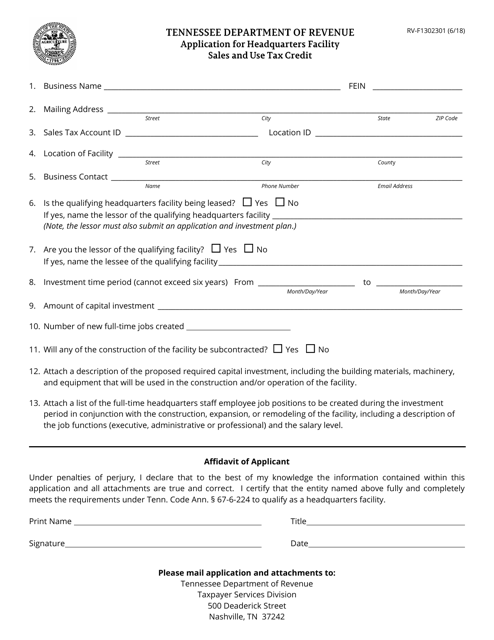

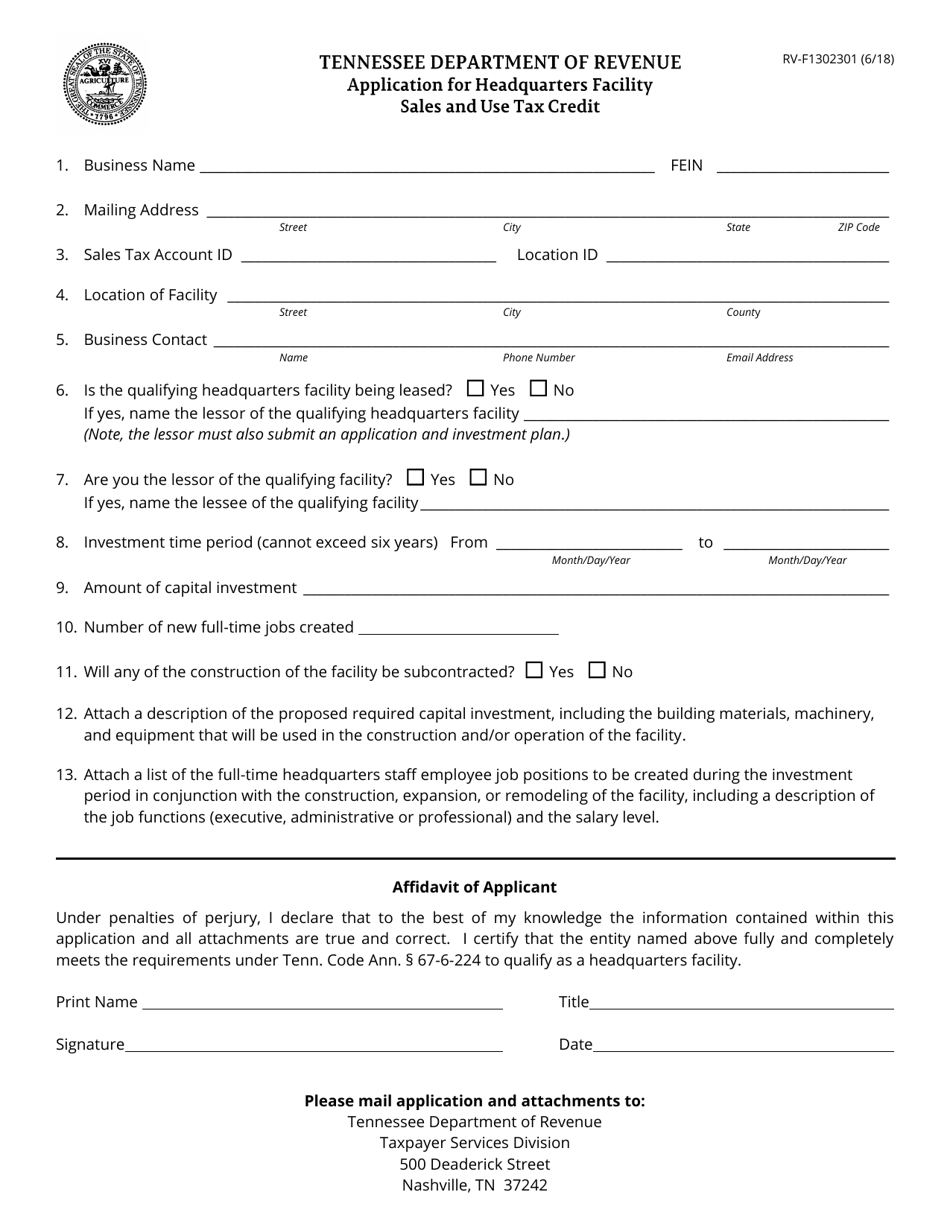

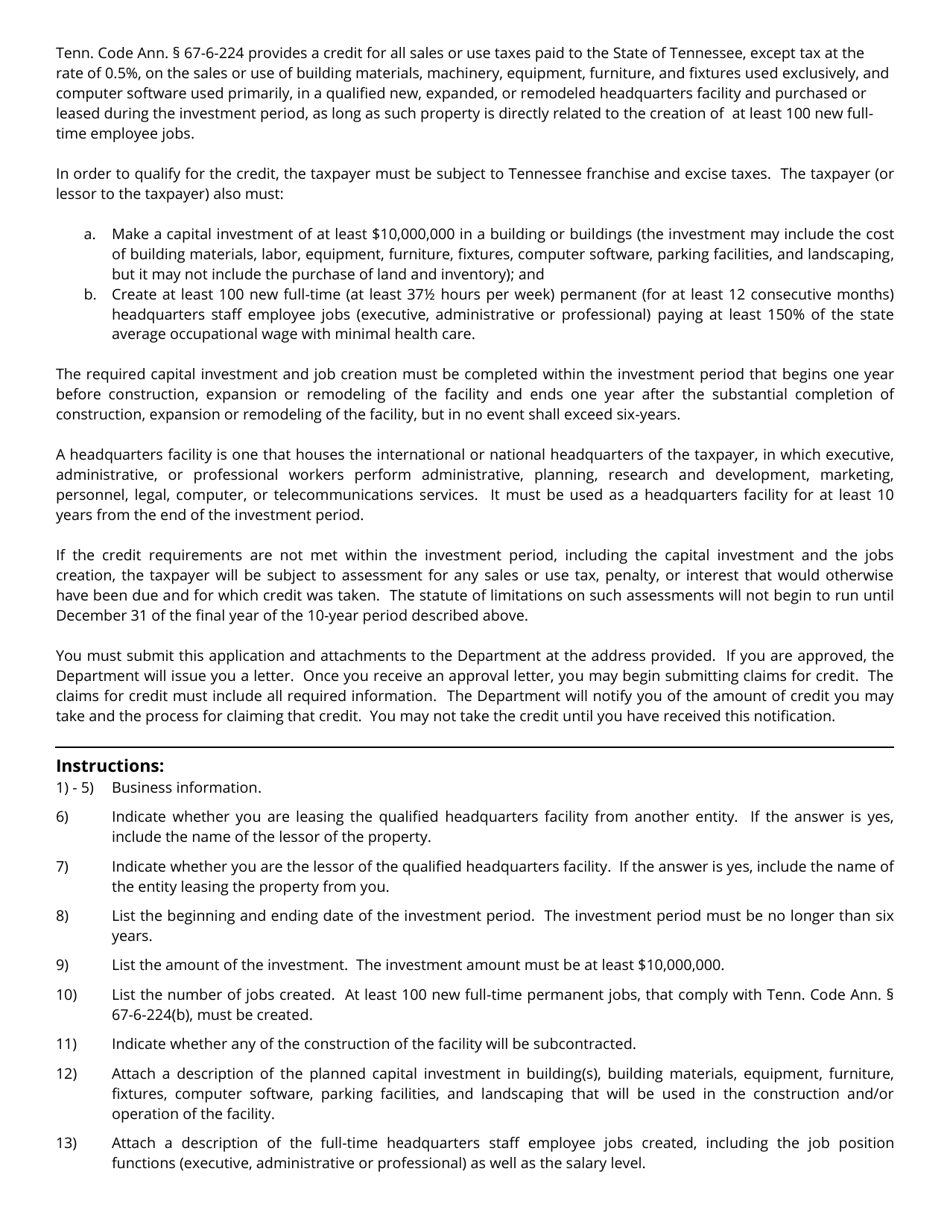

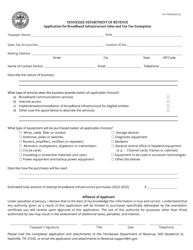

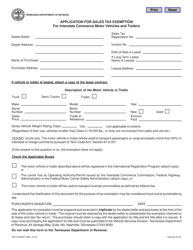

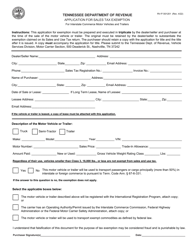

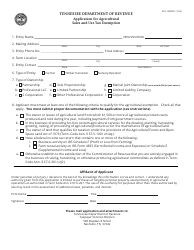

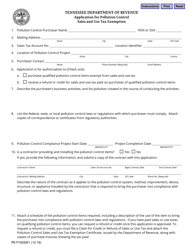

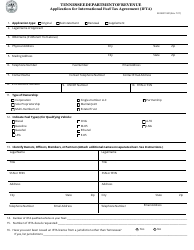

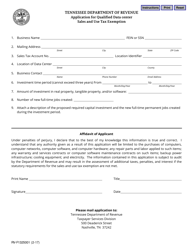

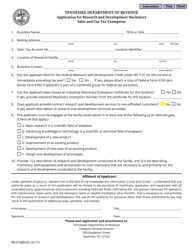

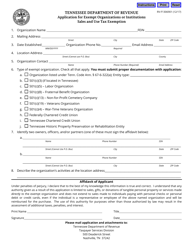

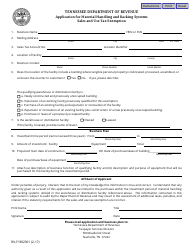

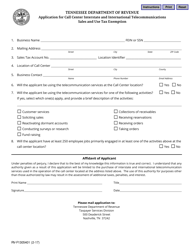

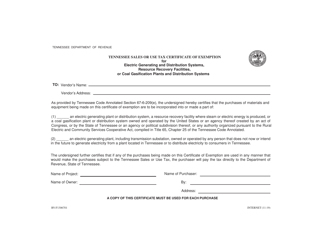

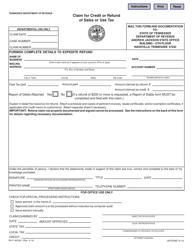

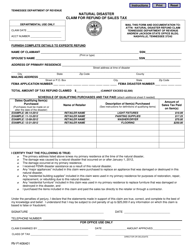

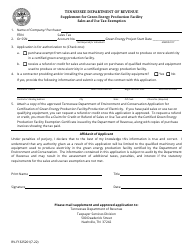

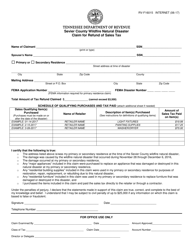

Form RV-F1302301 Application for Headquarters Facility Sales and Use Tax Credit - Tennessee

What Is Form RV-F1302301?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RV-F1302301 Application?

A: The RV-F1302301 Application is an application form used in Tennessee to apply for the Headquarters Facility Sales and Use Tax Credit.

