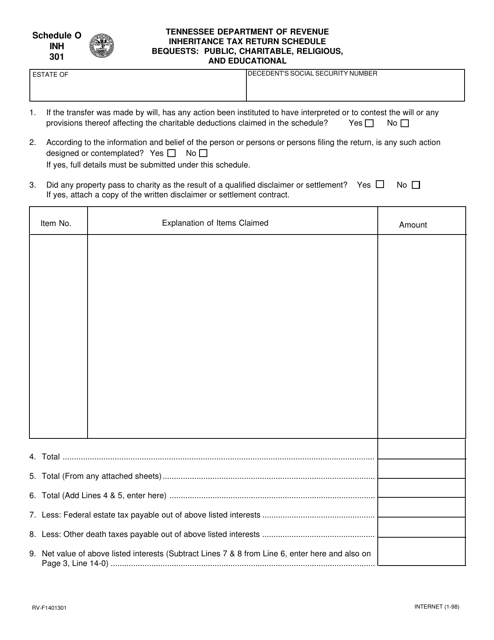

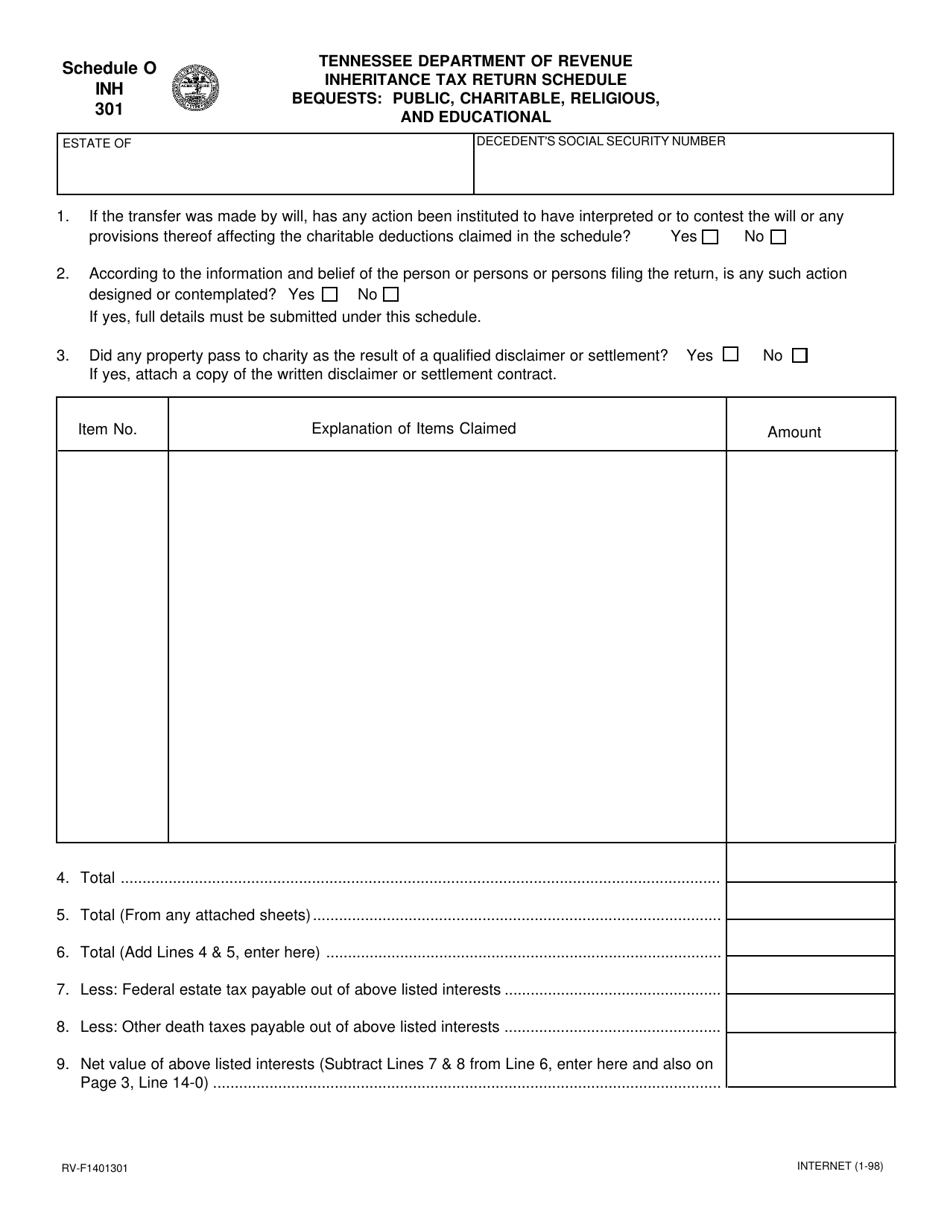

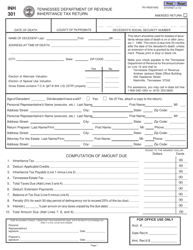

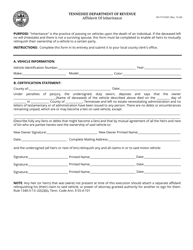

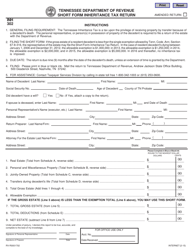

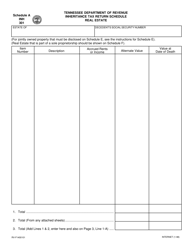

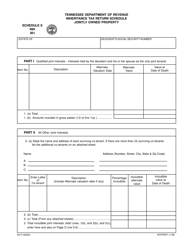

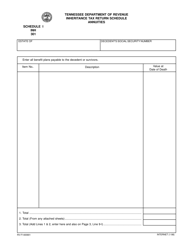

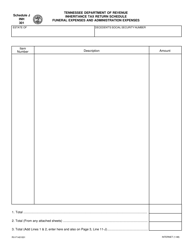

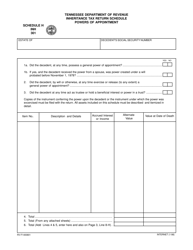

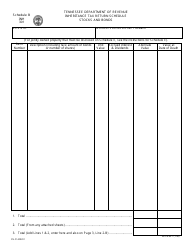

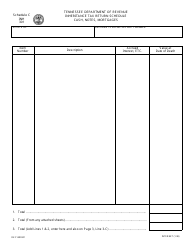

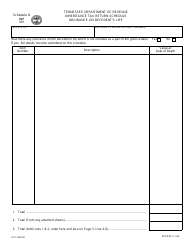

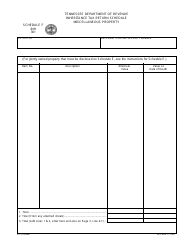

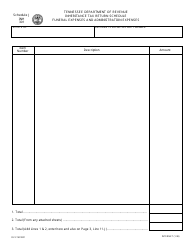

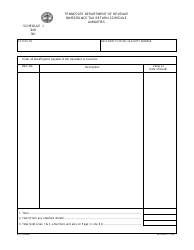

Form RV-F1401301 (INH301) Schedule O Inheritance Tax Return Schedule - Bequests: Public, Charitable, Religious, and Educational - Tennessee

What Is Form RV-F1401301 (INH301) Schedule O?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee.The document is a supplement to Form INH301, Inheritance Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F1401301 (INH301)?

A: Form RV-F1401301 (INH301) is the Inheritance Tax Return Schedule for Bequests: Public, Charitable, Religious, and Educational in Tennessee.

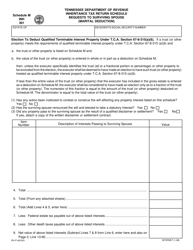

Q: What does Schedule O refer to?

A: Schedule O is the section of the Inheritance Tax Return Schedule that pertains to bequests made to public, charitable, religious, and educational organizations.

Q: What is the purpose of Schedule O?

A: The purpose of Schedule O is to report any bequests made to public, charitable, religious, and educational organizations for inheritance tax purposes.

