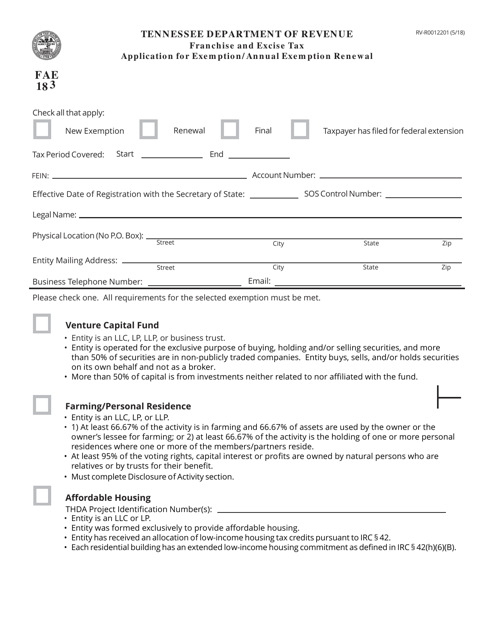

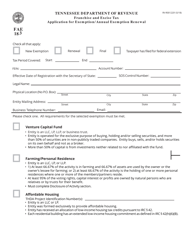

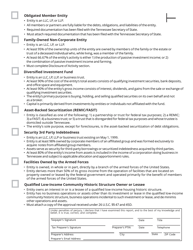

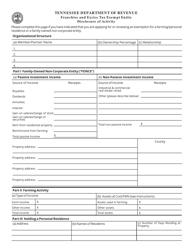

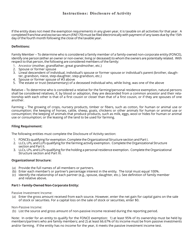

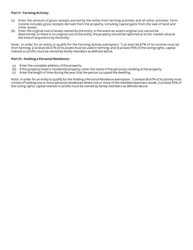

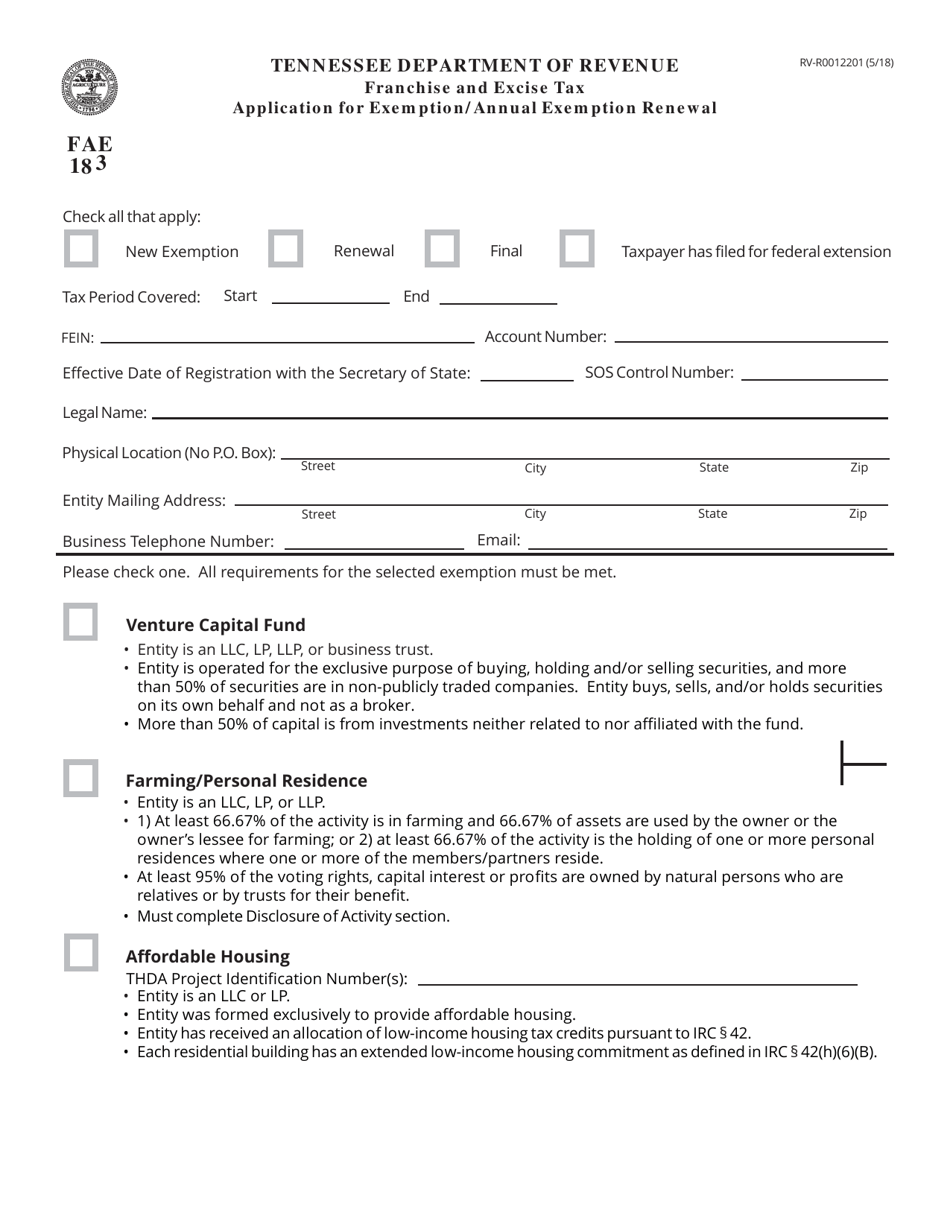

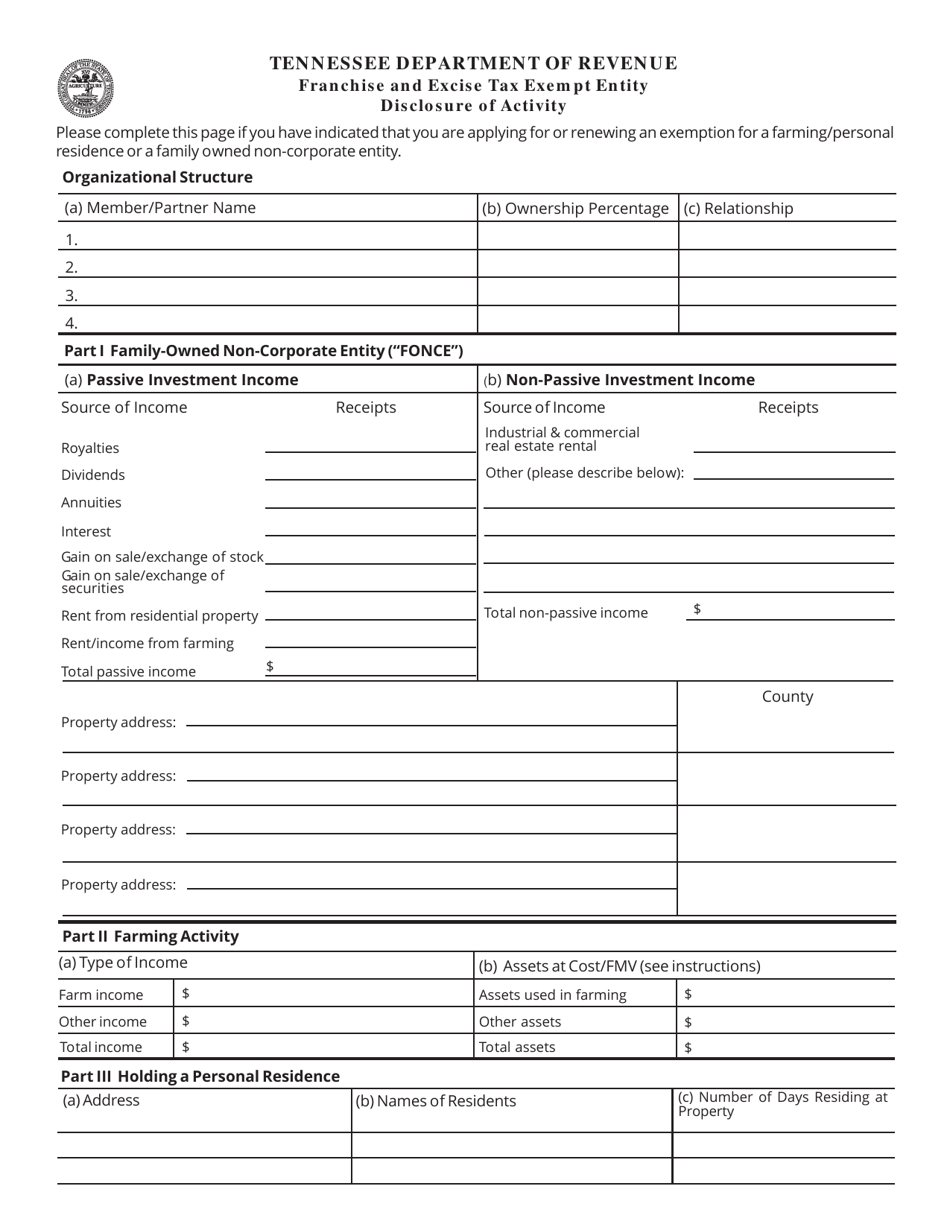

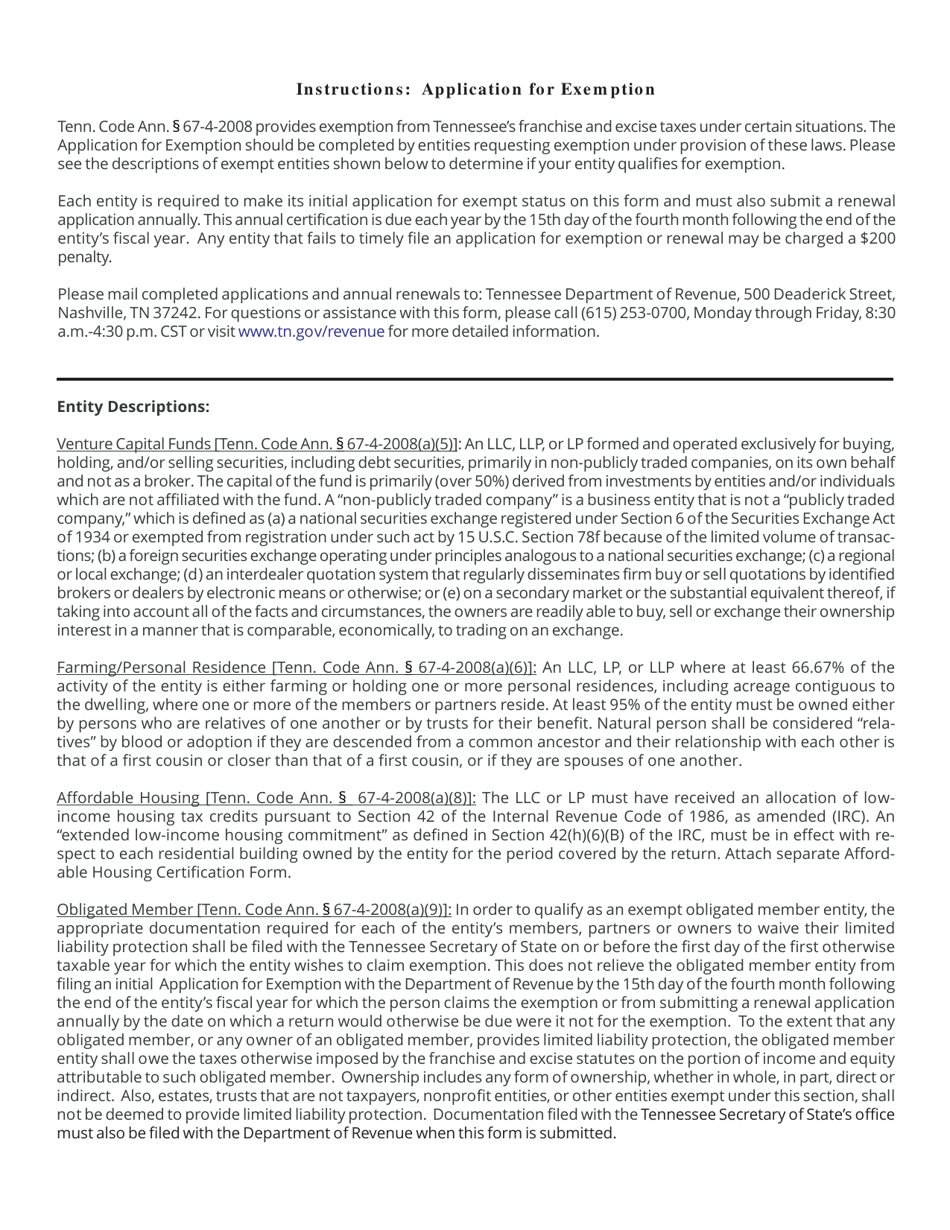

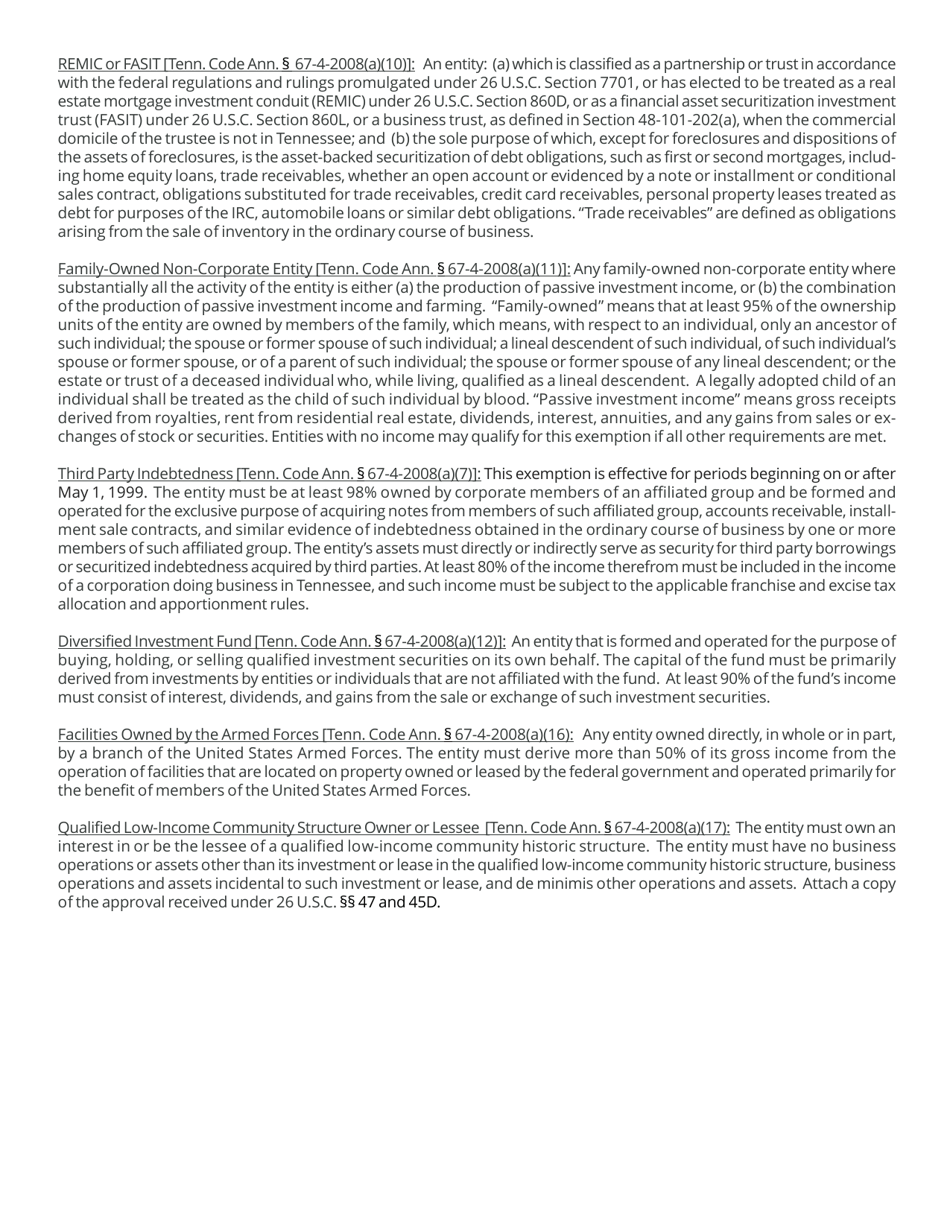

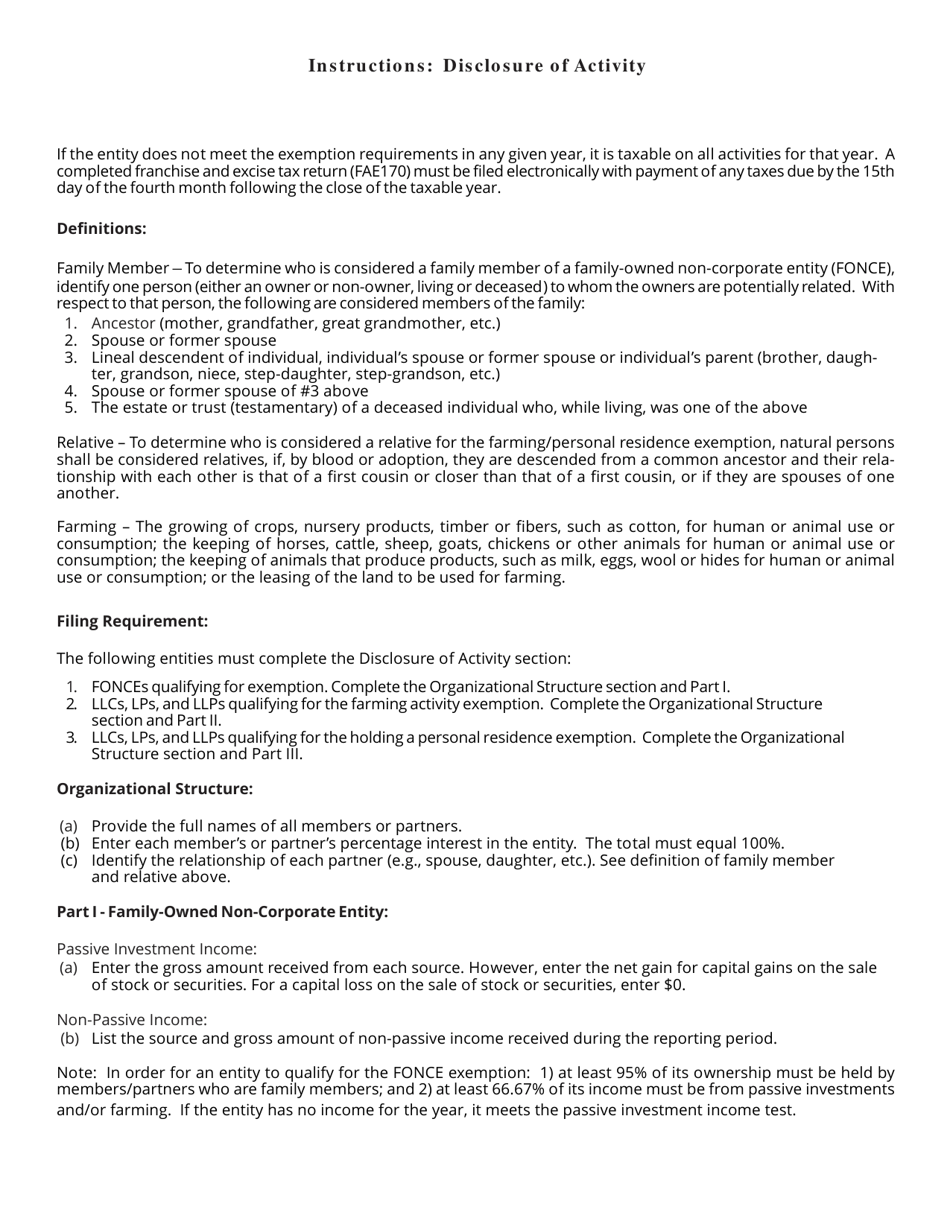

