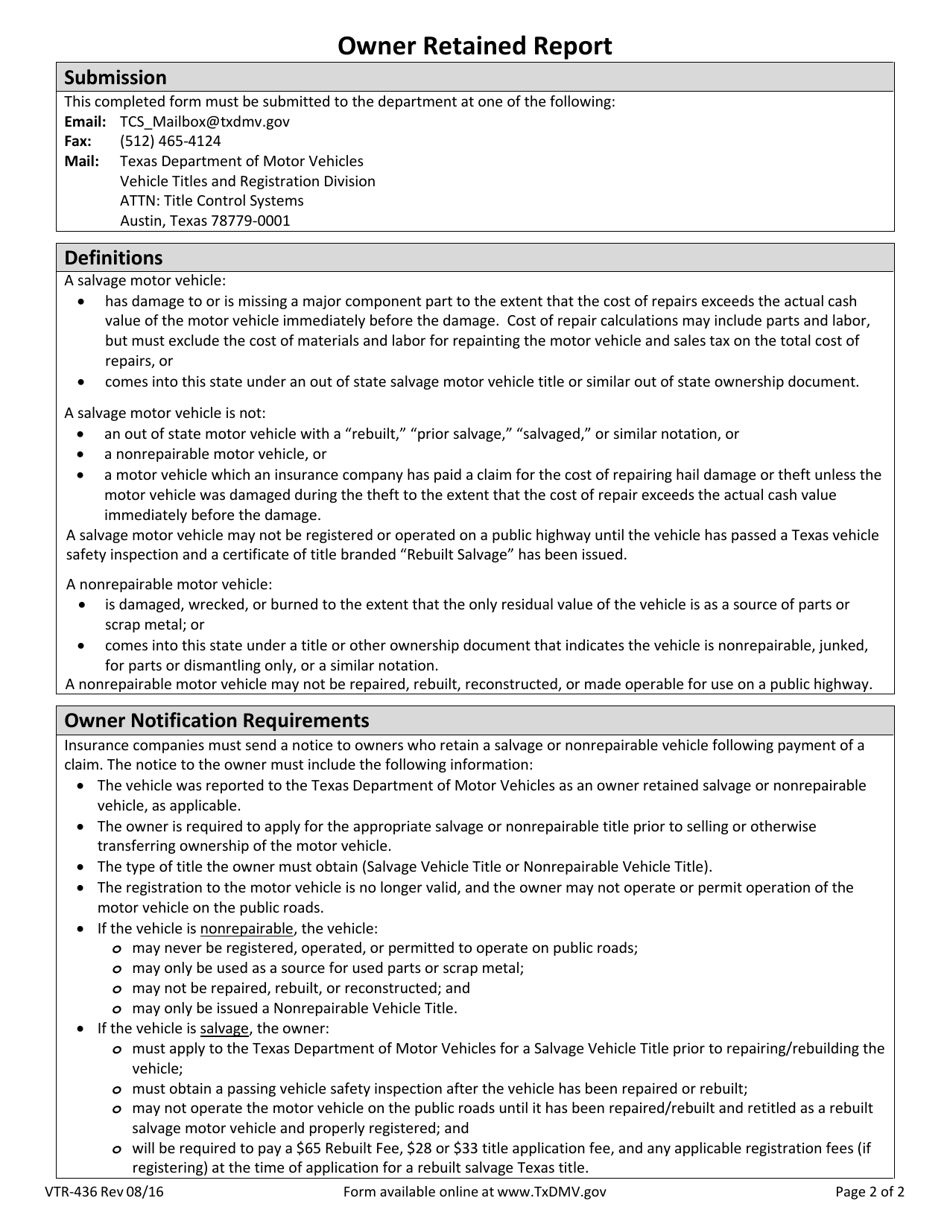

Form VTR-436

for the current year.

