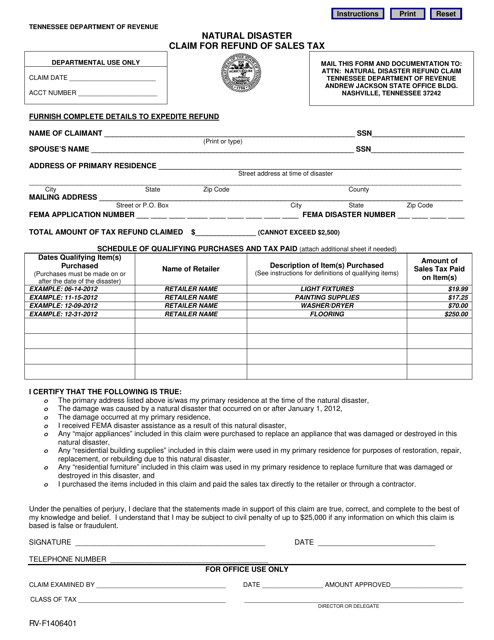

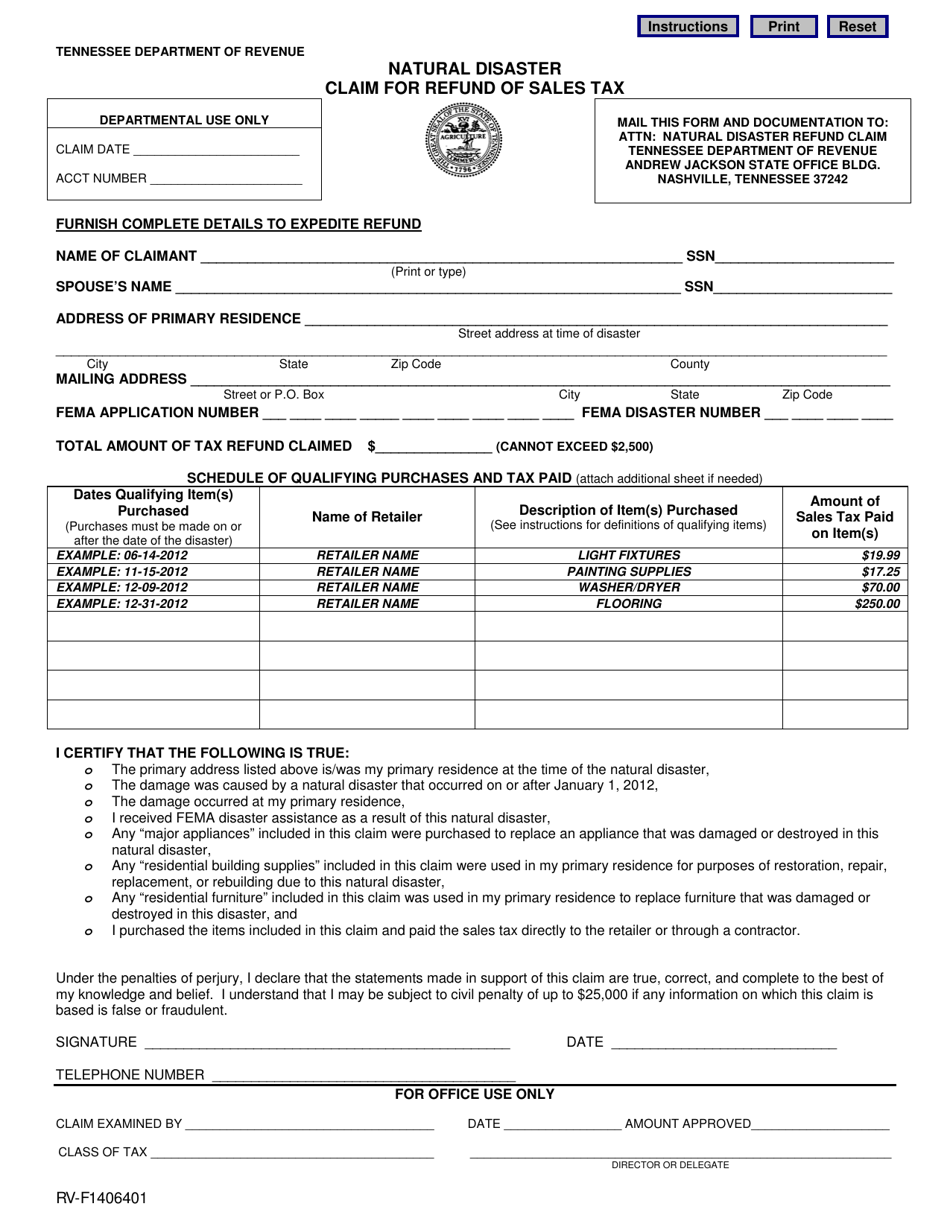

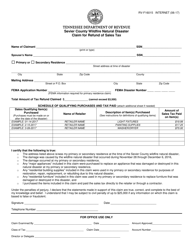

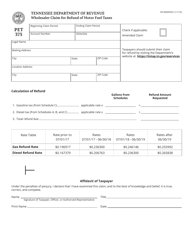

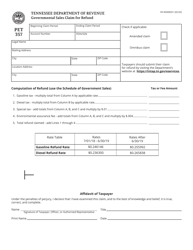

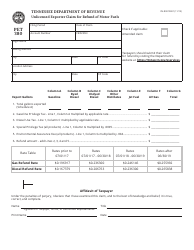

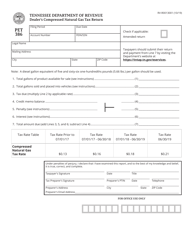

Form RV-F1406401 Natural Disaster Claim for Refund of Sales Tax - Tennessee

What Is Form RV-F1406401?