Q: Who needs to fill out Schedule O?

A: Anyone who made bequests to public, charitable, religious, or educational organizations and is filing an Inheritance Tax Return in Tennessee needs to fill out Schedule O.

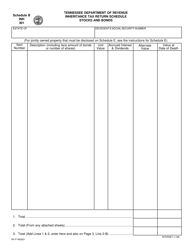

Q: What types of organizations are considered in Schedule O?

A: Schedule O covers bequests made to public, charitable, religious, and educational organizations.

Q: Is there a specific form for Schedule O?

A: Yes, Schedule O is part of Form RV-F1401301 (INH301), the Inheritance Tax Return Schedule for Bequests in Tennessee.

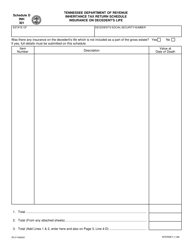

Q: Are there any deadlines for filing Schedule O?

A: The deadlines for filing Schedule O may vary. It is best to consult the Tennessee Department of Revenue or the instructions provided with the form for specific deadlines.

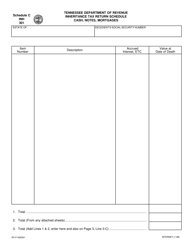

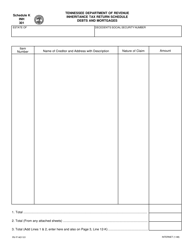

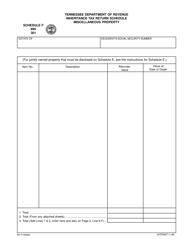

Q: What information is required in Schedule O?

A: Schedule O requires information about the bequests made to public, charitable, religious, and educational organizations, including the recipient's name, address, and the value of the bequest.

Q: Do I need to attach supporting documents to Schedule O?

A: It is possible that supporting documents may be required when filing Schedule O. Consult the instructions provided with the form or seek guidance from the Tennessee Department of Revenue.

Form Details:

- Released on January 1, 1998;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1401301 (INH301) Schedule O by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.