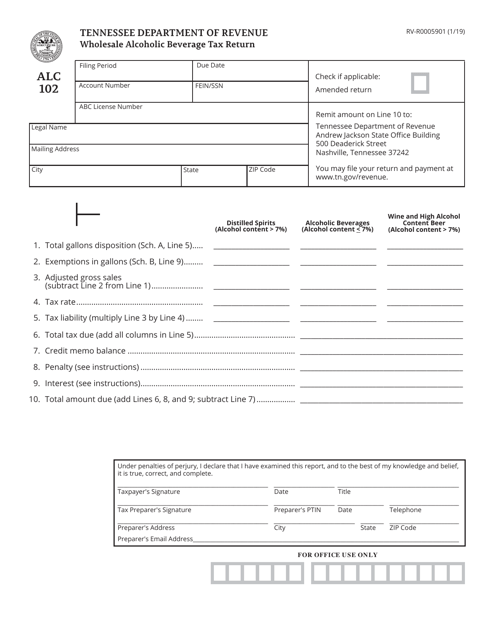

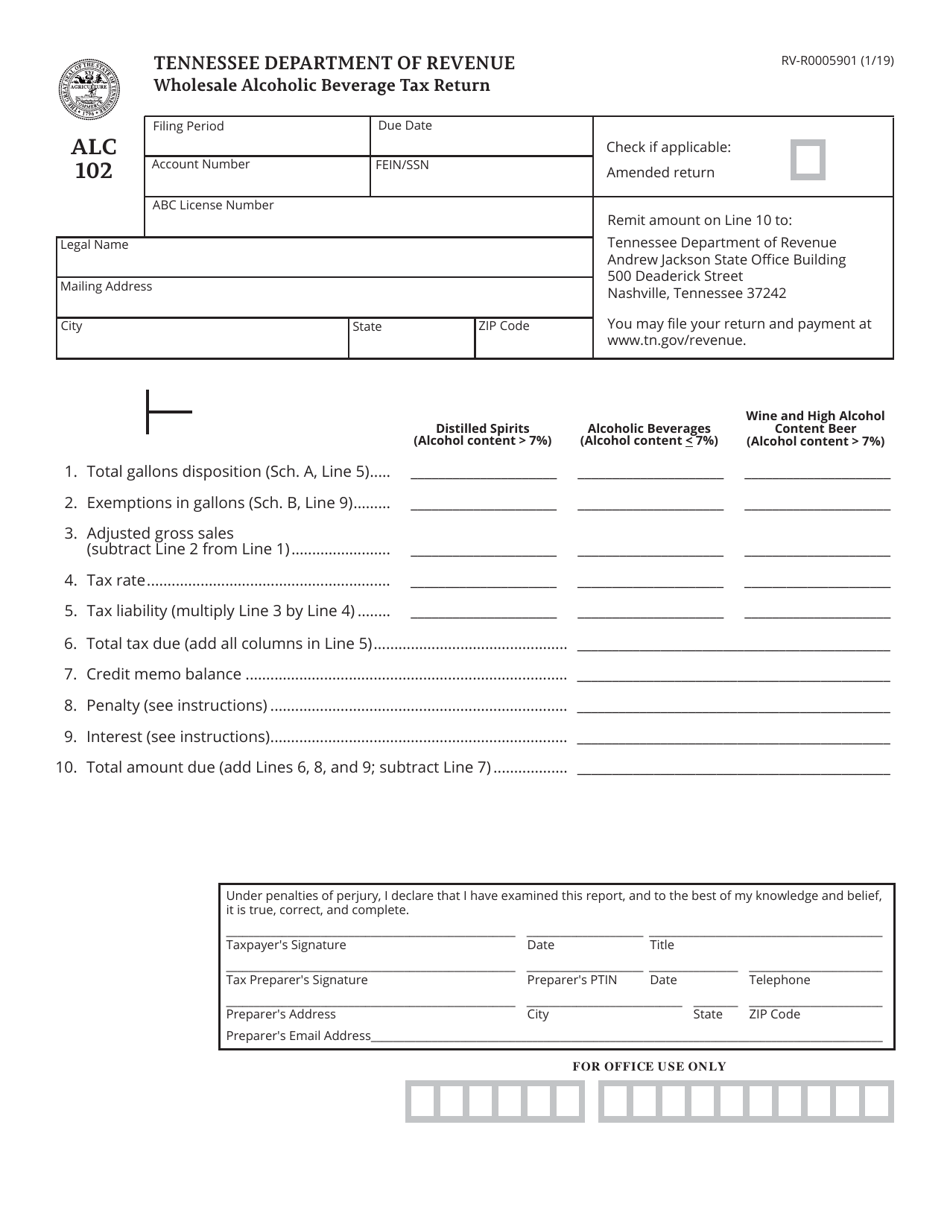

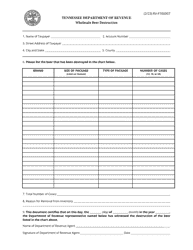

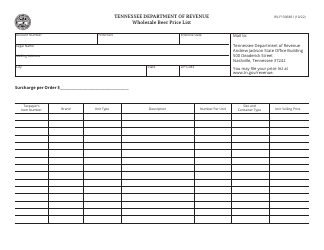

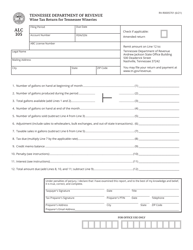

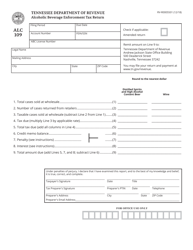

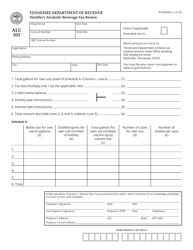

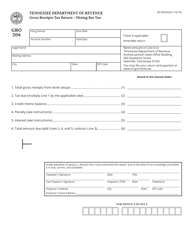

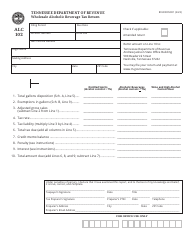

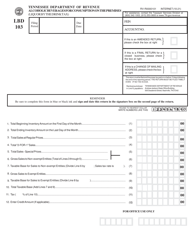

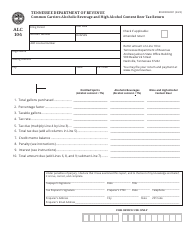

Form RV-R0005901 (ALC102) Wholesale Alcoholic Beverage Tax Return - Tennessee

What Is Form RV-R0005901 (ALC102)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-R0005901 (ALC102)?

A: Form RV-R0005901 (ALC102) is the Wholesale Alcoholic Beverage Tax Return for Tennessee.

Q: Who needs to file Form RV-R0005901 (ALC102)?

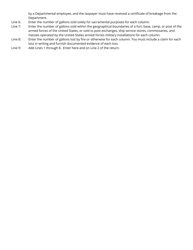

A: Businesses engaged in the wholesale sale of alcoholic beverages in Tennessee need to file Form RV-R0005901 (ALC102).

