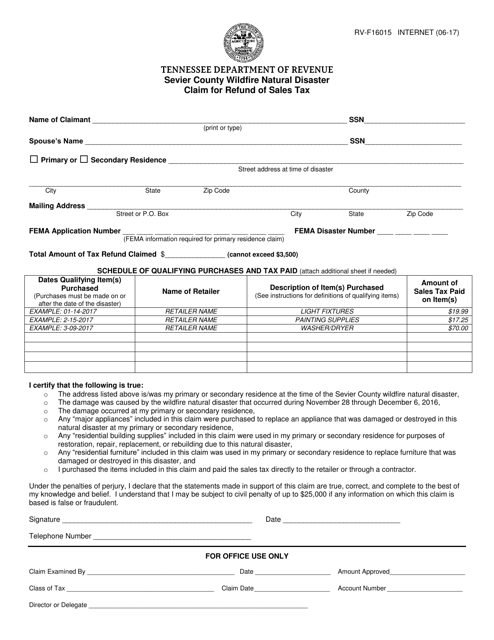

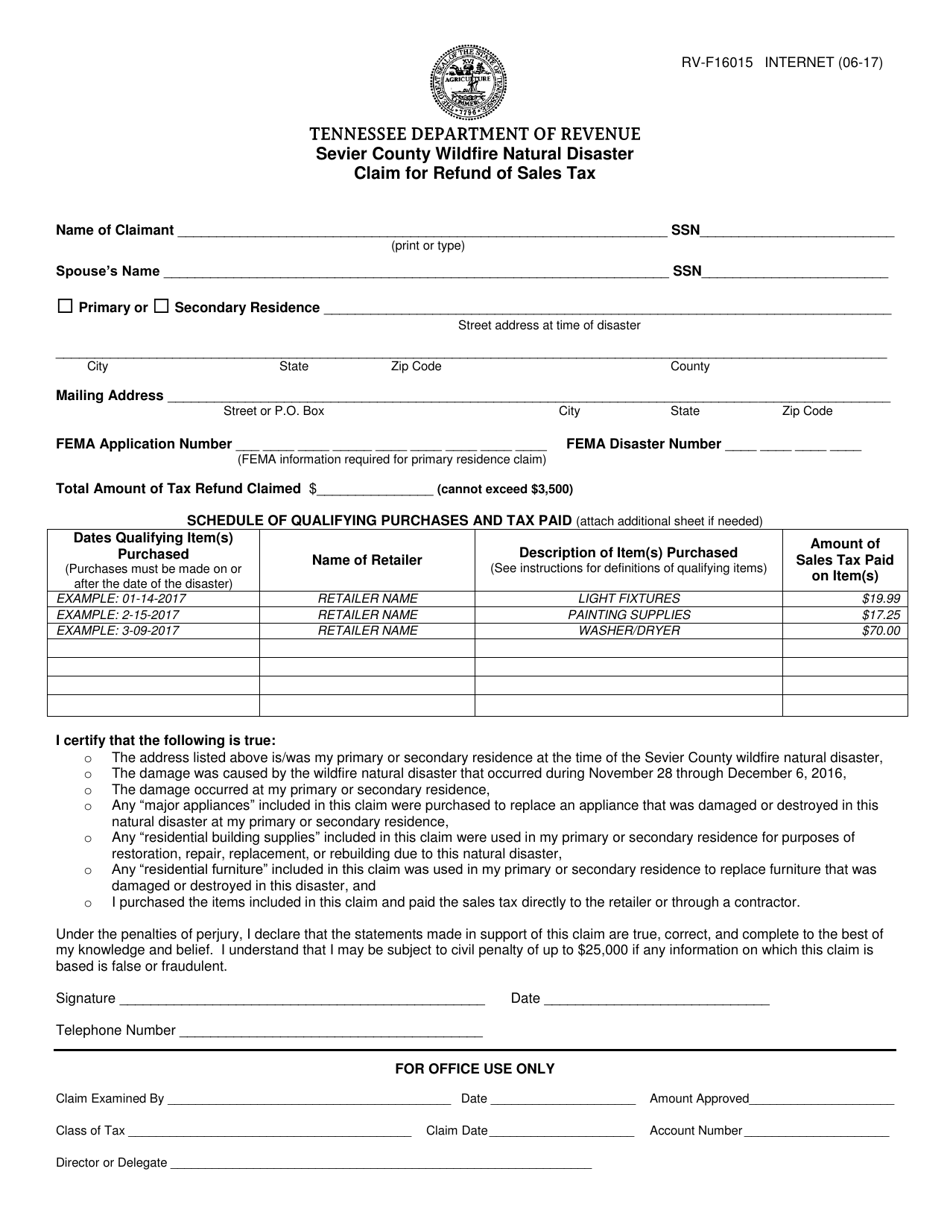

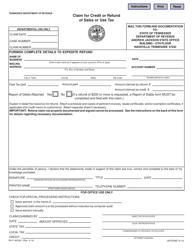

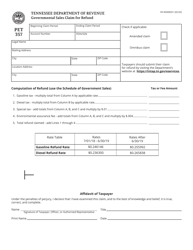

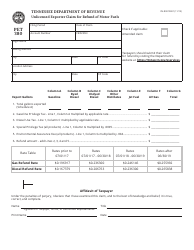

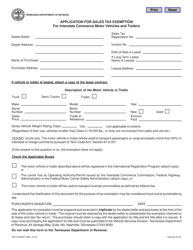

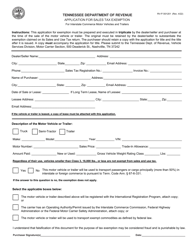

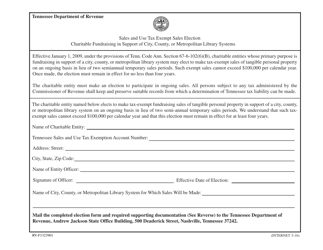

Form RV-F16015 Sevier County Wildfire Natural Disaster Claim for Refund of Sales Tax - Tennessee

What Is Form RV-F16015?

