This version of the form is not currently in use and is provided for reference only. Download this version of

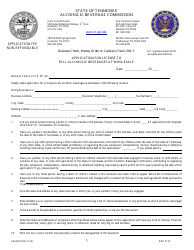

Form LBD103 (RV-R0000101)

for the current year.

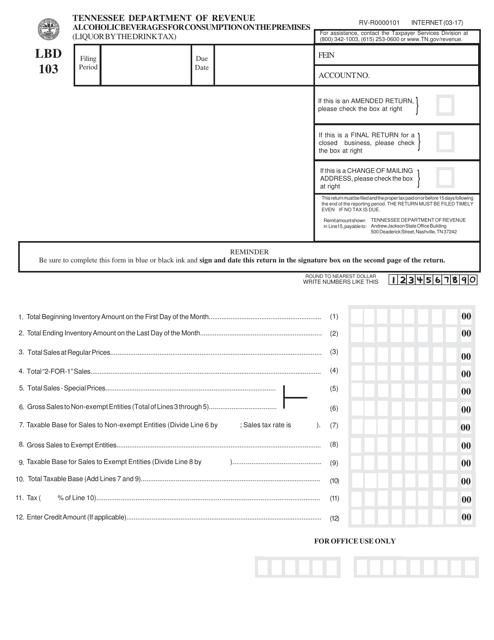

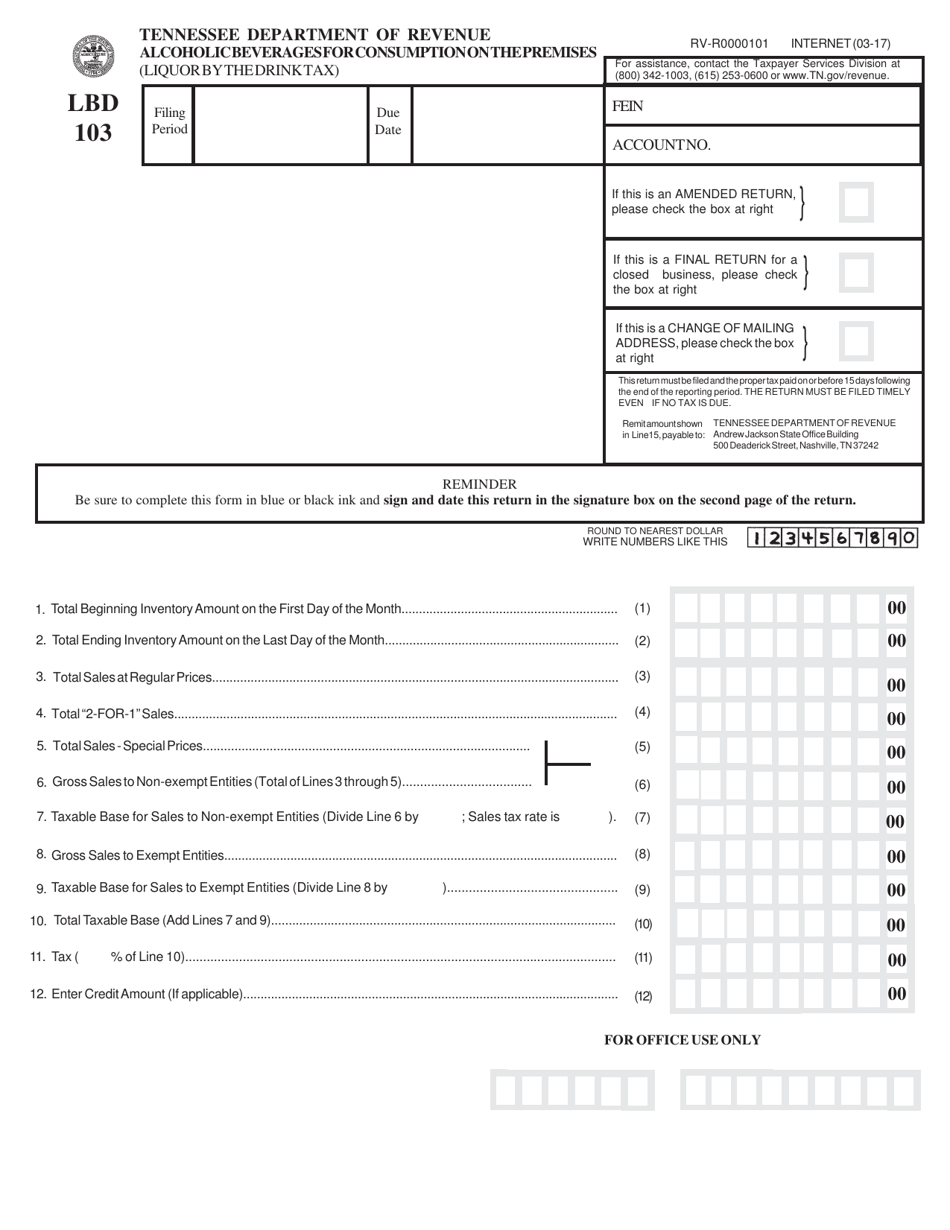

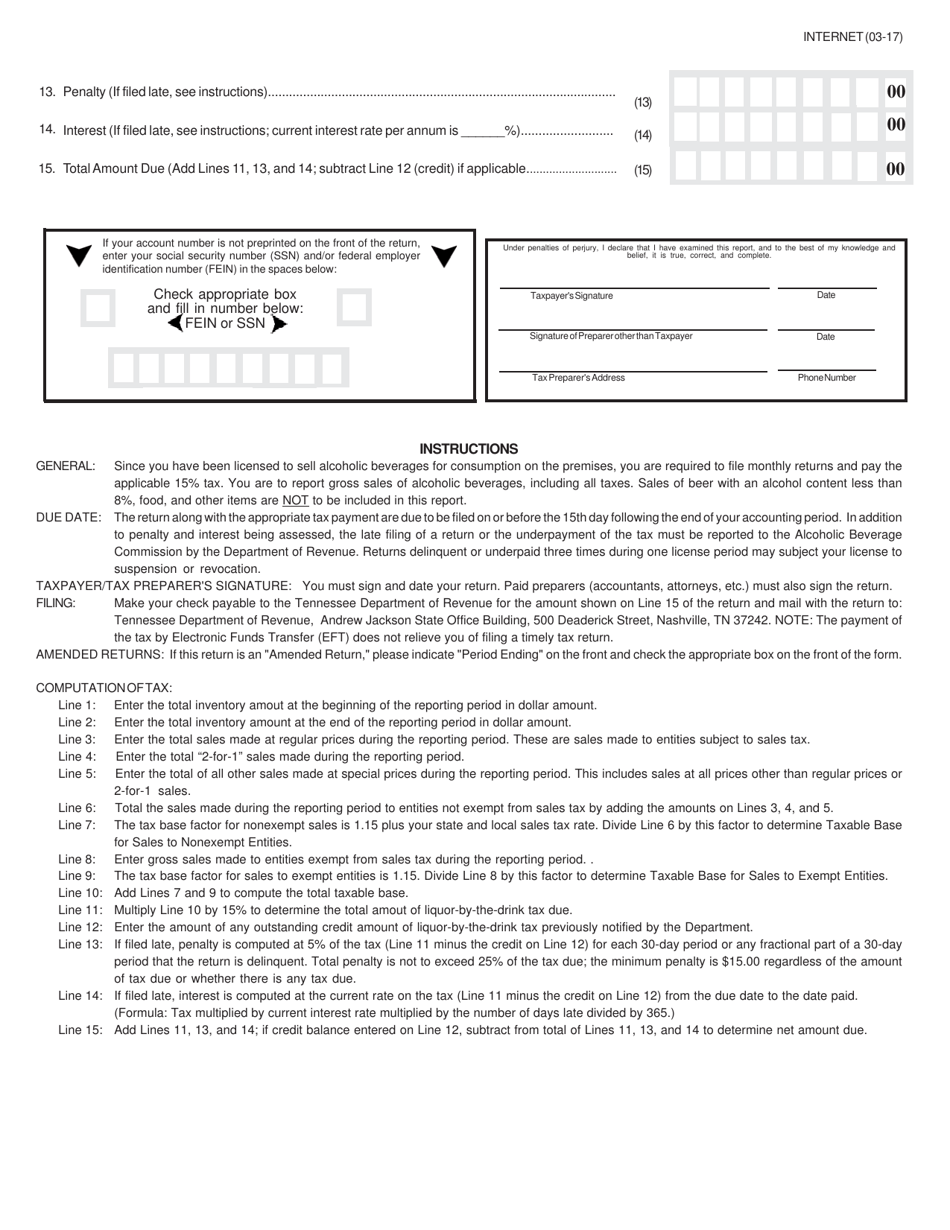

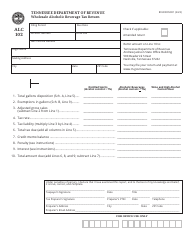

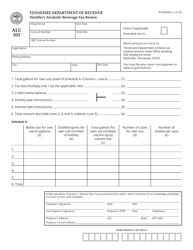

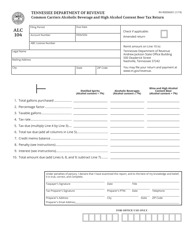

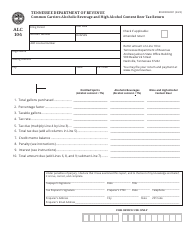

Form LBD103 (RV-R0000101) Alcoholic Beverages for Consumption on the Premises (Liquor by the Drink Tax) - Tennessee

What Is Form LBD103 (RV-R0000101)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LBD103?

