This version of the form is not currently in use and is provided for reference only. Download this version of

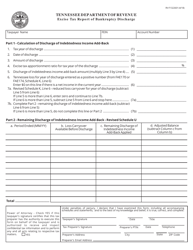

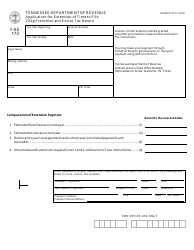

Form RV-F1402401 Schedule X

for the current year.

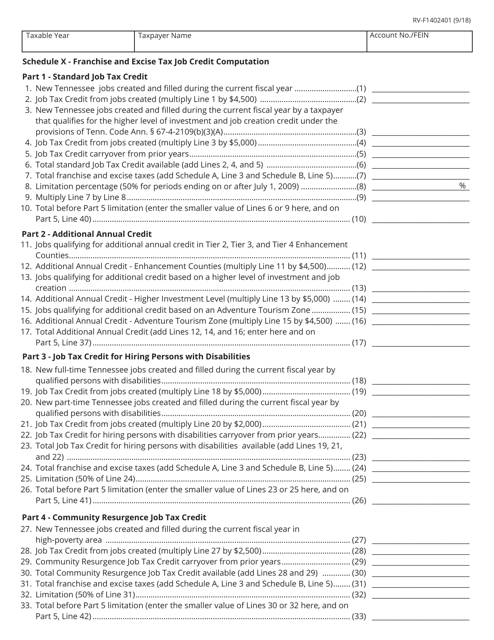

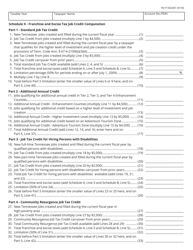

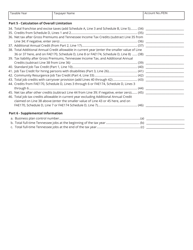

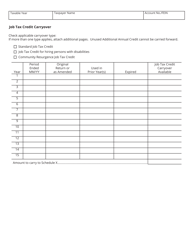

