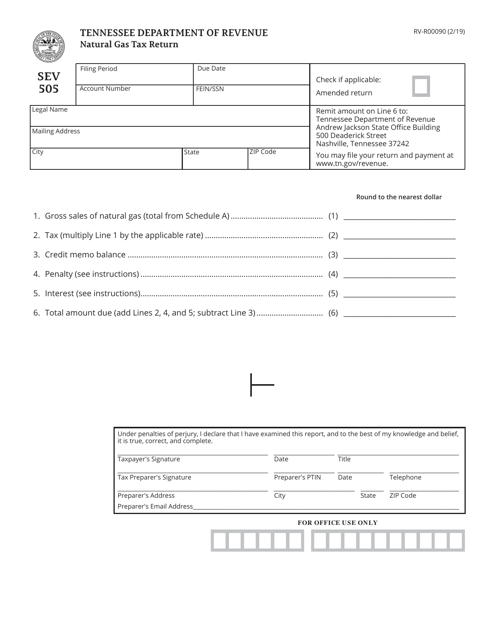

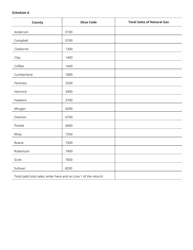

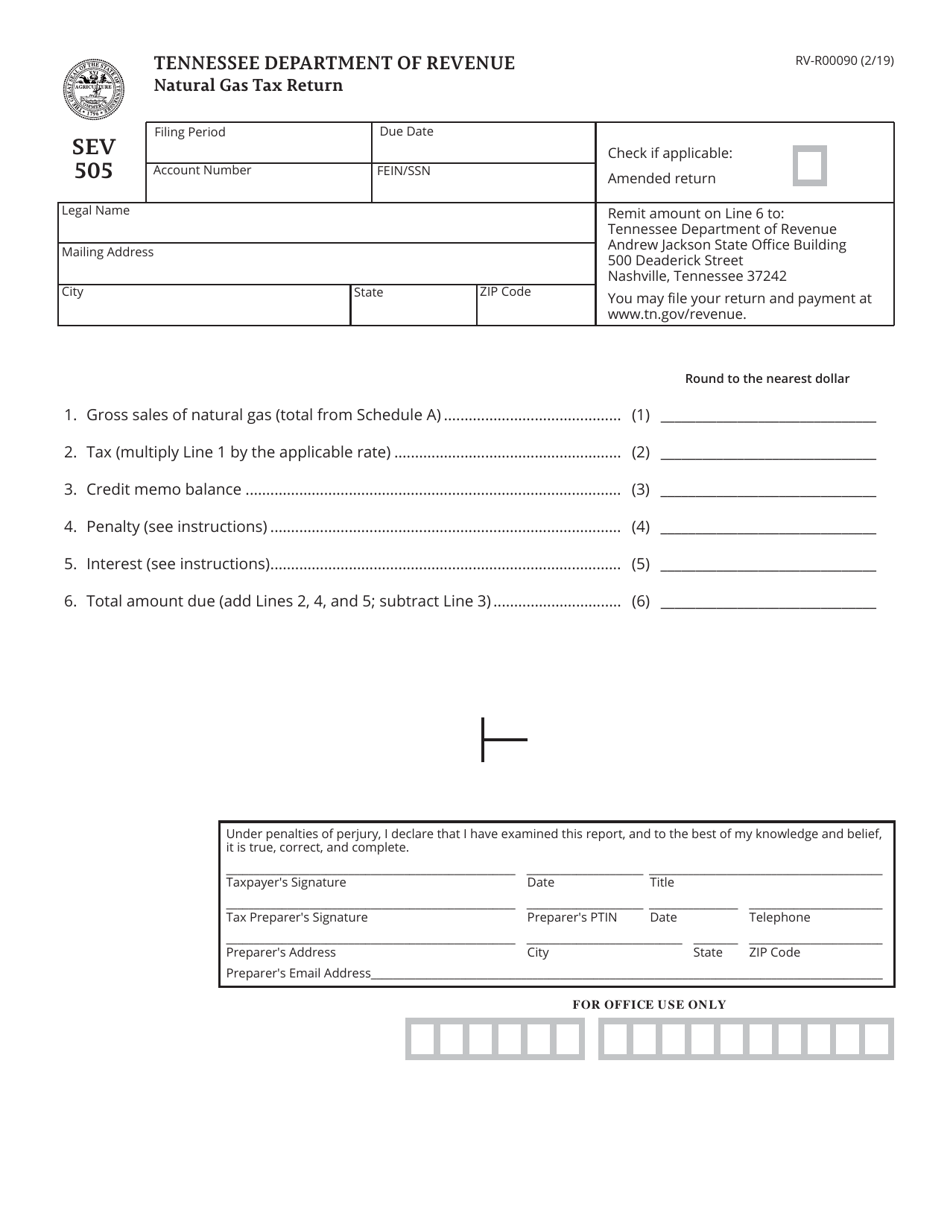

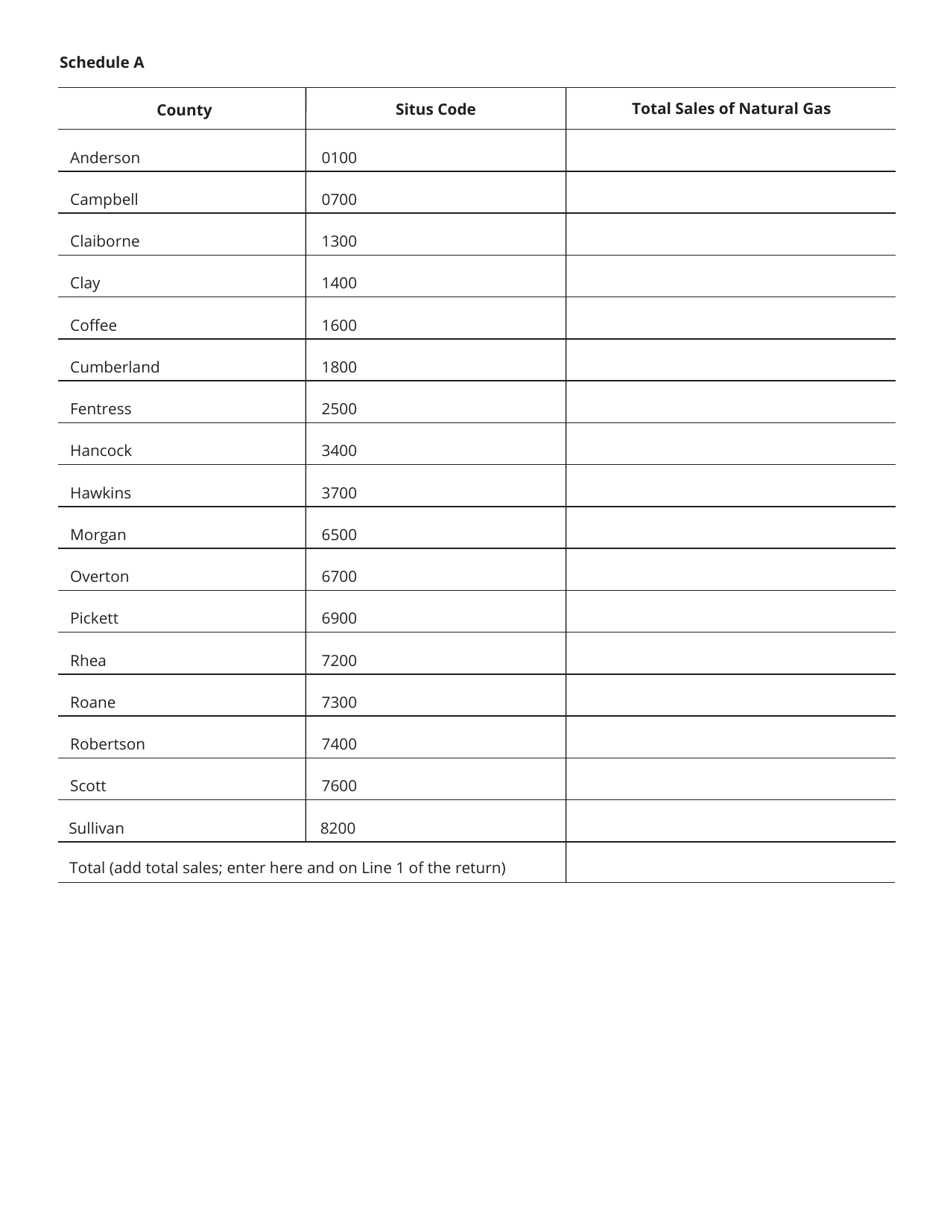

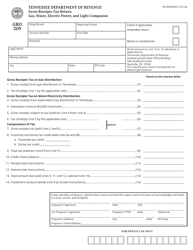

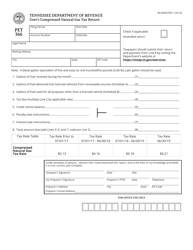

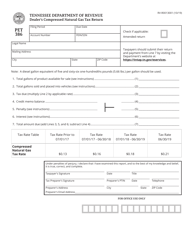

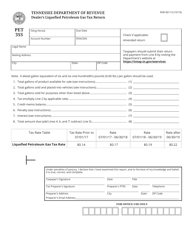

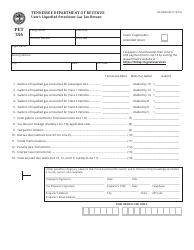

Form SEV505 (RV-R00090) Natural Gas Tax Return - Tennessee

What Is Form SEV505 (RV-R00090)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SEV505?

A: Form SEV505 is the Natural Gas Tax Return for the state of Tennessee.

Q: Who needs to file Form SEV505?

