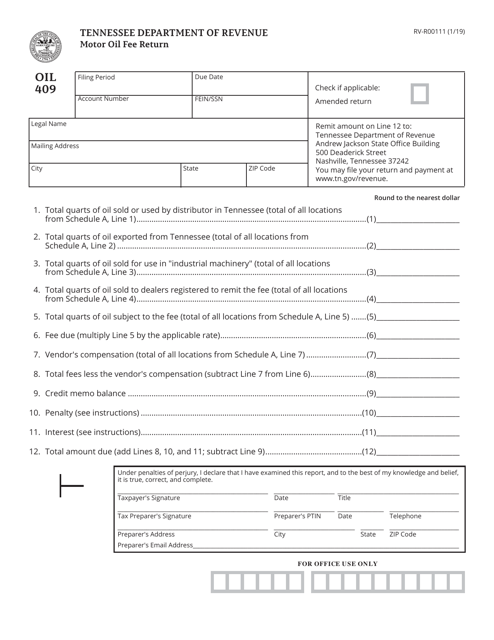

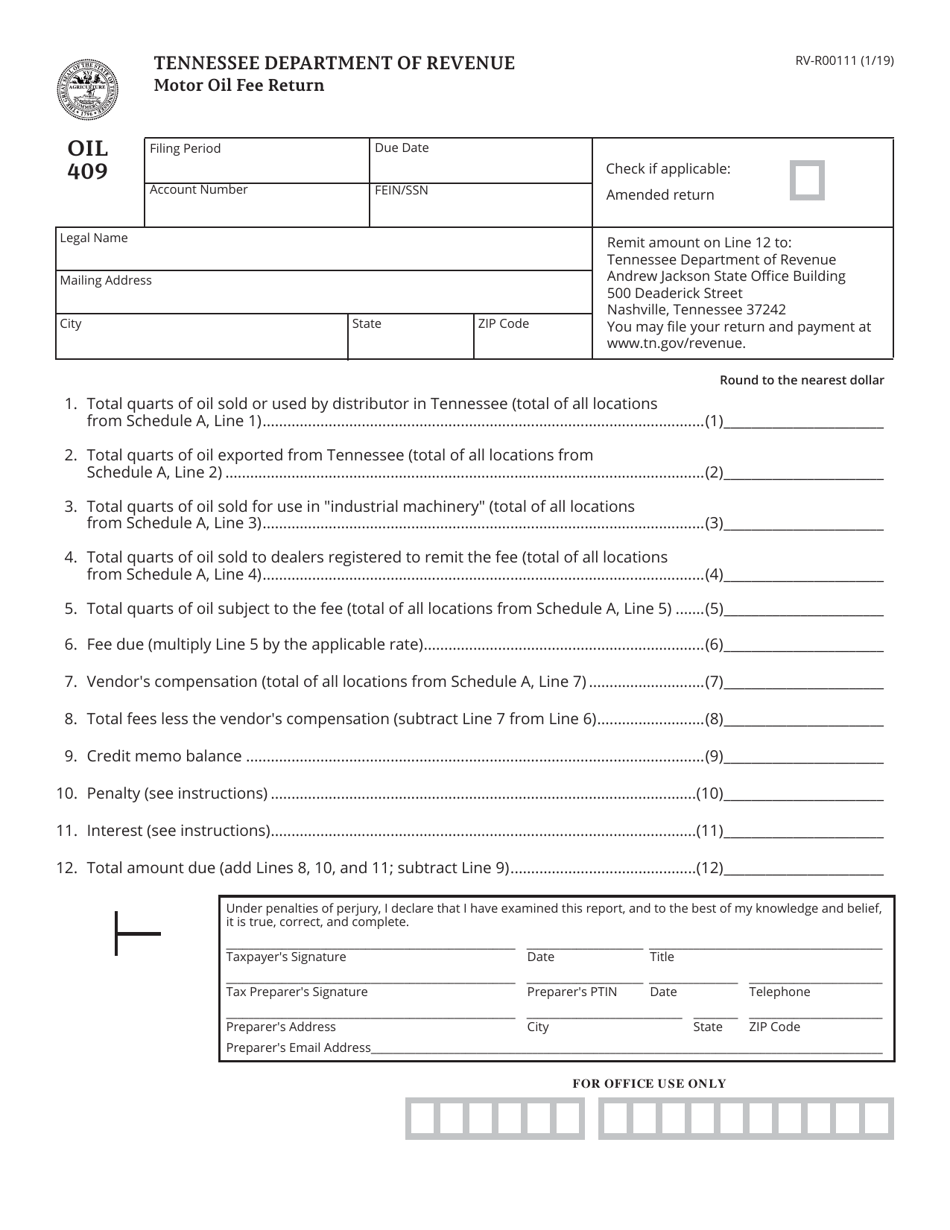

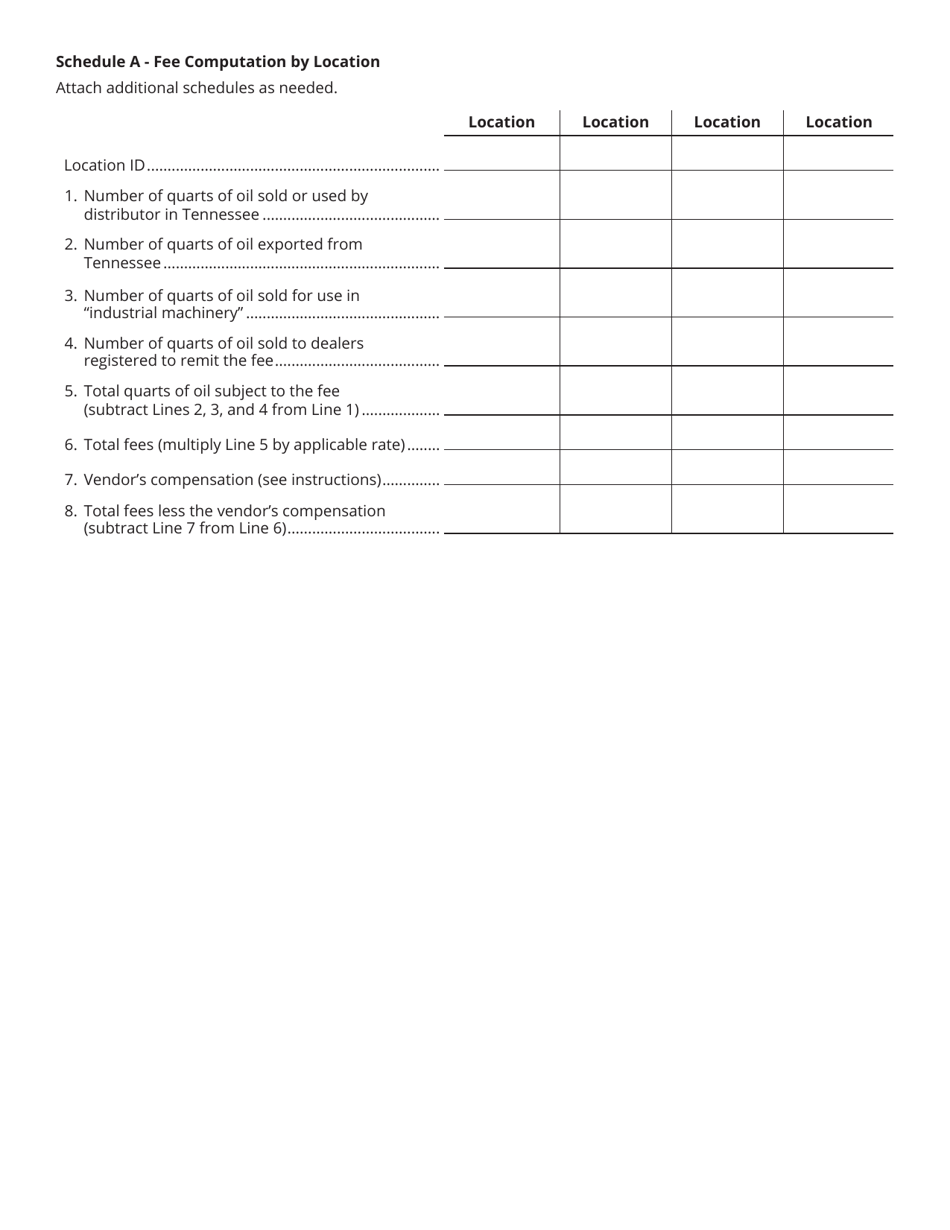

