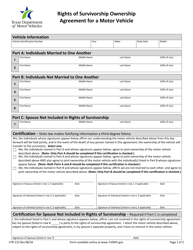

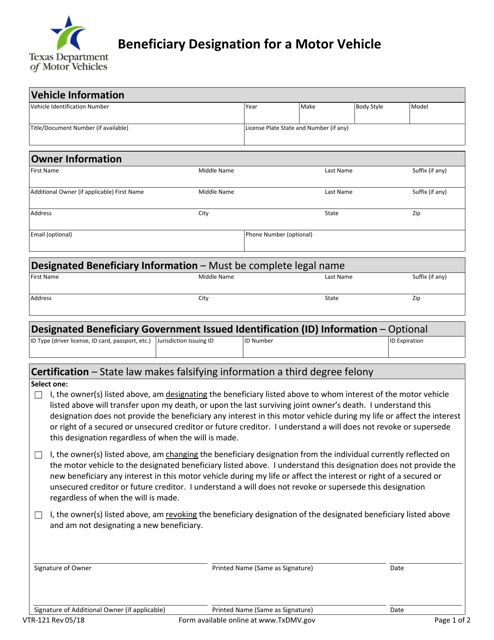

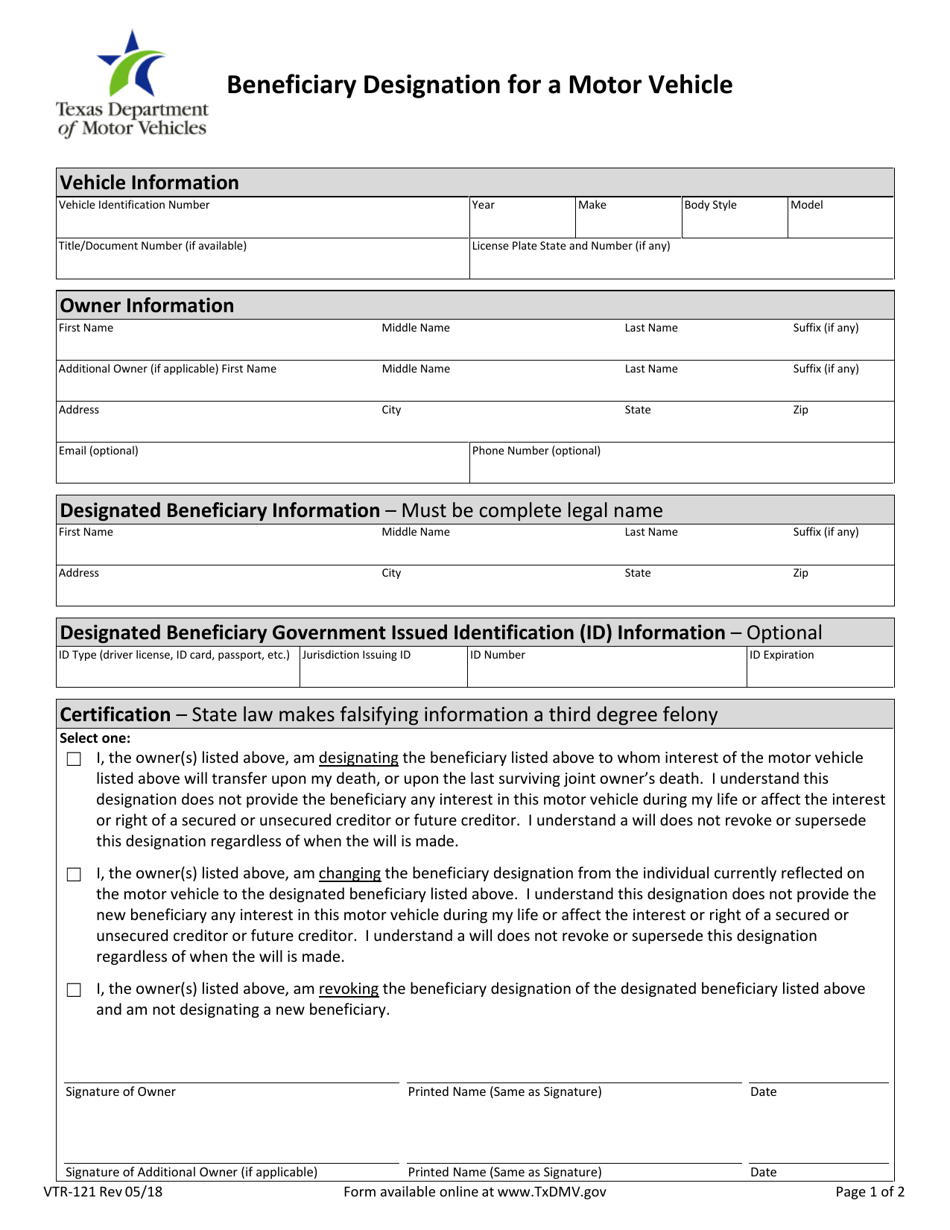

Form VTR-121 Beneficiary Designation for a Motor Vehicle - Texas

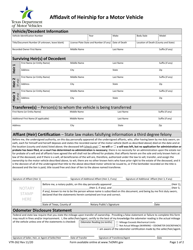

What Is Form VTR-121?

