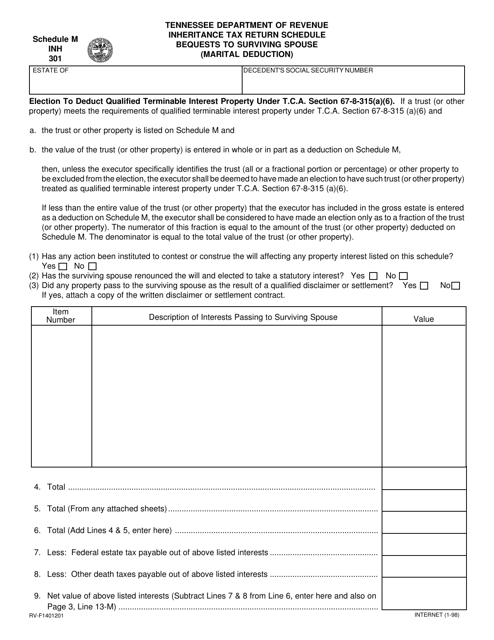

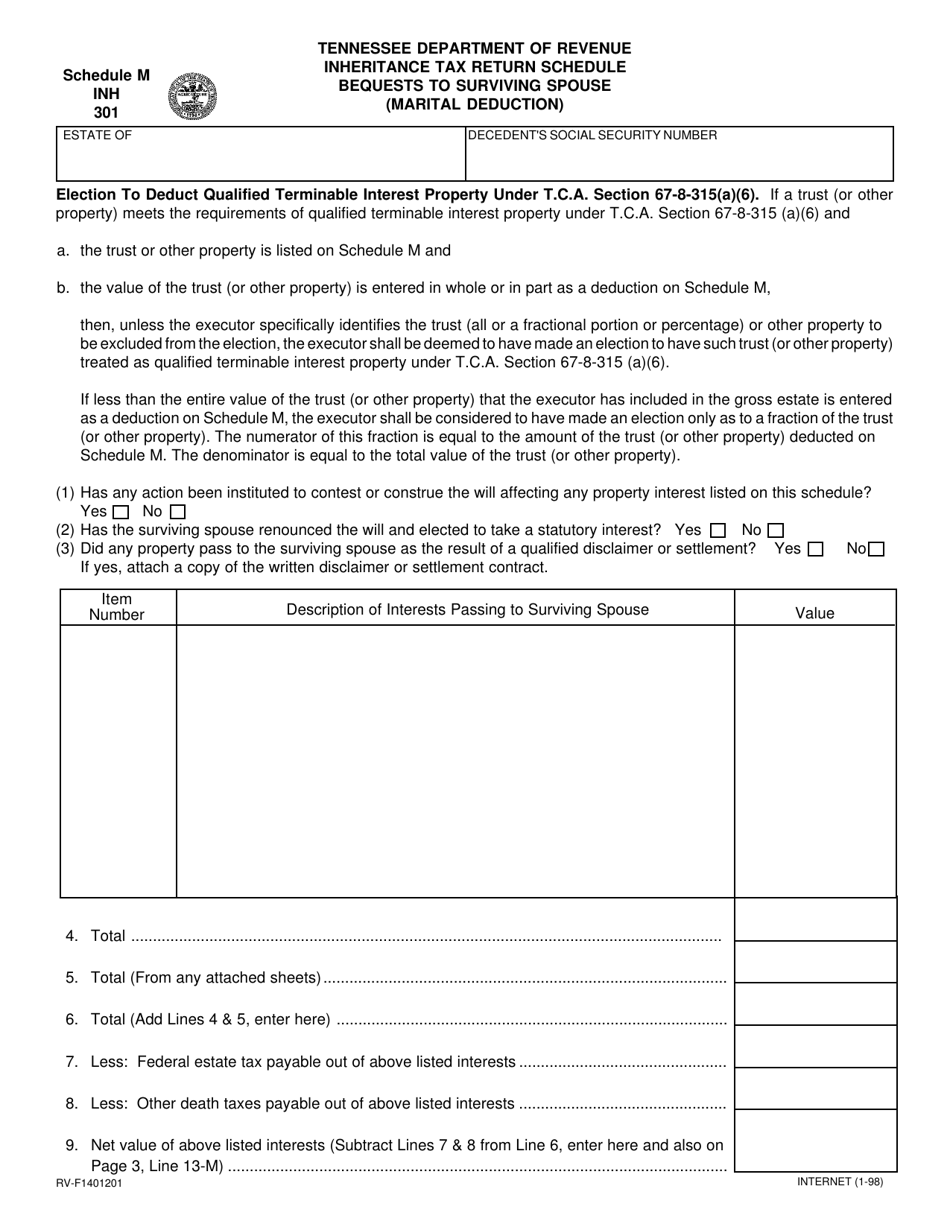

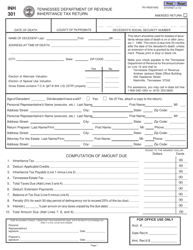

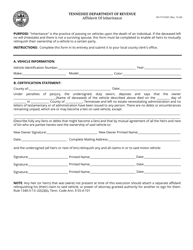

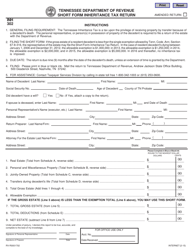

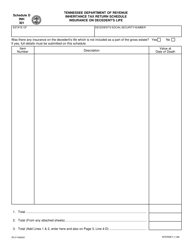

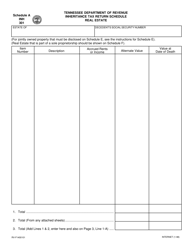

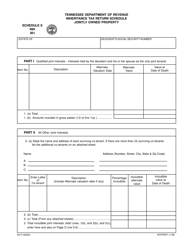

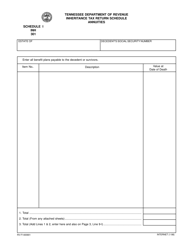

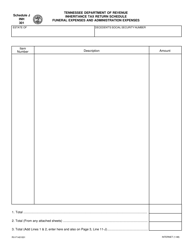

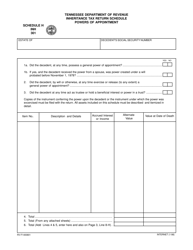

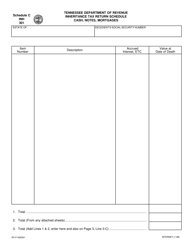

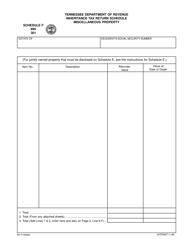

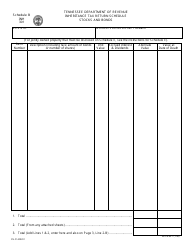

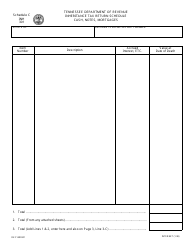

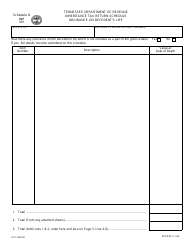

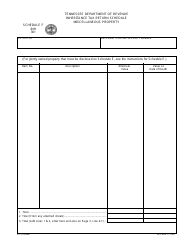

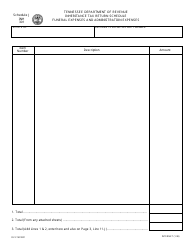

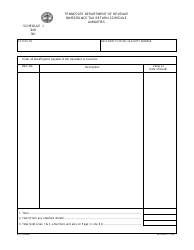

Form RV-F1401201 (INH301) Schedule M Inheritance Tax Return Schedule - Bequests to Surviving Spouse (Marital Deduction) - Tennessee

What Is Form RV-F1401201 (INH301) Schedule M?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee.The document is a supplement to Form INH301, Inheritance Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F1401201 (INH301)?

A: Form RV-F1401201 (INH301) is the Inheritance Tax Return Schedule used for reporting bequests to a surviving spouse in Tennessee.

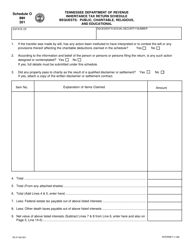

Q: What does Schedule M refer to?

A: Schedule M refers to the section of Form RV-F1401201 (INH301) specifically for reporting bequests to a surviving spouse (Marital Deduction).

Q: Who needs to file Schedule M?

A: Individuals who are filing the Inheritance Tax Return in Tennessee and have made bequests to a surviving spouse need to complete Schedule M.

Q: What is the purpose of Schedule M?