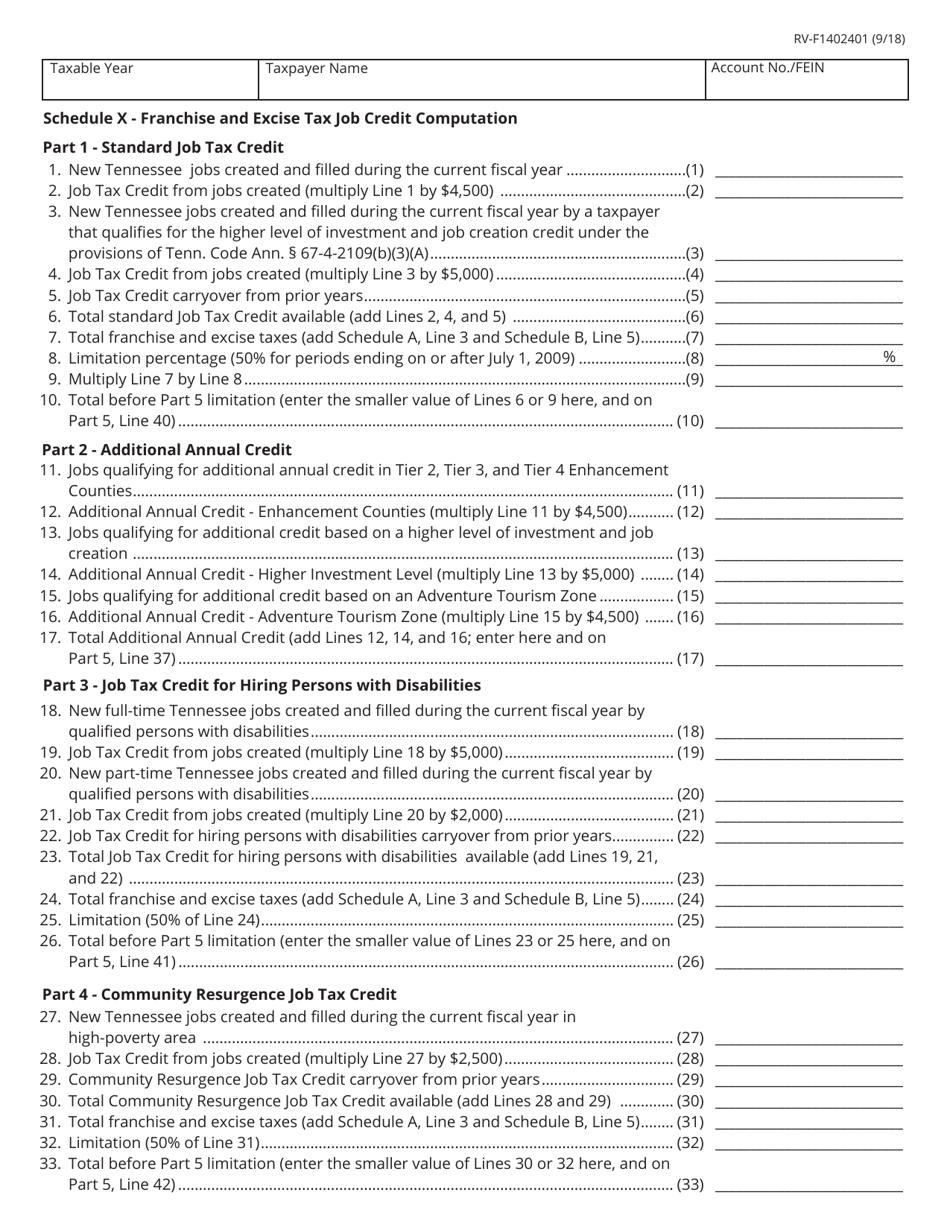

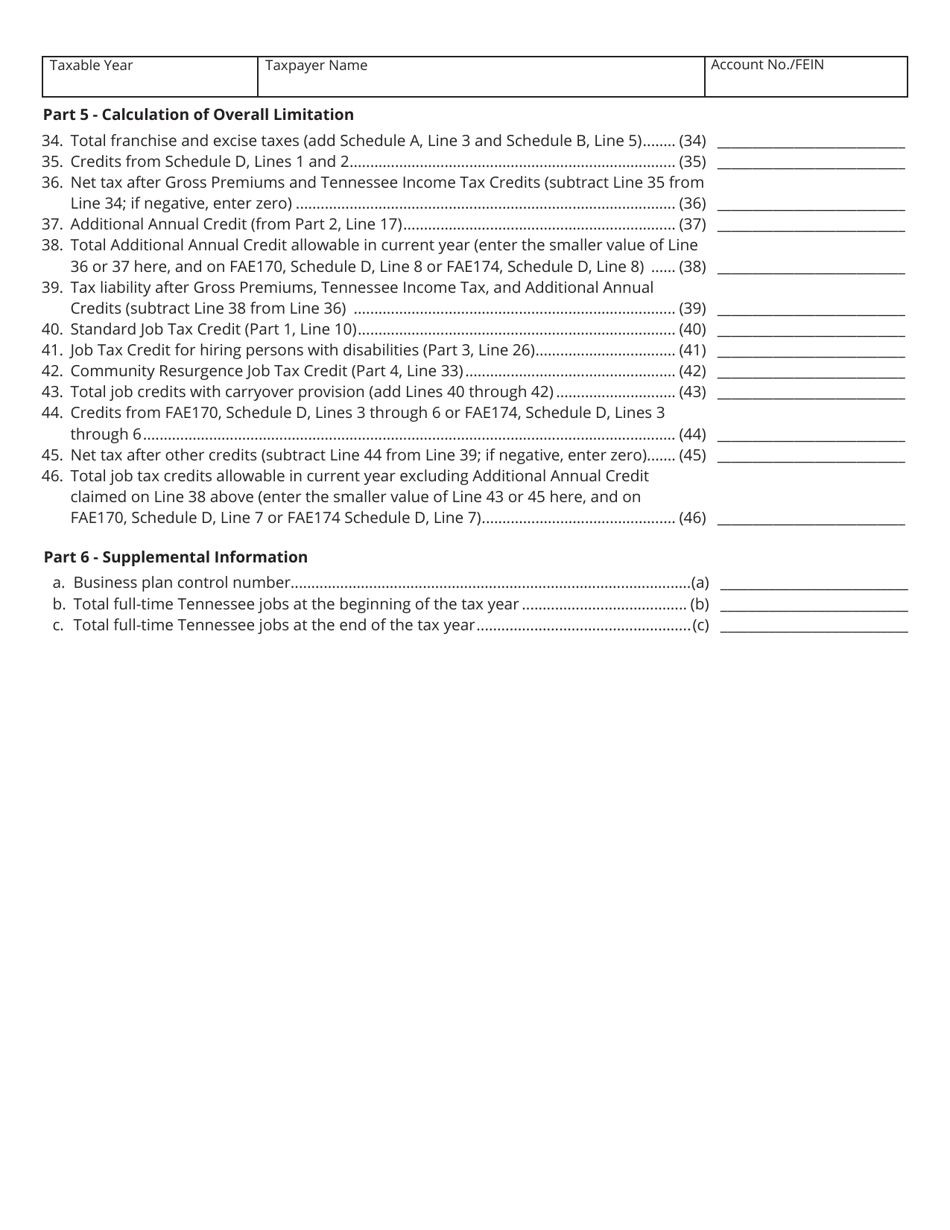

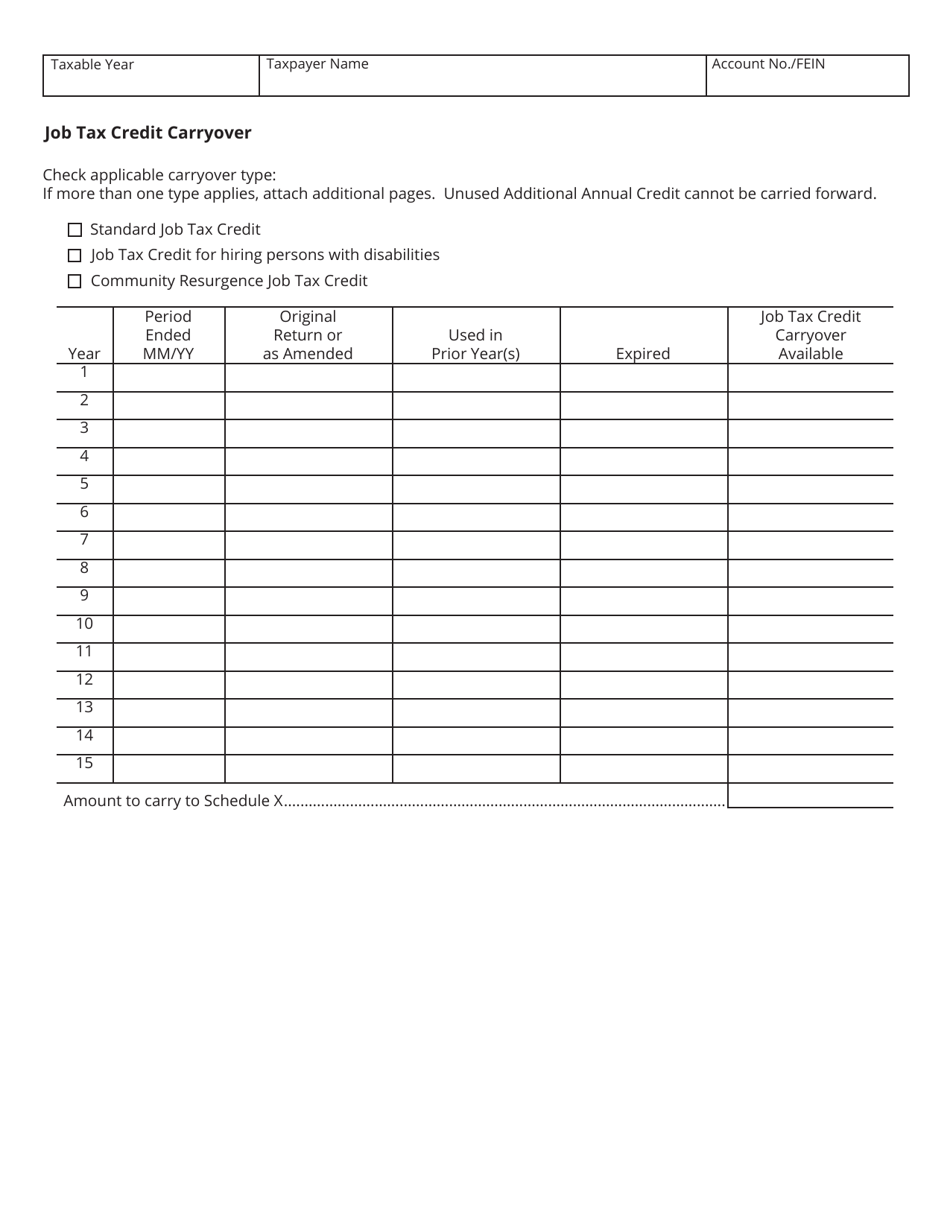

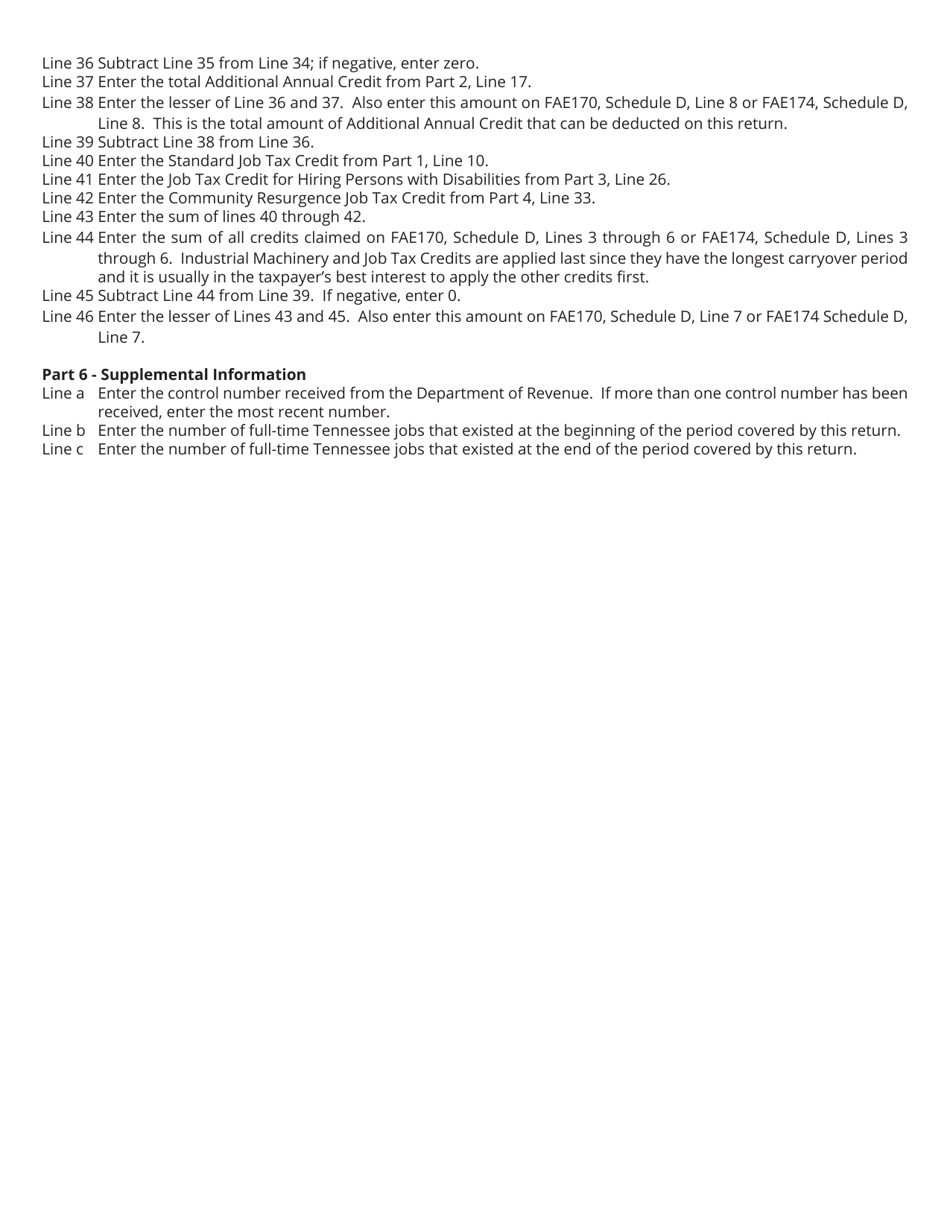

