This version of the form is not currently in use and is provided for reference only. Download this version of

Form VTR-262

for the current year.

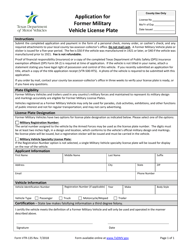

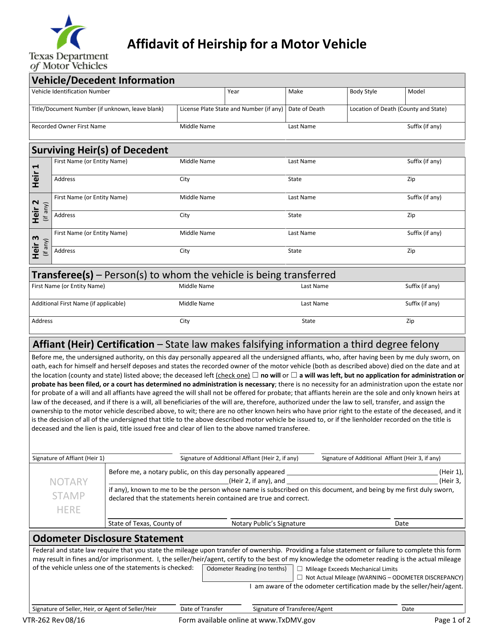

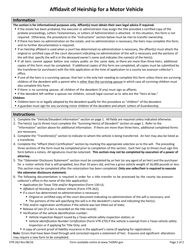

Form VTR-262 Affidavit of Heirship for a Motor Vehicle - Texas

What Is Form VTR-262?

This is a legal form that was released by the Texas Department of Motor Vehicles - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VTR-262?

A: Form VTR-262 is the Affidavit of Heirship for a Motor Vehicle in Texas.

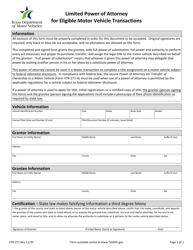

Q: What is the purpose of Form VTR-262?

A: The purpose of Form VTR-262 is to establish heirship and transfer ownership of a motor vehicle after the death of the owner.

Q: Who can use Form VTR-262?

A: Form VTR-262 can be used by the heirs of a deceased owner to transfer the ownership of a motor vehicle.

