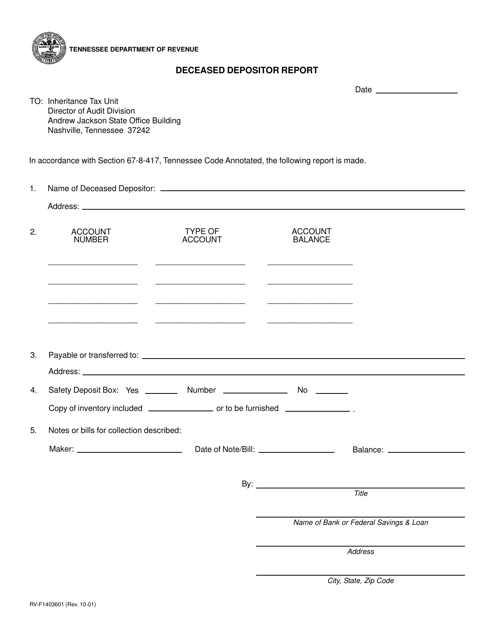

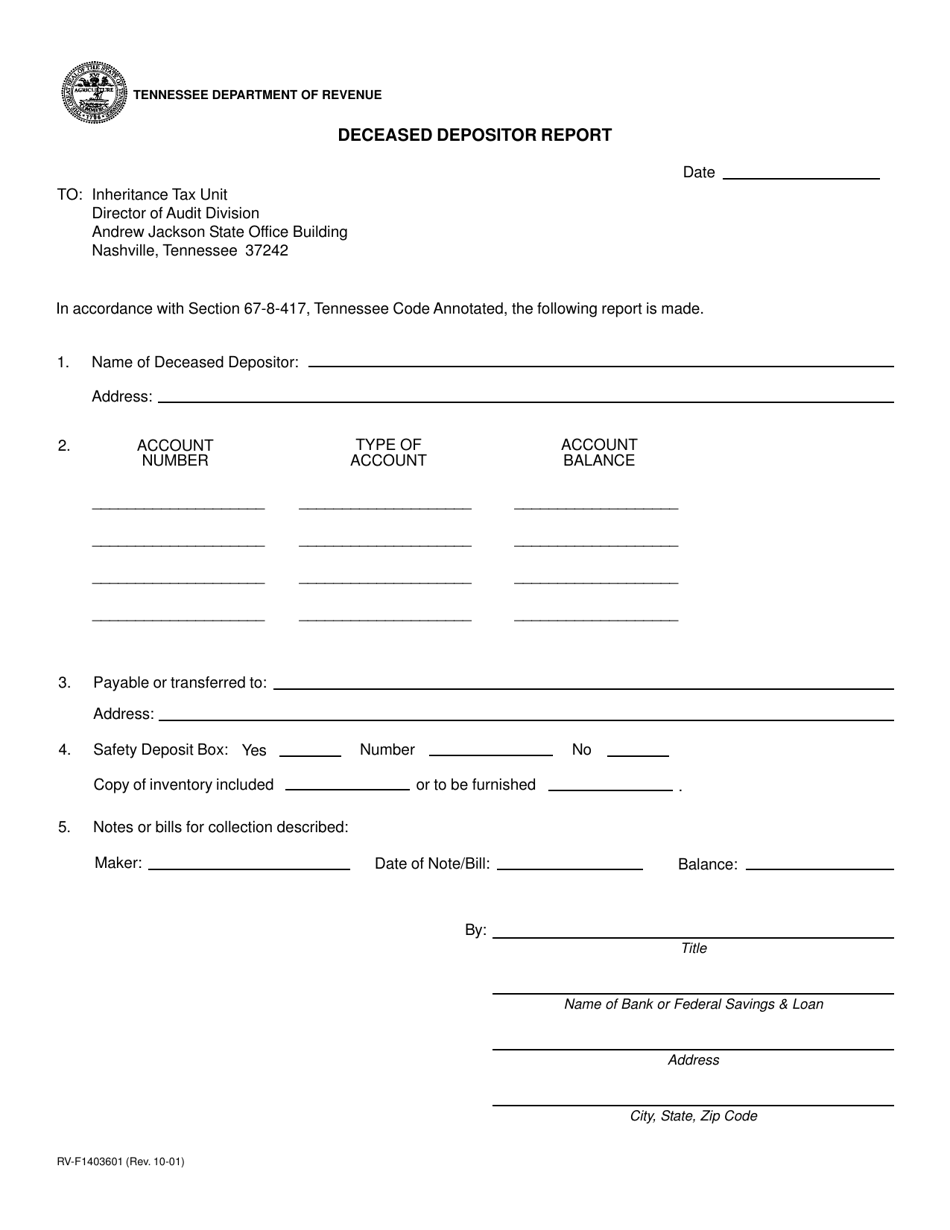

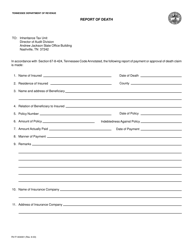

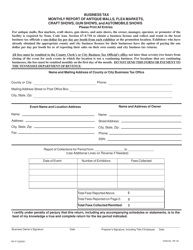

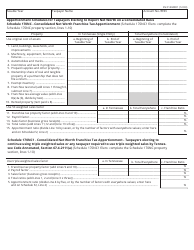

Form RV-F1403601 Deceased Depositor Report - Tennessee

What Is Form RV-F1403601?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F1403601?

A: Form RV-F1403601 is the Deceased Depositor Report specific to Tennessee.

Q: What is the purpose of Form RV-F1403601?

A: The purpose of Form RV-F1403601 is to report the death of a bank account holder.

Q: Who needs to fill out Form RV-F1403601?

A: The financial institution where the deceased person had an account needs to fill out Form RV-F1403601.

Q: What information is required on Form RV-F1403601?

A: Form RV-F1403601 requires information such as the deceased person's name, date of birth, social security number, account information, and contact information for the person reporting the death.

Q: Are there any deadlines for submitting Form RV-F1403601?

A: Deadlines for submitting Form RV-F1403601 may vary, so it's best to consult with the Tennessee Department of Financial Institutions or the specific financial institution for their requirements.

Q: Is there a fee associated with Form RV-F1403601?

A: There is usually no fee associated with Form RV-F1403601, but it's best to confirm with the Tennessee Department of Financial Institutions or the specific financial institution.

Q: What happens after submitting Form RV-F1403601?

A: After submitting Form RV-F1403601, the financial institution will process the report and take appropriate action, such as freezing the deceased person's account and transferring funds according to legal requirements.

Form Details:

- Released on October 1, 2001;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1403601 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.