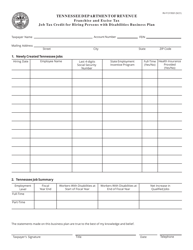

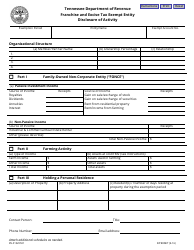

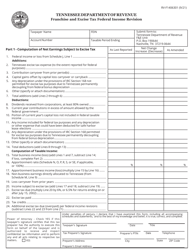

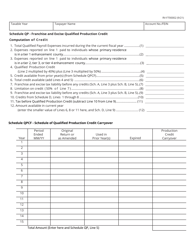

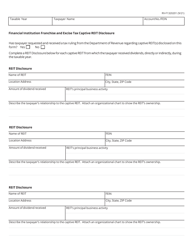

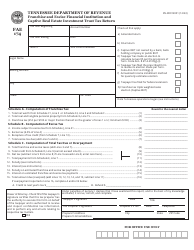

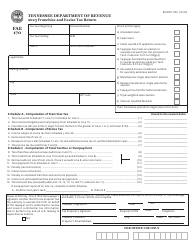

Form RV-F1402401 Schedule X Franchise and Excise Tax Job Credit Computation - Tennessee

What Is Form RV-F1402401 Schedule X?