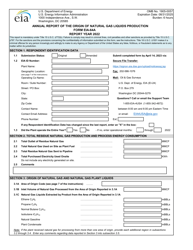

A: Any person or entity engaged in the business of selling natural gas in Tennessee needs to file Form SEV505.

Q: What is the purpose of Form SEV505?

A: The purpose of Form SEV505 is to report and pay the natural gas tax owed to the state of Tennessee.

Q: How often should Form SEV505 be filed?

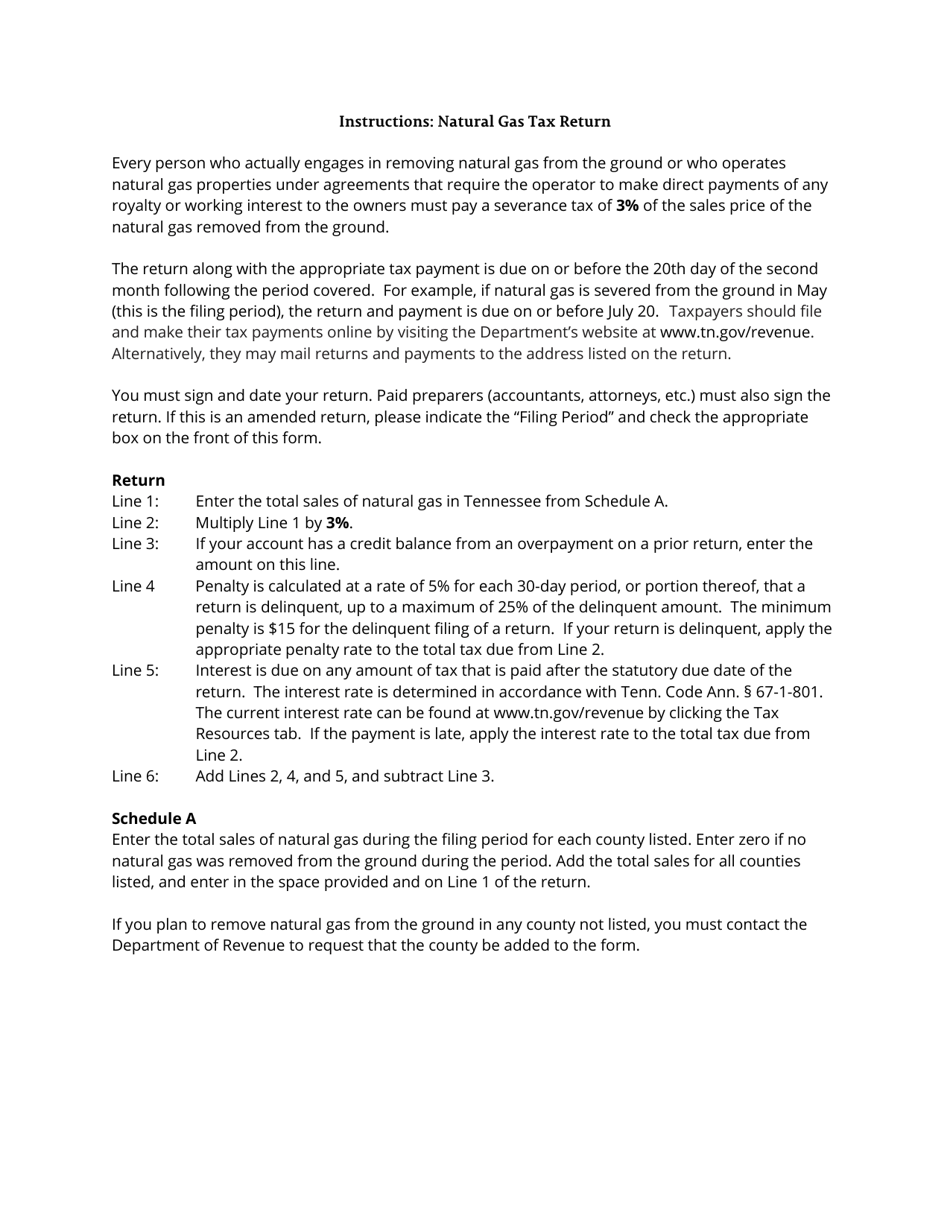

A: Form SEV505 should be filed monthly, no later than the 20th day of the following month.

Q: Is there any penalty for late filing of Form SEV505?

A: Yes, there is a penalty for late filing of Form SEV505. The penalty is 5% of the tax due for each month or fraction thereof that the return is late.

Q: What is the tax rate for natural gas in Tennessee?

A: The tax rate for natural gas in Tennessee is currently $0.35 per thousand cubic feet.

Q: Are there any exemptions or deductions available for natural gas tax in Tennessee?

A: Yes, there are certain exemptions and deductions available for natural gas tax in Tennessee. You should refer to the instructions for Form SEV505 for more information.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SEV505 (RV-R00090) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.