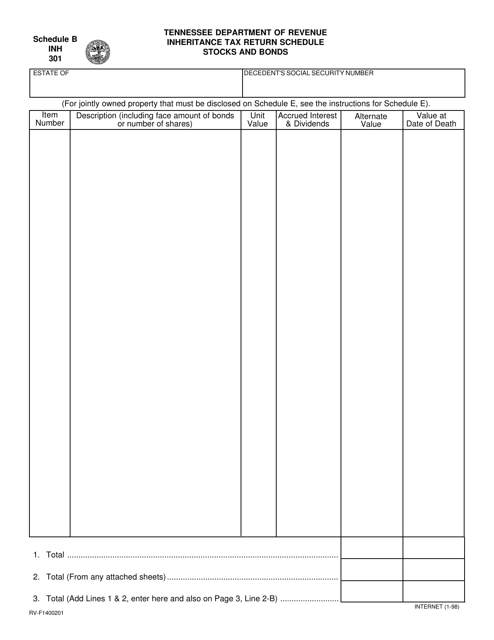

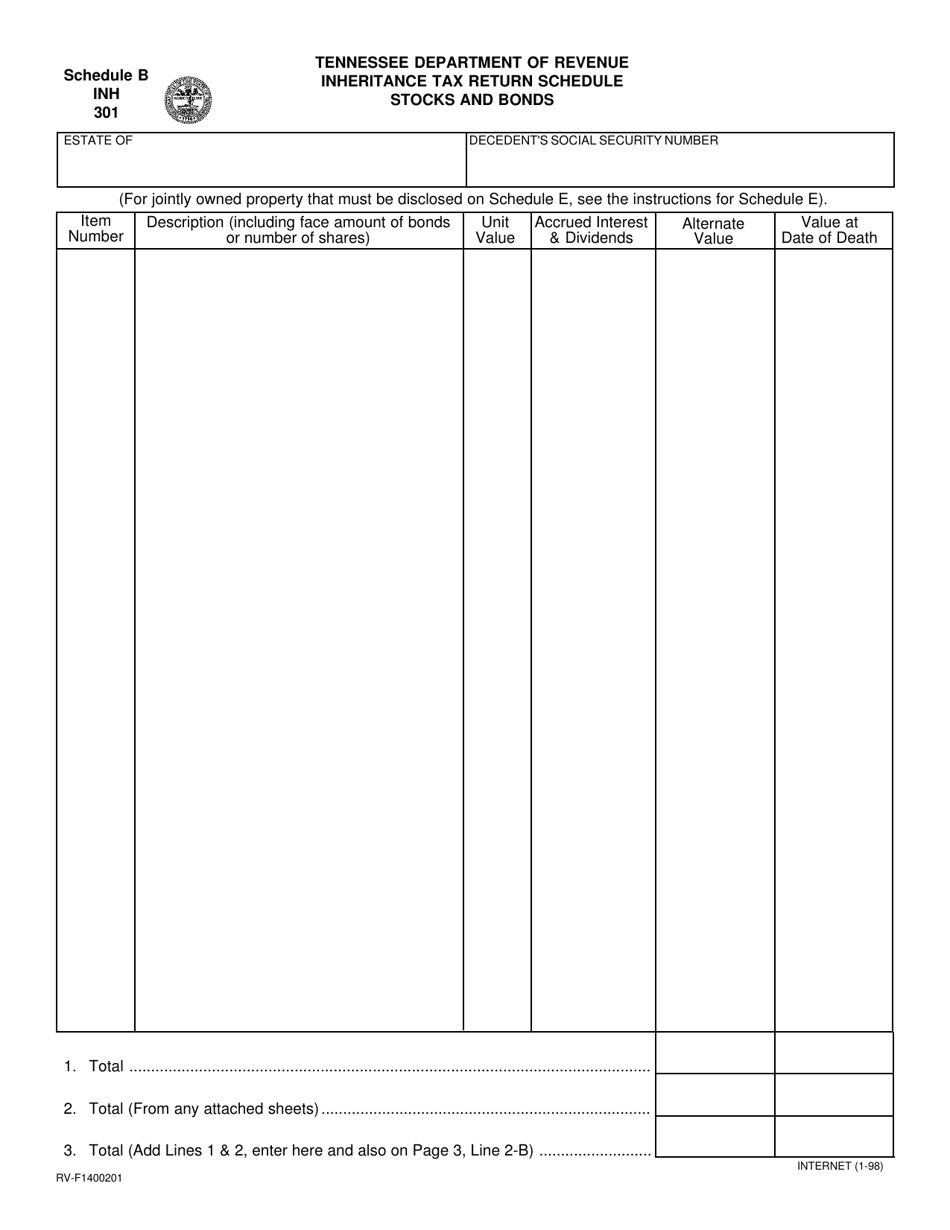

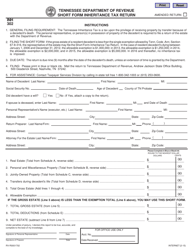

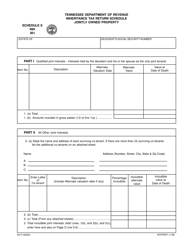

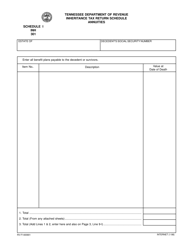

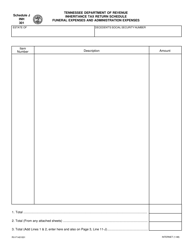

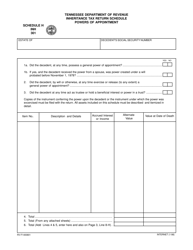

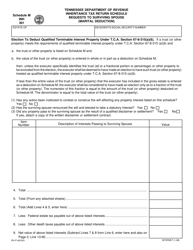

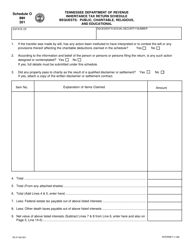

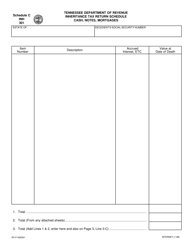

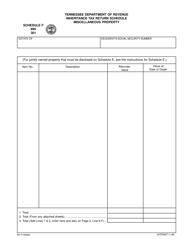

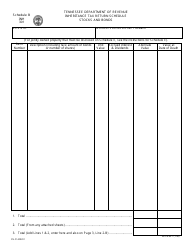

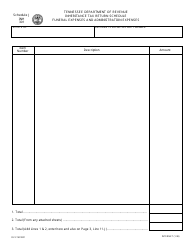

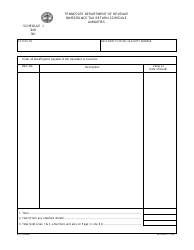

Form RV-F1400201 (INH301) Schedule B Inheritance Tax Return Schedule - Stocks and Bonds - Tennessee

What Is Form RV-F1400201 (INH301) Schedule B?

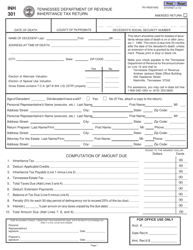

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee.The document is a supplement to Form INH301, Inheritance Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F1400201 (INH301) Schedule B?

A: Form RV-F1400201 (INH301) Schedule B is an Inheritance Tax Return Schedule specifically for reporting stocks and bonds in Tennessee.

Q: When is Form RV-F1400201 (INH301) Schedule B used?

A: This form is used when reporting stocks and bonds as part of an inheritance tax return in Tennessee.

Q: What information should be provided on Form RV-F1400201 (INH301) Schedule B?

A: Form RV-F1400201 (INH301) Schedule B requires information about the stocks and bonds inherited, including their value and any relevant details.

Q: Is Form RV-F1400201 (INH301) Schedule B specific to Tennessee?

