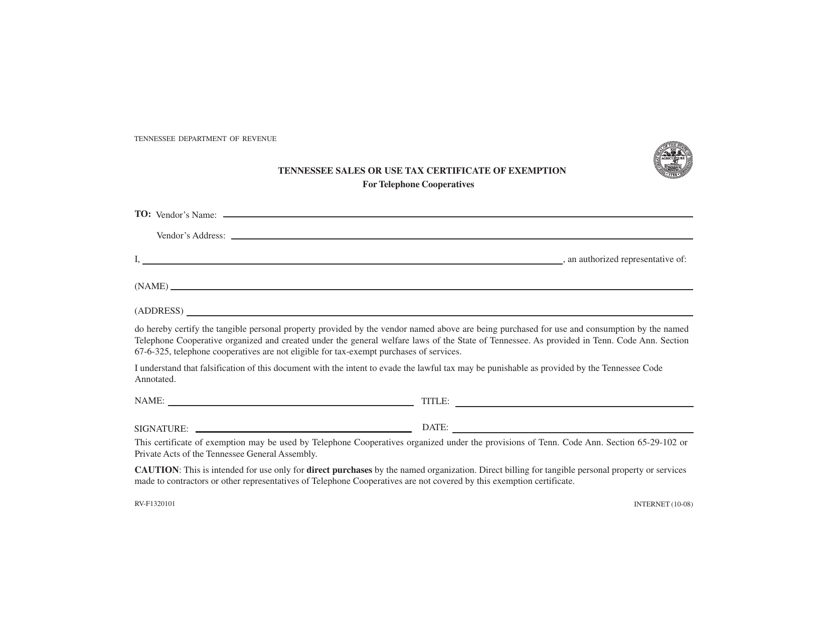

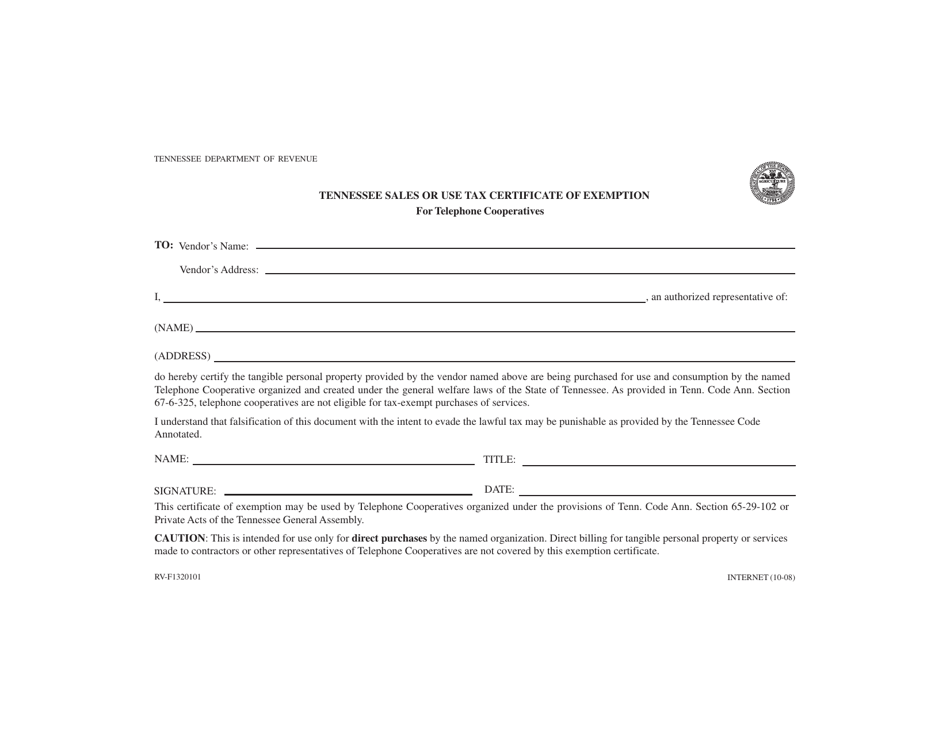

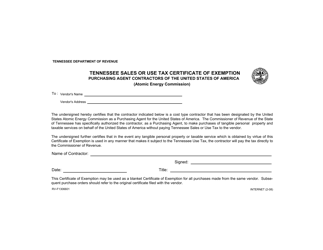

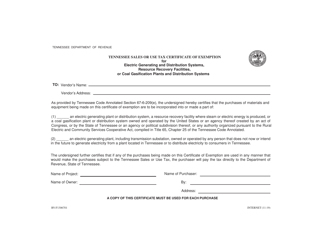

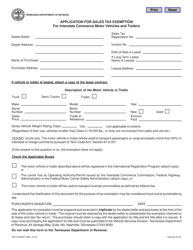

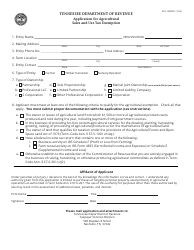

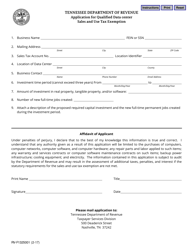

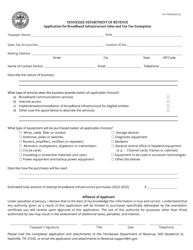

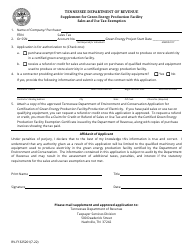

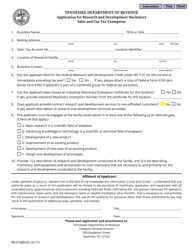

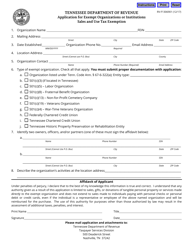

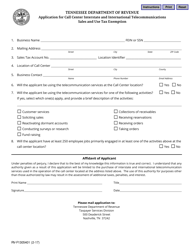

Form RV-F1320101 Tennessee Sales or Use Tax Certificate of Exemption for Telephone Cooperatives - Tennessee

What Is Form RV-F1320101?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RV-F1320101 form?

A: The RV-F1320101 form is the Tennessee Sales or Use Tax Certificate of Exemption for Telephone Cooperatives form.

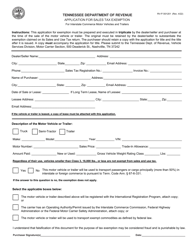

Q: Who can use the RV-F1320101 form?

A: The RV-F1320101 form can be used by telephone cooperatives in Tennessee to claim exemption from sales or use tax.

Q: What is the purpose of the RV-F1320101 form?

A: The purpose of the RV-F1320101 form is to certify that a telephone cooperative is eligible for exemption from sales or use tax in Tennessee.

Q: What information is required on the RV-F1320101 form?

A: The RV-F1320101 form requires information such as the name and address of the telephone cooperative, the reason for exemption, and the signature of an authorized representative.

Q: Are all telephone cooperatives in Tennessee eligible for exemption from sales or use tax?

A: No, not all telephone cooperatives in Tennessee are eligible for exemption from sales or use tax. They must meet certain criteria to qualify for exemption.

Q: What should I do with the completed RV-F1320101 form?

A: Once you have completed the RV-F1320101 form, you should keep a copy for your records and provide the original to the seller or lessor from whom you are purchasing or leasing taxable items.

Form Details:

- Released on October 1, 2008;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1320101 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.