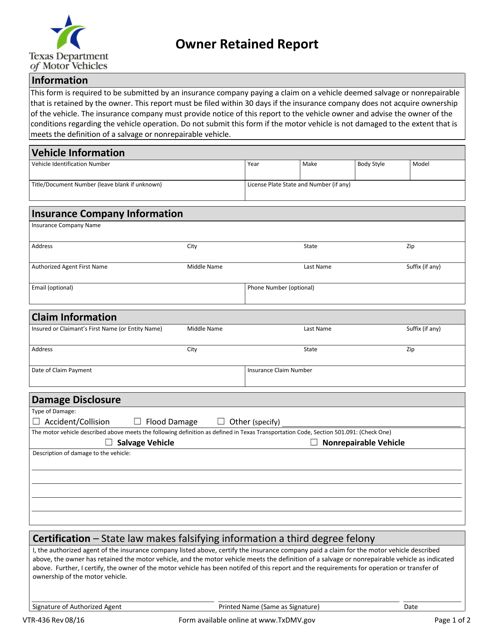

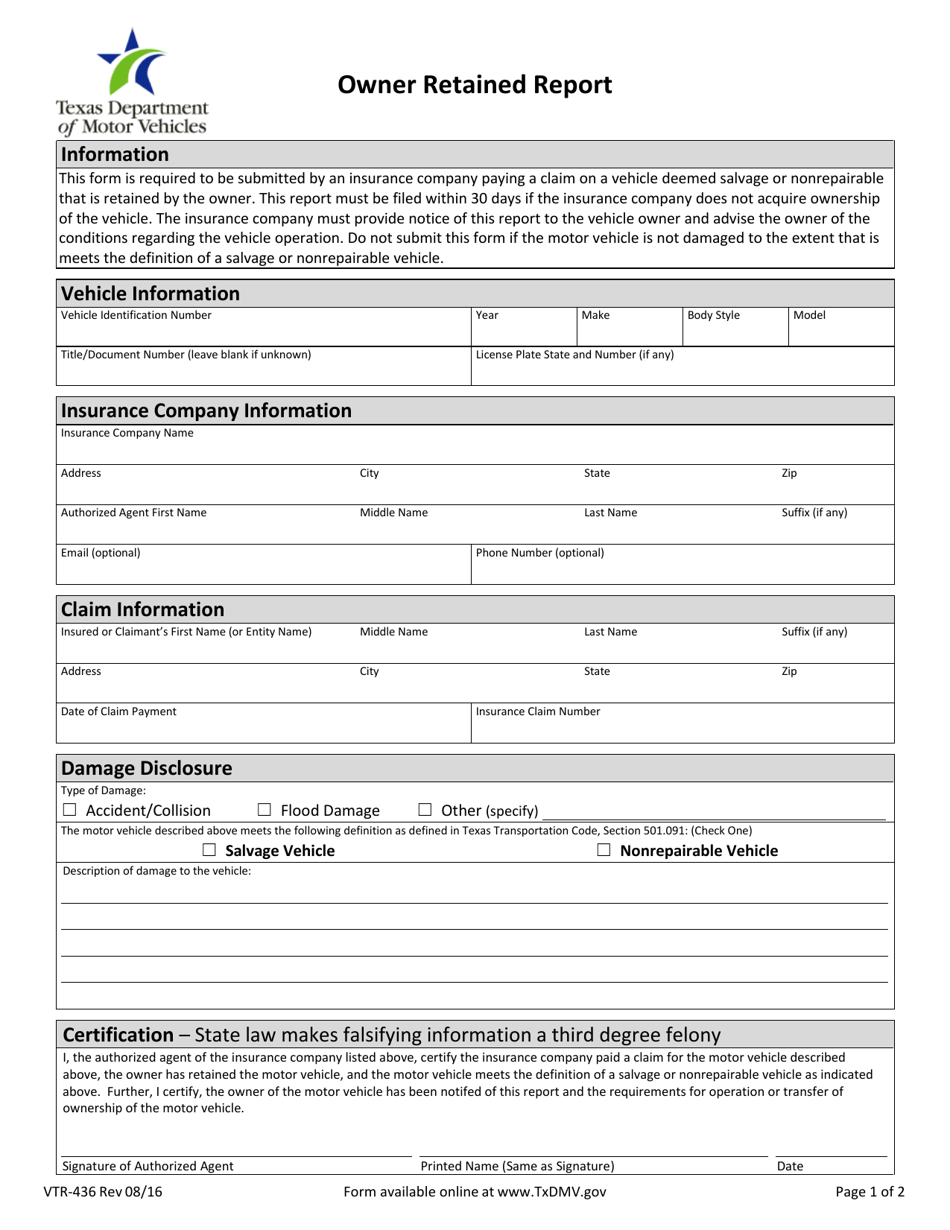

Form VTR-436 Owner Retained Report - Texas

What Is Form VTR-436?

This is a legal form that was released by the Texas Department of Motor Vehicles - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form VTR-436 Owner Retained Report?

A: The Form VTR-436 Owner Retained Report is a document used in Texas to report the sale of a vehicle by an individual who retains ownership.

Q: Who needs to fill out the Form VTR-436?

A: The Form VTR-436 needs to be filled out by individuals who have sold a vehicle in Texas but have decided to retain ownership.

Q: What information is required on the Form VTR-436?

A: The Form VTR-436 requires information such as the seller's name, address, legal description of the vehicle, and details of the sale.

Q: Is there a deadline for submitting the Form VTR-436?

A: Yes, the Form VTR-436 must be submitted within 30 days of the sale of the vehicle.

Q: What is the purpose of the Form VTR-436?

A: The purpose of the Form VTR-436 is to document the sale of a vehicle by an individual who retains ownership, ensuring that the appropriate taxes and fees are paid.

Q: Are there any fees associated with submitting the Form VTR-436?

A: There is no fee for submitting the Form VTR-436.

Q: What should I do with the completed Form VTR-436?

A: After completing the Form VTR-436, it should be submitted to your local Texas Department of Motor Vehicles office.

Q: What happens if I do not submit the Form VTR-436?

A: Failure to submit the Form VTR-436 within the required timeframe may result in penalties or fines.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Texas Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VTR-436 by clicking the link below or browse more documents and templates provided by the Texas Department of Motor Vehicles.