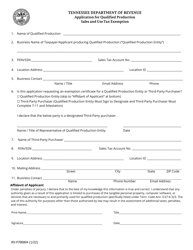

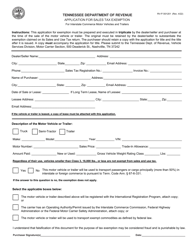

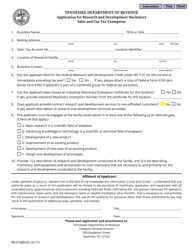

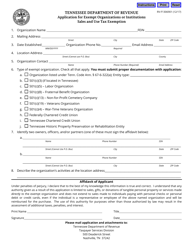

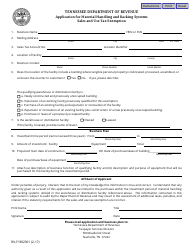

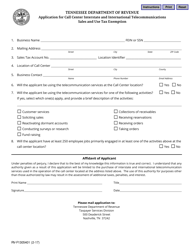

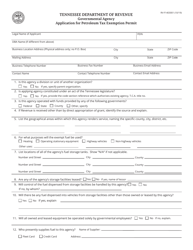

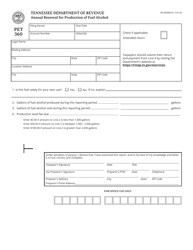

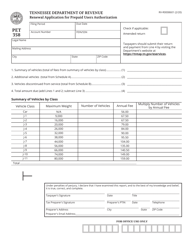

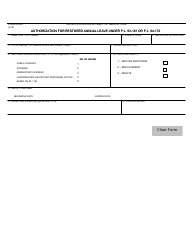

