This version of the form is not currently in use and is provided for reference only. Download this version of

Form RV-F1300901

for the current year.

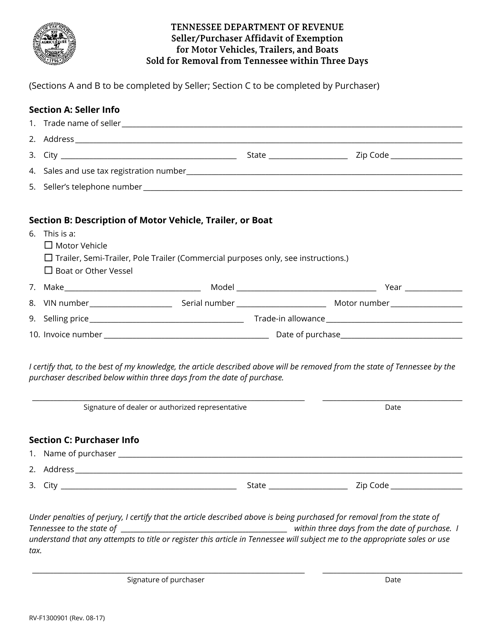

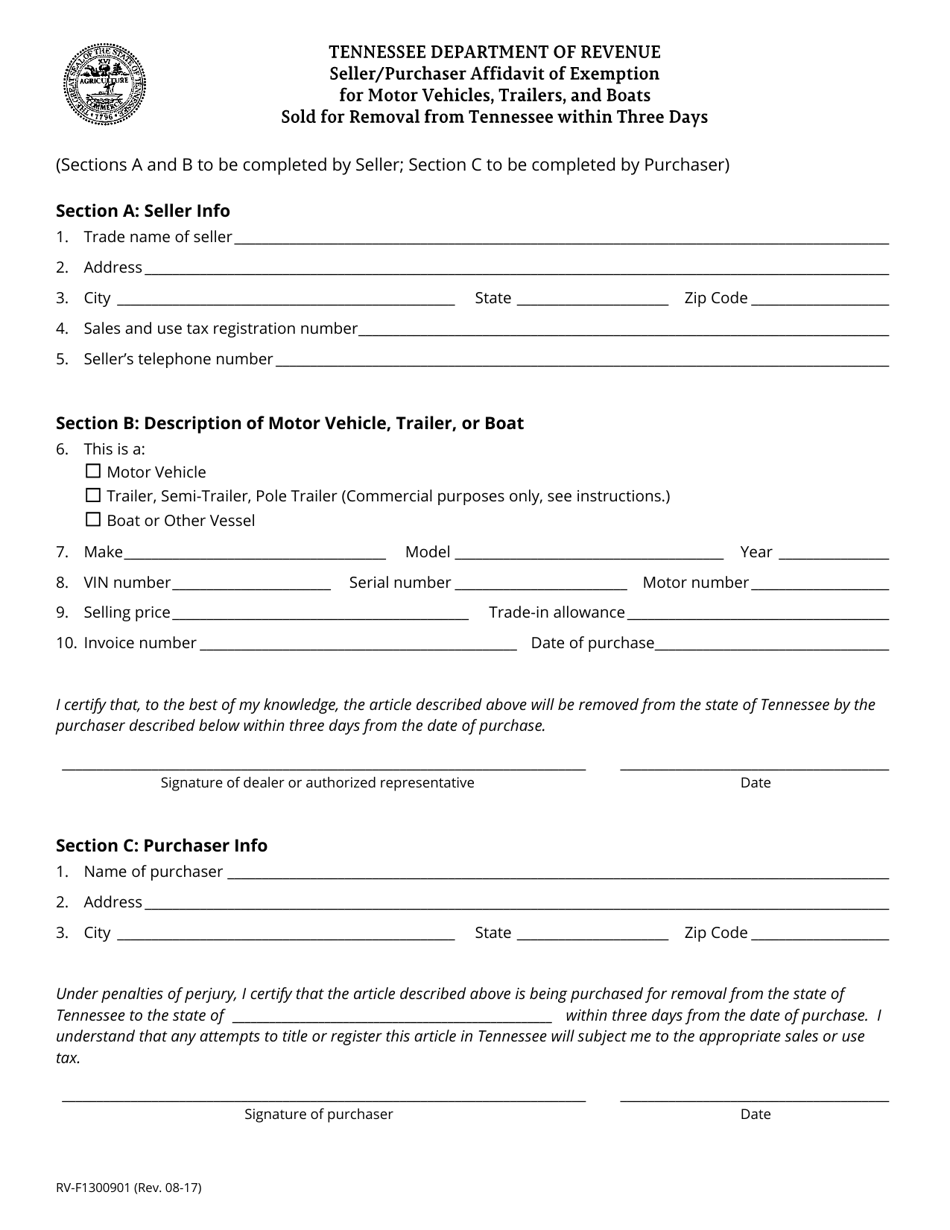

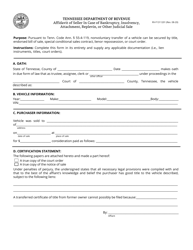

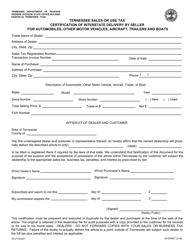

Form RV-F1300901 Seller / Purchaser Affidavit of Exemption for Motor Vehicles, Trailers and Boats Sold for Removal From Tennessee Within Three Days - Tennessee

What Is Form RV-F1300901?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F1300901?

A: Form RV-F1300901 is the Seller/Purchaser Affidavit of Exemption for Motor Vehicles, Trailers and Boats Sold for Removal From Tennessee Within Three Days.

Q: What is the purpose of Form RV-F1300901?

A: The purpose of Form RV-F1300901 is to exempt motor vehicles, trailers, and boats from Tennessee sales tax when they are sold for removal from Tennessee within three days.

Q: Who needs to fill out Form RV-F1300901?

A: Both the seller and purchaser need to fill out Form RV-F1300901 when selling a motor vehicle, trailer, or boat for removal from Tennessee within three days.

Q: How long do I have to remove the vehicle, trailer, or boat from Tennessee after filling out Form RV-F1300901?

A: You have three days to remove the vehicle, trailer, or boat from Tennessee after filling out Form RV-F1300901.

Q: Is there a fee for filing Form RV-F1300901?

A: No, there is no fee for filing Form RV-F1300901.

Q: Do I still need to have a bill of sale or title when selling a vehicle, trailer, or boat for removal from Tennessee within three days?

A: Yes, you still need to have a bill of sale or title when selling a vehicle, trailer, or boat for removal from Tennessee within three days. Form RV-F1300901 is an additional form to exempt the sale from Tennessee sales tax.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1300901 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.