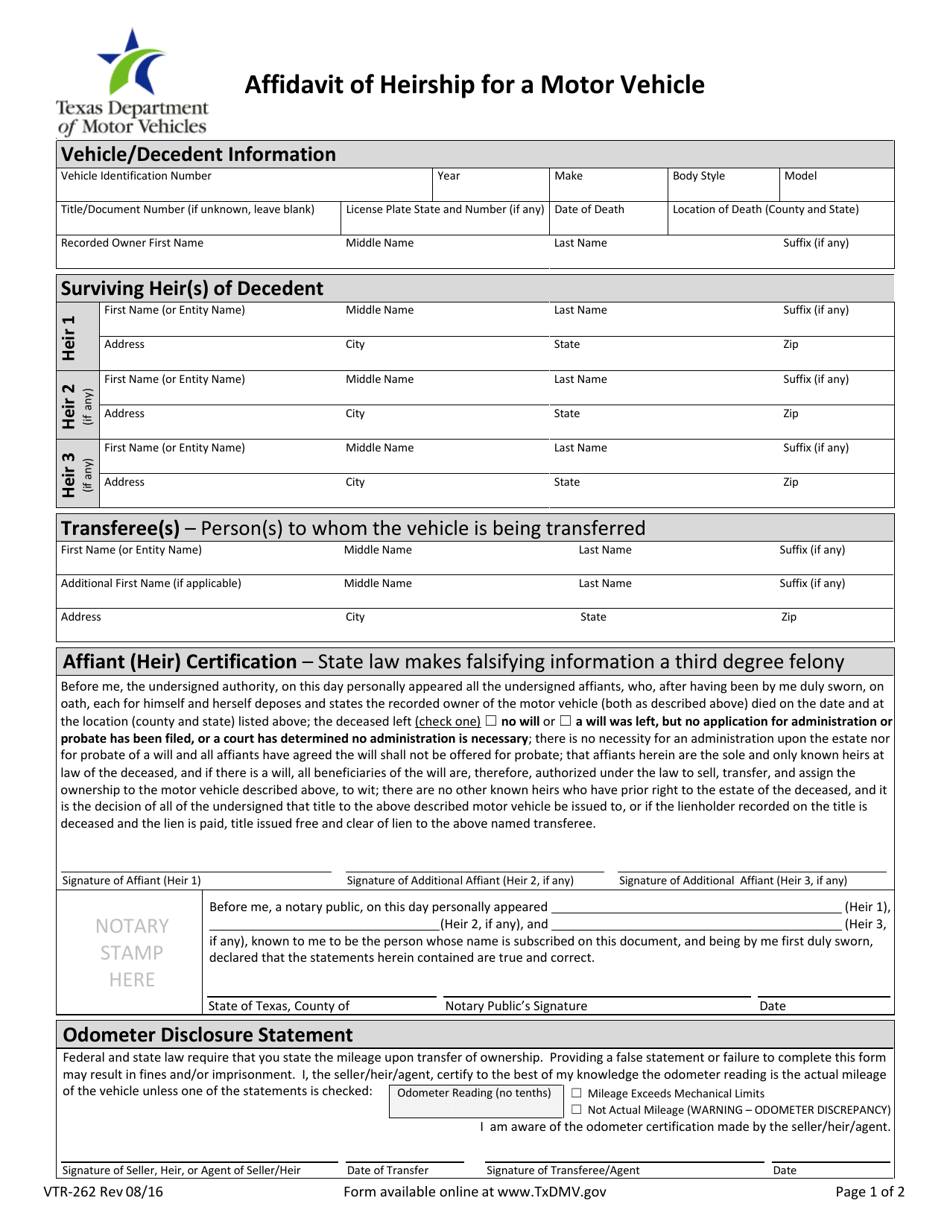

Q: What information is required on Form VTR-262?

A: Form VTR-262 requires information such as the deceased owner's name, vehicle details, and a notarized affidavit signed by the heirs.

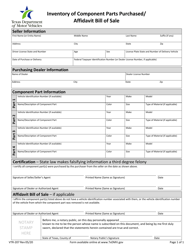

Q: Are there any fees associated with Form VTR-262?

A: Yes, there are fees associated with transferring ownership of a motor vehicle. The specific fees can vary depending on the county in Texas.

Q: Do all heirs need to sign Form VTR-262?

A: Yes, all heirs mentioned in the affidavit must sign Form VTR-262.

Q: Do I need to submit any supporting documents with Form VTR-262?

A: Yes, you may need to submit supporting documents such as the death certificate of the deceased owner and a copy of the will (if applicable).

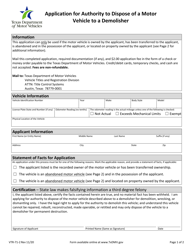

Q: Can Form VTR-262 be used for other types of vehicles?

A: No, Form VTR-262 is specifically for motor vehicles in Texas. Other types of vehicles may have different procedures for transferring ownership.

Q: What should I do after completing Form VTR-262?

A: After completing Form VTR-262, you should submit it to your local tax office along with any required fees and supporting documents.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Texas Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VTR-262 by clicking the link below or browse more documents and templates provided by the Texas Department of Motor Vehicles.

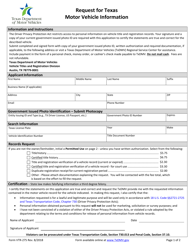

![Document preview: Form VTR-275-LE Request for Texas Motor Vehicle Information [law Enforcement] - Texas](https://data.templateroller.com/pdf_docs_html/2185/21855/2185582/form-vtr-275-le-request-for-texas-motor-vehicle-information-law-enforcement-texas.png)