Q: What is the Headquarters Facility Sales and Use Tax Credit?

A: The Headquarters Facility Sales and Use Tax Credit is a tax credit available in Tennessee for eligible businesses that establish or expand headquarters facilities.

Q: Who is eligible for the Headquarters Facility Sales and Use Tax Credit?

A: Eligible businesses that establish or expand headquarters facilities in Tennessee may be eligible for the tax credit.

Q: How do I apply for the Headquarters Facility Sales and Use Tax Credit?

A: To apply for the Headquarters Facility Sales and Use Tax Credit, you need to fill out the RV-F1302301 Application form and submit it to the Tennessee Department of Revenue.

Q: What information do I need to provide on the RV-F1302301 Application?

A: The RV-F1302301 Application form requires information such as business details, investment amounts, employment figures, and other relevant details about the planned or existing headquarters facility.

Q: Are there any deadlines for submitting the RV-F1302301 Application?

A: Specific deadlines for submitting the RV-F1302301 Application may vary. It is best to refer to the instructions provided with the application or contact the Tennessee Department of Revenue for more information.

Q: What happens after I submit the RV-F1302301 Application?

A: After submitting the RV-F1302301 Application, the Tennessee Department of Revenue will review the application and determine eligibility for the Headquarters Facility Sales and Use Tax Credit. If approved, you may receive the tax credit.

Q: Can I claim the Headquarters Facility Sales and Use Tax Credit for previous years?

A: The availability of retroactive tax credits may vary. It is recommended to consult with the Tennessee Department of Revenue or a tax professional for guidance on claiming credits for previous years.

Q: What are the benefits of the Headquarters Facility Sales and Use Tax Credit?

A: The Headquarters Facility Sales and Use Tax Credit can provide eligible businesses with a credit against sales and use taxes related to eligible expenses for establishing or expanding headquarters facilities, potentially reducing their tax liability.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1302301 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.