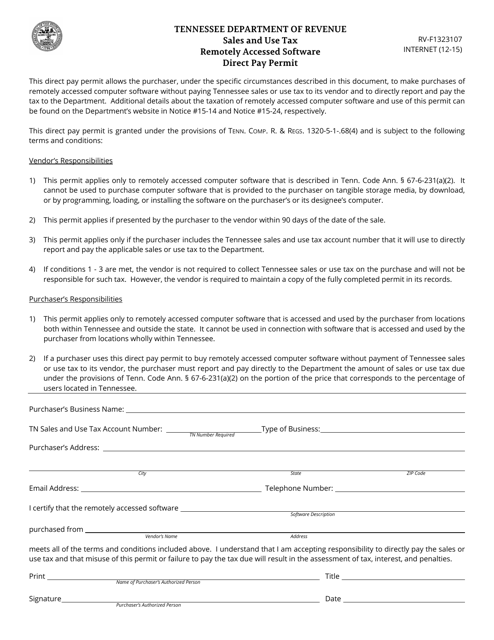

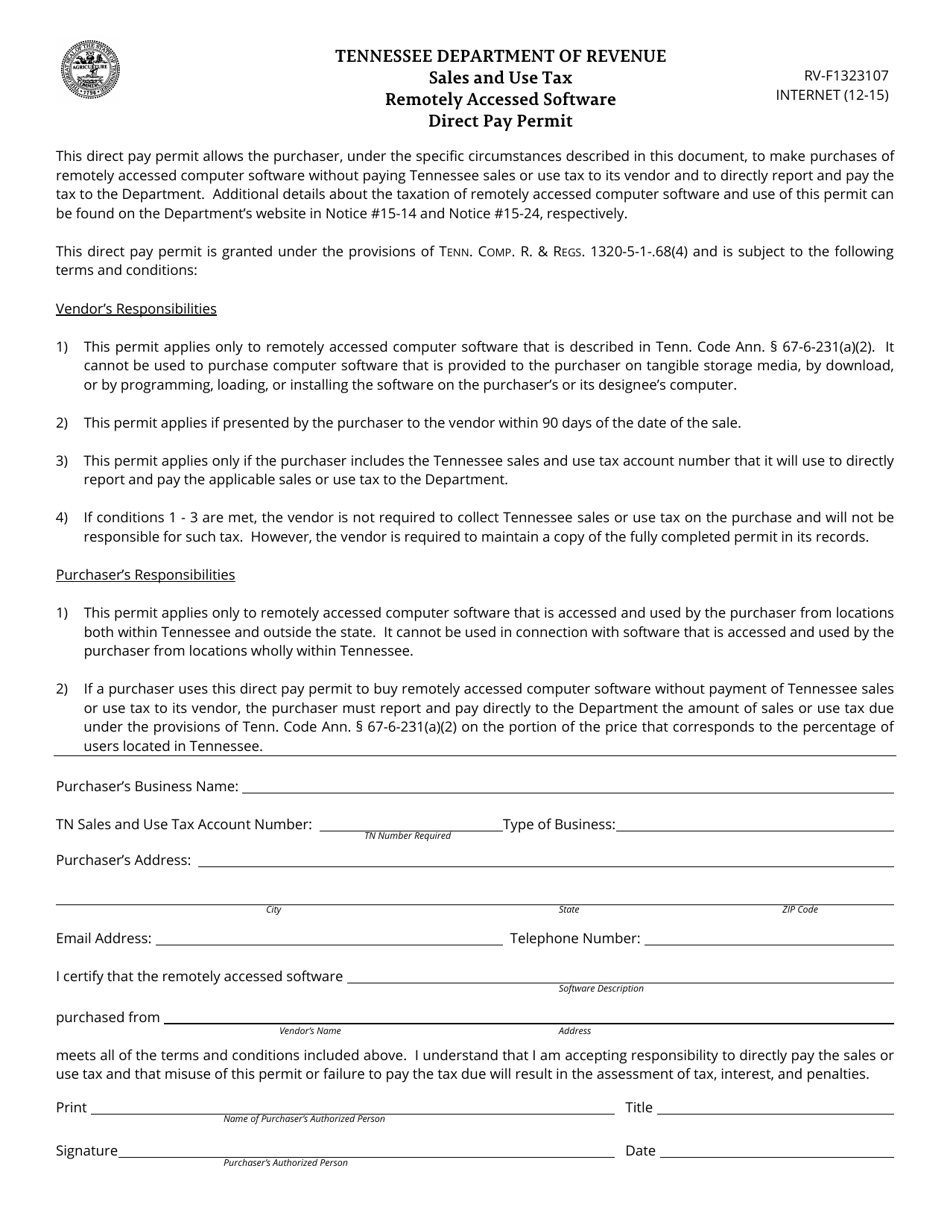

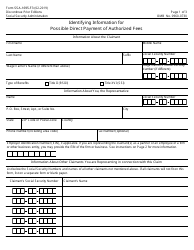

Form RV-F1323107 Remotely Accessed Software Direct Pay Permit - Tennessee

What Is Form RV-F1323107?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F1323107?

A: Form RV-F1323107 is a document related to Remotely Accessed Software Direct Pay Permit.

Q: What is a Remotely Accessed Software Direct Pay Permit?

A: A Remotely Accessed Software Direct Pay Permit is a permit that allows a business to pay sales and use tax directly to the state of Tennessee for software accessed remotely by customers.

Q: What is the purpose of Form RV-F1323107?

A: The purpose of Form RV-F1323107 is to apply for a Remotely Accessed Software Direct Pay Permit in Tennessee.

Q: Who needs to fill out Form RV-F1323107?

A: Businesses that provide remotely accessed software and want to pay sales and use tax directly to Tennessee need to fill out Form RV-F1323107.

Q: What information is required on Form RV-F1323107?

A: Form RV-F1323107 requires information about the business, including name, address, tax identification number, and a description of the software being provided.

Q: Are there any fees associated with Form RV-F1323107?

A: There are no fees associated with Form RV-F1323107.

Q: What happens after I submit Form RV-F1323107?

A: After submitting Form RV-F1323107, the Tennessee Department of Revenue will review the application and notify the business of their decision.

Q: How often do I need to renew my Remotely Accessed Software Direct Pay Permit?

A: The Remotely Accessed Software Direct Pay Permit needs to be renewed annually.

Q: Can I cancel my Remotely Accessed Software Direct Pay Permit?

A: Yes, businesses can cancel their Remotely Accessed Software Direct Pay Permit by completing and submitting a cancellation request to the Tennessee Department of Revenue.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1323107 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.