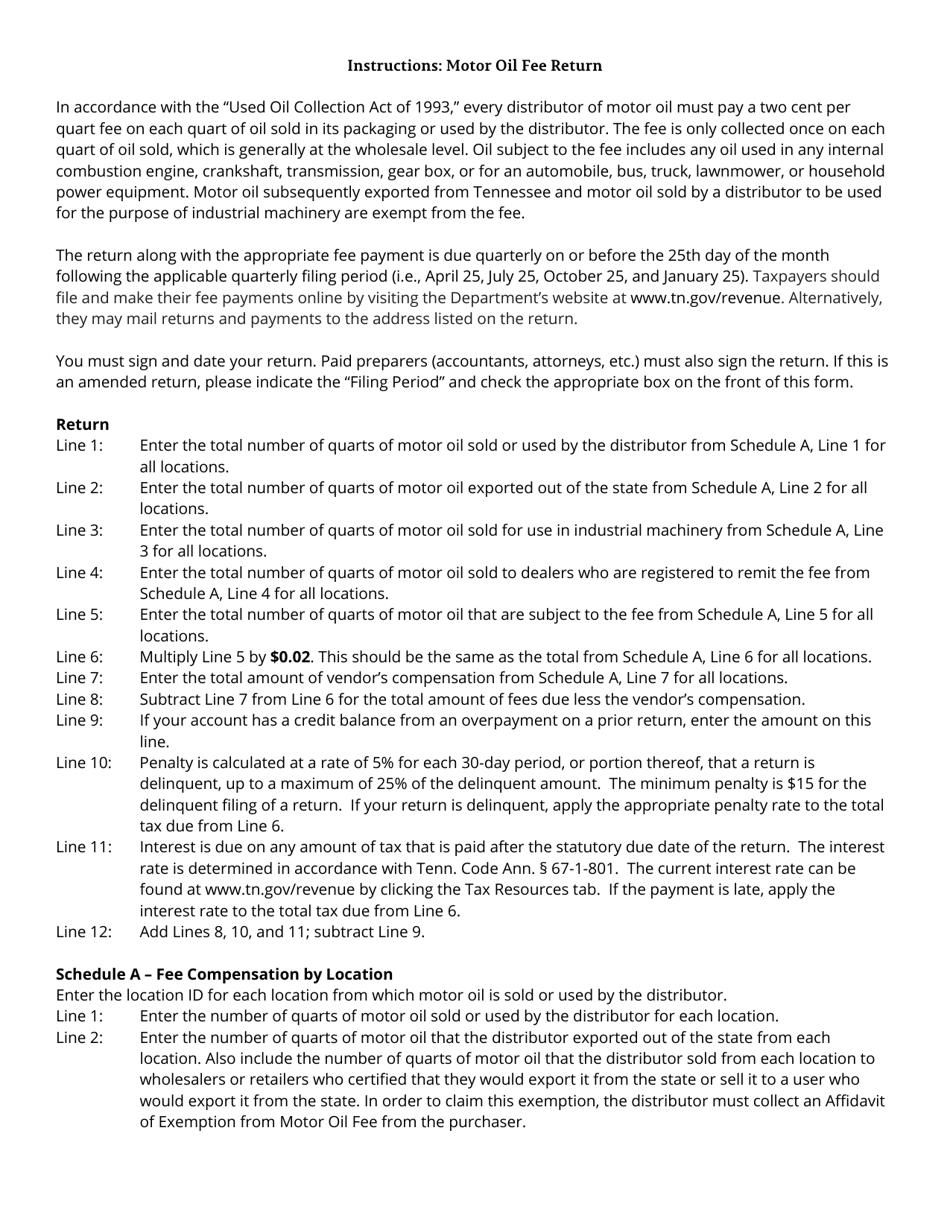

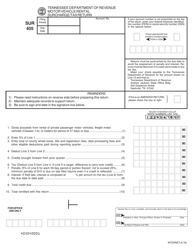

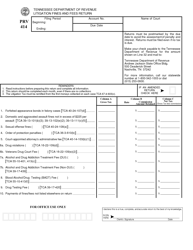

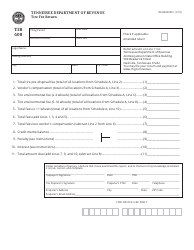

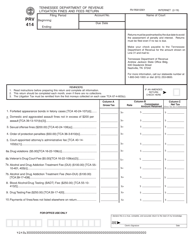

Form OIL409 (RV-R00111) Motor Oil Fee Return - Tennessee

What Is Form OIL409 (RV-R00111)?

