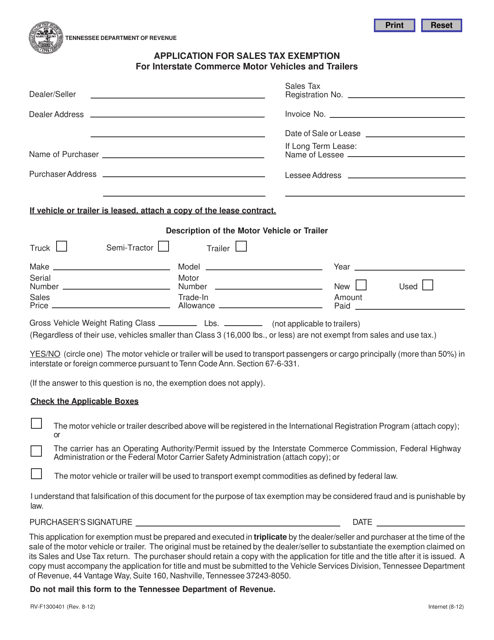

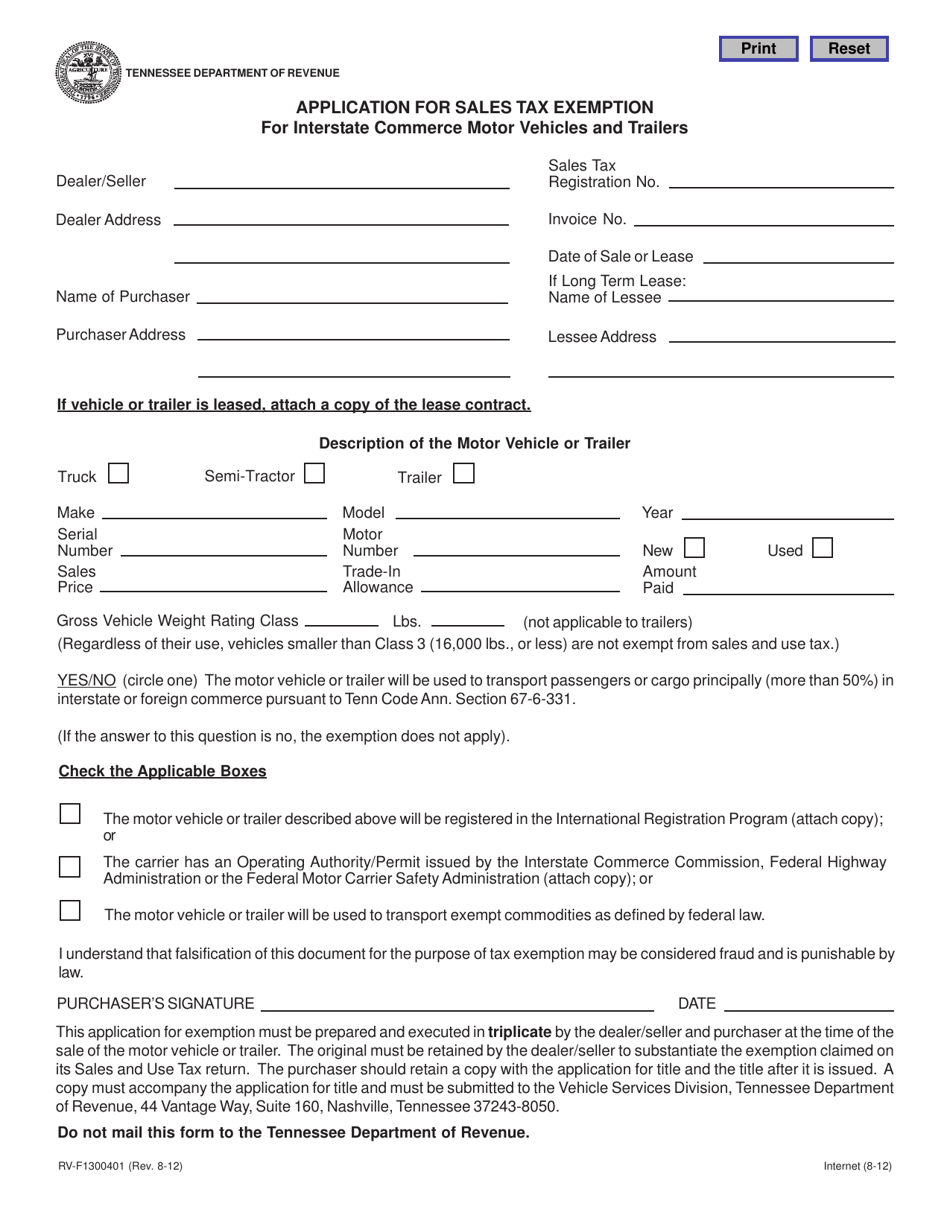

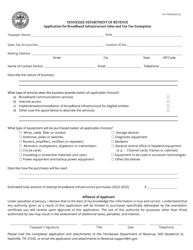

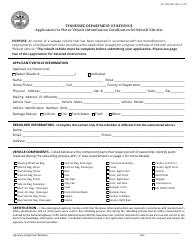

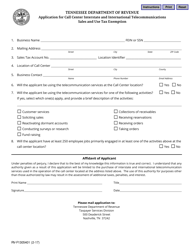

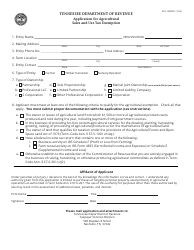

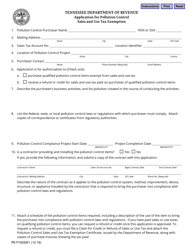

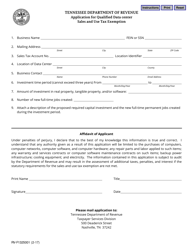

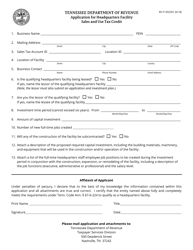

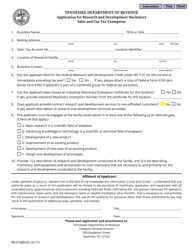

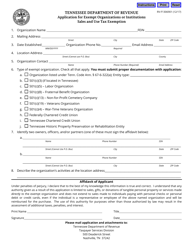

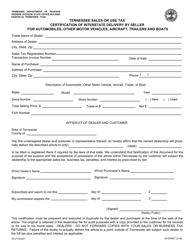

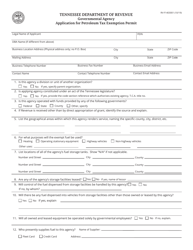

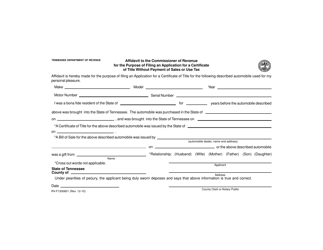

Form RV-F1300401 Application for Sales Tax Exemption for Interstate Commerce Motor Vehicles and Trailers - Tennessee

What Is Form RV-F1300401?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RV-F1300401 Application?

A: RV-F1300401 Application is an application form for obtaining sales tax exemption for motor vehicles and trailers engaged in interstate commerce in Tennessee.

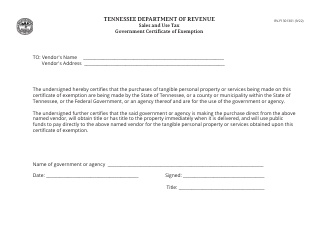

Q: Who is eligible for sales tax exemption?

A: Motor vehicles and trailers engaged in interstate commerce are eligible for sales tax exemption.

Q: What is the purpose of the sales tax exemption?

A: The purpose of the sales tax exemption is to provide an incentive for businesses engaged in interstate commerce by exempting them from paying sales tax on motor vehicles and trailers.

Q: How can I obtain the RV-F1300401 Application?

A: You can obtain the RV-F1300401 Application by contacting the appropriate department or agency in Tennessee that handles sales tax exemptions for interstate commerce.

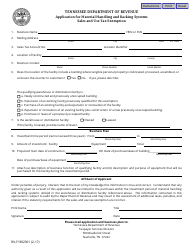

Q: What information is required on the RV-F1300401 Application?

A: The RV-F1300401 Application requires information about the motor vehicle or trailer, including the vehicle identification number, make, model, and year, as well as information about the owner or lessee of the vehicle.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-F1300401 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.