A: Form LBD103 is a tax form related to Alcoholic Beverages for Consumption on the Premises in Tennessee.

Q: What is the purpose of Form LBD103?

A: The purpose of Form LBD103 is to report and pay the Liquor by the Drink Tax.

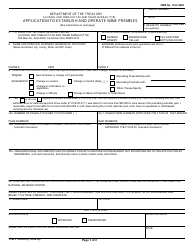

Q: Who needs to file Form LBD103?

A: Businesses that sell alcoholic beverages for consumption on the premises in Tennessee need to file Form LBD103.

Q: What is the Liquor by the Drink Tax?

A: The Liquor by the Drink Tax is a tax imposed on businesses that sell alcoholic beverages for consumption on the premises in Tennessee.

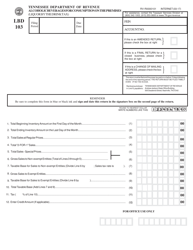

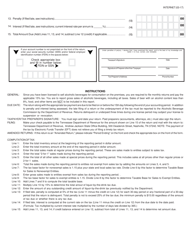

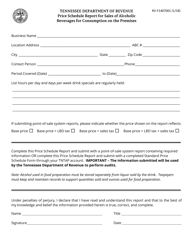

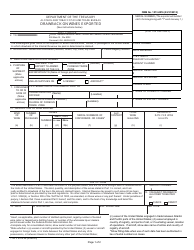

Q: What information is required on Form LBD103?

A: Form LBD103 requires information such as sales amounts, tax rates, and tax due.

Q: When is Form LBD103 due?

A: Form LBD103 is due on the 20th day of each month for the previous month's sales.

Q: Is there a penalty for late filing of Form LBD103?

A: Yes, there may be penalties for late filing or failure to file Form LBD103.

Q: Are there any exceptions or exemptions to the Liquor by the Drink Tax?

A: Yes, there are certain exceptions and exemptions to the Liquor by the Drink Tax. It is best to consult the Tennessee Department of Revenue or a tax professional for specific information.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LBD103 (RV-R0000101) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.