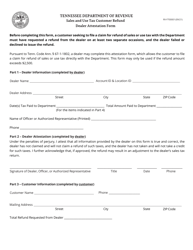

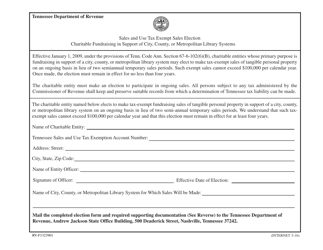

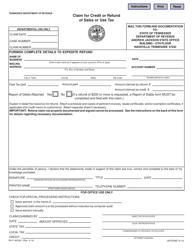

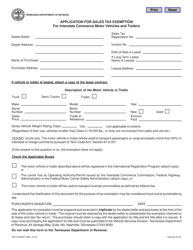

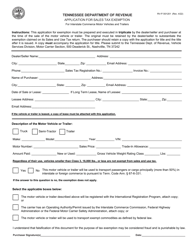

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F1406401?

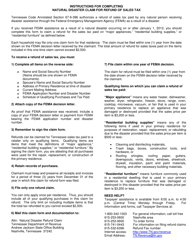

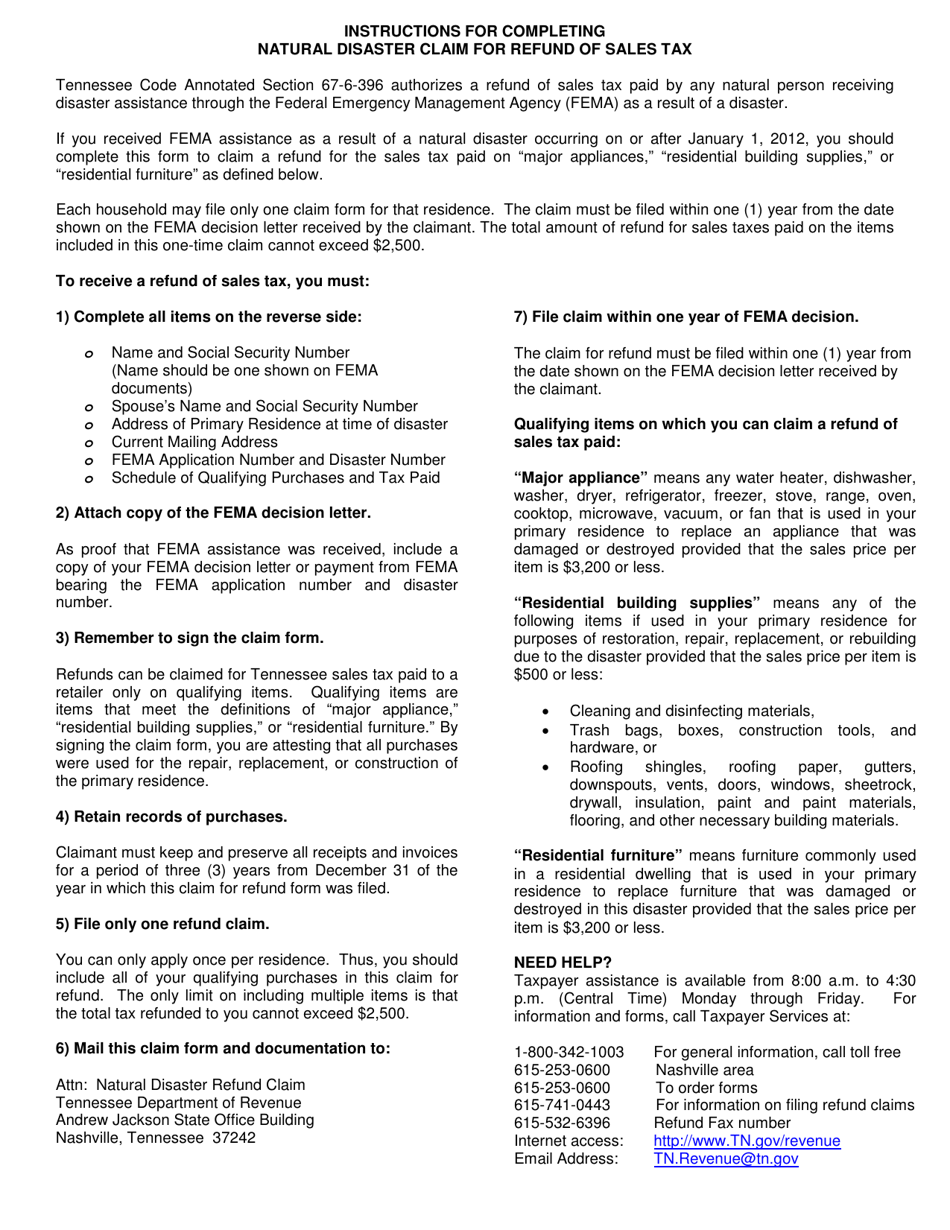

A: Form RV-F1406401 is a document used for filing a claim for refund of sales tax in Tennessee after experiencing a natural disaster.

