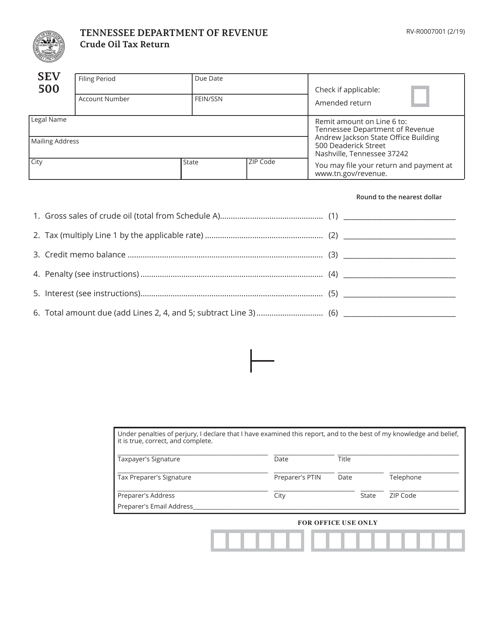

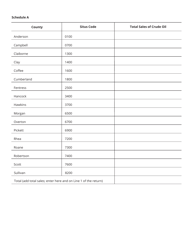

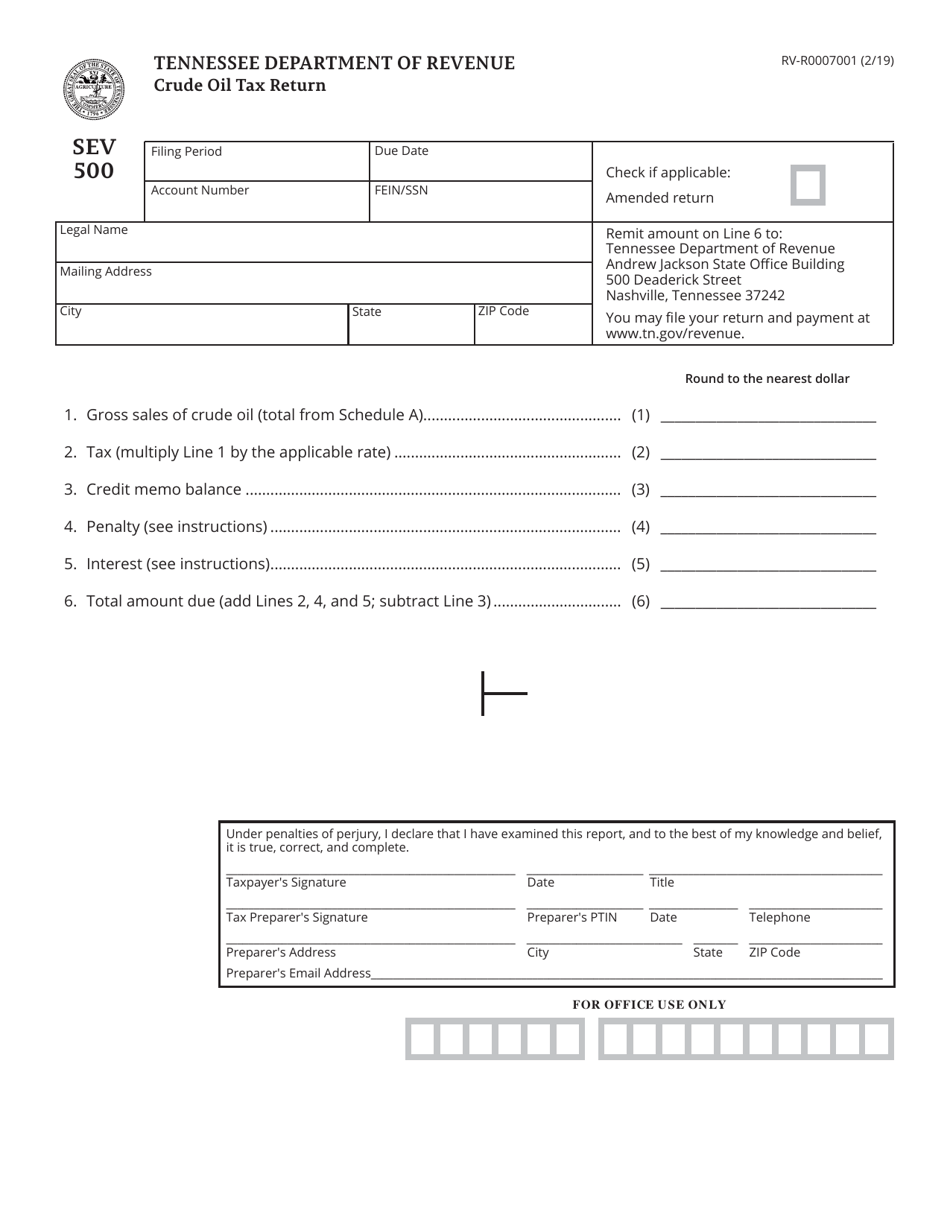

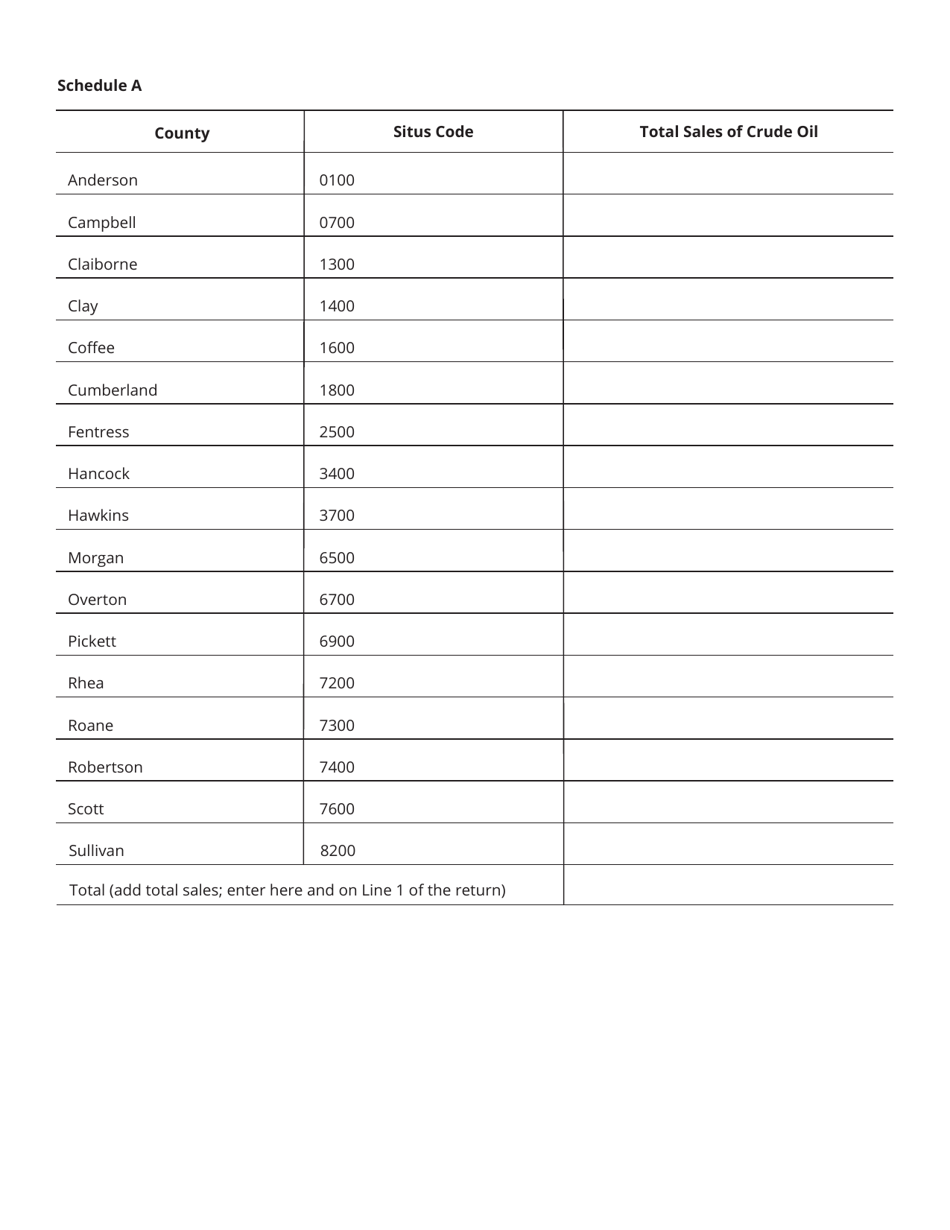

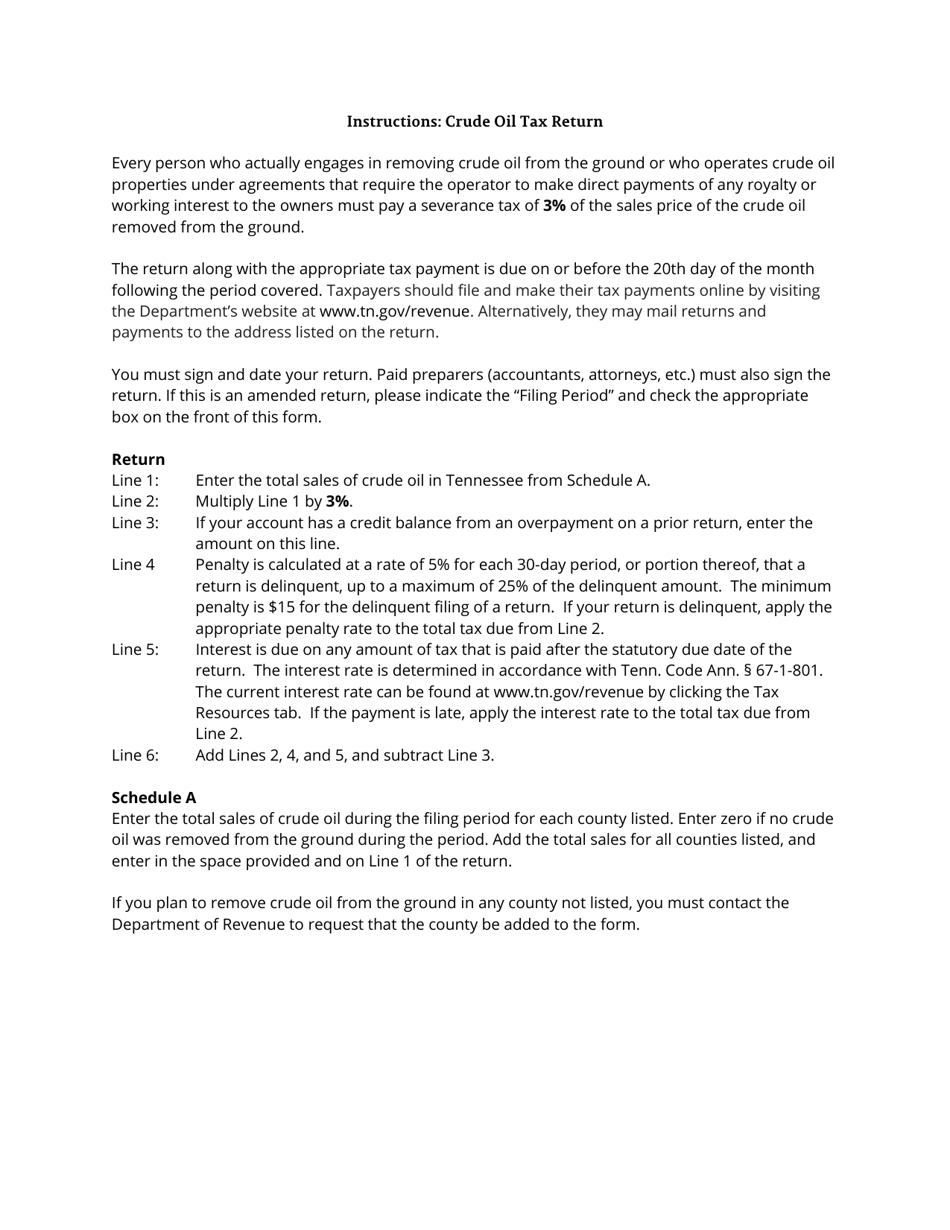

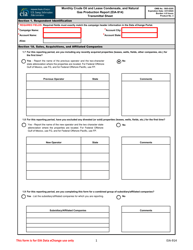

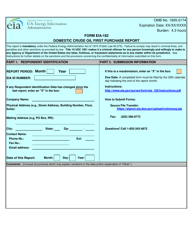

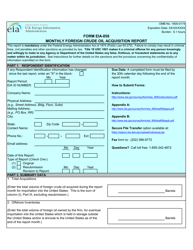

Form SEV500 (RV-R0007001) Crude Oil Tax Return - Tennessee

What Is Form SEV500 (RV-R0007001)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SEV500?

A: Form SEV500 is the Crude Oil Tax Return for the state of Tennessee.

Q: Who needs to file Form SEV500?

A: Any individual or entity engaged in the production, refining, or distribution of crude oil in Tennessee needs to file Form SEV500.

Q: What is the purpose of Form SEV500?

A: The purpose of Form SEV500 is to report and pay the taxes owed on the production, refining, or distribution of crude oil in Tennessee.

Q: How often do I need to file Form SEV500?

A: Form SEV500 is filed on a quarterly basis, meaning it needs to be filed four times a year.

Q: When is the deadline for filing Form SEV500?

A: The deadline for filing Form SEV500 is on the 20th day of the month following the end of each quarter.

Q: What should I do if I have questions or need assistance with Form SEV500?

A: If you have any questions or need assistance with Form SEV500, you should contact the Tennessee Department of Revenue for guidance.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SEV500 (RV-R0007001) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.