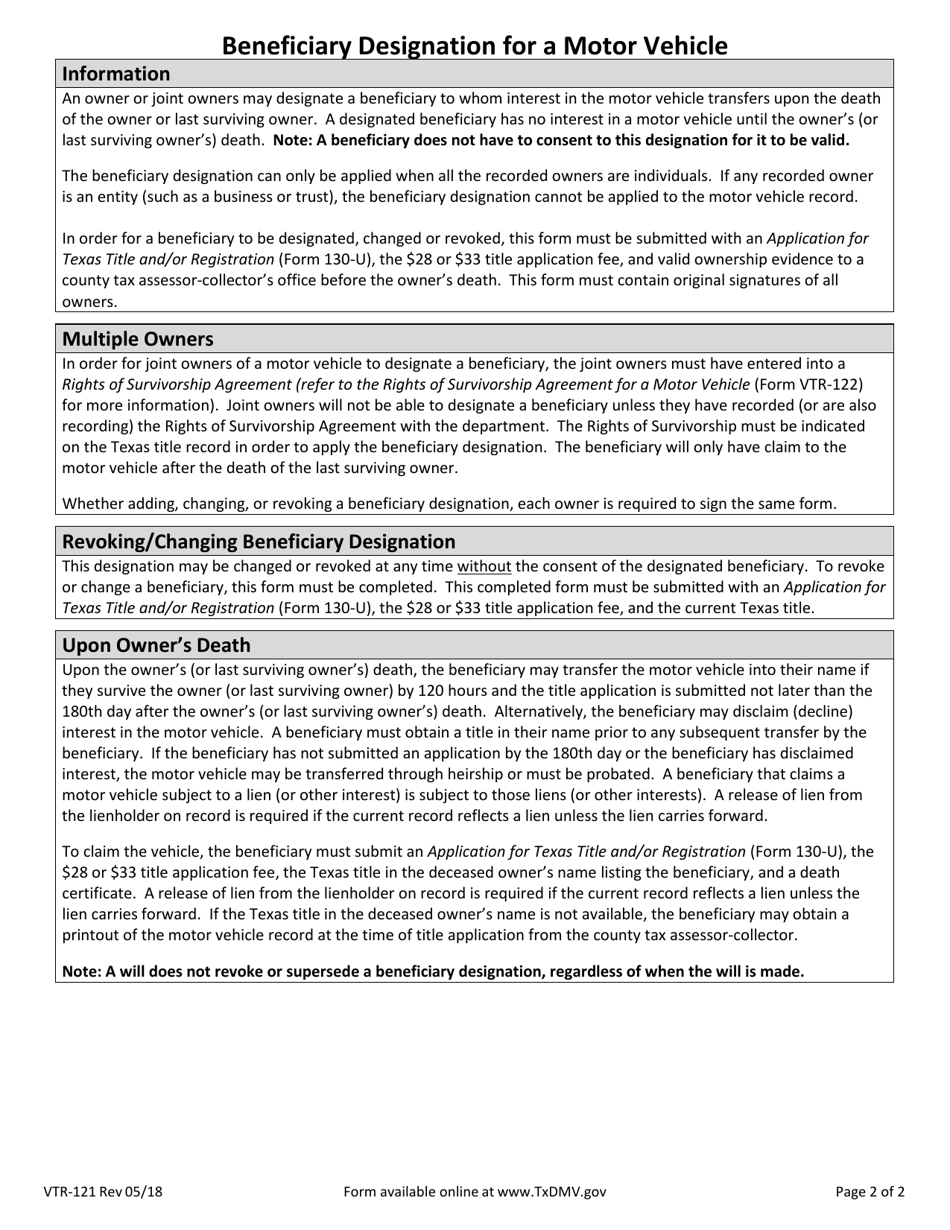

This is a legal form that was released by the Texas Department of Motor Vehicles - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VTR-121?

A: Form VTR-121 is the Beneficiary Designation for a Motor Vehicle form in Texas.

Q: What is the purpose of Form VTR-121?

A: The purpose of Form VTR-121 is to designate a beneficiary for a motor vehicle in case of the owner's death.

Q: How do I fill out Form VTR-121?

A: You need to provide your personal information, the vehicle information, and the beneficiary's information on the form.

Q: Do I need to notarize Form VTR-121?

A: Yes, Form VTR-121 needs to be notarized before it is considered valid.

Q: How much does it cost to file Form VTR-121?

A: The filing fee for Form VTR-121 is $5.

Q: What happens after I submit Form VTR-121?

A: Once submitted, the beneficiary designation will be recorded by the Department of Motor Vehicles.

Q: Can I change my designated beneficiary after submitting Form VTR-121?

A: Yes, you can change your designated beneficiary by completing a new Form VTR-121.

Q: Is Form VTR-121 valid in other states?

A: No, Form VTR-121 is specific to Texas and may not be valid in other states.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Texas Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VTR-121 by clicking the link below or browse more documents and templates provided by the Texas Department of Motor Vehicles.

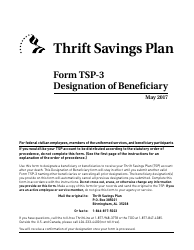

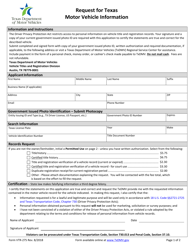

![Document preview: Form VTR-275-LE Request for Texas Motor Vehicle Information [law Enforcement] - Texas](https://data.templateroller.com/pdf_docs_html/2185/21855/2185582/form-vtr-275-le-request-for-texas-motor-vehicle-information-law-enforcement-texas.png)