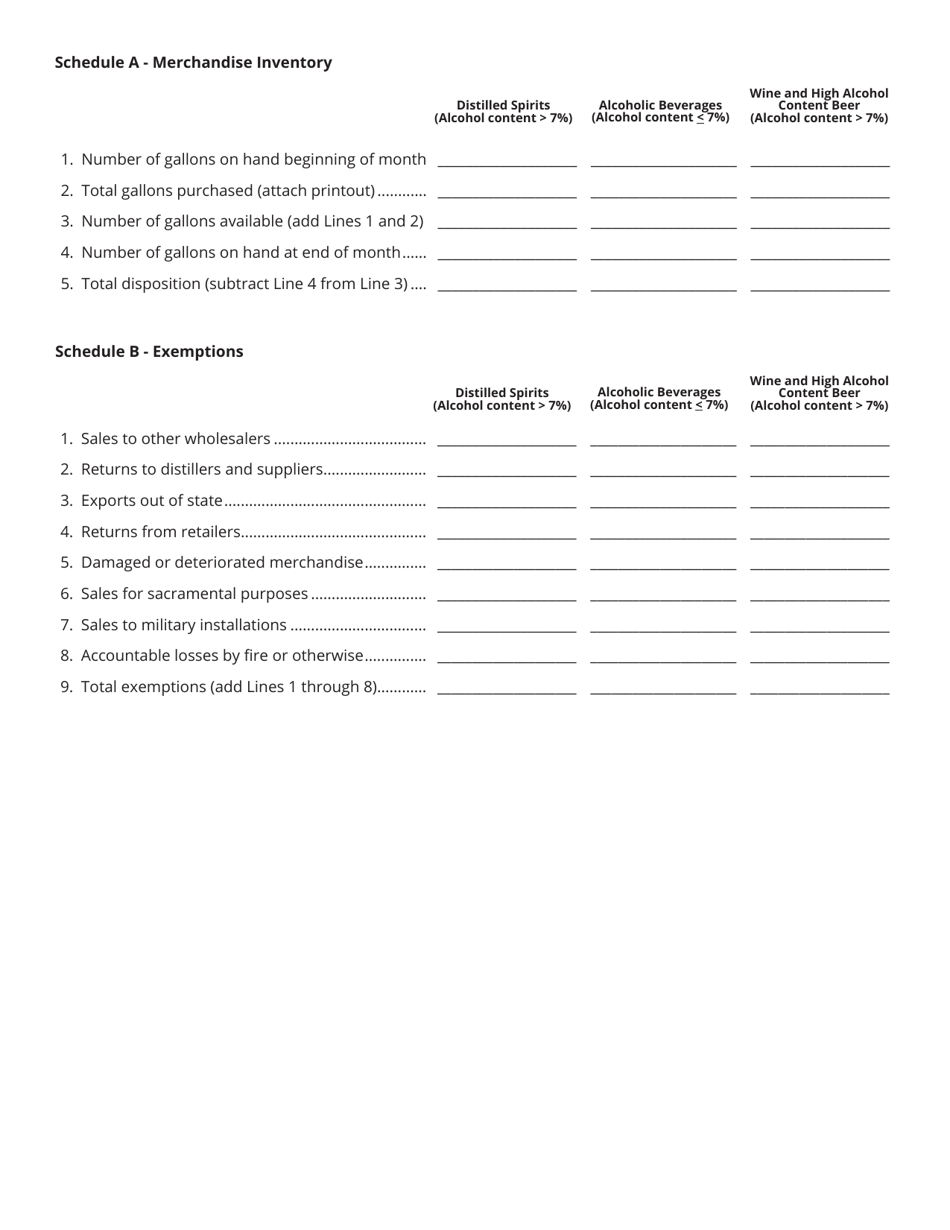

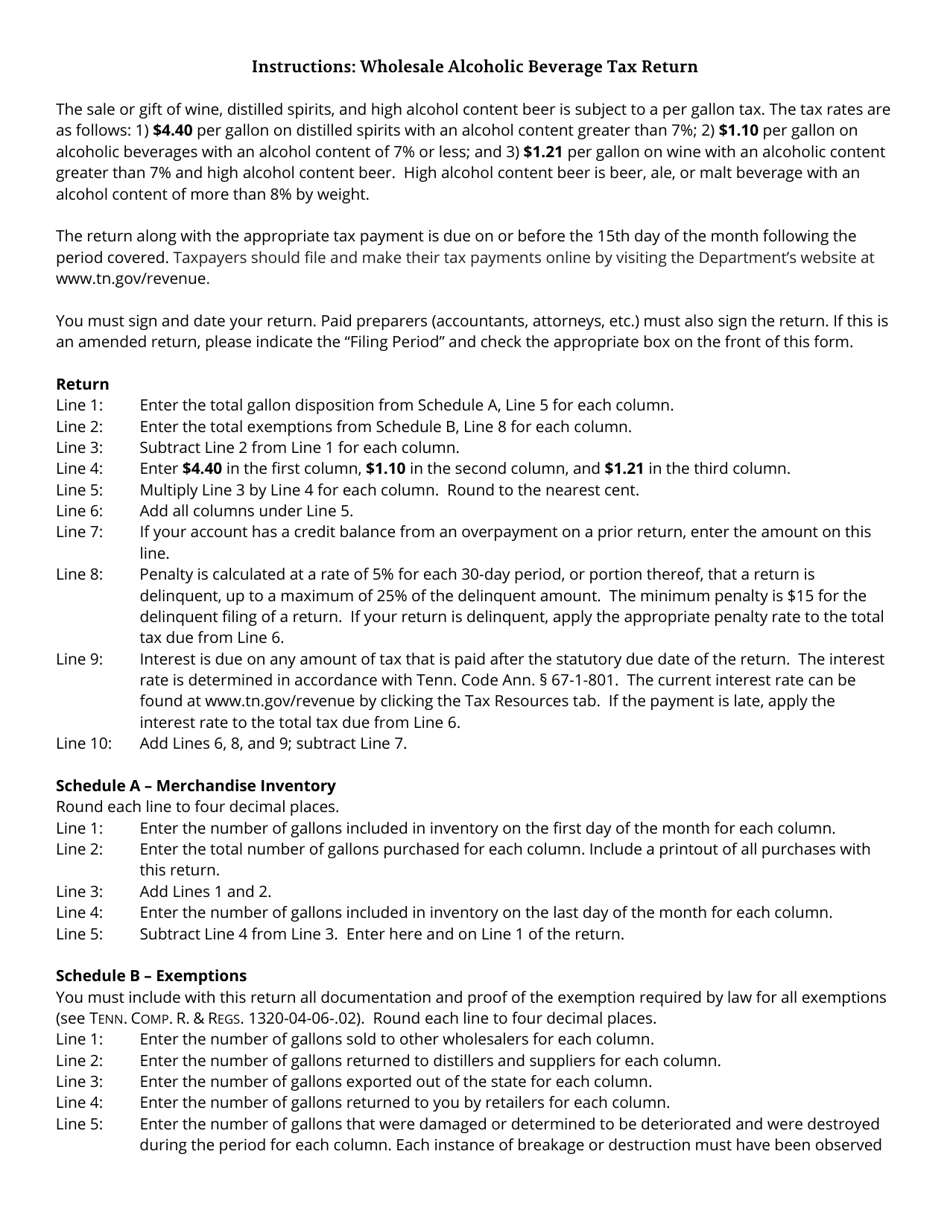

Q: What is the purpose of Form RV-R0005901 (ALC102)?

A: Form RV-R0005901 (ALC102) is used to report and remit the wholesale alcoholic beverage tax owed to the state of Tennessee.

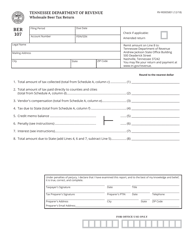

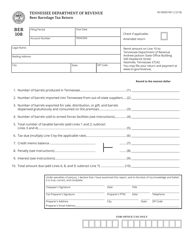

Q: When is Form RV-R0005901 (ALC102) due?

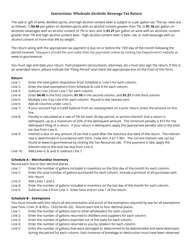

A: Form RV-R0005901 (ALC102) is due on the 20th day of the month following the month being reported. For example, the return for January is due on February 20th.

Q: Are there any penalties for late filing of Form RV-R0005901 (ALC102)?

A: Yes, there are penalties for late filing of Form RV-R0005901 (ALC102). The penalty for late filing is 5% of the tax due per month, up to a maximum of 25%.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-R0005901 (ALC102) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.