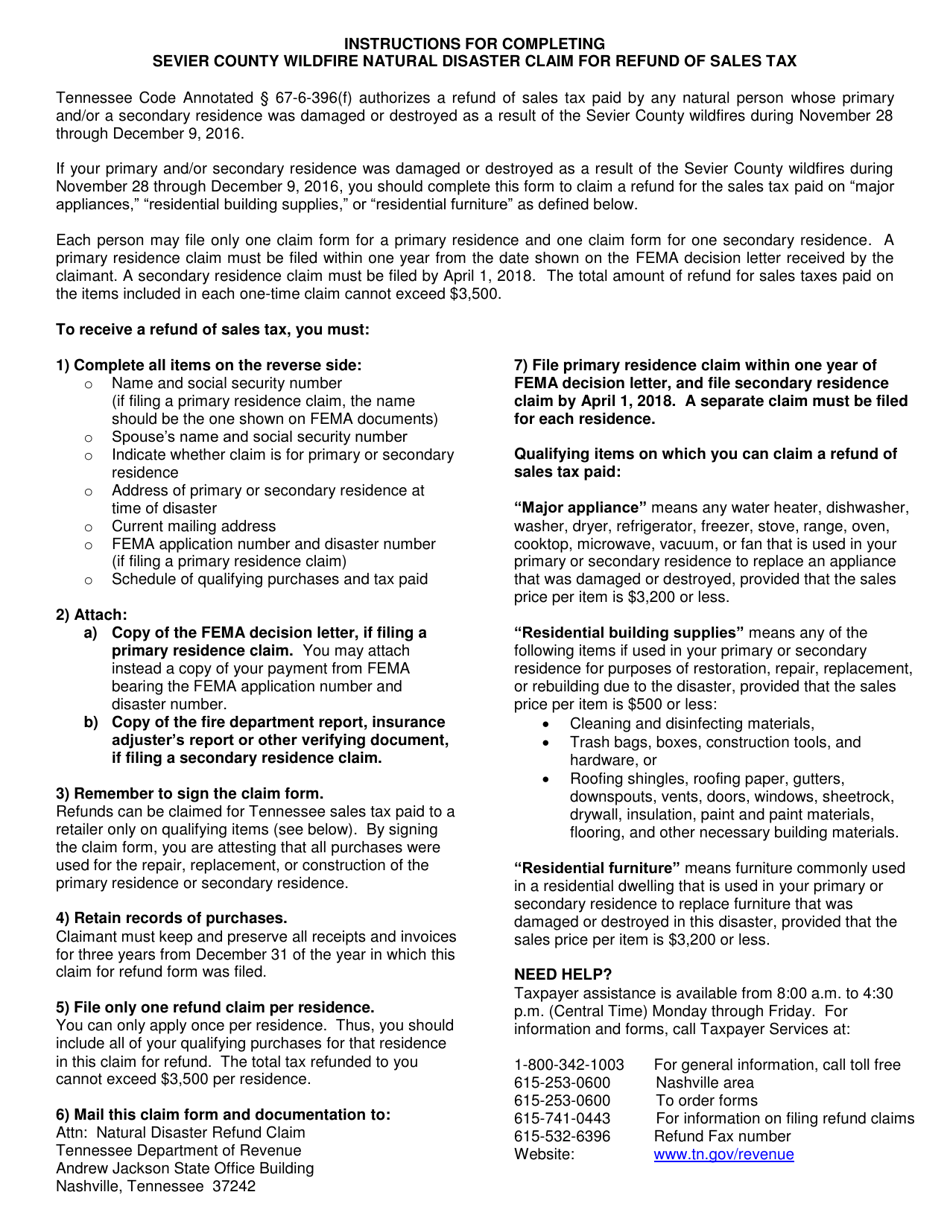

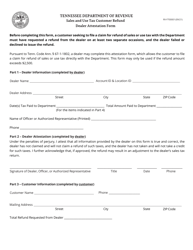

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F16015?

A: Form RV-F16015 is a document for Sevier County residents to claim a refund of sales tax due to the wildfire natural disaster.

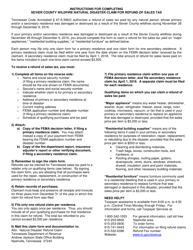

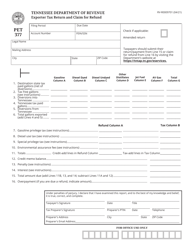

Q: Who is eligible to use Form RV-F16015?

A: Sevier County residents affected by the wildfire natural disaster are eligible to use Form RV-F16015.

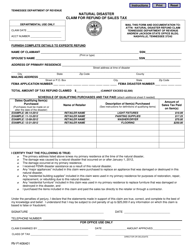

Q: What is the purpose of Form RV-F16015?

A: The purpose of Form RV-F16015 is to seek a refund of sales tax paid by Sevier County residents due to the wildfire natural disaster.

