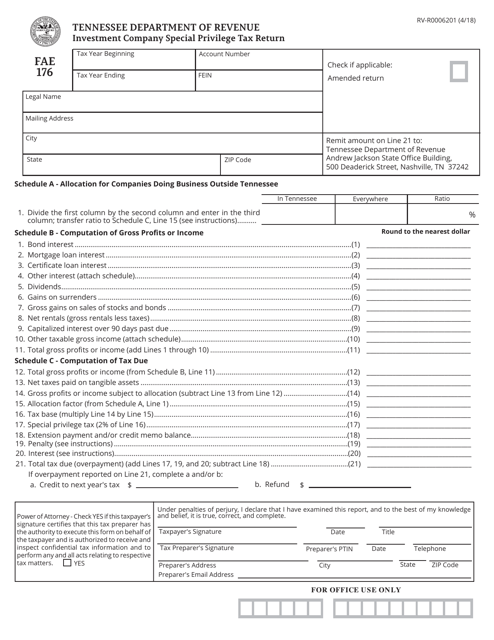

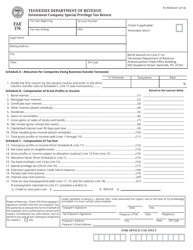

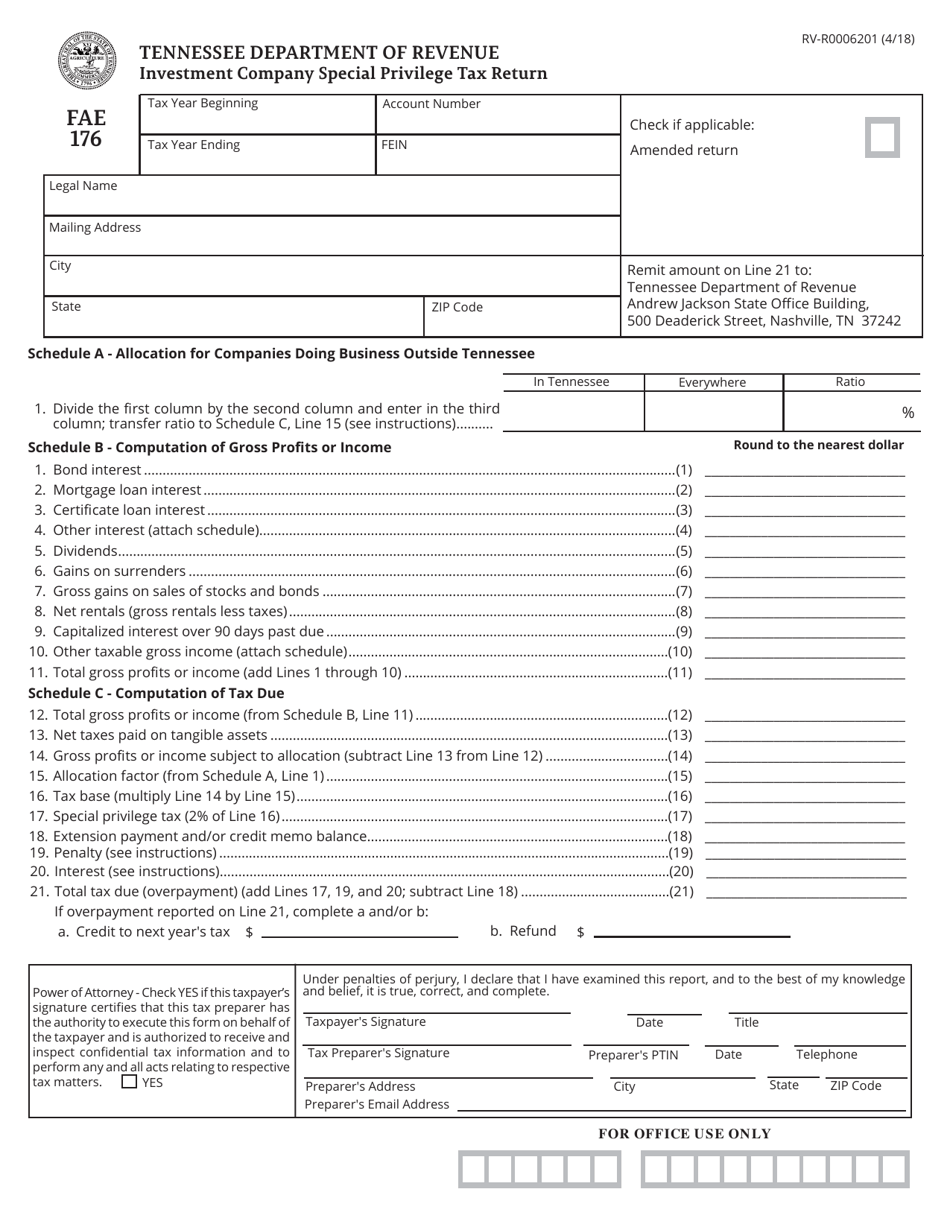

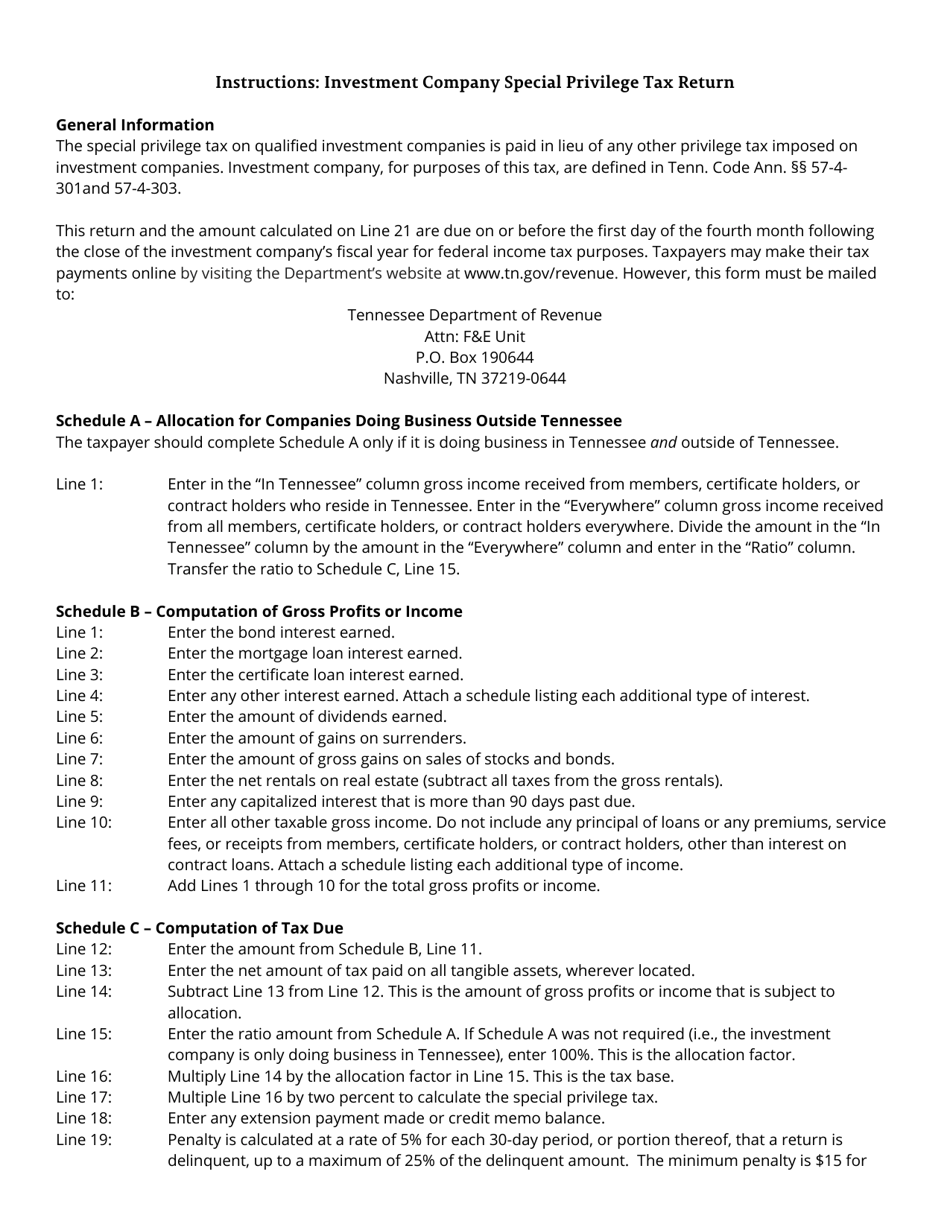

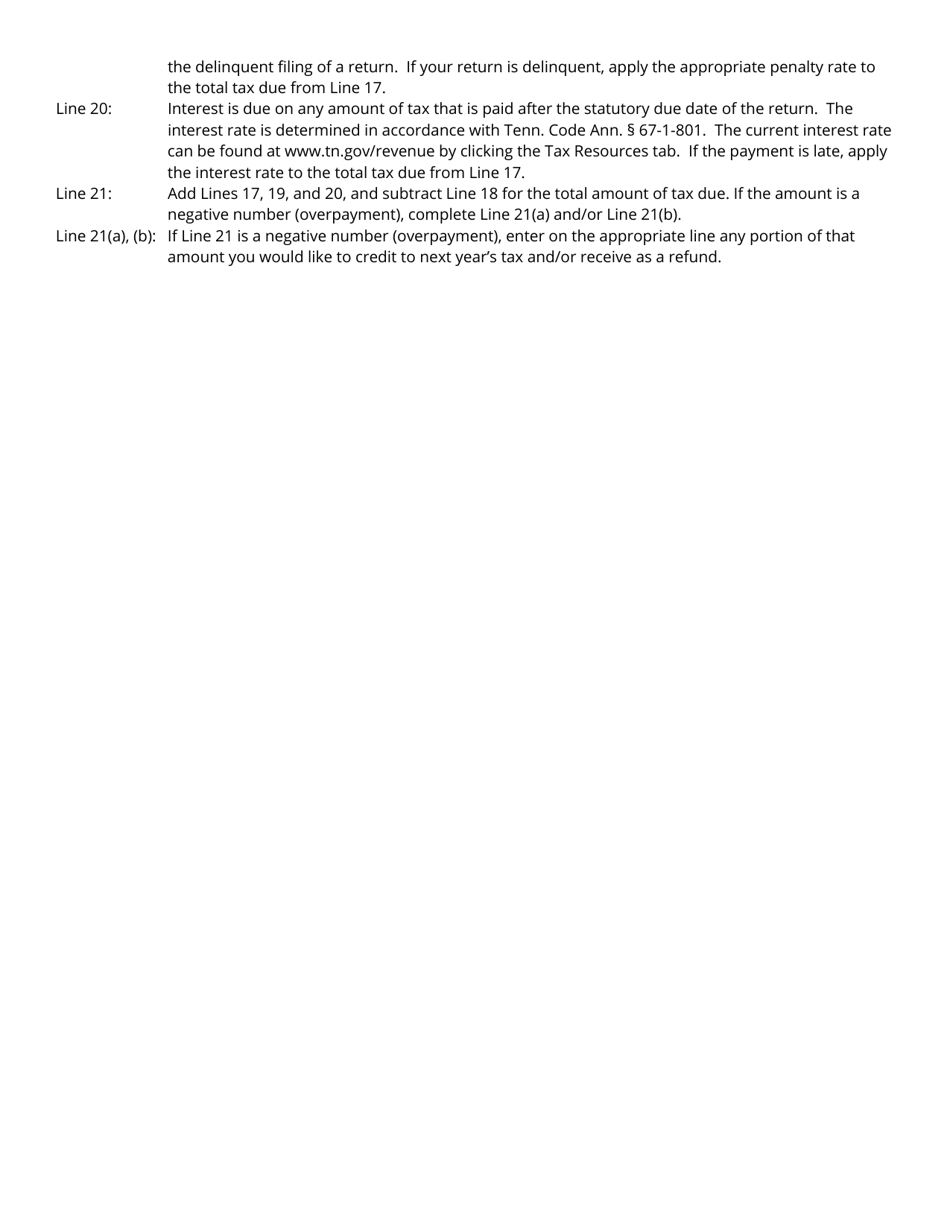

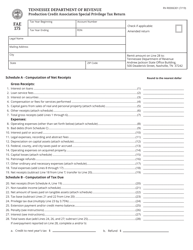

Form RV-R0006201 (FAE176) Investment Company Special Privilege Tax Return - Tennessee

What Is Form RV-R0006201 (FAE176)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-R0006201?

A: Form RV-R0006201 is the Investment Company Special Privilege Tax Return for Tennessee.

Q: Who needs to file Form RV-R0006201?

A: Investment companies in Tennessee need to file Form RV-R0006201.

Q: What is the purpose of Form RV-R0006201?

A: The purpose of Form RV-R0006201 is to report and pay the Special Privilege Tax for investment companies in Tennessee.

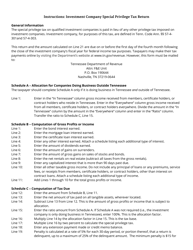

Q: When is the due date for filing Form RV-R0006201?

A: The due date for filing Form RV-R0006201 is the 15th day of the fourth month following the close of the tax year.

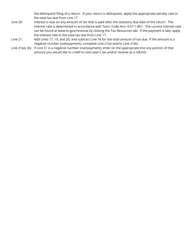

Q: Are there any penalties for late filing of Form RV-R0006201?

A: Yes, there are penalties for late filing of Form RV-R0006201. It is important to file the form on time to avoid penalties.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-R0006201 (FAE176) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.