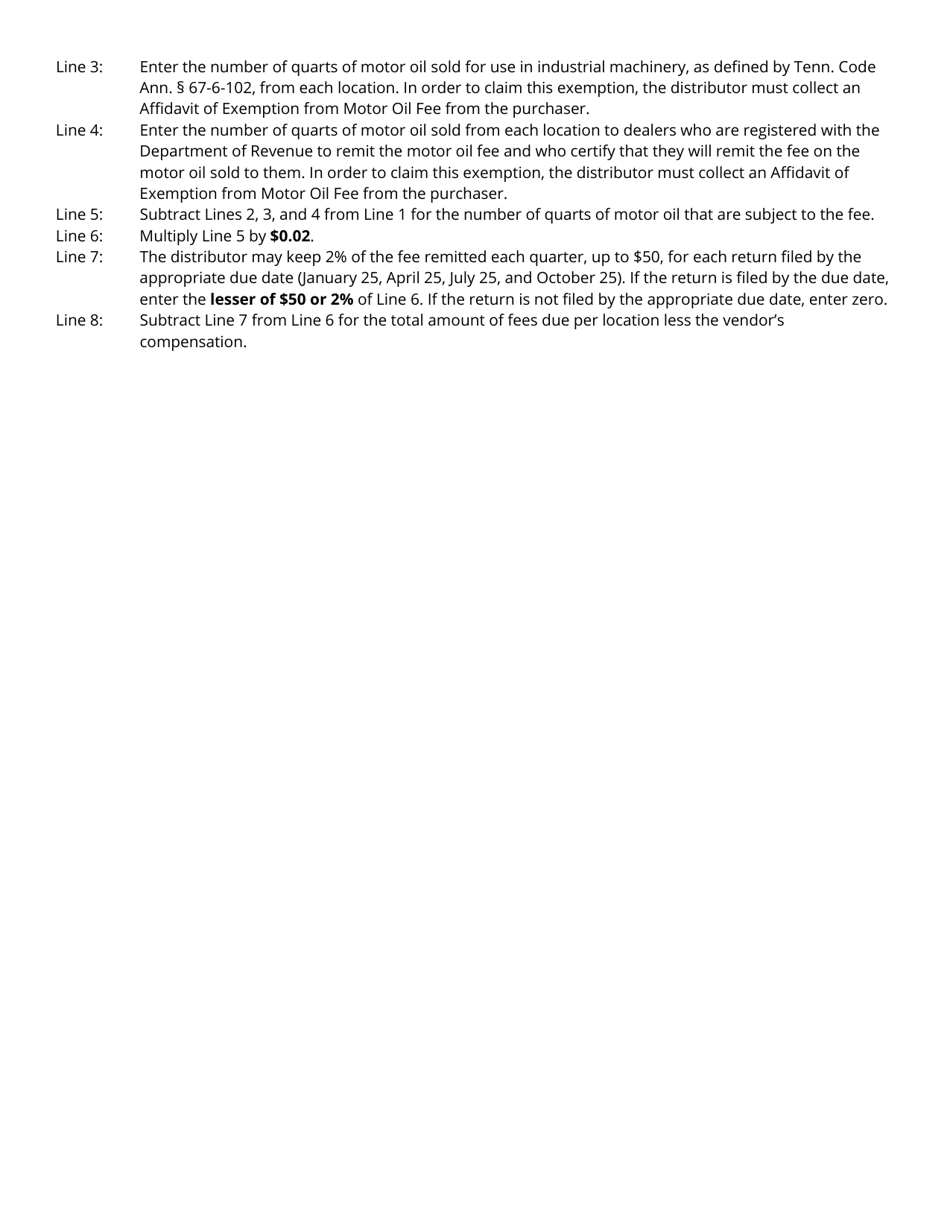

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OIL409 (RV-R00111)?

A: Form OIL409 (RV-R00111) is a Motor Oil Fee Return form in Tennessee.

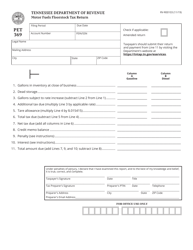

Q: What is the purpose of Form OIL409 (RV-R00111)?

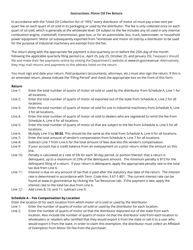

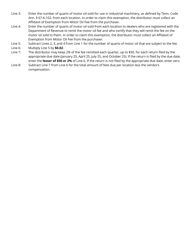

A: The purpose of Form OIL409 (RV-R00111) is to report and remit the motor oil fee in Tennessee.

Q: Who needs to file Form OIL409 (RV-R00111)?

A: Anyone who sells or distributes motor oil in Tennessee is required to file Form OIL409 (RV-R00111).

Q: How often should Form OIL409 (RV-R00111) be filed?

A: Form OIL409 (RV-R00111) should be filed on a quarterly basis.

Q: Is there a deadline for filing Form OIL409 (RV-R00111)?

A: Yes, Form OIL409 (RV-R00111) must be filed and the payment must be received on or before the 20th day following the end of the quarter.

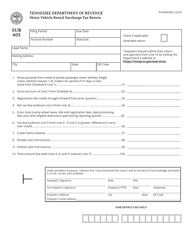

Q: What happens if I fail to file Form OIL409 (RV-R00111) or pay the motor oil fee?

A: Failure to file Form OIL409 (RV-R00111) or pay the motor oil fee may result in penalties and interest.

Q: Are there any exemptions or deductions available for the motor oil fee?

A: No, there are no exemptions or deductions available for the motor oil fee in Tennessee.

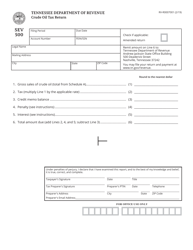

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OIL409 (RV-R00111) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.