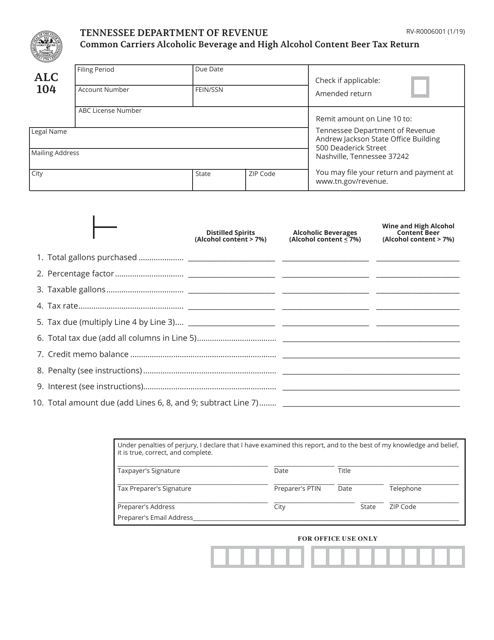

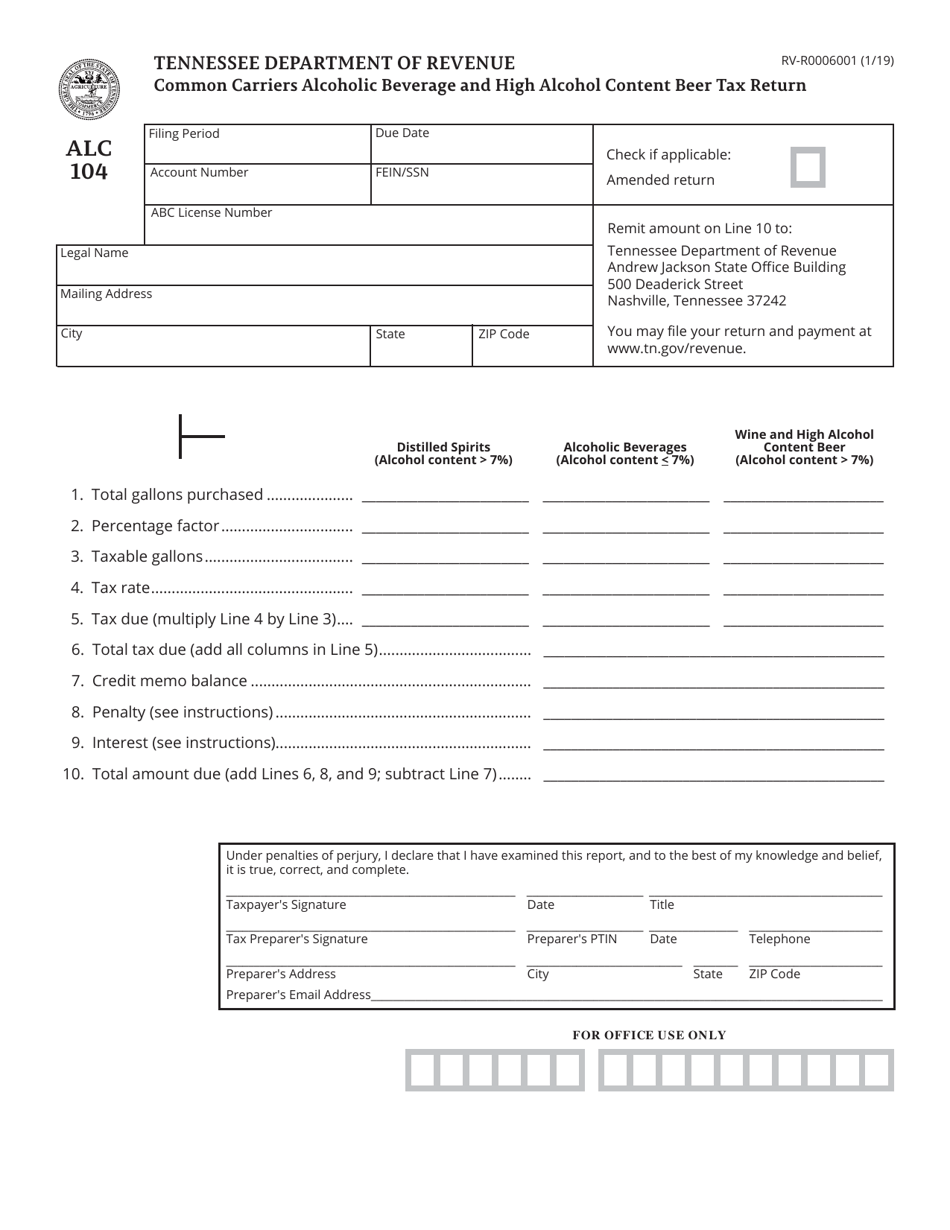

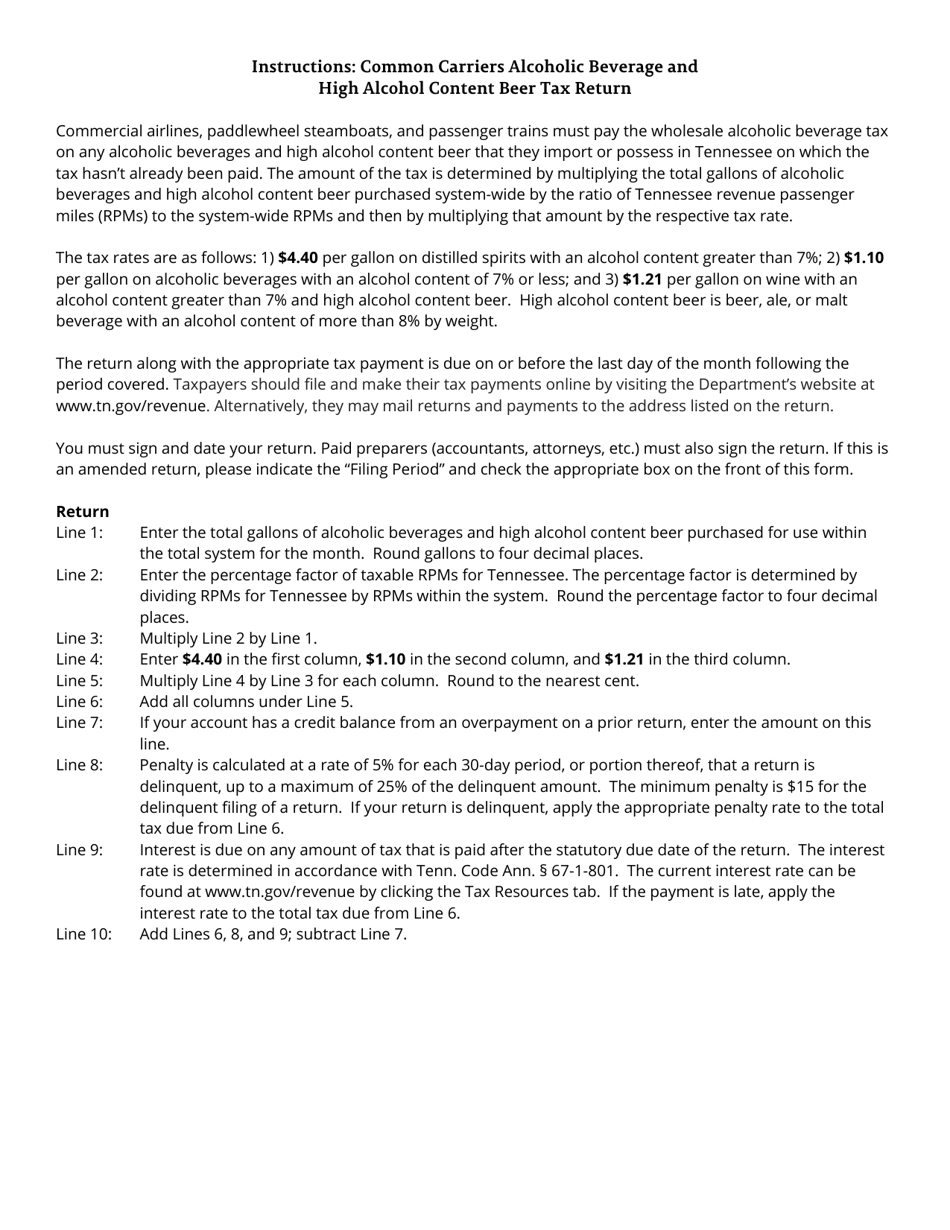

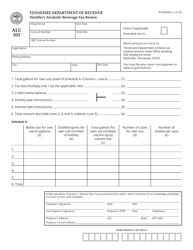

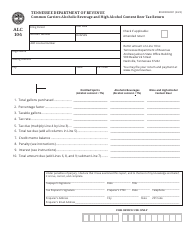

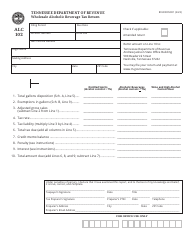

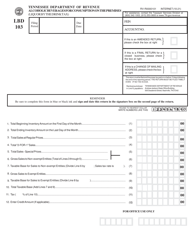

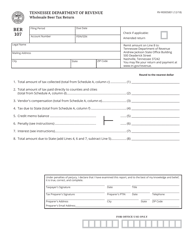

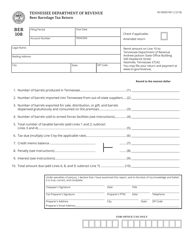

Form RV-R0006001 (ALC104) Common Carriers Alcoholic Beverage and High Alcohol Content Beer Tax Return - Tennessee

What Is Form RV-R0006001 (ALC104)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-R0006001 (ALC104)?

A: Form RV-R0006001 (ALC104) is the Common CarriersAlcoholic Beverage and High Alcohol Content Beer Tax Return for Tennessee.

Q: Who needs to file Form RV-R0006001 (ALC104)?

A: Common carriers transporting alcoholic beverages and high alcohol content beer in Tennessee need to file Form RV-R0006001 (ALC104).

Q: What is the purpose of Form RV-R0006001 (ALC104)?

A: The purpose of Form RV-R0006001 (ALC104) is to report and pay taxes on the alcoholic beverages and high alcohol content beer being transported in Tennessee.

Q: When is Form RV-R0006001 (ALC104) due?

A: Form RV-R0006001 (ALC104) is due on the 20th day of the month following the end of the reporting period.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-R0006001 (ALC104) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.