This version of the form is not currently in use and is provided for reference only. Download this version of

Form FAE175 (RV-R0006301)

for the current year.

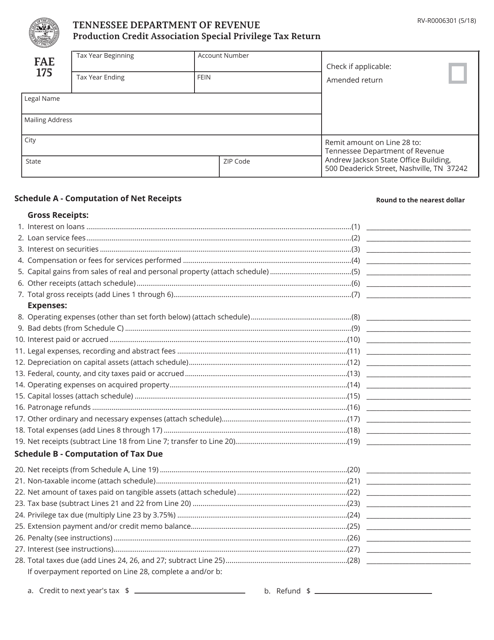

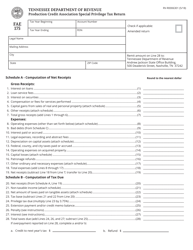

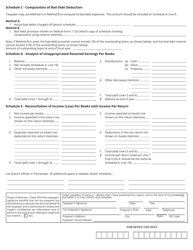

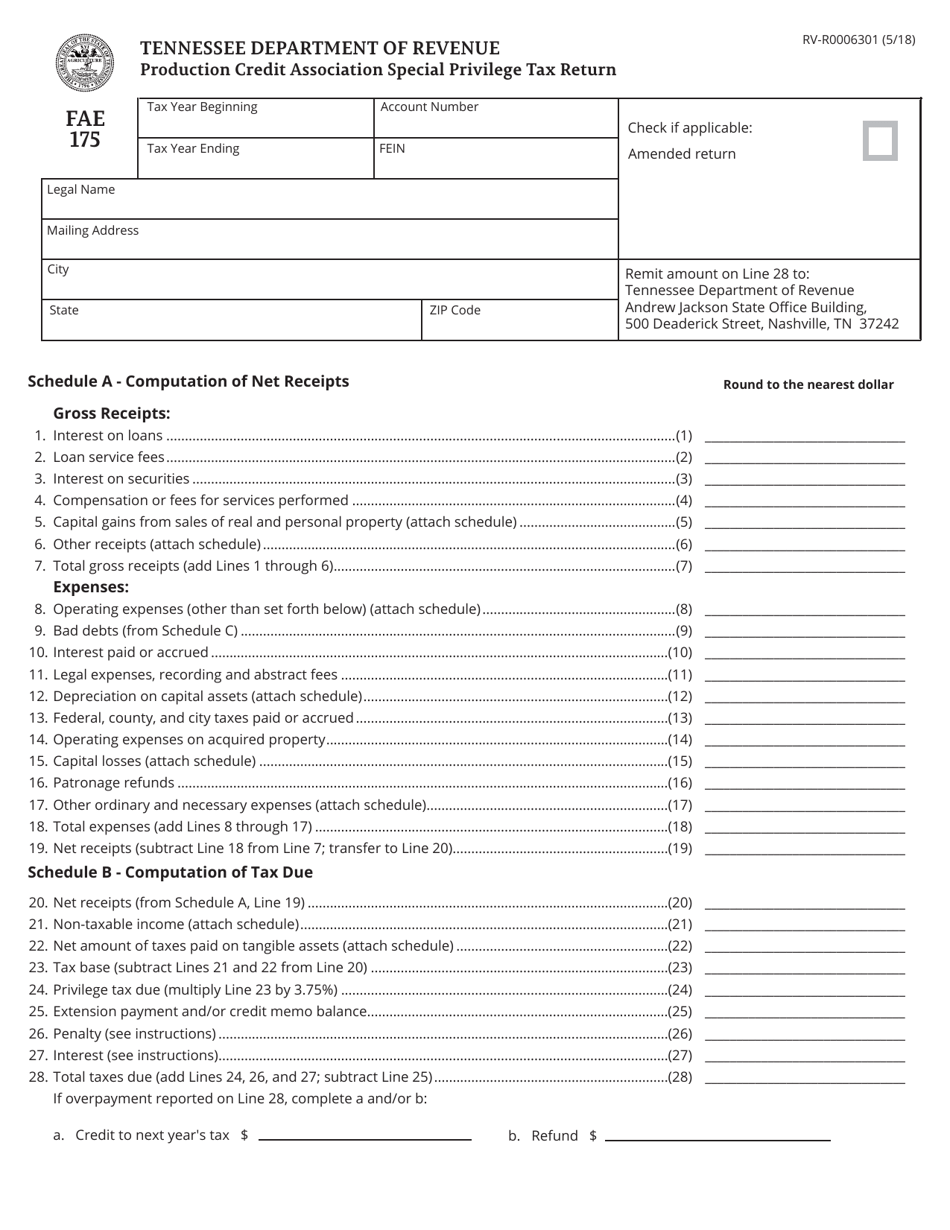

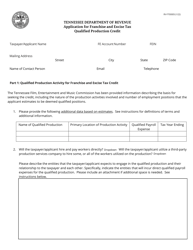

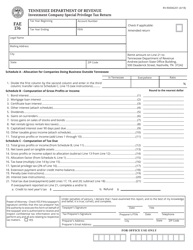

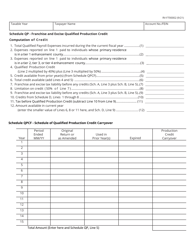

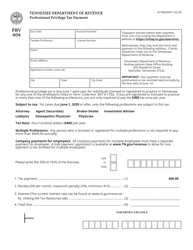

Form FAE175 (RV-R0006301) Production Credit Association Special Privilege Tax Return - Tennessee

What Is Form FAE175 (RV-R0006301)?

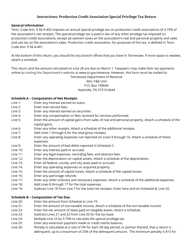

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FAE175?

A: Form FAE175 is the Production Credit Association Special Privilege Tax Return in Tennessee.

Q: What is the purpose of Form FAE175?

A: The purpose of Form FAE175 is to report and pay the special privilege tax for Production Credit Associations in Tennessee.

Q: Who needs to file Form FAE175?

A: Production Credit Associations in Tennessee need to file Form FAE175.

Q: What is the special privilege tax?

A: The special privilege tax is a tax levied on the income or privilege of certain businesses or organizations, such as Production Credit Associations.

Q: How often does Form FAE175 need to be filed?

A: Form FAE175 needs to be filed annually.

Q: Is there a deadline for filing Form FAE175?

A: Yes, the deadline for filing Form FAE175 is determined by the Tennessee Department of Revenue and may vary each year.

Q: What happens if I don't file Form FAE175?

A: Failure to file Form FAE175 or pay the special privilege tax may result in penalties and interest imposed by the Tennessee Department of Revenue.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FAE175 (RV-R0006301) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.