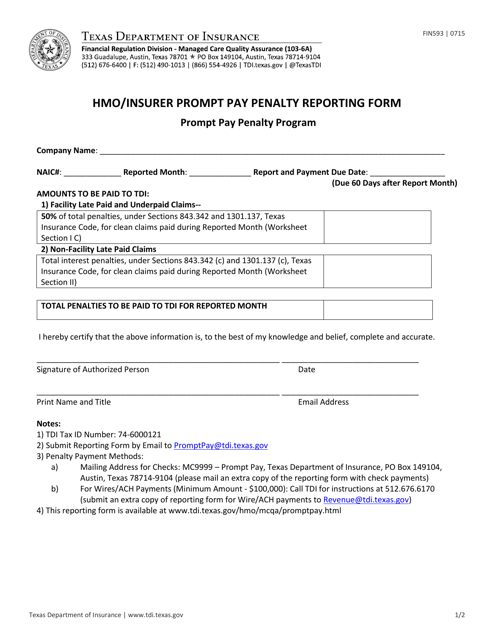

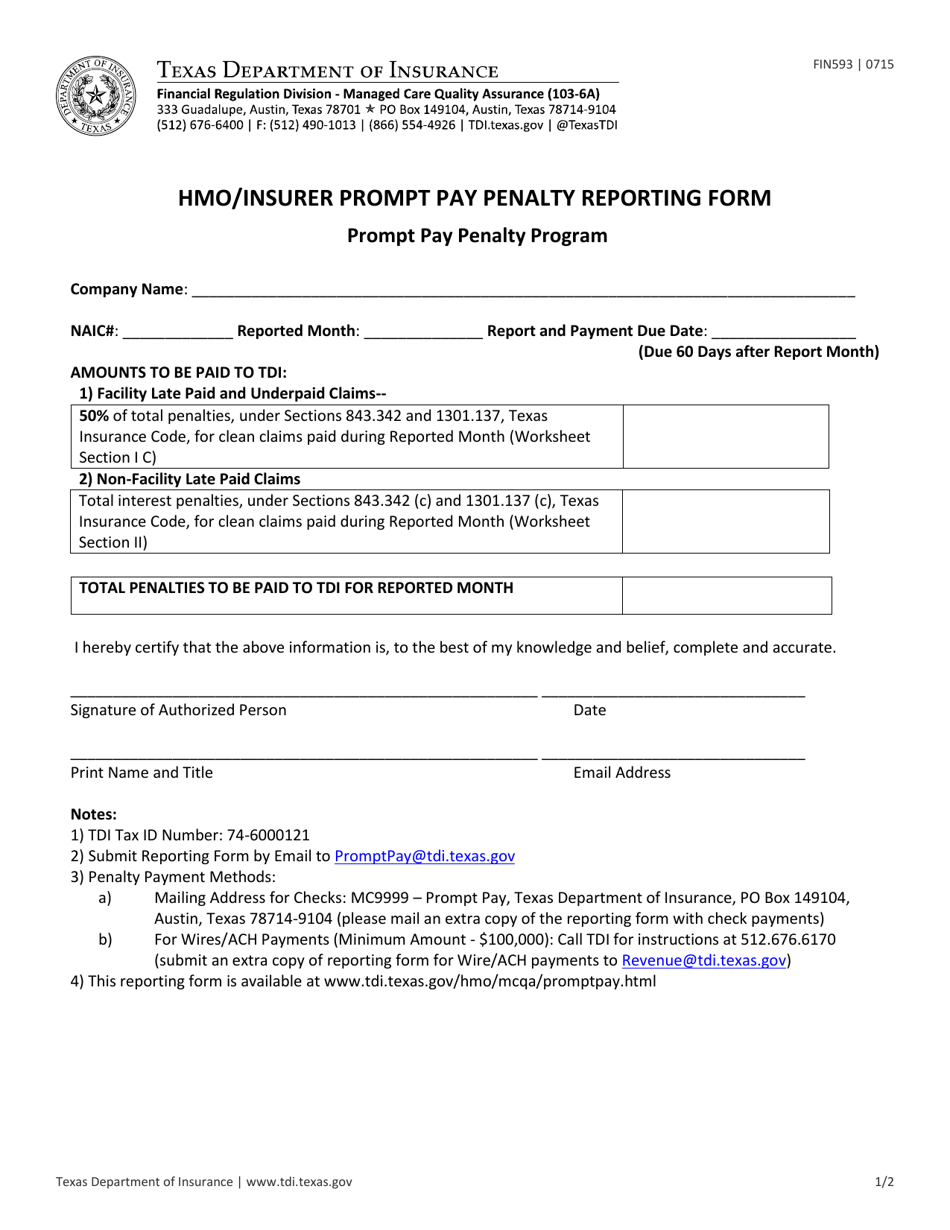

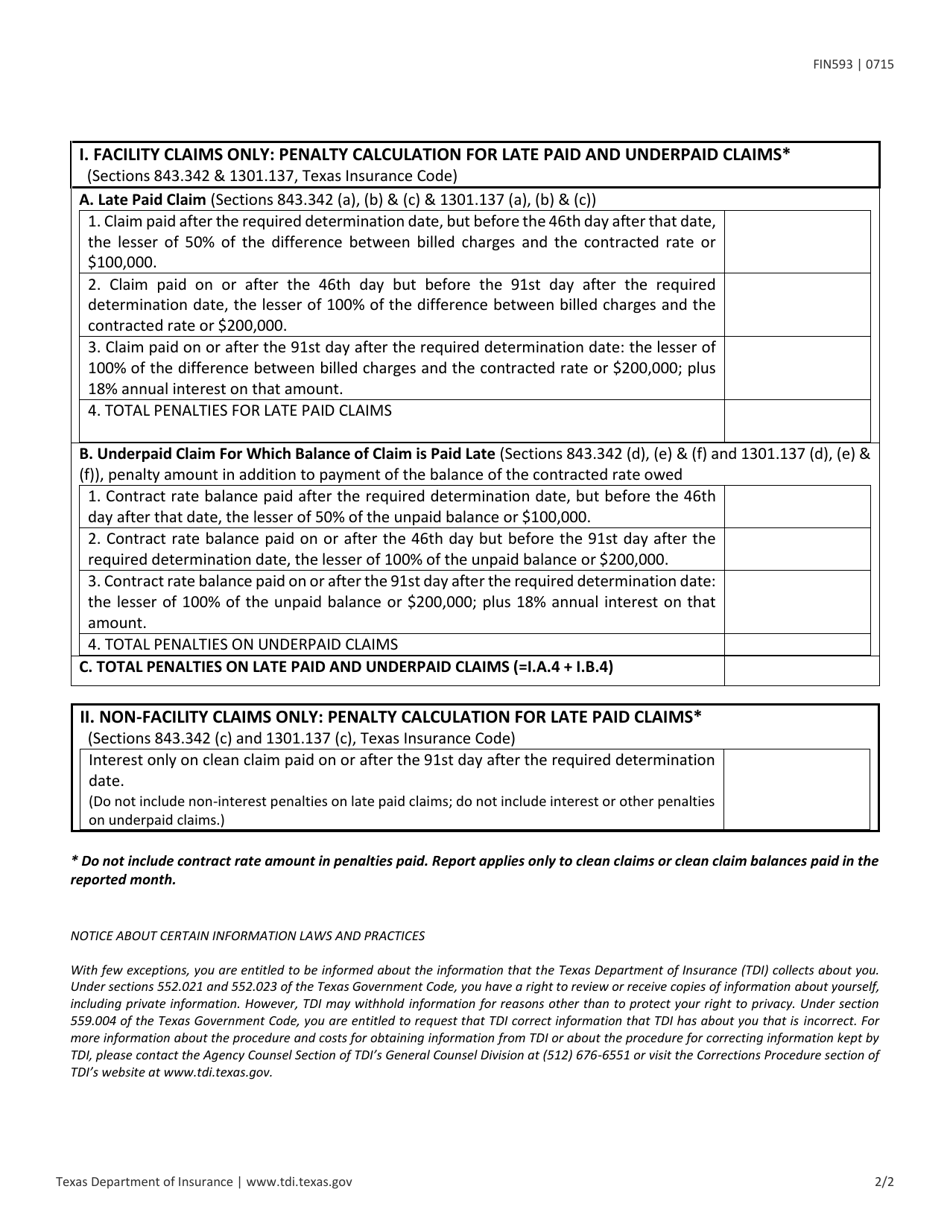

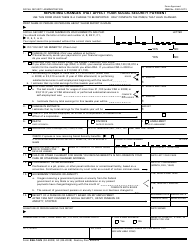

Form FIN593 HMO / Insurer Prompt Pay Penalty Reporting Form - Texas

What Is Form FIN593?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form FIN593?

A: The Form FIN593 is the HMO/Insurer Prompt Pay Penalty Reporting Form in the state of Texas.

Q: What is the purpose of the Form FIN593?

A: The purpose of the Form FIN593 is to report prompt pay penalties imposed on HMOs and insurers in Texas.

Q: Who needs to use the Form FIN593?

A: HMOs and insurers in Texas need to use the Form FIN593 to report prompt pay penalties.

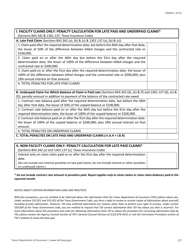

Q: What information is required on the Form FIN593?

A: The Form FIN593 requires information such as the type of penalty, the date of imposition, the amount of the penalty, and the reason for the penalty.

Q: Are there any deadlines for submitting the Form FIN593?

A: Yes, HMOs and insurers in Texas must submit the Form FIN593 within 45 days of the date the penalty is imposed.

Q: What are the consequences of not submitting the Form FIN593?

A: Failure to submit the Form FIN593 may result in penalties or other enforcement actions by the Texas Department of Insurance.

Q: Is the Form FIN593 confidential?

A: No, the information provided on the Form FIN593 may be subject to public disclosure under the Texas Public Information Act.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIN593 by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.