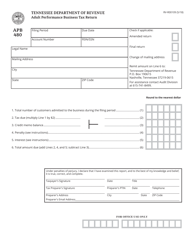

This version of the form is not currently in use and is provided for reference only. Download this version of

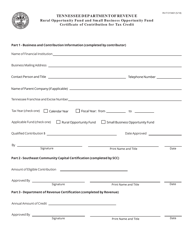

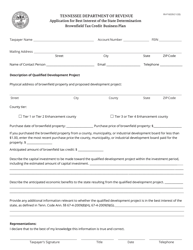

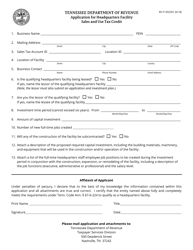

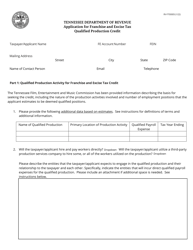

Form RV-F1319501

for the current year.

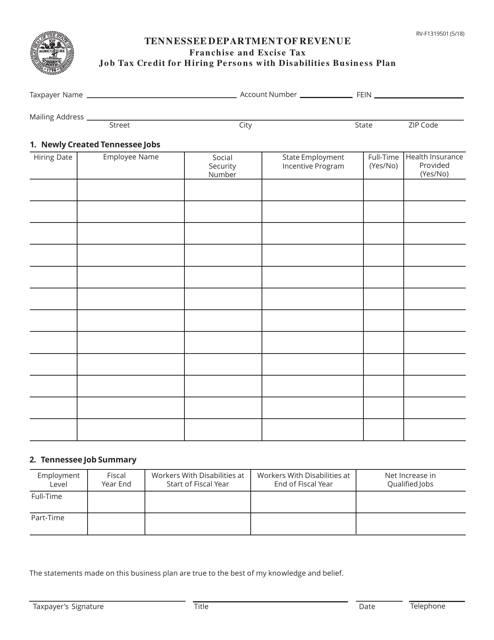

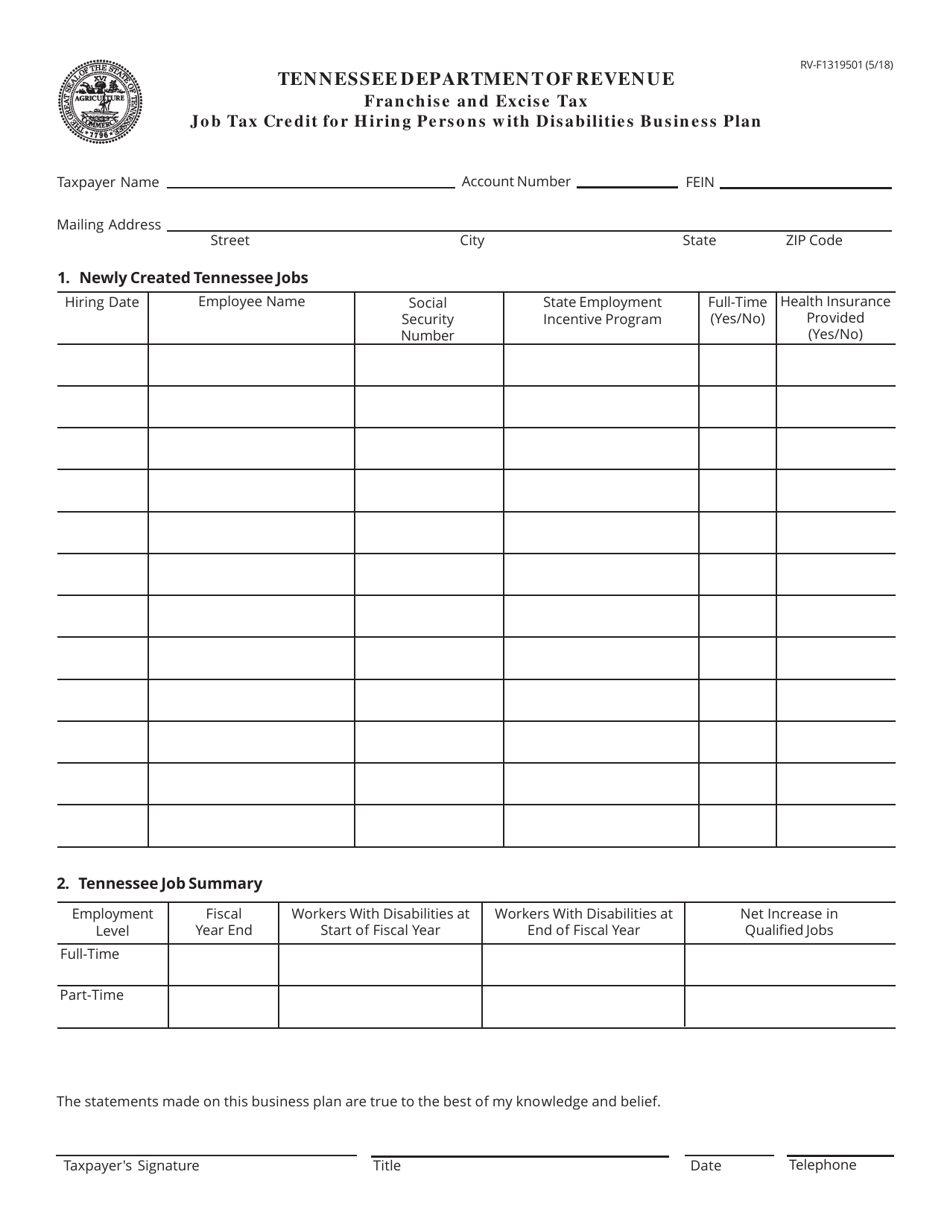

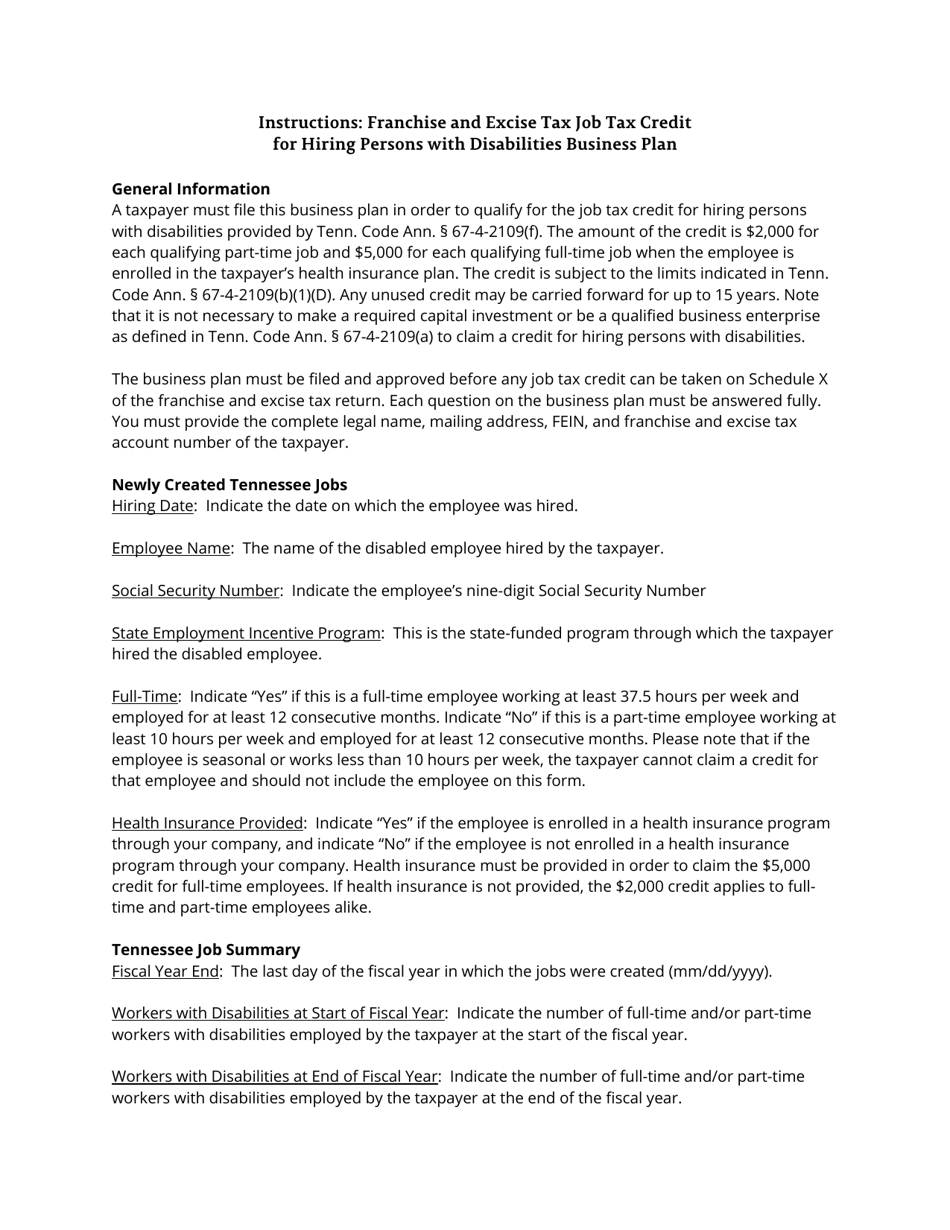

Form RV-F1319501 Job Tax Credit for Hiring Persons With Disabilities Business Plan - Tennessee

What Is Form RV-F1319501?

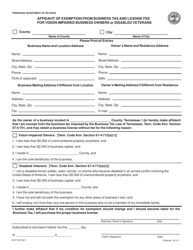

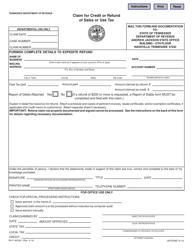

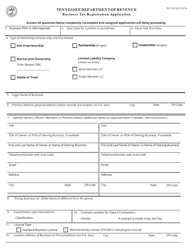

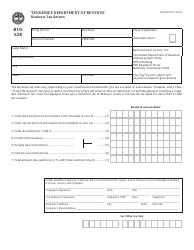

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F1319501?

A: Form RV-F1319501 is a business plan for the Job Tax Credit for Hiring Persons With Disabilities in Tennessee.

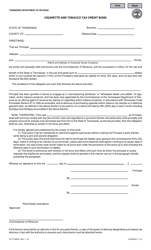

Q: What is the purpose of the Job Tax Credit for Hiring Persons With Disabilities in Tennessee?

A: The purpose is to provide tax incentives to businesses that hire individuals with disabilities.

Q: What is the eligibility criteria for the tax credit?

A: To be eligible, businesses must hire and retain qualified individuals with disabilities and meet certain employee and wage requirements.

Q: How can businesses apply for the tax credit?

A: Businesses can apply by filling out and submitting Form RV-F1319501 to the Tennessee Department of Revenue.

Q: What are the benefits of the tax credit?

A: The tax credit allows businesses to reduce their state franchise and excise tax liability.

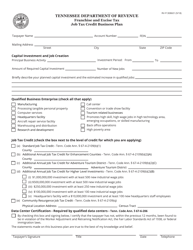

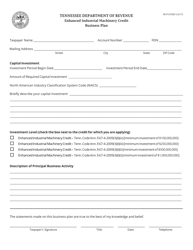

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1319501 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.