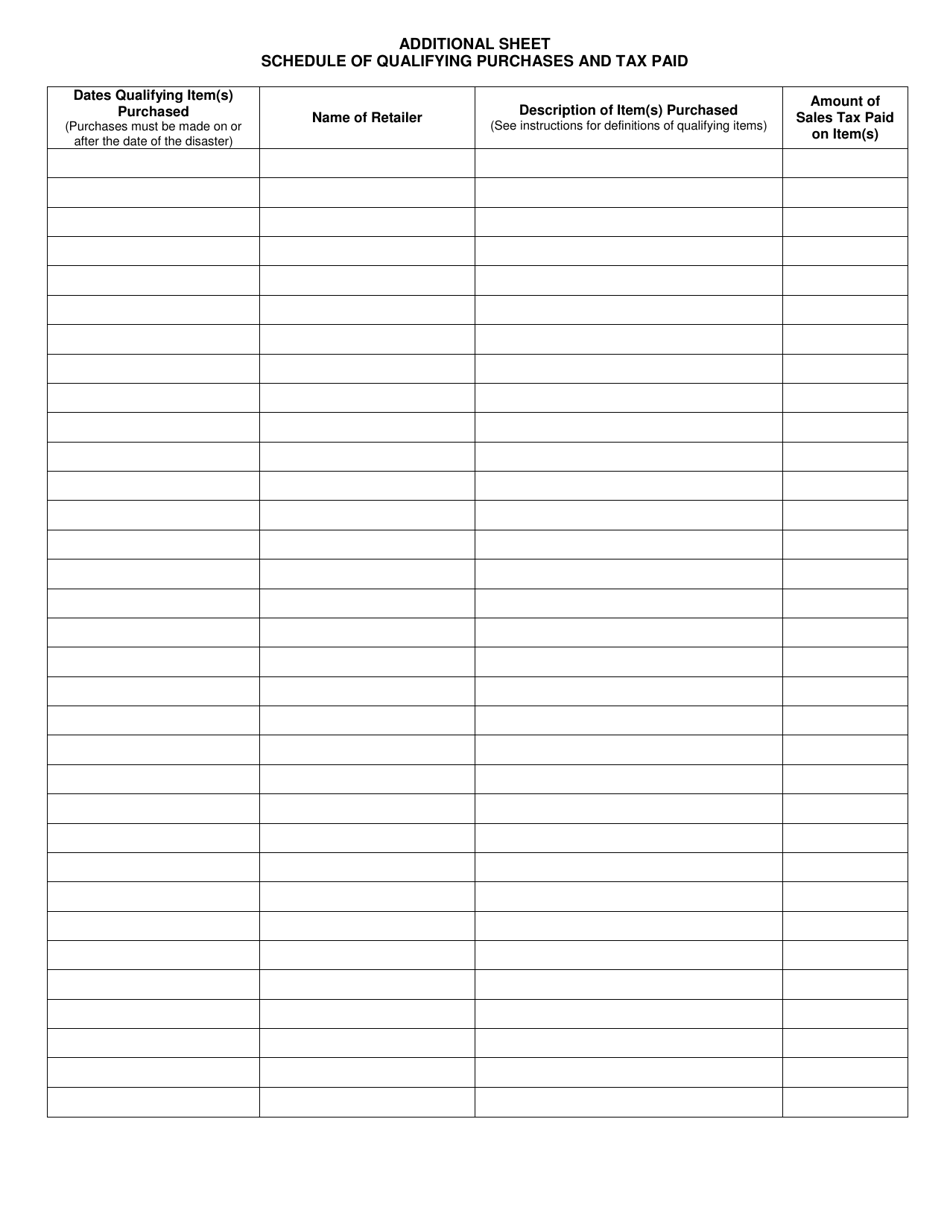

Q: What information is required on Form RV-F16015?

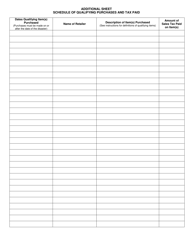

A: Form RV-F16015 requires information such as personal details, proof of residency, details of the wildfire natural disaster, and documentation of sales tax paid.

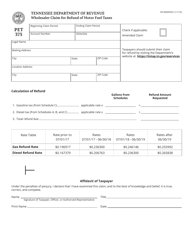

Q: Is there a deadline to submit Form RV-F16015?

A: Yes, there is a deadline to submit Form RV-F16015. The specific deadline will be mentioned on the form or communicated by the Tennessee Department of Revenue.

Q: How long does it take to process the Form RV-F16015?

A: The processing time for Form RV-F16015 can vary. It is recommended to contact the Tennessee Department of Revenue for an estimate on the processing time.

Q: What happens after submitting Form RV-F16015?

A: After submitting Form RV-F16015, the Tennessee Department of Revenue will review the claim and process the refund if approved.

Q: Are there any other requirements or documents needed along with Form RV-F16015?

A: Additional documentation such as receipts, invoices, or other supporting documents may be requested by the Tennessee Department of Revenue to process the claim.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F16015 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.