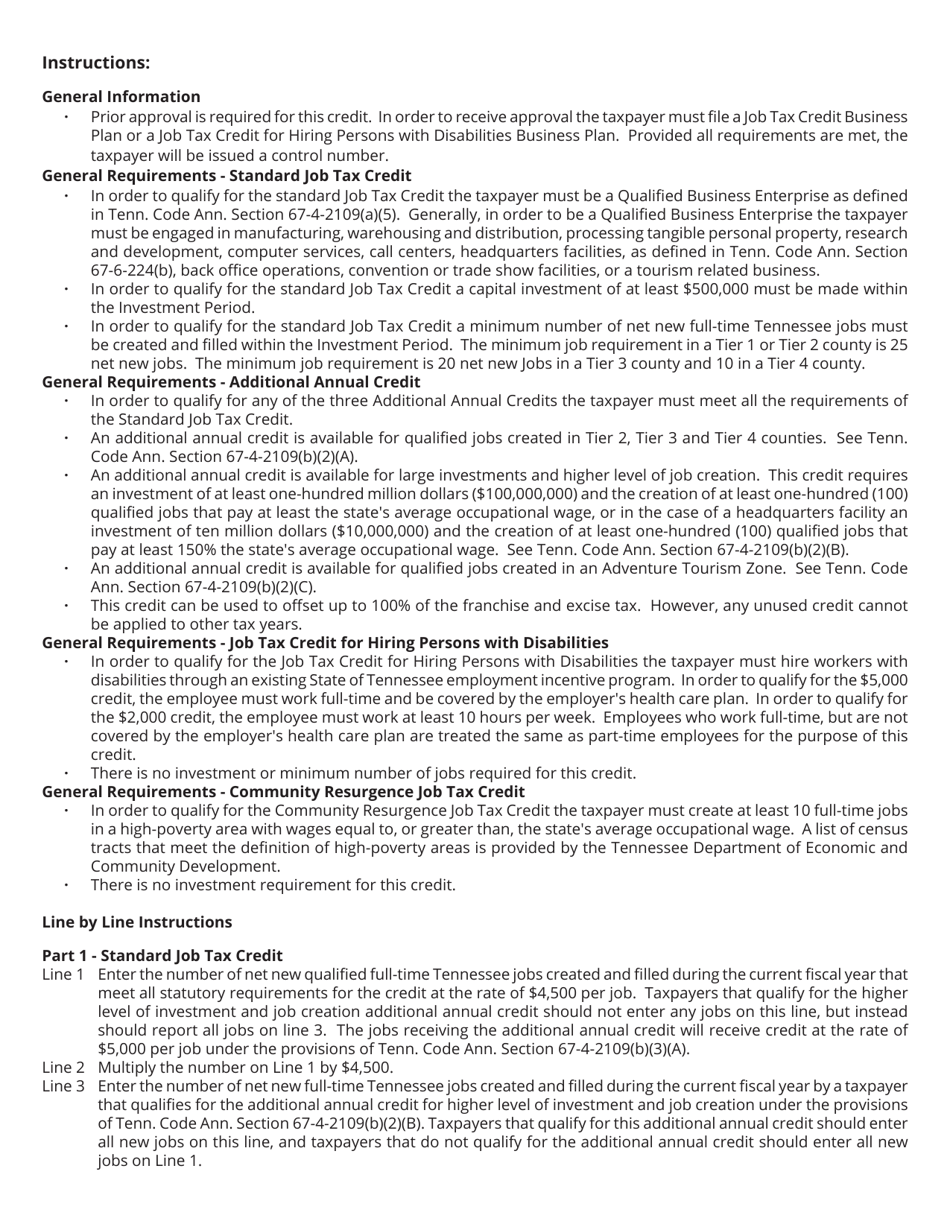

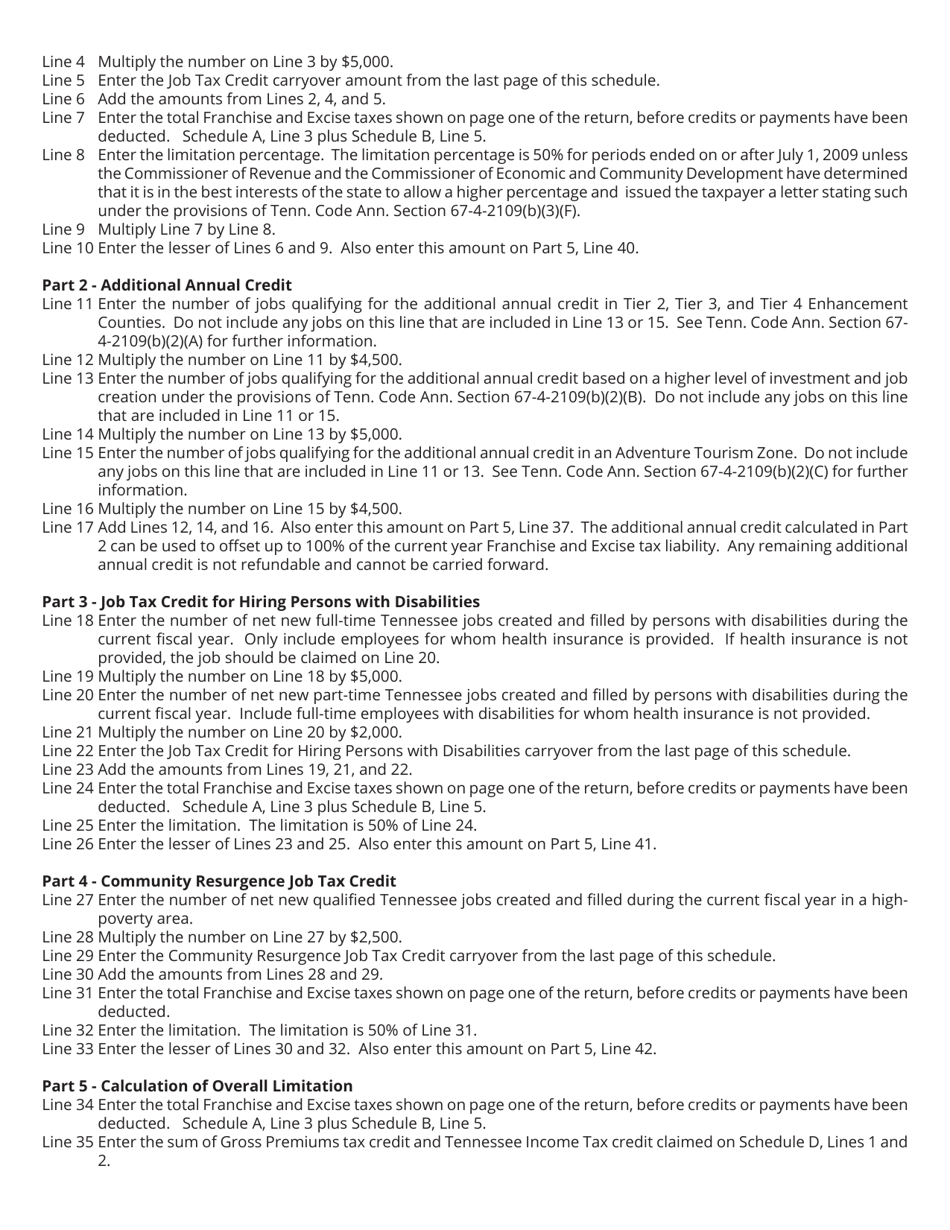

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

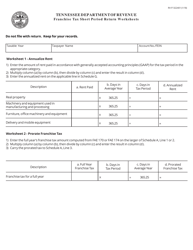

Q: What is RV-F1402401 Schedule X?

A: RV-F1402401 Schedule X is a form related to Franchise and Excise Tax Job Credit Computation in Tennessee.

Q: What is the purpose of the form?

A: The purpose of this form is to compute the Job Credit for the Franchise and Excise Tax.

Q: Who needs to file RV-F1402401 Schedule X?

A: Any taxpayer in Tennessee that wants to claim the Franchise and Excise Tax Job Credit needs to file this form.

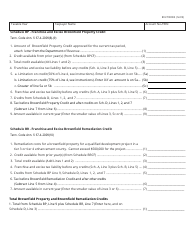

Q: What is the Franchise and Excise Tax Job Credit?

A: The Franchise and Excise Tax Job Credit is a credit available to businesses that create new jobs in Tennessee.

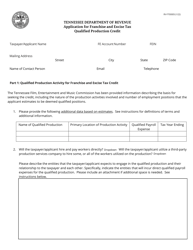

Q: How do I fill out RV-F1402401 Schedule X?

A: To fill out RV-F1402401 Schedule X, you need to provide the required information and calculations as per the form's instructions.

Q: When is the deadline for filing RV-F1402401 Schedule X?

A: The deadline for filing RV-F1402401 Schedule X is the same as the deadline for filing the Franchise and Excise Tax return in Tennessee.

Q: Can I claim the Franchise and Excise Tax Job Credit if I didn't create any new jobs?

A: No, the Franchise and Excise Tax Job Credit is specifically for businesses that create new jobs in Tennessee.

Q: Is there a limit on the amount of Job Credit that can be claimed?

A: Yes, there are certain limitations and restrictions on the amount of Job Credit that can be claimed. It is advisable to refer to the form's instructions for more details.

Q: What supporting documentation do I need to attach with RV-F1402401 Schedule X?

A: You may need to attach supporting documentation such as payroll records and employment tax returns to substantiate the claimed Job Credit. Refer to the form's instructions for specific requirements.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1402401 Schedule X by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.