A: The purpose of Schedule M is to calculate and report the amount of bequests made to a surviving spouse, which may qualify for the Marital Deduction.

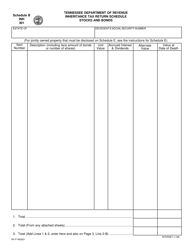

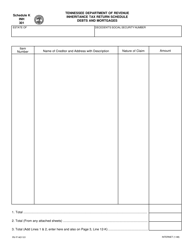

Q: How do I complete Schedule M?

A: To complete Schedule M, you will need to provide details of the bequests made to a surviving spouse, including the type of property transferred, value of the property, and any applicable deductions.

Q: Are there any specific guidelines for completing Schedule M?

A: Yes, there are specific guidelines and instructions provided with Form RV-F1401201 (INH301) Schedule M. It is important to carefully read and follow these instructions when completing the schedule.

Q: Do I need to submit any supporting documents with Schedule M?

A: Depending on the circumstances, you may need to submit supporting documents such as copies of wills, trusts, or legal agreements relating to the bequests made to a surviving spouse. Check the instructions for specific requirements.

Q: Is there a deadline for filing Form RV-F1401201 (INH301) Schedule M?

A: Yes, there is a deadline for filing Form RV-F1401201 (INH301) Schedule M in Tennessee. The specific deadline can vary, so it is important to check the instructions or contact the state tax authority for the current deadline.

Q: What happens if I don't file Form RV-F1401201 (INH301) Schedule M?

A: If you are required to file Form RV-F1401201 (INH301) Schedule M and fail to do so, you may be subject to penalties and interest imposed by the state tax authority.

Form Details:

- Released on January 1, 1998;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1401201 (INH301) Schedule M by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.