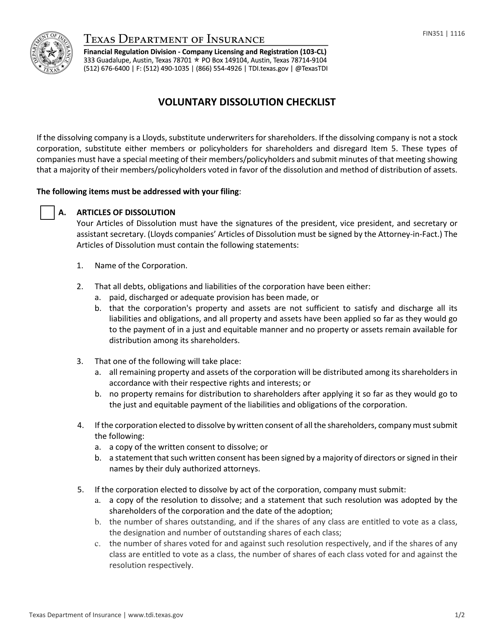

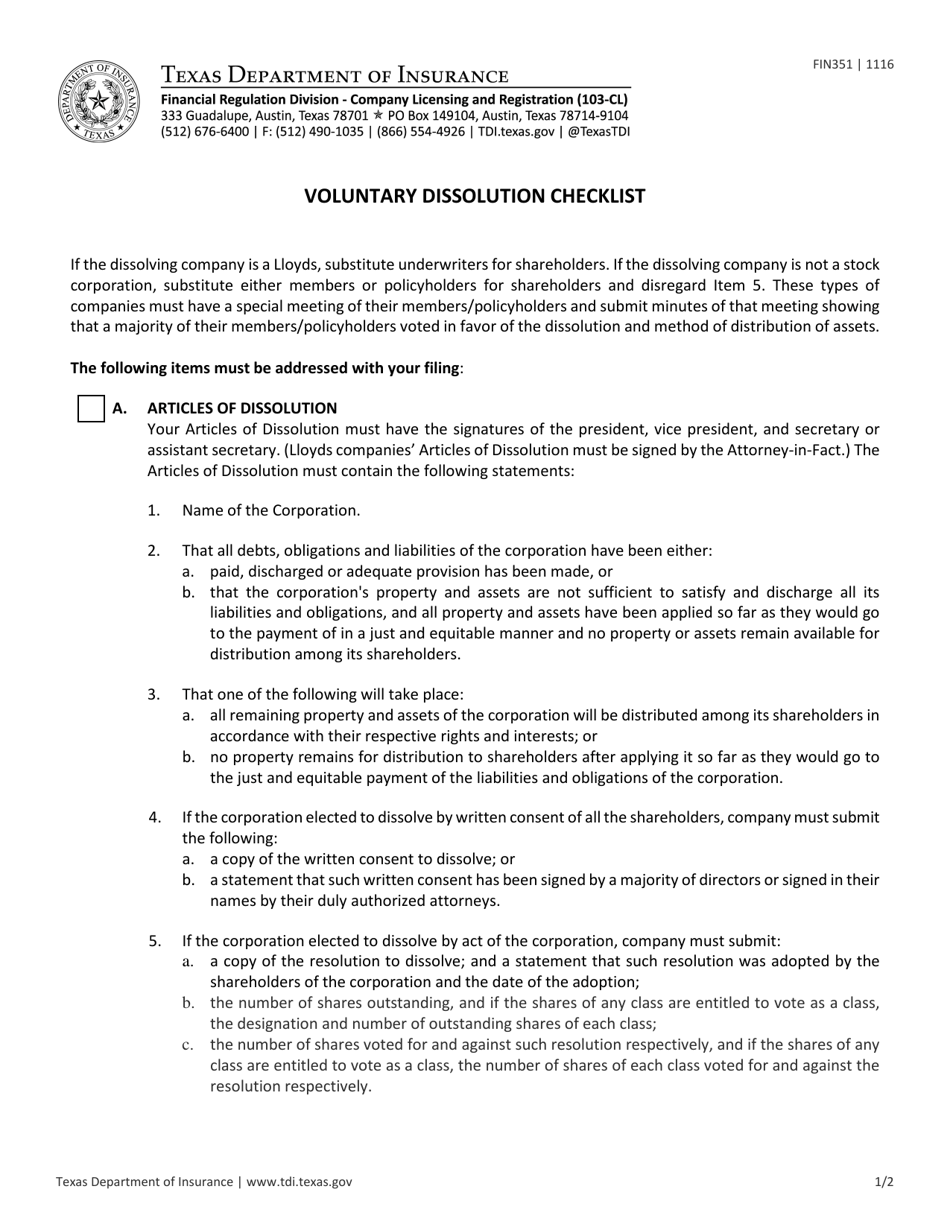

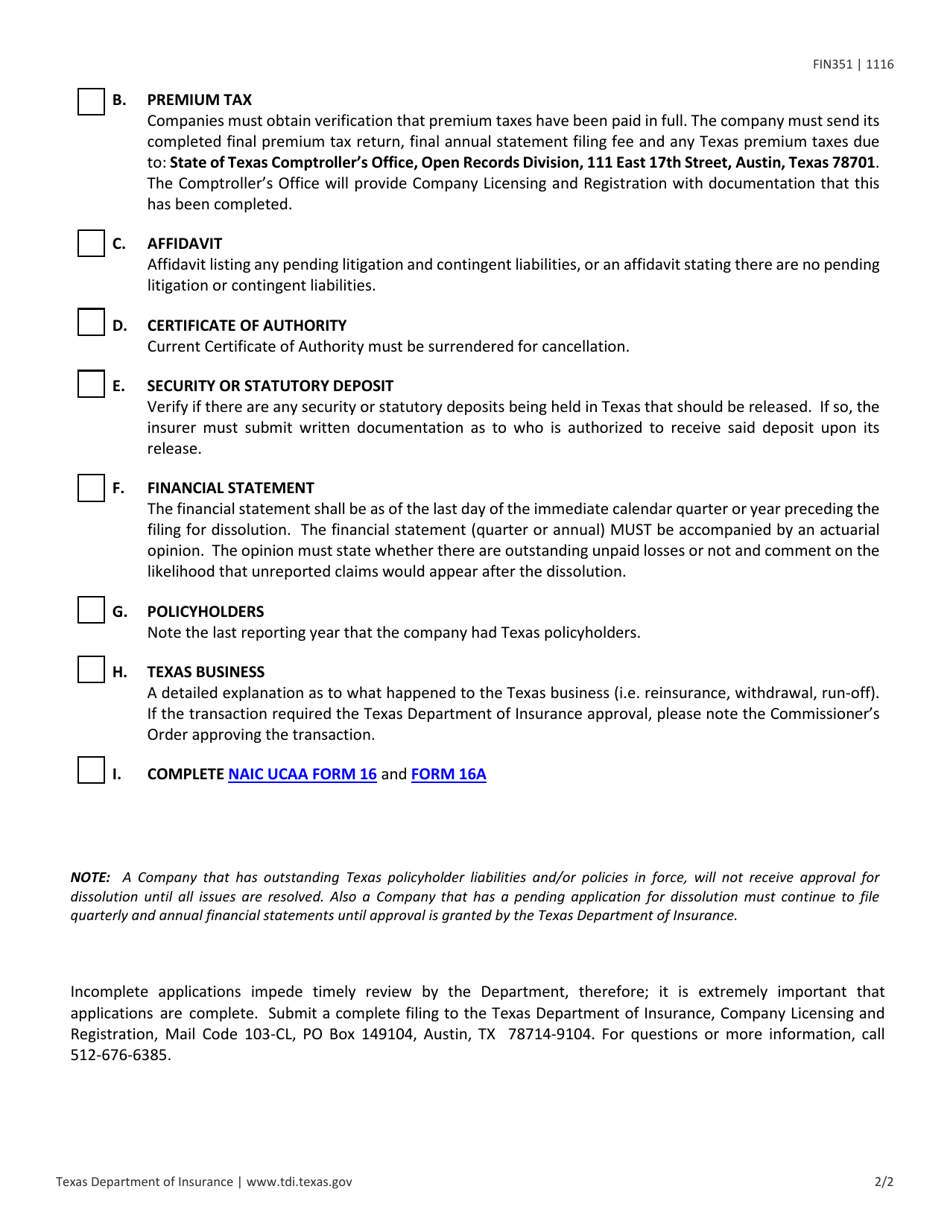

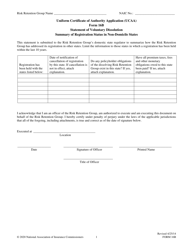

Form FIN351 Voluntary Dissolution Checklist - Texas

What Is Form FIN351?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form FIN351?

A: Form FIN351 is used for voluntary dissolution of a Texas corporation.

Q: What is voluntary dissolution?

A: Voluntary dissolution is the process of ending the existence of a corporation by choice.

Q: Who can use Form FIN351?

A: Any Texas corporation that wants to voluntarily dissolve.

Q: What information is required on Form FIN351?

A: The form requires the corporation's name, file number, and a statement of dissolution.

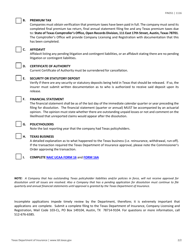

Q: Are there any fees associated with filing Form FIN351?

A: Yes, there is a filing fee of $40 for submitting Form FIN351.

Q: Is there a deadline for filing Form FIN351?

A: There is no specific deadline, but it is recommended to file the form as soon as a decision to dissolve is made.

Q: What happens after I submit Form FIN351?

A: Once the form is processed and approved, the corporation's existence will be officially terminated.

Q: Do I need to notify any other agencies or creditors after filing Form FIN351?

A: Yes, you should notify the IRS, state and local tax agencies, and any creditors or vendors.

Q: Can I change my mind after filing Form FIN351?

A: In certain cases, it may be possible to withdraw the voluntary dissolution, but it is best to consult with an attorney.

Q: Are there any tax implications to voluntary dissolution?

A: There may be tax implications, so it is recommended to consult with a tax professional.

Q: Can I dissolve a foreign corporation using Form FIN351?

A: No, Form FIN351 is specifically for Texas corporations. Foreign corporations should consult with their home state for dissolution procedures.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIN351 by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.