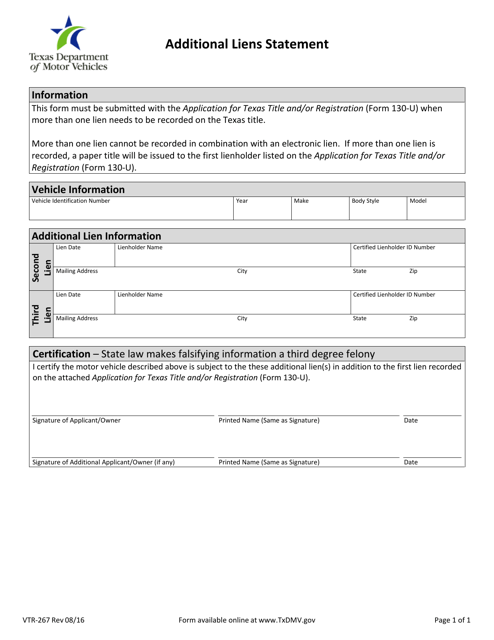

Form VTR-267 Additional Liens Statement - Texas

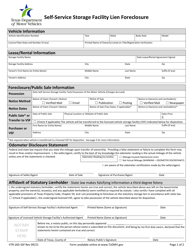

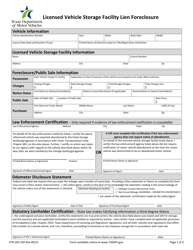

What Is Form VTR-267?

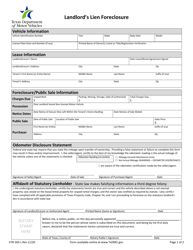

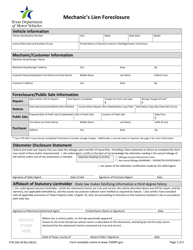

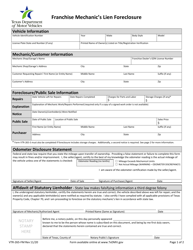

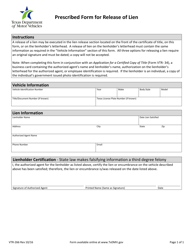

This is a legal form that was released by the Texas Department of Motor Vehicles - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VTR-267?

A: Form VTR-267 is an Additional Liens Statement used in Texas.

Q: What is the purpose of Form VTR-267?

A: The purpose of Form VTR-267 is to disclose any additional liens on a vehicle that already has a lien recorded.

Q: Who needs to use Form VTR-267?

A: Form VTR-267 must be used by individuals or businesses who hold a lien on a vehicle and need to disclose any additional liens.

Q: Are there any fees associated with filing Form VTR-267?

A: Yes, there is a fee for filing Form VTR-267, which can vary depending on the county in Texas.

Q: What information do I need to provide in Form VTR-267?

A: You need to provide the vehicle information, owner information, any existing liens, and any additional liens on the vehicle.

Q: How do I submit Form VTR-267?

A: You can submit Form VTR-267 by mail or in person at a local Tax Assessor-Collector's office.

Q: Is Form VTR-267 mandatory?

A: Yes, if you have an existing lien on a vehicle and want to disclose any additional liens, filing Form VTR-267 is mandatory in Texas.

Q: Can I use Form VTR-267 for multiple vehicles?

A: No, each vehicle requires its own separate Form VTR-267.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Texas Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VTR-267 by clicking the link below or browse more documents and templates provided by the Texas Department of Motor Vehicles.