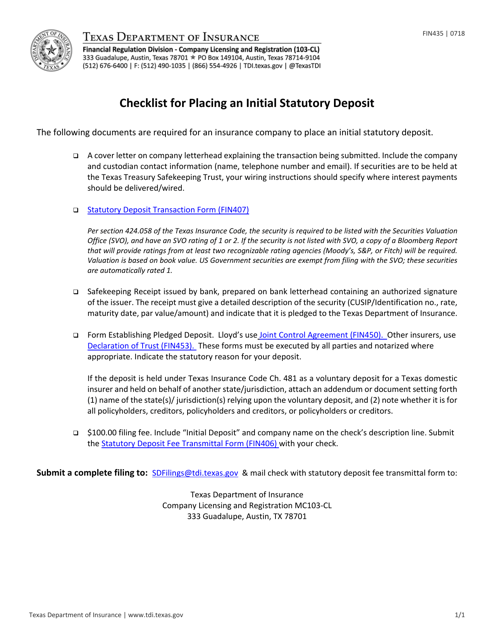

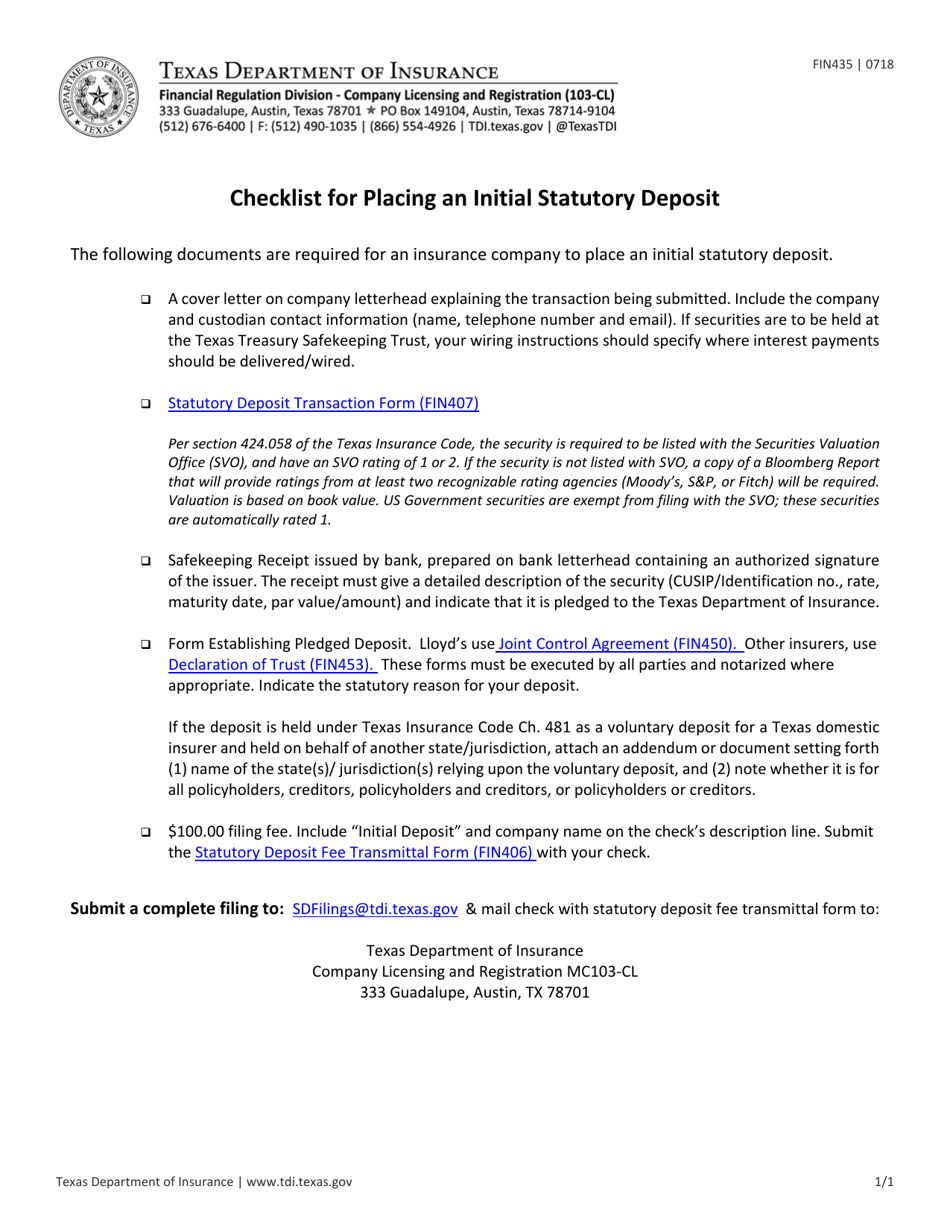

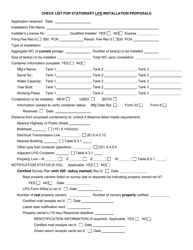

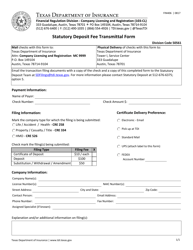

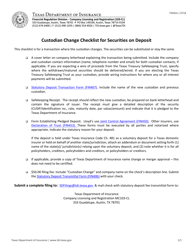

Form FIN435 Checklist for Placing an Initial Statutory Deposit - Texas

What Is Form FIN435?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FIN435?

A: FIN435 is a checklist for placing an initial statutory deposit in Texas.

Q: What is an initial statutory deposit?

A: An initial statutory deposit is the required amount of money that must be deposited with the state when forming a new insurance company.

Q: Why is an initial statutory deposit required?

A: An initial statutory deposit is required to ensure that an insurance company has sufficient funds to meet its obligations to policyholders.

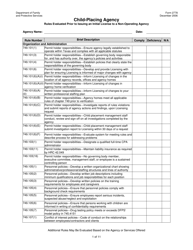

Q: Who needs to complete the FIN435 checklist?

A: Insurance companies forming in Texas need to complete the FIN435 checklist.

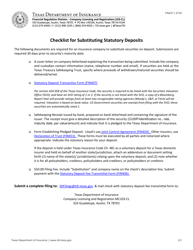

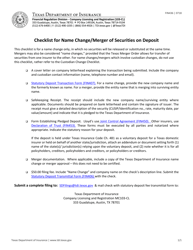

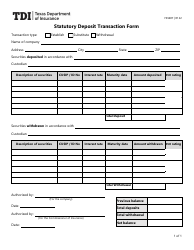

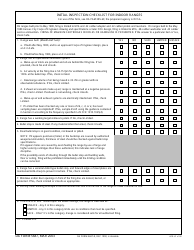

Q: What information is included in the checklist?

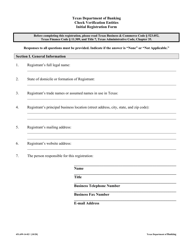

A: The FIN435 checklist includes information about the insurance company's name, address, officers, directors, and the amount of the initial statutory deposit.

Q: Are there any fees associated with the initial statutory deposit?

A: Yes, there may be fees associated with the initial statutory deposit. These fees vary depending on the size of the deposit.

Q: Can the initial statutory deposit be made in cash?

A: No, the initial statutory deposit must be made in the form of a certified or cashier's check.

Q: How long does it take for the initial statutory deposit to be processed?

A: The processing time for the initial statutory deposit may vary, but it typically takes a few business days.

Q: What happens to the initial statutory deposit once it is processed?

A: The initial statutory deposit is held by the state and can be used towards the payment of policyholder claims if needed.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FIN435 by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.