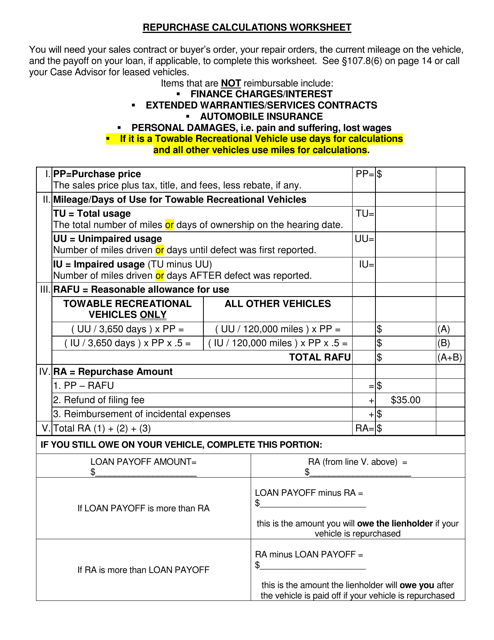

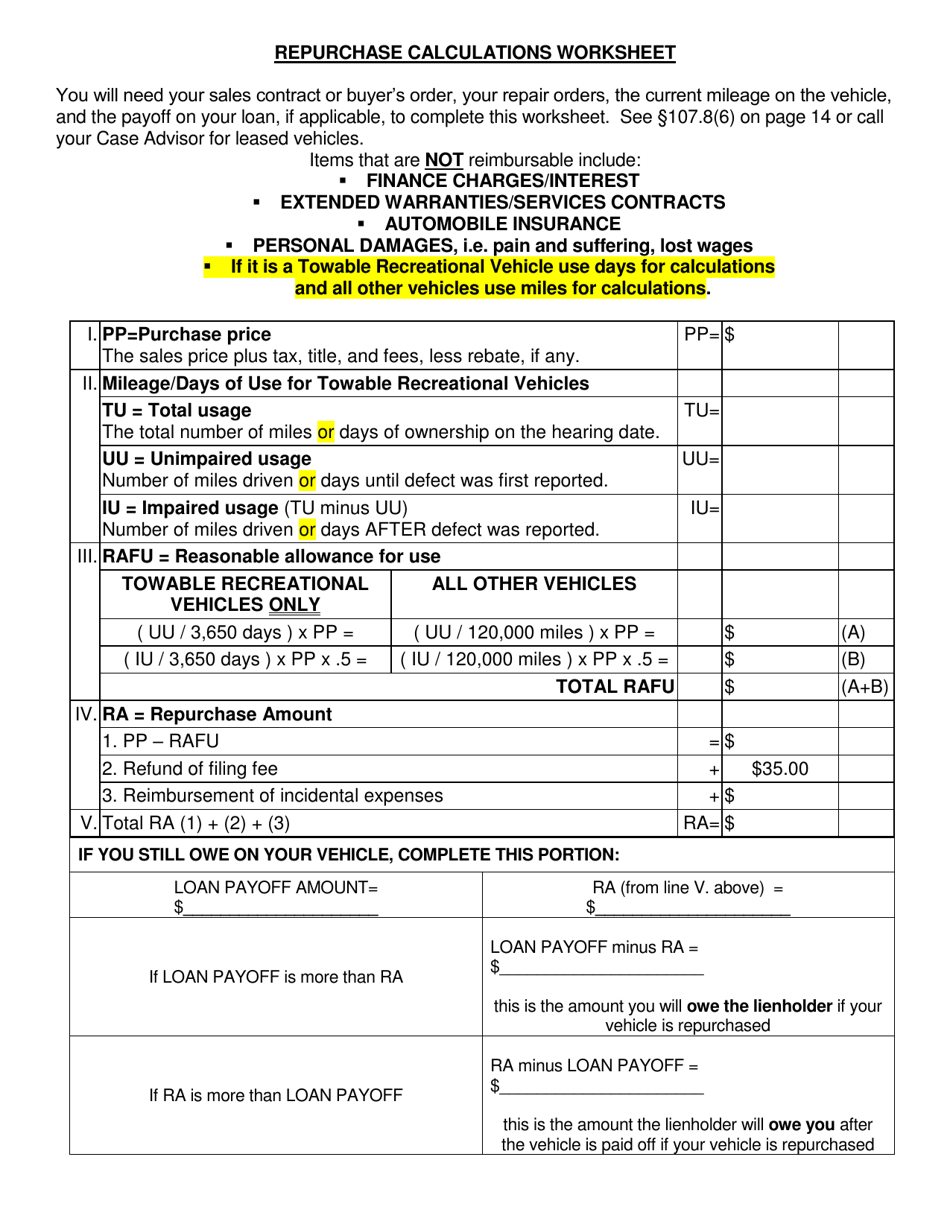

Repurchase Calculations Worksheet - Texas

Repurchase Calculations Worksheet is a legal document that was released by the Texas Department of Motor Vehicles - a government authority operating within Texas.

FAQ

Q: What is a repurchase calculation?

A: A repurchase calculation is a process used to estimate the amount of money that will be needed to repurchase a property.

Q: How is a repurchase calculation done?

A: A repurchase calculation is typically done by estimating the current value of the property and subtracting any existing debt or liens.

Q: Why would someone need to do a repurchase calculation?

A: A repurchase calculation is often done when a property owner wants to sell their property and needs to determine how much money they will have available after repurchasing it.

Q: What factors are considered in a repurchase calculation?

A: Factors that are considered in a repurchase calculation include the current market value of the property, any outstanding mortgage balances, and any closing costs or fees associated with the repurchase.

Q: Can a repurchase calculation change over time?

A: Yes, a repurchase calculation can change over time as the market value of the property and the balance on any outstanding debts or liens can fluctuate.

Q: Are there any limitations to a repurchase calculation?

A: Yes, a repurchase calculation is an estimate and may not account for all possible costs or factors that may affect the final repurchase amount.

Q: Who typically performs a repurchase calculation?

A: A repurchase calculation can be done by the property owner themselves, a real estate agent, or a financial professional.

Q: Is a repurchase calculation required when selling a property?

A: No, a repurchase calculation is not required, but it can be a helpful tool for property owners to determine their financial position when selling their property.

Q: Can a repurchase calculation be used for other types of properties?

A: Yes, a repurchase calculation can be used for any type of property, including residential, commercial, or vacant land.

Q: Are there any legal requirements for a repurchase calculation in Texas?

A: There are no specific legal requirements for a repurchase calculation in Texas, but it is recommended to consult with a real estate or financial professional to ensure accuracy.

Form Details:

- The latest edition currently provided by the Texas Department of Motor Vehicles;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Motor Vehicles.