A: Yes, Form RV-F1400201 (INH301) Schedule B is specific to Tennessee and is used for reporting stocks and bonds as part of the inheritance tax return in the state.

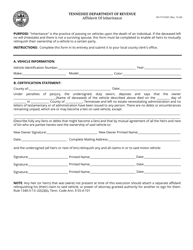

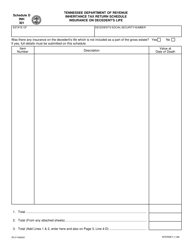

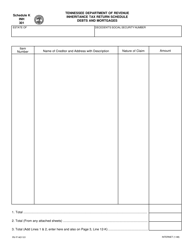

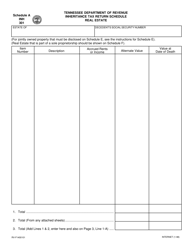

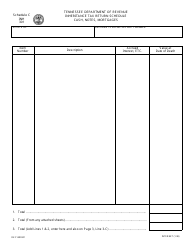

Q: Are there any other schedules or forms required for the inheritance tax return in Tennessee?

A: Yes, depending on the specific assets and details of the inheritance, there may be additional schedules or forms required. It is recommended to consult the Tennessee Department of Revenue or a tax professional for guidance.

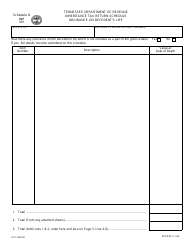

Q: What is the purpose of the inheritance tax return in Tennessee?

A: The purpose of the inheritance tax return in Tennessee is to calculate and report any applicable taxes on inherited assets, including stocks and bonds.

Q: Are there any exemptions or exclusions for the inheritance tax on stocks and bonds in Tennessee?

A: Yes, Tennessee has certain exemptions and exclusions for inheritance taxes. These exemptions and exclusions vary depending on factors such as the relationship between the deceased and the heir. It is advisable to consult the Tennessee Department of Revenue or a tax professional for specific information.

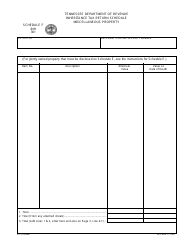

Form Details:

- Released on January 1, 1998;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1400201 (INH301) Schedule B by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.