Form RV-R0012201 (FAE183) Application for Exemption / Annual Exemption Renewal - Tennessee

What Is Form RV-R0012201 (FAE183)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-R0012201 (FAE183)?

A: Form RV-R0012201 (FAE183) is the application for exemption or annual exemption renewal in Tennessee.

Q: What is the purpose of Form RV-R0012201 (FAE183)?

A: The purpose of Form RV-R0012201 (FAE183) is to apply for exemption or renew annual exemption in Tennessee.

Q: Who needs to fill out Form RV-R0012201 (FAE183)?

A: Individuals or organizations seeking exemption or annual exemption renewal in Tennessee need to fill out this form.

Q: Is there a fee to submit Form RV-R0012201 (FAE183)?

A: No, there is no fee to submit Form RV-R0012201 (FAE183).

Q: What supporting documents should be included with Form RV-R0012201 (FAE183)?

A: You should include any required documentation to support your exemption or annual exemption renewal with Form RV-R0012201 (FAE183).

Q: When is the deadline to submit Form RV-R0012201 (FAE183)?

A: The deadline to submit Form RV-R0012201 (FAE183) depends on the specific exemption or renewal period. Please refer to the instructions or contact the Tennessee Department of Revenue for the deadline.

Q: How long does it take to process Form RV-R0012201 (FAE183)?

A: The processing time for Form RV-R0012201 (FAE183) may vary. It is recommended to submit the form well in advance to ensure timely processing.

Q: What happens after I submit Form RV-R0012201 (FAE183)?

A: After you submit Form RV-R0012201 (FAE183), the Tennessee Department of Revenue will review your application and notify you of the status.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-R0012201 (FAE183) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.