Q: Who can use Form RV-F1406401?

A: Individuals or businesses who have been affected by a natural disaster in Tennessee and have paid sales tax on damaged or destroyed property can use this form to claim a refund.

Q: What is the purpose of filing Form RV-F1406401?

A: The purpose of filing this form is to request a refund of the sales tax paid on damaged or destroyed property as a result of a natural disaster in Tennessee.

Q: What information is required on Form RV-F1406401?

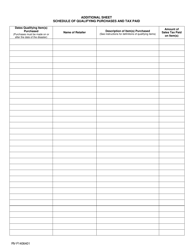

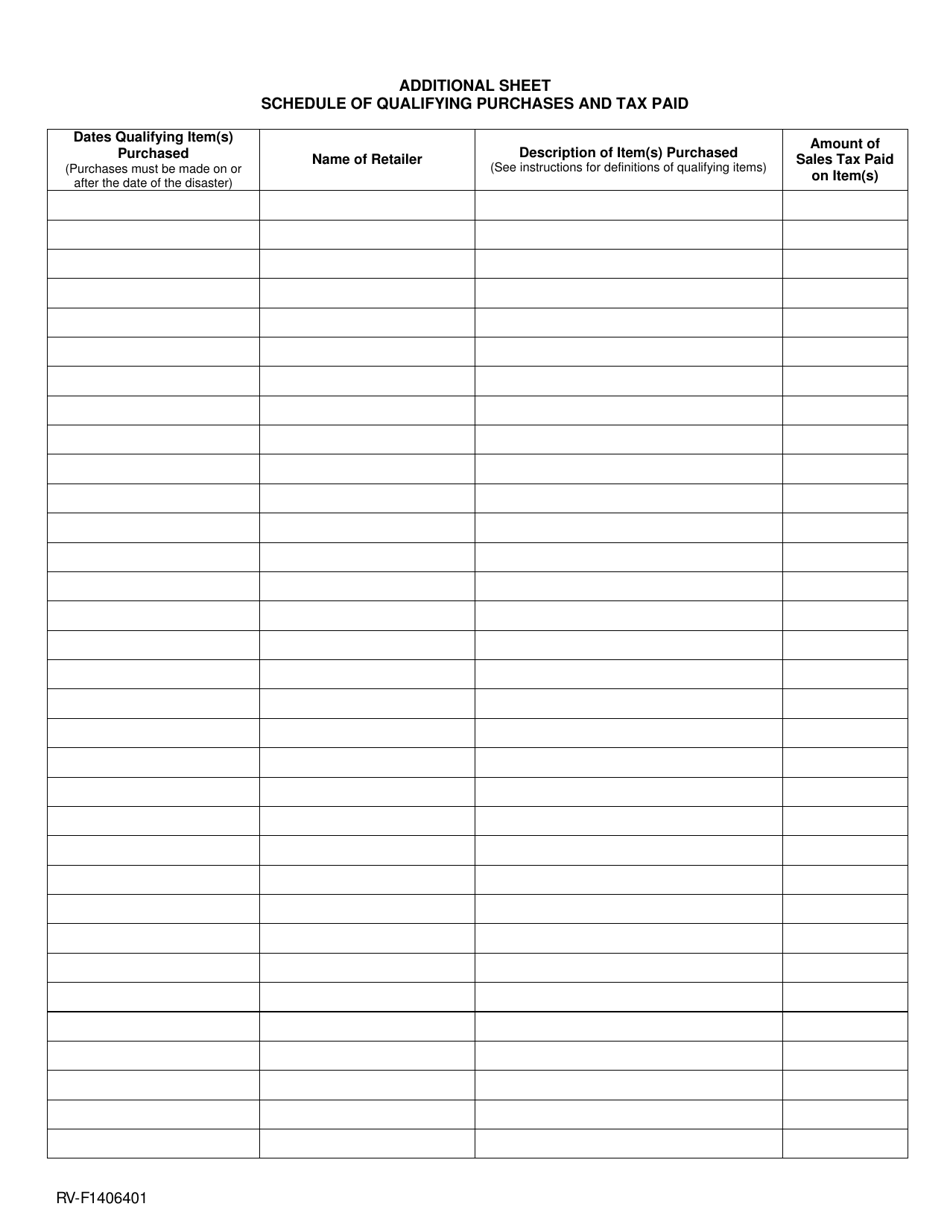

A: Form RV-F1406401 requires information such as the taxpayer's name, address, account number, details of the natural disaster, description of damaged property, and documentation supporting the claim.

Form Details:

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-F1406401 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.