This version of the form is not currently in use and is provided for reference only. Download this version of

Form VTR-265-L

for the current year.

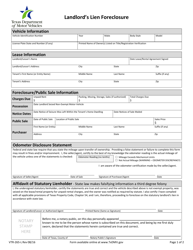

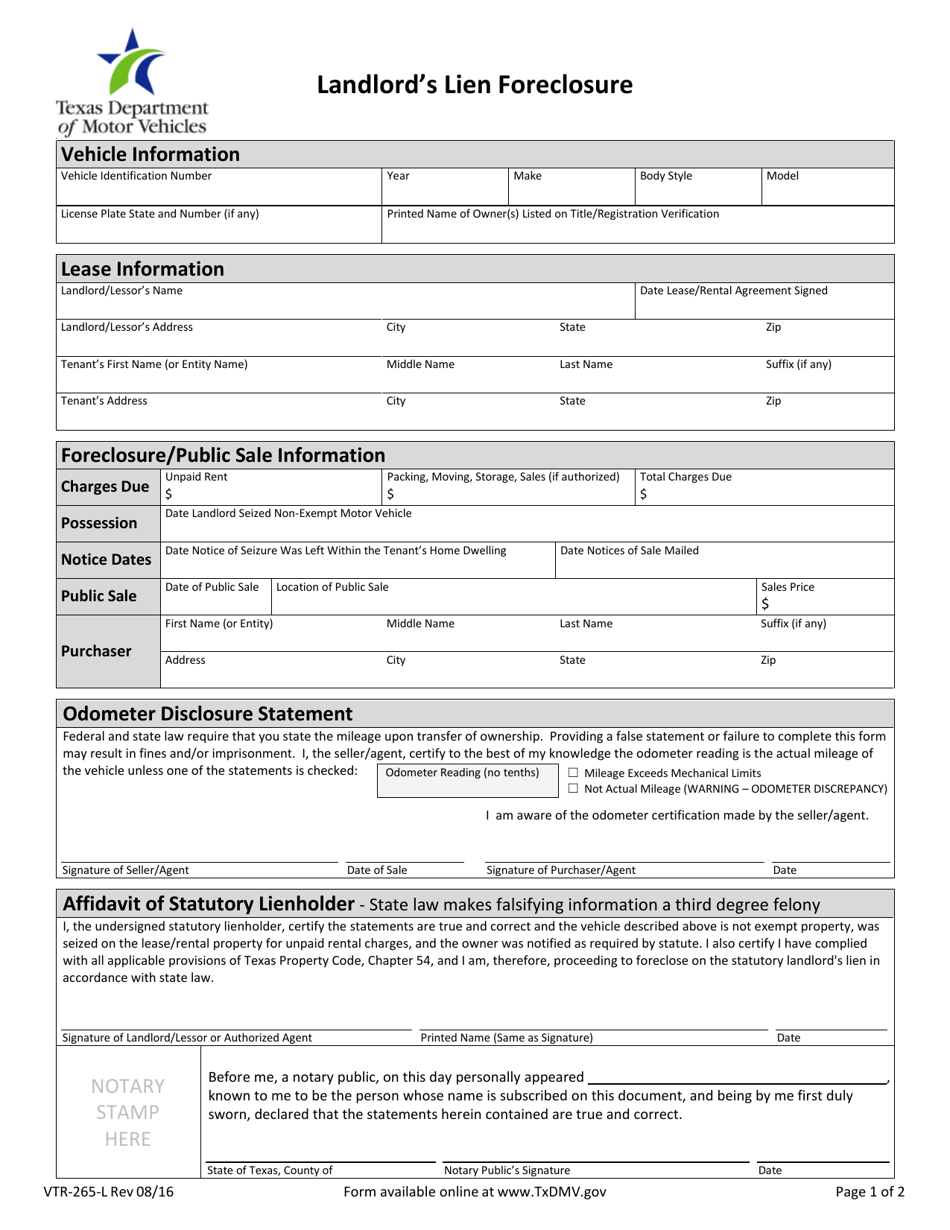

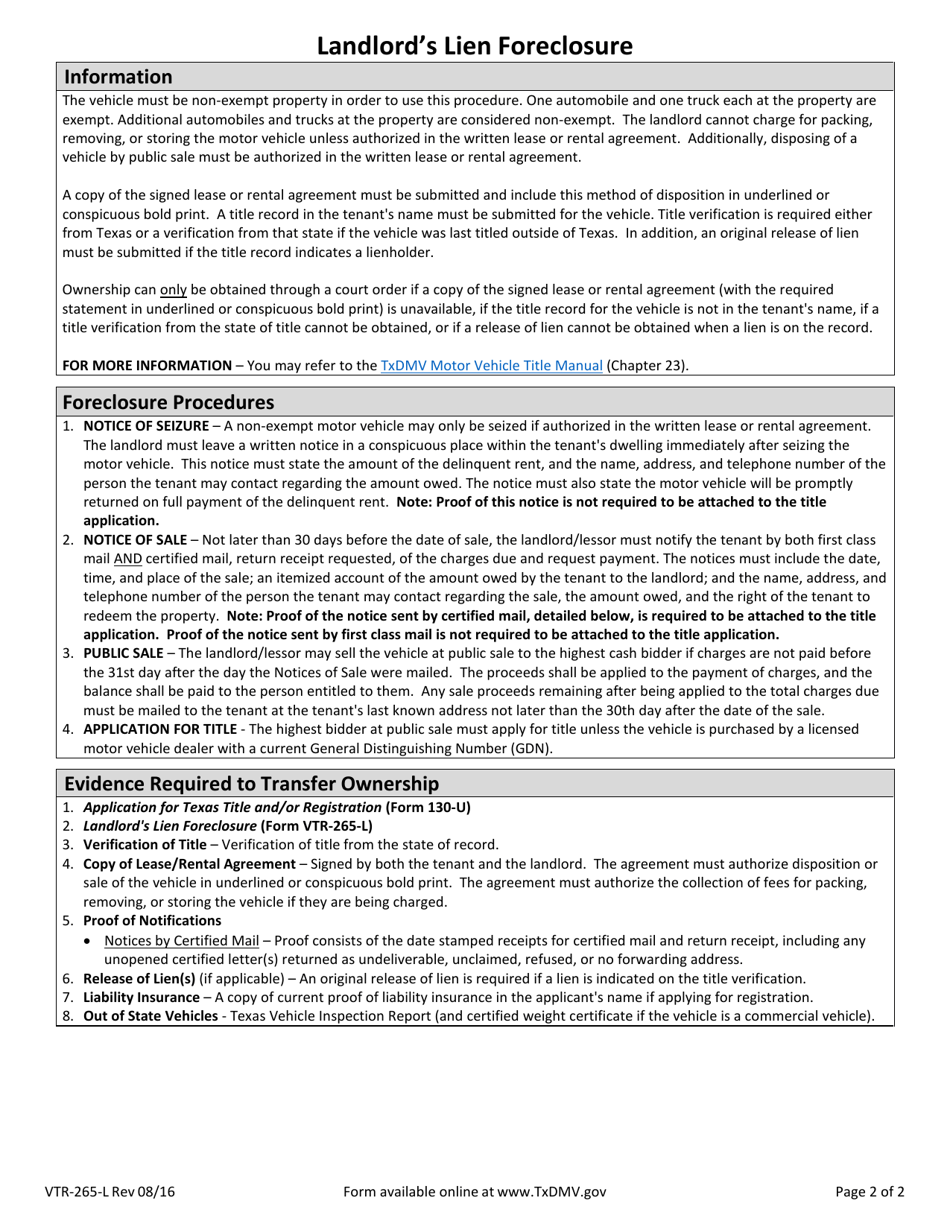

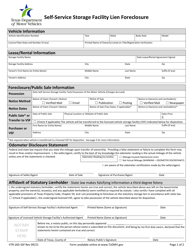

Form VTR-265-L Landlord's Lien Foreclosure - Texas

What Is Form VTR-265-L?

This is a legal form that was released by the Texas Department of Motor Vehicles - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form VTR-265-L?

A: Form VTR-265-L is the Landlord's Lien Foreclosure form in Texas.

Q: What is a Landlord's Lien Foreclosure?

A: A Landlord's Lien Foreclosure is a legal process by which a landlord can take control of a tenant's vehicle to satisfy unpaid rent.

Q: Who can use Form VTR-265-L?

A: Form VTR-265-L can be used by landlords in Texas who have a valid lien on a tenant's vehicle.

Q: What is the purpose of Form VTR-265-L?

A: The purpose of Form VTR-265-L is to notify the Texas Department of Motor Vehicles (DMV) of a landlord's intent to foreclose on a tenant's vehicle.

Q: What information is required on Form VTR-265-L?

A: Form VTR-265-L requires information such as the tenant's name and address, the landlord's information, and details about the vehicle and the unpaid rent.

Q: What happens after filing Form VTR-265-L?

A: After filing Form VTR-265-L, the DMV will issue a notice to the tenant informing them of the foreclosure. The landlord can then proceed with the legal process to take possession of the vehicle.

Q: What should a tenant do if they receive a notice of foreclosure?

A: If a tenant receives a notice of foreclosure, it is important for them to seek legal advice to understand their rights and options.

Q: Can a landlord sell a tenant's vehicle immediately after foreclosure?

A: No, a landlord cannot sell a tenant's vehicle immediately after foreclosure. There are specific legal procedures that must be followed, and the tenant may have a right to redeem the vehicle.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Texas Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VTR-265-L by clicking the link below or browse more documents and templates provided by the Texas Department of Motor Vehicles.